Brief

The future has arrived in retail, and it is significantly pressuring supply chains to be more flexible, effective and efficient.

Customers want a seamless, easy shopping experience across channels. They want what they want, when and where they want it delivered, and, increasingly, they want it delivered for free. The value of merchandise ordered via same-day delivery is expected to exceed $4 billion by 2018, whereas it was only $100 million in 2014. Pacesetter Amazon Prime now offers two-hour delivery for consumers in 27 US markets. As these new standards emerge, retailers in all categories are rapidly investing in their omnichannel supply chain capabilities. And they are feeling the strains and the headaches.

Retailers are dealing with increasing complexity as they offer flexible fulfillment options, add shipping nodes and allow product returns in stores. They are forced to change forecasting, planning and product deployment algorithms and processes, requiring them to boost data analytics capabilities. They are enabling real-time inventory visibility across channels by funneling sales information back to internal market groups and vendors. They are pressured to improve in-stock levels while reducing inventory costs and to adapt physical networks for warehousing and transportation, requiring them to change operations up and down the supply chain—including within the four walls of their stores.

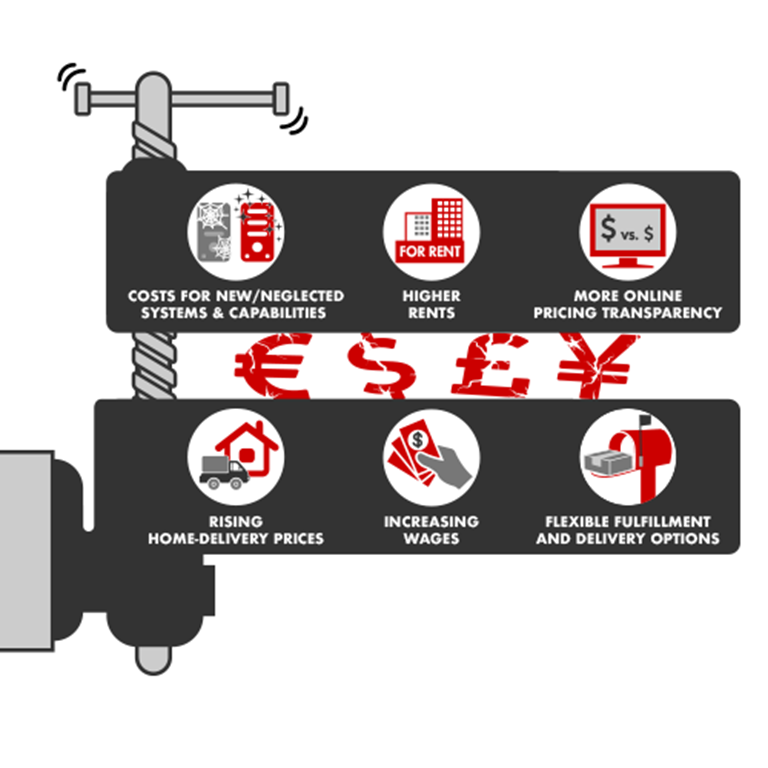

These moves massively stress budgets. Some of the largest retailers are investing as much as $2 billion to cover capital costs for new systems and capabilities, and we see many retailers of all sizes watching their operating incomes drop by 1% to 2% because of increased expenses for “pick and pack” operations, shipping expenses that can’t be absorbed and other new costs. For example, home-delivery shipping prices have risen nearly 5% annually since 1997, and with both FedEx and UPS upping their rates, this situation is likely to continue. These strains have come at a time when retailers are dealing with price pressures caused by the transparency of online pricing, increasing wages and rising rents.

Several retailers are making steady progress meeting these challenges and will likely succeed. However, many are behind and will struggle as they strive to stay relevant, especially as they look for payback on their investments in capital and operating expenses.

Supplying What Customers Want

How omnichannel retailers can revamp their supply chains as e-commerce and free and fast deliveries grow exponentially.

To better determine how retailers can make the best supply chain decisions amid these rapid changes, Bain conducted extensive research and codified our experience partnering with both retail and non-retail clients. We found four basic rules for success.

Go back to basics: Understand your business and customer strategy

All supply chain decisions should be grounded in a well-defined business strategy that involves clearly knowing where you want to play and how to win over time. That requires knowing everything possible about your customers. It’s an exhaustive list: which segments they belong to, how they shop, where they may switch to, how they want to receive and return their goods, and what they will pay for and why. Some customers want fast delivery; others prefer a predictable arrival time. Some prefer one or the other, depending on the occasion. Some are less concerned about timing and more concerned about cost. Many still value tactile store experiences and in-person service. And much of this behavior will change in the future.

In response, retailers are refining their customer strategies. Some are developing “future store” concepts that offer more personalized experiences. For example, Uniqlo and other apparel retailers have introduced fitting-room technology that enables greater customization and better ordering and shopping experiences. In recent years, companies such as Macy’s, Dollar General, Target and Home Depot have spoken publically about their localized assortment strategies. These strategies have big and thorny supply chain implications.

Build supply chain capabilities that support your unique strategy

Until recently, retail supply chains were characterized by a few large distribution centers, full truckload shipping and acceptable service levels at the lowest cost. The premise was that pickups would be at stores and shipping would occur from catalog centers. Speed was not a vital factor. But today’s retailers are required to invest in more fulfillment centers near customers’ homes or workplaces and deliver more small packages quickly to either location. That’s why Myer department stores in Australia abandoned its third-party centralized-distribution center model in favor of opening its own fulfillment centers closer to customers. Now Myer can deliver products more quickly to online shoppers and offer click-and-collect shopping.

