Our Approach

Asked to help IndustryCo address its portfolio challenges, Bain applied an integrated approach to corporate strategy consisting of several key components.

A bold ambition. IndustryCo defined how much value its portfolio of businesses could create. It aligned market expectations, board views and management plans behind a few quantitative targets, and articulated a vision for its future portfolio. In a nutshell, IndustryCo set the bar for what good will look like.

Clarity on current strategic positions. By developing a solid understanding of existing business boundaries, the company came to a clear decision that only one business—advanced industrial technologies—had a compelling path to sustained value creation. At the same time, the in-depth analysis of the industry landscape helped executives in the other businesses understand why they were losing share year after year, despite all their efforts.

A new portfolio structure. Facilitating a profound discussion of strategic options helped to focus leadership on the opportunities with the greatest potential to create value. The company decided to radically double down on advanced industrial technologies and increase its focus on scaling it. A deep analysis allowed IndustryCo to identify multiple adjacent markets where it could deploy its core capabilities, multiplying the size of the addressable market.

A prioritized M&A pipeline. A broad screening of potential acquisition targets led to a clear set of options for inorganic expansion. Prioritizing potential deals helped to focus management teams and encouraged them to actively reach out.

A transformation roadmap. IndustryCo established a 5- to 10-year plan for focusing the company on one business only. It laid out the required transactions and their interplay, both on the buy and sell sides, and determined what organizational changes IndustryCo needed to transform from a holding company into an operating company. While some of the actions were no-regret moves (and were executed within months of board approval), others are options based on scenarios that have yet to materialize. For this reason, the company keeps operating one of its assets despite strong interest from potential buyers until the right offer comes along.

A clear financial strategy. The company developed a financial strategy that included simulating the group’s financial statements in sync with the planned transformation. The CFO set and tested financial guardrails on leverage and rating, payouts and financial flexibility. This led to a feasible transaction sequence over a set period of years.

Strong alignment between management and the supervisory board. The company’s leadership established a shared view of the target portfolio. Management and the board replaced a single-deal perspective with a transaction roadmap and laid out the resulting strategic and operational priorities at the business unit level. The leadership team then committed to embark on the transformation, with clear roles and career options established for each executive.

Credibility in capital markets. IndustryCo’s transformation led to a strong and simple equity story, which improved market expectations by building investor confidence in the company’s upside potential and management’s ability to deliver it.

