Brief

Резюме

- China’s chemicals market is the largest in the world, and its growth makes up half the growth of the global chemicals market. The edge that multinational chemical companies have enjoyed there for two decades is thinning as China’s local chemical companies become more competitive.

- Increasingly, local companies are pushing their advantage in understanding customer preferences in China, developing products and solutions optimized for its home market, and at a more competitive price given their access to affordable engineering talent.

- International companies were once the favored destination for top local talent. But increasingly these valuable executives are choosing to work for Chinese companies, where they see more opportunity. Local companies are also making better use of China’s vast and advanced e-commerce ecosystems, given their familiarity with the market and its players.

- To remain competitive in China—and to compete with China’s chemical companies as they enter international markets—multinational companies will have to regain their footing in these and other important arenas of competition.

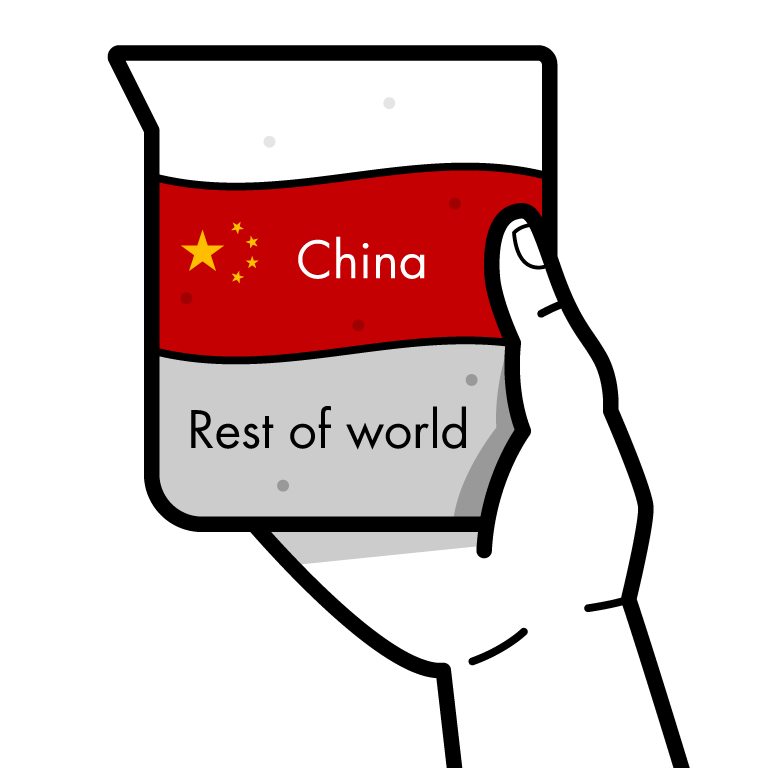

China is the world’s largest market for chemicals, growing at 4% to 5% annually compared with about 3% growth for the rest of the world (see Figure 1). Its contribution to the global market is significant, with about half the sector’s global growth occurring in China. China’s continuing urbanization and the rise of its middle class promise to increase the long-term demand for specialty and commodity chemicals, in spite of midterm headwinds like trade friction and a slowdown in economic growth.

China is the largest consumer of chemicals in the global market and accounts for half the market’s overall growth

For executives of multinational chemical firms, China’s market represents enormous opportunity. But few of these executives would say they’re taking full advantage of the market’s potential. Although China’s chemicals sector has been open to foreign participation, the sector is experiencing rapid change that could make it increasingly challenging for multinational companies (MNCs) to gain and retain a winning position in the market. Local attackers are challenging global chemical companies as the favored destination for top engineering and commercial talent. Innovative local companies are developing competitive technologies and high-quality products that are customized to the demands of China’s market. And digital commercial platforms are becoming the primary conduit for sales transactions, supplanting sales teams and offering a competitive edge to local companies that are more comfortable with these platforms. Combined, these changes are empowering local, private chemical producers to outgrow international competitors in China (see Figure 2).

Local private players are growing faster than MNCs in China’s chemicals market; SOEs lag behind

Other transitions are also making it more difficult for international chemical companies to grow their businesses in China, including the country’s shift from an investment to a consumption economy, stronger environmental policies that increase costs, and new cybersecurity and IP protection laws. Increasingly, China is not the only market where international chemical producers will face these competitors: China’s chemical companies are beginning to make forays into international markets. Experience competing with Chinese players in their home may help MNCs compete with them in their own home markets.

In the face of such complex challenges, many executives of international companies are unsure how to proceed in China’s chemicals market. Some firms, however, are demonstrating successful strategies for gaining and retaining a competitive position in China’s rapidly changing market. While there are many aspects to success, three major themes will be critical.

- Advanced talent strategy. Leaders will find ways to attract and retain top national talent, without becoming a training ground for local competitors.

- Local innovation models. International chemical companies will need to invest in market intelligence that helps them understand the evolving demands of China’s end customers and set up local innovation centers to serve these demands, a key strategic need as the country shifts from an investment economy to one focused on consumption.

- Digital platforms. The chemicals sector lags behind others in its adoption of digital technologies in production. But China has a vibrant digital commercial landscape, with leading platforms developed by Alibaba and others facilitating hundreds of billions of dollars of transactions each year.

Of course, companies will need to make vital strategic decisions on other aspects of doing business in China, including deciding how China fits into their international portfolio, whom to partner with and on what aspects of the business, and whether to advance in joint ventures, through M&A or on their own. But these three aspects of the business can help executives start thinking about how to make the right moves to gain traction in the world’s fastest-growing chemicals market.

Bain Partner Thomas Luedi explains how multinational companies can address market shifts in China's chemicals industry.

