Forbes.com

Fashion has a way of following necessity in private equity. General partners (GPs) have faced no shortage of needs. They need to put vast sums of dry powder to work at a time when opportunities to do multibillion-dollar mega-buyouts are scarce. They need to avoid overpaying for assets while deal multiples remain high. And they need to find ways to realize top returns when they are holding aging assets in their portfolios at little more than intrinsic value.

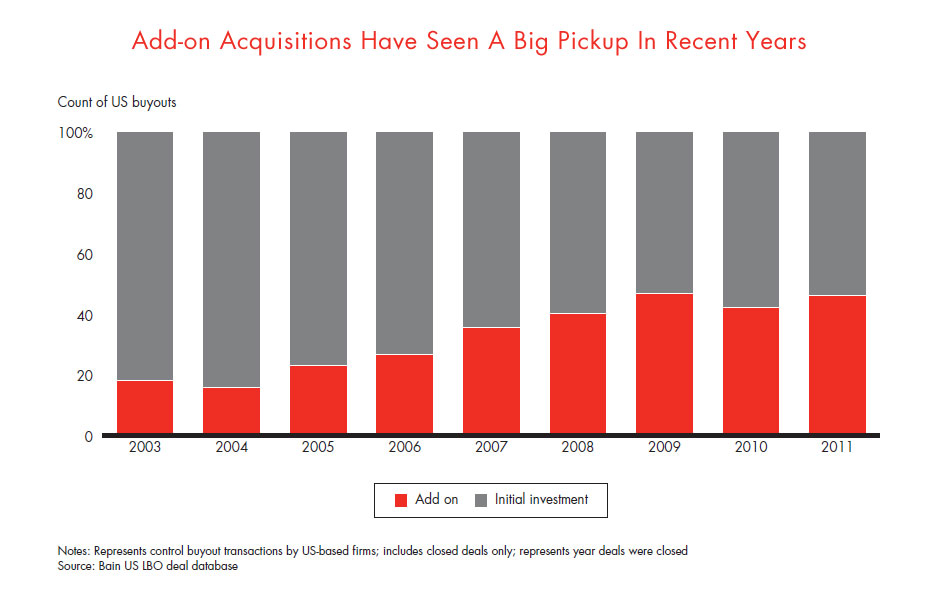

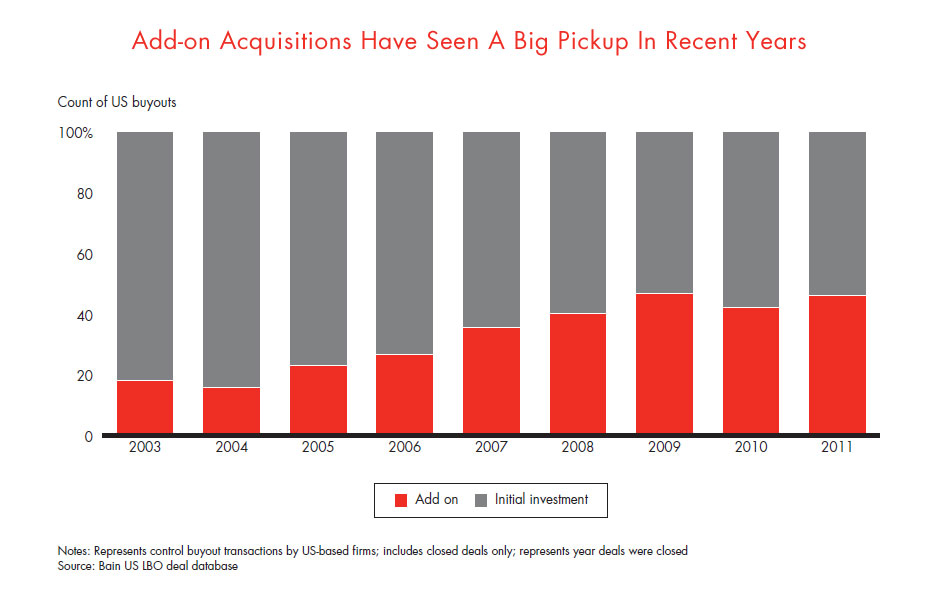

Those circumstances have combined to bring “buy and build” strategies into vogue (see figure below).

Based on the logic that the whole can be more than the sum of its parts, buy-and-build investors acquire a platform company that occupies an attractive niche in a fragmented market, and then carefully add on several other closely related businesses. The private equity owners aim to capture the advantages of scale and improve performance to add value.

It’s not hard to understand the many advantages of buy and build. Because acquisition multiples are lower, buying and merging smaller companies with management teams they know and trust is often less costly than buying scale businesses. Also, creditors see add-on deals as less risky than new-money ones making them more willing to lend.

Third, buy and build usually increases flexibility when the time comes to exit by owning assets big enough for an IPO or to attract the interest of a strategic buyer.

Finally, buy and build increases the possibility that GPs can alter the profile of a business languishing in their portfolio and dramatically improve its prospects for a more profitable sale.

Executing a successful buy-and-build strategy, however, requires discipline, planning and patience. Bain & Company’s work with scores of clients that have embraced buy and build for more than two decades has revealed that adherence to six key success factors separate the winners from the losers.

- Harness top talent. The common attribute contributing to a successful buy-and-build program is the strength and leadership of the senior management team charged with spearheading it.

- Buy small; buy often. One of the most frequent pitfalls of buy-and-build programs—as with M&A generally—is the propensity of acquirers to bet the ranch on a single, large acquisition. Distracting complexities of integrating two nearly equal-sized companies proliferate, absorbing precious resources and management time. Successful GPs focus on assembling a “string of pearls”—many smaller businesses, each of which tucks seamlessly into the platform company.

- Stick to the core. Building a business to scale succeeds far more frequently than attempts to expand its scope. Each add-on should strengthen the platform company’s core and complement its strengths.

- Know the true synergies of scale. GPs and company management need to understand in detail how scale economics work in the target industry, including how costs can come out and how much margins can expand as the company moves up the scale curve.

- Plan for exit from the start. Even as they embark on their buy-and-build venture, GPs need to develop a clear view of their point of arrival for the combined business.

- Hone a repeatable model. The true benefits of buy and build compound with experience. Frequent acquirers that have a repeatable formula for integrating add-on companies usually enjoy bigger and more frequent successes.

When done right, buy and build can be a portfolio management strategy ideally suited for markets like today’s, when PE firms can no longer ride in the tailwinds of multiple expansion and leverage but need to generate alpha to earn their carry.

This post was written by Graham Elton, Bill Halloran, Hugh MacArthur and Suvir Varma, leaders of Bain & Company’s Private Equity Group.