Brief

What is behind the trend?

• Demand for all commodities will rise. Increased consumption of oil, food, water and ores is a function of population growth but has been amplified by the industrialization of emerging economies.

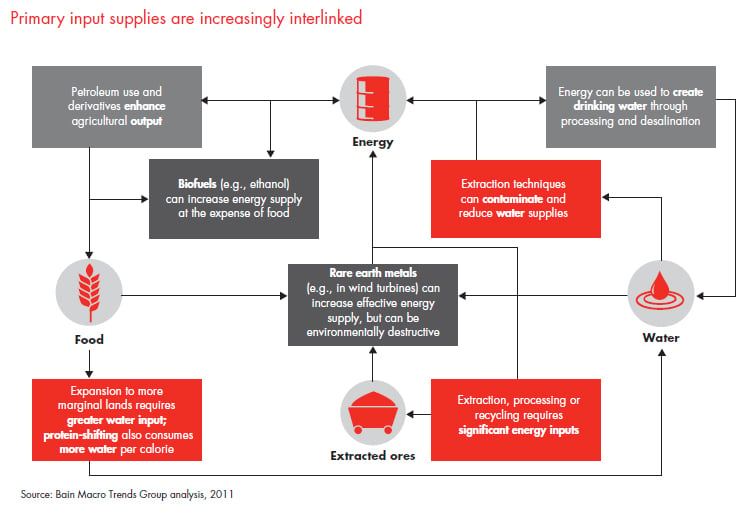

• Basic commodities are under pressure not only from their own higher demand but also from increasing alternate uses. For example, corn will be needed for food and ethanol. Water will be required for consumption, agricultural production and energy production.

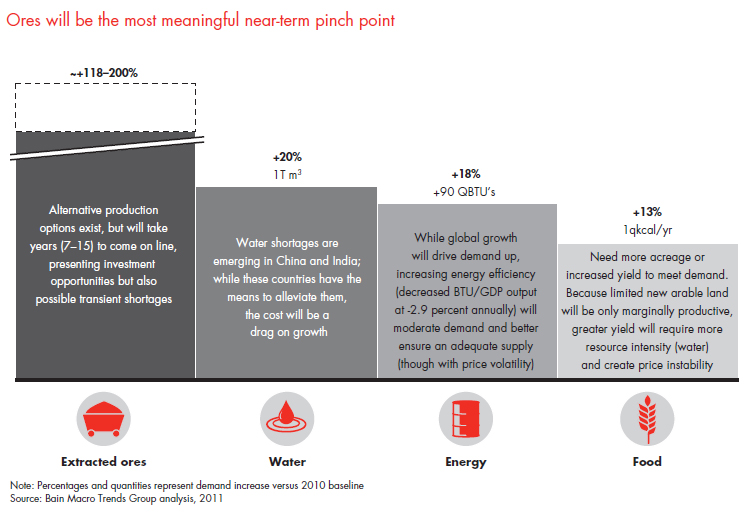

• Only a short list of commodities is likely to result in real constraints this decade. But for all, rising prices and volatility are likely to be the norm. Ore supply will also gradually adjust to meet demand, although not until the end of the decade. To meet food demand, a sustained period of rising production efficiency will be necessary to forestall the alternative—sustained food price inflation.

Macro Trends Insights

Demographics, automation and inequality could dramatically reshape our world in the 2020s and beyond. Our insights discuss how executives can prepare for the new global economy.

What does it mean for business?

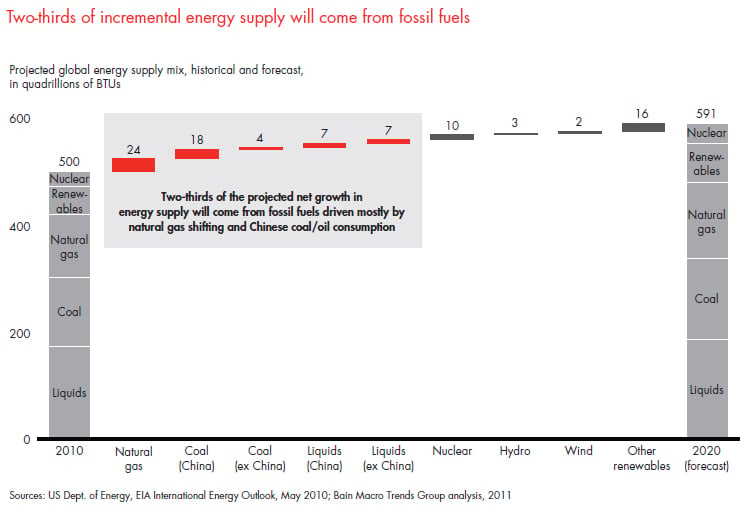

• Expect upward price pressure on commodities throughout the decade, with the exception of oil (although energy prices may become very volatile).

• General price volatility will increase, partly reflecting the global surplus of financial capital seeking investment returns, which amplify demand-price shifts.

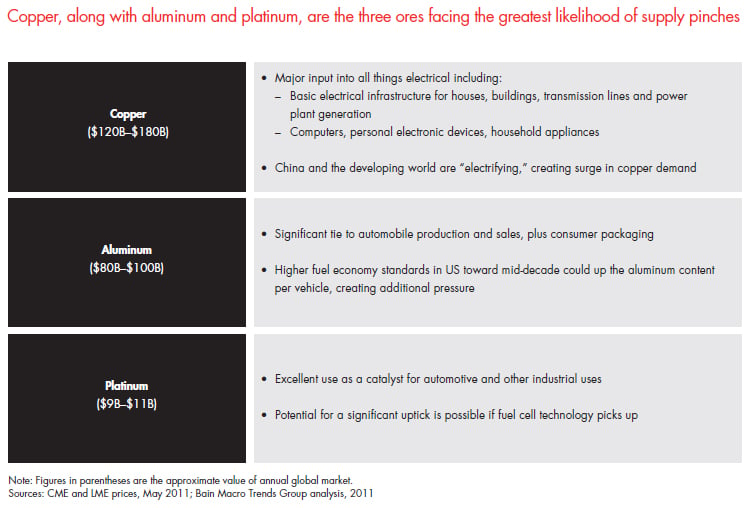

• Business challenges are likely to come from holdups and shortages of copper and rare earth metals rather than from shortages of energy, food and water.

Ores will be the most meaningful near-term pinch point

Primary input supplies are increasingly interlinked

Two-thirds of incremental energy supply will come from fossil fuels

Copper, along with aluminum and platinum, are the three ores facing the greatest likelihood of supply pinches