Forbes.com

Somewhat insulated from the recession anxieties and sovereign debt default fears that gripped the developed markets, fast-growing emerging market economies from Asia to Latin America continued to beckon global private equity investors. General partners (GPs) continued to flock to healthier macroeconomic climates and booming regions like Greater China, Southeast Asia, and the Indian subcontinent seeking investment opportunities.

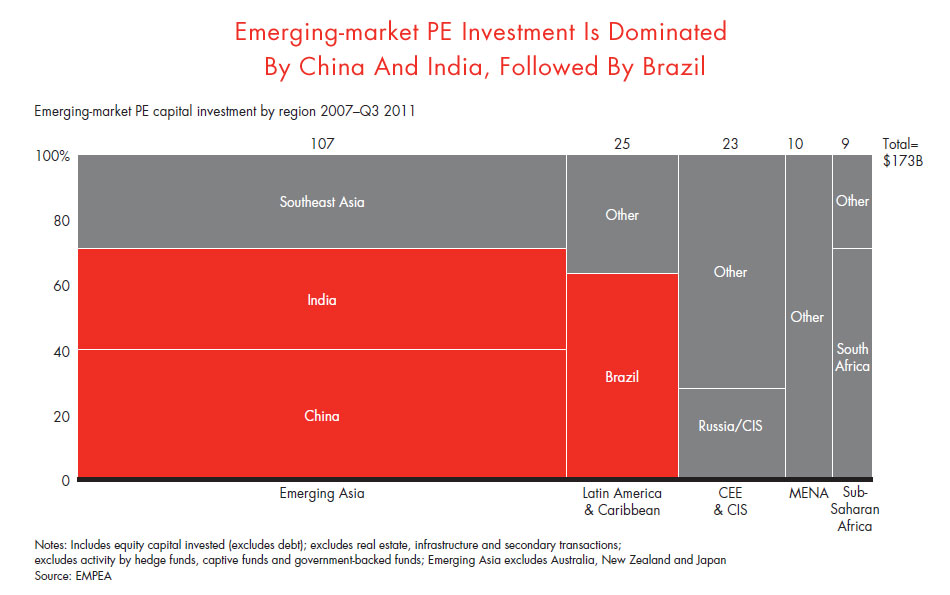

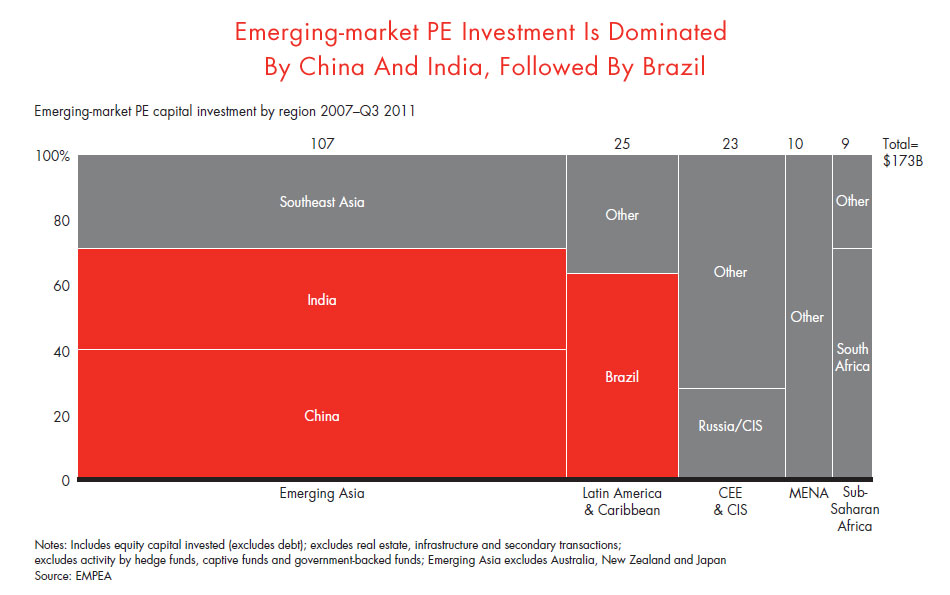

Overall, however, PE emerging market investment volume in 2011 was about half what it was at the peak of the private equity boom in 2007. But as we explained in our Global Private Equity Report 2012, the year played out differently in each country. PE volumes were up in the two biggest markets, China and India, but investment activity stalled in Brazil, the third-largest emerging-market destination for PE capital.

China: Total 2011 private equity investments in China ended up higher than in 2010 and even surpassed the boom years of 2007 and 2008. Yet investment activity did not live up to its full potential. One major factor hindering GPs’ efforts to put more capital to work was a valuation mismatch between buyers and sellers. Despite lower and more volatile public equity markets, sellers held out for the lofty trading multiples high-quality assets commanded at the market peaks. In addition, with mounting uncertainty about the sustainability of global demand for goods from China’s export-driven economy, potential buyers were reluctant to stretch to meet sellers’ high price expectations.

India: India saw private equity investments grow substantially in 2011. Sectors seeing the biggest uptick in activity were real estate, information technology and information technology-enabled services, and manufacturing. As in previous years, deal volume skewed towards smaller transactions. Larger global funds continued to be challenged putting capital to work in a market dominated by minority-stake deals and with limited availability of sizeable potential targets in need of capital infusions.

Indian companies also showed an increased appetite for private equity capital in 2011 as more conventional financing sources became harder to find. Borrowing costs rose as India’s central bank raised interest rates to combat inflation and a volatile stock market discouraged public offerings. One question mark on the horizon is the potential impact of new draft regulations proposed by the Securities and Exchange Board of India last August. Under the new rules, international PE and venture capital funds could face more onerous registration and reporting requirements that would increase the cost and risk for PE firms.

Brazil: GDP growth slowed to less than 4% in 2011 from the 7.6% pace of a year earlier and private equity investment activity largely followed the macroeconomic trend. The sensitivity of the data to the impact of a few big deals does reveal an important characteristic of Brazilian PE: Brazil remains a thin market, dominated by small and mid-sized investments, chiefly in family-owned businesses. Moreover, the process of matching PE buyers and sellers increasingly involves intermediaries, opening a wedge in prices.

Despite the recent slowdown, Brazil is clearly becoming more hospitable to private equity. Its capital markets are growing more sophisticated, and the country boasts one of the most active public equity markets in the world, making IPOs a realistic exit option. Yet, significant hurdles remain. Government regulation, tax policy and economic uncertainty add complexity and risk to PE deals, making local expertise, enhanced due diligence, strong risk management capabilities and attention to post-deal value creation imperatives for GPs operating there.

Looking ahead, GPs in all emerging markets will need to work hard to bridge the price-expectations gap. Successful private equity funds will work to educate company management about the contributions that PE owners can bring to a company. They will build strong relationships with owners prior to acquisition to align interests and make it possible to influence the company post-close. Finally, they will collaborate with their target-company partners during ownership to create value.

This post was written by Graham Elton, Bill Halloran, Hugh MacArthur and Suvir Varma, leaders of Bain & Company’s Private Equity Group.