Brief

Mobile devices are playing a vital role in more and more elements of our lives. Users expect immediate responsiveness when communicating via social media, watching a live stream on Facebook or Hulu, or using their favorite sports app. Meanwhile, investors are pouring billions of dollars into new ventures that will entice mobile customers to do even more on their devices, meaning demand for network services will continue to rise.

This steady increase in usage creates a remarkable opportunity for mobile network operators. It also brings serious challenges. As customer demand rises, so too do expectations for reliable and responsive service. Operators that fail to deliver a consistently superior customer-received usage experience (CRUX) are vulnerable to negative customer reviews and increased churn.

In a highly competitive and rapidly growing marketplace, operators are fighting for their futures. They’re struggling to generate sufficient cash flow to make the necessary investments in capacity and technology that will provide customers with the CRUX they demand. As a result, operators face rising congestion in mobile cells, hampering their ability to deliver great user experiences. This puts mobile operators in an untenable position: Unable to make desperately needed improvements to their services, they often cut their rates to keep customers from defecting to rivals, which can trigger destructive price wars.

In this challenging environment, carriers that figure out how to deliver a superior customer experience can break out of the cycle and increase both their market share and their pricing power. Winning companies will be those that profoundly shift their focus from a system that relies on rigid, engineering-oriented measures of network performance to one that actively manages CRUX. Telcos that succeed will be able to sense how their customers are using the network, decide how much bandwidth is required to generate a good usage experience for each activity and then act on that information in real time.

Running to stay in place

Mobile operators are scrambling to keep pace with the massive increases in customer demand brought about by network-intensive usage episodes, such as watching live sports, playing bandwidth-hungry multiplayer games and experimenting with augmented and virtual reality. (A usage episode is any action that involves a network connection and fulfills a specific customer need, from making a phone call to watching a YouTube video.) Operators have urgently been increasing the capacity of their radio access networks by adding more frequencies to their cell sectors, along with corresponding licenses and necessary antennas, backhaul and transport.

However, to date, operators have largely been running to stay in place. While they are spending more on capacity expansion to keep up with the exponential traffic growth, they are often frustrated when they don’t see direct benefits in terms of gains in market share or increases in average revenue per user—or even indirect benefits such as a higher Net Promoter Score®, a key measure of customer loyalty.

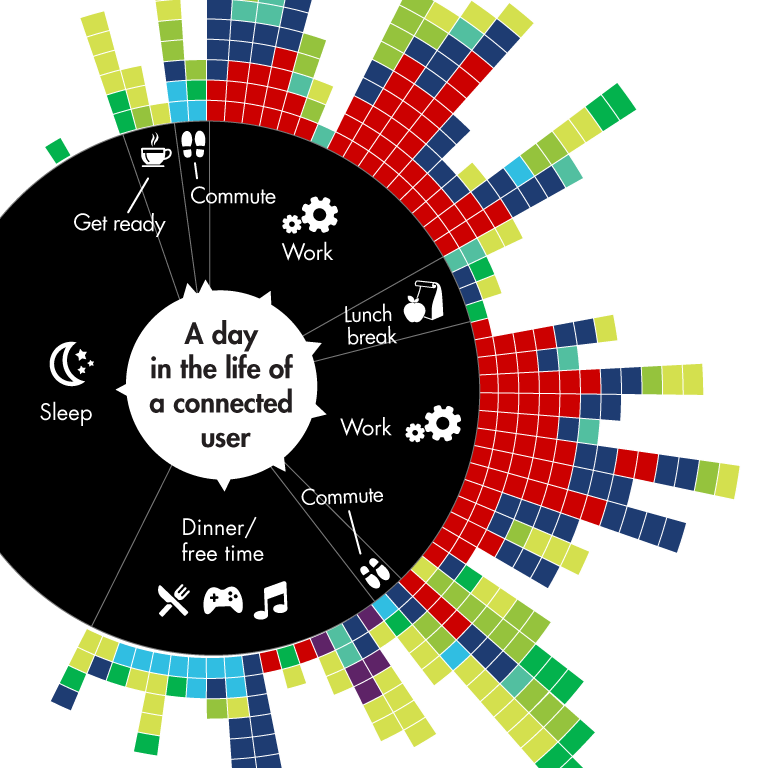

Most operators rely on traditional network performance metrics to shape their usage-experience improvement strategies. These metrics worked well when operators controlled entire usage episodes, as they did with voice calling and text messages. But today’s customers engage in an ever-broadening array of usage episodes that rely on a growing ecosystem of applications, content providers, operating systems and devices (see Figure 1).

The episodes that matter most today differ greatly from those that were significant just 5 to 10 years ago. Moreover, the way customers evaluate CRUX depends on the activity they’re engaged in. When they’re browsing the web, they care about page download times. When they’re watching a video, they want it to start immediately. When they’re video chatting with their friends, they need the connection to be clear and crisp. If the reception is choppy, they’ll revert to voice or simply hang up.

The problem is that operators have trouble seeing what their customers are doing. Most operators suffer from limited visibility at the edge, where user applications first interact with the network. Whether it is a social media app, a bank or an airline, content providers encrypt more than 80% of traffic on average, according to measurements by Vasona Networks, which means the mobile operator cannot readily identify the kind of content flowing through the access network.