But as retailers make such choices, copying the best of what others are doing may not work, and will most likely lead to unsustainably high fixed and variable costs. Customer service levels need to be customized to a retailer’s competitive set and its customers’ needs, now and in the future. Two-hour delivery in Fairfield, Idaho, may not make sense if no one else offers it and customers do not expect it or want to pay for it.

For any retailer, the right answers require complex trade-offs between operating costs and capital investments to ensure product availability and speed. One practical approach is to start by envisioning a perfect solution and then iterating to determine what is practical and affordable.

In the omnichannel world, supply chains encompass more than just traditional distribution facilities and transportation. Undeniably, they now include stores, for example. If two-hour shipping is a requirement, then local ship-from points—either stores or local fulfillment centers—become prerequisites. This advantage holds even for next-day deliveries, as our research suggests that for large retailers, shipping next day from stores can offer up to 30% cost advantage, on average, over shipping next day from warehouses (see Figure 1). It could make sense to retrofit store layouts to serve as fulfillment centers. While this move may be unpopular with store managers, it can provide a competitive advantage, protect revenues and store jobs, and potentially prevent store closures.

If time is less of an issue for customers, shipping from a more centralized distribution center usually is much more economical. The economics can vary significantly by geography and product. For example, the UK has widely different distribution economics than the US. Additionally, the economics of low-margin grocery products differ from higher-margin fashion apparel or electronics products.

Amidst the dizzying choices, companies are making trade-offs, investing to selectively match or beat competitors and counting on those investments to deliver revenue gains. For example, the majority of retailers now offer the option to order online and pick up at the store or have the item shipped from the store, and these offers are supported by different supply chain decisions. The best companies take a methodical approach to adapting their supply chains for new services. An example is Dick’s Sporting Goods. The retailer started with a well-sequenced rollout of its ship-from-store capability. After gaining confidence, it systematically added the choice to order online or pick up at the store, and has continued to refine its omnichannel offerings and infrastructure.

These many factors—increased costs of omnichannel retailing, Amazon’s daunting influence on prices and the need to swiftly develop competitive capabilities—have led some retailers to an inevitable conclusion: Find joint venture partners or third-party intermediaries. Noncompeting players that aren’t big enough or far enough along to do it alone are joining forces in an effort to scale up fast, preserve margins and gain other benefits, such as improving their ability to leverage customer data. For example, last-mile delivery is populated with a host of new alternatives, from ShopRunner and Postmates to UberRUSH and Google Express. And we expect to see more alliances and joint ventures form in the near term. For many, picking the right ones will be critical for survival.

Kim Borchert, a partner in Bain's Retail practice, outlines the four rules of supply chain strategy that can help retailers stay competitive and meet customers' expectations.

Adapt your operating model

Retail supply chains now start with the consumer and work backward, all the way to the vendor. This requires much more involvement across areas that were traditionally considered separate from the supply chain, such as store management, product allocation, buying and assortment architecture. Key strategic and operational decisions now need to be made with participation from marketing, merchandising, e-commerce, distribution, transportation, store management and IT. Some forward-looking retailers are realigning their organizations and decision processes to be more cross-functional. But we continue to see many retailers still operating traditionally, which will likely result in painful outcomes.

Consider the new operating model required for making delivery decisions. Marketing and merchants want the fastest flows, especially during peak and promotional periods. Distribution wants to optimize the warehouse and transportation costs. Stores want to optimize store labor costs. In the omnichannel supply chain, those functions need to collaborate, taking an end-to-end view to make the right trade-offs.

Or consider the decisions around a store’s look and operations. How much square footage should be used as a mini-fulfillment center? How should store labor hours be assigned during peak selling times or peak packing times? How should demand or expectations about service level (pick-up in-store vs. home delivery) be modified in a particular market?

Cross-functional teams with aligned goals, metrics and clear decision rights will become increasingly important over time.

Use technology and analytics as a critical enabler

Technology has always been integral to retail supply chains, but the omnichannel ecosystem raises technology requirements exponentially in an industry that has historically underinvested in it.

Retailers now need different and better algorithms for forecasting demand; figuring out delivery vs. pick-up requirements; establishing stocking points (location and size), stock levels, reorder quantities and rules; and determining whether or not to price for delivery options. Beyond these analytical capabilities, retailers also need to track a customer’s order, determine the package it will be delivered in and be able to trace it along the entire supply chain. Delivery companies like FedEx and UPS have systems to do this well, and retailers need to replicate such capabilities. French retailer Decathlon took a big step in this direction by affixing RFID tags on all of its private-label apparel—even on relatively cheap items like T-shirts—allowing for real-time availability checks online for each store.

While technology often is a big part of the solution, we typically see a backlog of priorities that have been deferred due to insufficient funding or lack of IT talent. As a result, outmoded technology, high IT investment costs and a skills deficit can put many retailers at an unsurmountable disadvantage to deep-pocketed competitors with Agile development approaches or newer players with more flexible architectures.

The path forward

Most retailers are at the beginning of this long omnichannel journey with requirements that will evolve over the years. Companies need to plan for multiple time periods, understanding what projects they must do now and what can be put off until later; it’s a multiyear P&L and balance sheet issue. We counsel retailers to look at their investments and returns over time and to ensure that all costs and benefits are understood, baked into long-term plans and stress-tested for adequacy, given competitors’ moves and market changes.

These aren’t easy decisions. But as the industry evolves, these decisions will determine which retailers end up thriving in the unfolding omnichannel era and which ones just don’t make it.

Kimberly Borchert is a partner in Bain & Company’s Boston office. Pratap Mukharji is a partner, based in Atlanta. Both are members of Bain’s Retail practice.