Advanced talent strategy

Ever since their entrance to China’s chemicals market, international companies have enjoyed a position as the preferred choice for top talent. This applied to both technical talent (engineers) and commercial talent (for example, MBAs and other business school graduates, and, especially, experienced sales and marketing talent).

That’s changing as fast-growing local companies create high quality jobs, even as an evolving education system develops more suitable local talent. For example, Yantai Wanhua has been able to attract top local and international talent to develop its own competitive MDI technology, pursue global acquisitions and enter new chemical value chains such as polycarbonates. While international companies may offer high base salaries and an opportunity for rotation in other global locations, local firms can offer their managers and executives a greater voice in decision making, better stock options and a sense of purpose in helping a local company grow. By contrast, in international companies, executives from China often still take operational roles, career paths that may not develop into senior leadership roles.

Leading MNCs develop long-term talent plans that chart leadership pipelines for the business in China and globally. They encourage their top talent from China to join global rotation programs, proactively moving Chinese executives into international assignments. They also rotate top global talent into critical management roles in China. Performance-based compensation, rapid career progression and a lack of glass ceilings are all part of the value proposition these firms offer their Chinese executives. These international companies consider China a home market since these executives want to work for leading companies in China.

China's Chemicals Market Goes Local

International firms see their competitive edge waning as China’s chemical companies get better.

Local innovation models

Some of China’s companies are gaining a competitive edge with substantial investments in R&D. For example, in polycarbonates, traditionally produced by international chemical companies at levels lower than demand, local companies are on the verge of disrupting the market. Multiple local attackers, including Yantai Wanhua, have announced firm plans for or are building competitive domestic capacities with the objective of leading in the domestic and global polycarbonates market.

Beyond technology, innovation in China may be based on local preferences for products that are more popular than in other markets—for example, skin lightener. In some cases, B2B customers ask for different recipes based on their needs for cost savings or performance requirements. Local companies can often develop and produce new compounds and products faster and at lower costs than their Western counterparts, given China’s many engineers and the cost advantage in employing them.

Leading international companies develop local market intelligence to understand shifts in product demand and consumer preferences so they can localize products, too. They invest in local innovation centers and technical marketing to develop the right product portfolio. Several leading European specialty chemical companies have transformed the structure and governance of their China research activities, setting up development centers there that are governed locally but still within the context of global research activities. This allows them to prioritize and resource local projects while still benefiting from being integrated into the global R&D umbrella. Such an approach has allowed them to respond more rapidly to local customer demand and localize their products.

In summary, international chemical companies need to innovate to stay competitive in cost, to remain relevant in the products and compounds they offer and to remain ahead of local competitors, reacting quickly to local requirements.

Digital platforms

China’s digital e-commerce platforms are the largest and most advanced in the world. Tmall and 1688 are the most important for B2B and consumer commerce, but beyond these platforms, China’s entire digital landscape is a dynamic and disruptive workspace for entrepreneurs and incumbents alike (see Figure 3). Tactics and strategies that have served MNCs well in their home regions may require a different approach in China, because of local regulations, advanced ecosystems and rapidly emerging opportunities.

China’s e-commerce ecosystem presents a vast number of opportunities for partners across the value chain

These immense and busy platforms can provide chemical producers with closer access to their customers, to understand and adapt to local demand and speed up time to market. For example, Dow Chemical uses social media channels such as WeChat and Weibo to understand its customers’ needs and preferences, to market its specialty chemicals, and to provide technical advice and support to customers and potential buyers.

To get the most out of these platforms, executives need a clear understanding of their objectives. Leaders begin with a well-defined vision of their value proposition, which helps them determine how they plan to benefit from the platforms. Will they use these platforms primarily to grow sales, to improve customer service, or both?

It’s also critical to understand the business model of platforms and all digital partners. The space is crowded with many players at early stages of development, eager to raise their profile and increase traffic by adding highly visible brands. Some will last, but others will fade away—so it’s important to see through the hype and carefully evaluate platforms to ensure they can deliver a true “win-win” partnership.

Finally, start small and move fast. Once the ambition is defined, mobilize rapidly. Pursuing the digital opportunity doesn’t require a joint venture with a large Internet player, nor do companies need to create a new function within their ranks. Digital exploration can begin with a small, cross-functional team of talented and passionate employees who understand both the business and the digital ecosystem. Task these folks with creating digital innovations in sales and service, and they may impress you with their creativity.

What role will China play in the portfolio?

Of course, building a sustainable business in China requires much more than a deep understanding of these three themes and a strategy to address them. International chemical companies must make strategic decisions about the role of China in their portfolios.

- Will you develop China as a home market, with a market position similar to other core markets?

- Will you take an approach that focuses on specific products and markets within China, developing innovative and niche products?

- Or, will you take an opportunistic approach, largely exporting to China and selling through distributors?

MNCs also need to define their M&A and partnership strategies in China. Most of the experienced international companies in China have moved beyond partnerships and have begun to invest on their own in China. However, as stronger local competitors emerge and begin to challenge chemical companies globally, MNCs are likely to take a new look at M&A and partnerships that center around e-commerce platforms, marketing and distribution. The M&A process is more complex in China than elsewhere: A rapidly growing market offers less visibility into target companies—and fewer targets in general to combine into a series of acquisitions. A successful approach requires a dedicated team of senior executives with strong business development capabilities, both globally and locally.

As China transitions from an investment economy to one driven by consumption, the opportunities in specialty chemicals could outpace the growth of commodity chemicals. This shift represents a tremendous opportunity for chemical companies to reposition themselves to gain competitive advantage—or to see their market share opportunities lost to competitors. International chemical companies that make the right strategic decisions can retain their market position in China while strengthening their hand in the global chemicals marketplace.

Yin Chen and Thomas Luedi are partners with Bain & Company’s Energy & Natural Resources practice, working with the chemicals sector. They are based in Shanghai.