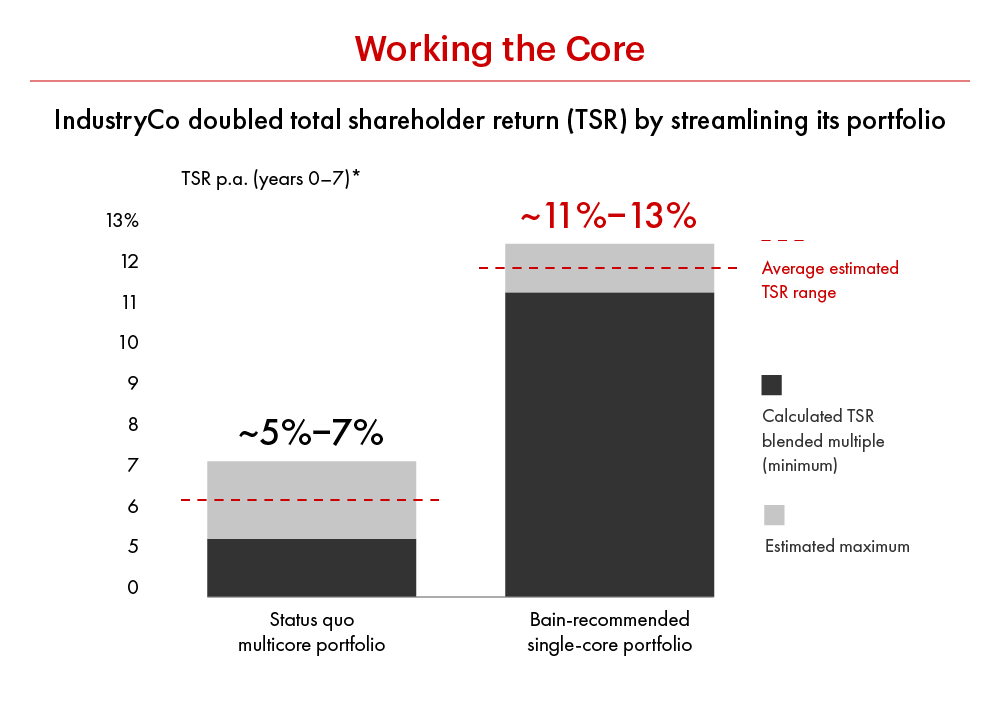

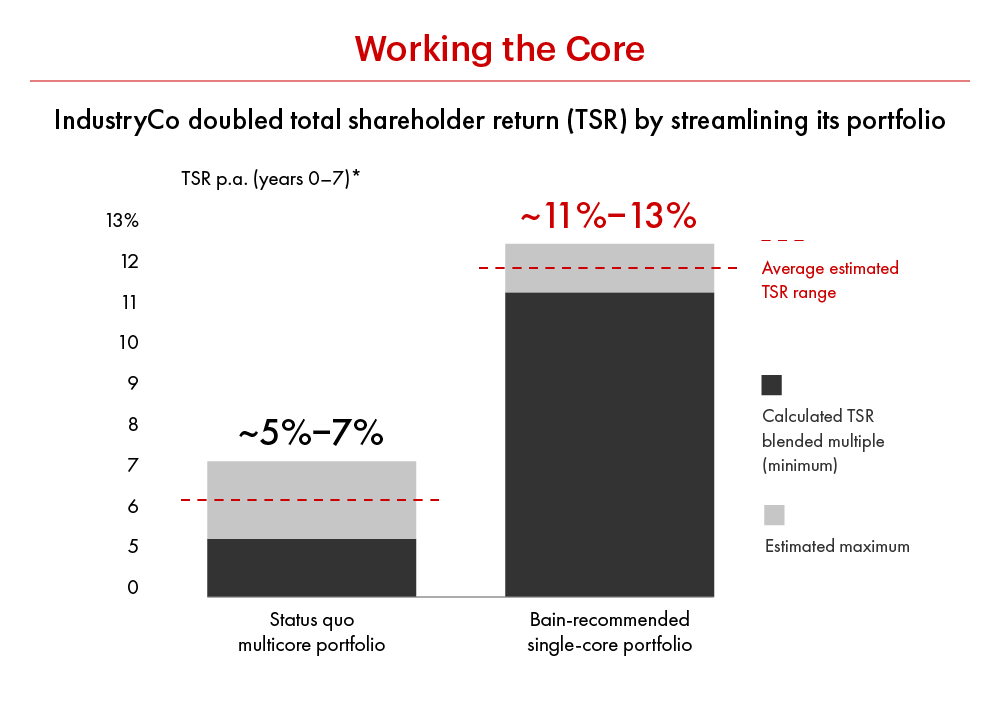

The Results

IndustryCo’s new strategy puts it on course to triple its market value. Despite the plan to divest materially, company management estimated it could triple the market value of the company in 5 to 10 years. As of late 2018, its valuation has nearly doubled, with further moves ahead.

IndustryCo’s in-depth look at its corporate strategy launched the company on a transformative journey guided by a clear action plan. Having established mid- to long-term expectations for each business and corporate unit, initiating a much more productive review of ongoing performance and contribution, and changing the way executives interact with one another, IndustryCo can orient its employees toward a common vision. Through the equity story, the new strategy will also serve as a compass for the capital markets, and help shift focus from quarterly results to the longer-term transformation.

* We take our clients' confidentiality seriously. While we've changed their names, the results are real.