Article

Industries in start-up mode can be innovative, scrappy and undisciplined as they scramble to grow and capture market share. Those traits have certainly characterized the rambunctious life insurance market over the past decade of India’s rapid economic expansion.

Eager to serve affluent, middle-class consumers new to insurance products and looking for the protection and potential investment returns insurance can provide, insurers piled into the market and pumped capital into assembling a distribution infrastructure. To drum up sales, they aggressively boosted marketing outlays, hired novice agents and front-loaded their commissions as an incentive to sign up policyholders. Business took off, lifting Indian life insurers’ revenues to US$57 billion in 2009, according to the latest industry data.

With premiums for private insurers growing at a 57 percent rate compounded since 2005, attractive opportunities remain for business to continue to expand. On a per capita basis, Indians are underinsured, paying annual premiums of just US$48—little more than half of what Chinese policyholders pay and just a small fraction of the $1,600 per capita premiums paid by US policy holders.

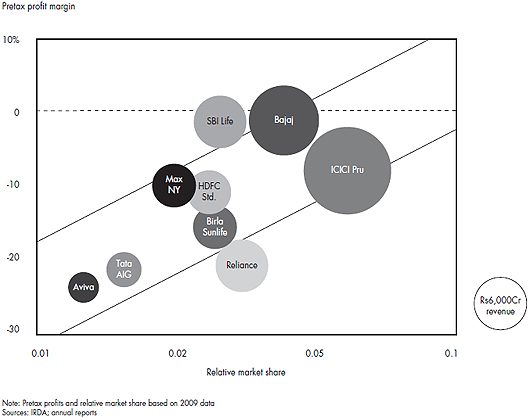

Yet, despite their torrid growth, Indian insurers are discovering that the route to profitability is a long and arduous one, typically taking nearly a decade to break even. Only a handful of the industry’s largest players, such as ICICI Prudential and Bajaj Allianz, have recently begun to turn a profit. India’s mostly sub-scale insurers are hemorrhaging cash as a result of high operating costs and rampant customer churn, as policyholders abandon their coverage long before their policies generate earnings.

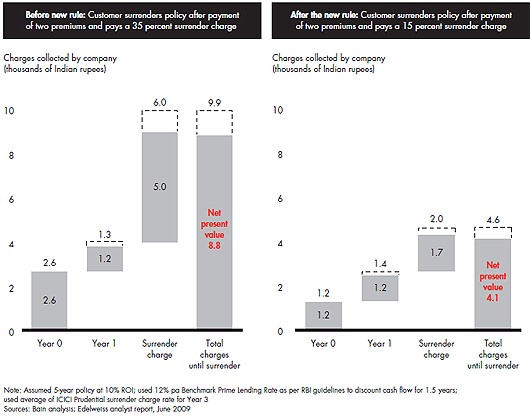

Life insurers’ uphill climb to profitability is becoming even steeper. Despite the industry’s shallow profit pools and adverse economics, new competitors continue to crowd into the market. Eight new companies have entered over the past five years, and several more are actively drawing up plans to join them. Meanwhile, the Insurance Regulatory and Development Authority (IRDA), the industry’s public overseer, issued new rules last fall to curb consumer abuses that are slowing industry cash flows. Among other measures to make the insurance market more customer-friendly, the IRDA has toughened rules that prevent insurers from frontloading fees on new policies while capping the surrender charges insurers can levy. We expect that the new limit will cause the net present value of insurers’ revenues from surrender charges to fall by more than half.

Suddenly, already distant profitability goals look even further away. Overall, industry analysts estimate that the new IRDA rulings will reduce the discounted profits on new policies sold by between 8 percent and 10 percent and will increase the amount of capital insurers will be required to hold in this already heavily capital-intensive business by some 40 percent. The double whammy of more competition and tougher regulation will be felt across the industry but will be acutely painful for newcomers and for companies that have yet to achieve the scale needed to succeed.

Insurers that hope to survive the coming shakeout and ultimately turn profitable will need to find efficiencies and boost productivity in three key areas:

Target the right customers. Most Indian insurers rely on a direct-agent salesforce to win market share, paying steep commissions that drive up new-customer acquisition costs. Outlays for payroll and commissions typically eat up more than half the first-year premium— far higher than for benchmarks in other emerging and developed markets. But high customer churn rates mean that too many policies are surrendered long before they generate sufficient premium income to become profitable.

Companies that focus on attracting customers that their organization is best able to serve get far more bang for their marketing outlays than their less discriminating competitors. Our work with insurers around the world has shown that insurers who zero in on the right customers and use a closed-loop feedback process to track how well their organization meets or exceeds customer expectations on the critical touch-points reap higher revenue growth rates and market share.

The reason these leaders excel is self-evident: policyholders are loyal to insurers that treat them well. Not only do promoters cost less to serve than customers who are disgruntled detractors, they are also less apt to defect, they buy more products and they are far likelier to recommend their insurer to friends and colleagues.

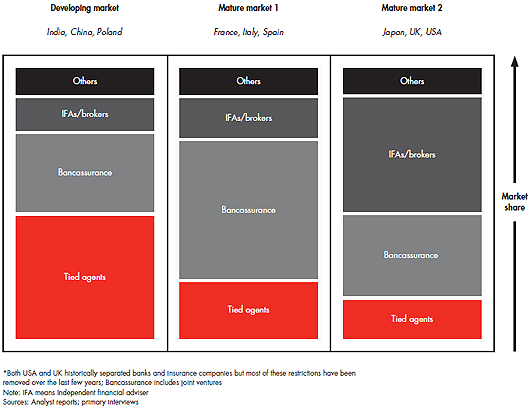

Rethink the distribution network. The recent regulatory changes and faster competitive tempo are forcing insurers to take a fresh look at their distribution channels. Our analysis shows that new business premiums correlate closely with the reach and concentration of offices insurers have in their network. Currently, distribution is heavily skewed toward agency sales, which account for approximately 80 percent of total industry revenues. Efficient tie-ins with banks that use their multipurpose branch networks to sell insurance products will probably account for a higher proportion of new policy sales going forward.

Bancassurance has the lowest costs, and the industry’s evolution in mature markets has clearly favored this channel. But it will be difficult for new market entrants to forge one of the few remaining partnerships available in India. Thus, while an agency-based salesforce will remain an important channel, insurers will need to take steps to improve agent productivity, which can vary by as much as 500 percent between the best and the worst performers. To close that wide gap, the laggards will want to tighten up recruitment to bring in better new hires, invest in better professional training to raise skill levels, identify the top producers and restructure compensation and incentives in order to retain the best people.

Strip waste out of opex. Taken together, operating expenditures and customer acquisition costs account for between 25 percent and 50 percent of total annual premiums and are fat targets for rationalization. We estimate that these overhead outlays can be reduced by as much as one-third. With the smarter customer targeting described above, advertising and promotion costs, which eat up another 5 percent of total premium revenue, can also be trimmed. Achieving competitive scale is perhaps the most effective way for cost savings to flow to the bottom line. Thus, the pressure will be on newer subscale players, in particular, to ramp up quickly—through organic growth, strategic alliances or mergers.

With the wild “land grab” phase of the life insurance business coming to an end as the industry begins to mature and comes under tighter scrutiny, India’s insurers face tough choices in the months and years ahead. Those that are unable to rework their business models risk years of losses and debilitating drains on cash reserves. Getting the distribution network right, squeezing down costs and achieving scale are insurers’ best policies for success.