As a result, mobile operators have a limited and imprecise understanding of what matters to customers, including what constitutes “good enough” vs. a truly differentiated experience. Operators find themselves staring at large network capital expenditures, unsure about which investments will deliver real improvements in CRUX.

Operators face a big challenge in catching up with their customers; they are trying to hit a moving target. The continuing innovation in applications virtually ensures that the current predicament will present itself again and again. The usage episodes that people engage in via their mobile devices are evolving rapidly and will continue to do so for the foreseeable future.

Winning the Battle for Mobile Customers

Today's mobile users are constantly connected, using more bandwidth and expecting a faster, more reliable usage experience. Here's how telcos can satisfy the massive surge in demand.

Making sense of episodes: Evolving new KPIs

For broadband delivery, most operators rely on two measures to trigger mobile access network investment: average throughput (bitrate) per user, and radio resource utilization during busy hours in each cell. If the average user bitrate falls too low or utilization is too high, engineers assume a particular cell is delivering poor usage episodes, and they add capacity to that cell. These cell expansions and the corresponding fiber or microwave backhaul constitute the bulk of capital investment by mobile operators each year.

While a common practice, this type of generic threshold setting doesn’t capture the nature of the usage episode. Generic thresholds don’t differentiate between customer activities that are bitrate-intensive, such as watching a video, and those that are bitrate-light, such as using social media apps. A cell can have high traffic volume and still meet customer demand even when conventional metrics would indicate that it is overcrowded and in need of an upgrade.

To achieve the best possible CRUX for a given expenditure, forward-looking operators are using a new approach called quality on investment (QOI). Smart telcos are investing in tools that allow them to sense what customers are doing and then act in real time to dynamically manage traffic in a way that maximizes CRUX. The first step is to establish key performance indicators (KPIs) that reflect how customers actually use the network, including identifying critical usage episodes, such as web browsing during an evening commuter train ride or live streaming during a weekly football game.

To truly understand and monitor usage episodes, carriers need to develop a new common language, one that captures customers’ emotive reactions when they’re having what they consider to be a superior experience. Owners of luxury sports cars, for example, don’t measure their satisfaction by the horsepower rating of the engine. What matters to them is how they feel during a particular episode, such as driving down an open stretch of road. Similarly, football fans don’t talk about bitrate speeds but about the pleasure they take in watching their favorite teams on their mobile devices.

Getting better-quality experiences on each incremental investment

Mobile operator executives are accustomed to thinking of strategies in terms of return on investment, or ROI. But with evolving KPIs and new technologies, it is possible to assess how much improvement in CRUX they’re achieving with each investment. The goal is to leverage technology to get the optimal QOI for the operator and the best possible CRUX for the customer.

Among the tools available to help operators sense what their customers are doing are edge-based traffic management applications. These apps, which run on cloud-based platforms, classify usage episodes by type—such as video, browsing, social media or background traffic—while the content is moving through the mobile access network. The content is never decrypted, but the technology can identify and assess the episode type. This provides operators with a means to “deaverage” the network according to what customers want to do and then set performance target thresholds tailored to episode types. Armed with this information, companies can make investment decisions based on the need to improve CRUX (see Figure 2).

Edge-based traffic management applications and QOI optimization change the way operators measure and invest in their networks. The applications allow for a new level of network programmability and flexibility. Beyond helping operators gauge the performance of each usage type on an individual-cell level, these platforms use real-time analytics to take instant traffic management actions—enhancing user experiences when and where it matters. The network is able to recognize usage episode types as they occur and improve CRUX in the moment. As a result, operators can achieve usage-episode-based performance thresholds while allocating resources more efficiently and reducing the need to upgrade cell sectors (see Figure 3).

Using customer experience to drive network investment

The QOI methodology emphasizes creating a granular view of the customer experience to optimize investment decisions, providing fact-based proof points for a predictable CRUX. Companies that have adopted QOI have shown they can achieve as much as a 30% improvement in customer usage experiences for the same level of investment by changing 20% of planned projects. Operators that employ quality-of-experience decision making can shave up to 10% off capex spending while simultaneously increasing their Net Promoter Scores.

Edge-based traffic management solutions are delivering real benefits today, including reductions in video stalls and delays during busy hours. Consider data from a 2016 deployment of Vasona’s multi-access mobile edge computing (MEC) platform in the center of one of the busiest cities in the world, with 3,000 cell sites and 4 million user lines. In this deployment, a tier-one operator indicated that video buffering fell by 25% and session bitrates increased by 15% during periods of network congestion, enabling the operator to defer radio frequency expansions.

Once mobile operators successfully move from a focus on generic network performance to an approach that allows them to sense what users are doing in real time, they will be able to dynamically manage traffic and maximize CRUX. In short, they’ll be able to invest in the experiences customers value most. Combining QOI-oriented planning with network technology focused on usage episodes can yield satisfied customers and improved returns.

Jeff Melton and Andrew Rodd are partners in Bain & Company’s Melbourne office. John Reister is vice president of marketing and product management at Vasona Networks, based in San Jose, California.

Net Promoter Score® is a registered trademark of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.