Management Tools

Over the past decade, Mergers and Acquisitions (M&As) have reached unprecedented levels as companies use corporate financing strategies to maximize shareholder value and create a competitive advantage. Acquisitions occur when a larger company takes over a smaller one; a merger typically involves two relative equals joining forces and creating a new company. Most Mergers and Acquisitions are friendly, but a hostile takeover occurs when the acquirer bypasses the board of the targeted company and purchases a majority of the company’s stock on the open market. A merger is considered a success if it increases shareholder value faster than if the companies had remained separate. Because corporate takeovers and mergers can reduce competition, they are heavily regulated, often requiring government approval. To increase the chances of a deal’s success, acquirers need to perform rigorous due diligence—a review of the targeted company’s assets and performance history—before the purchase to verify the company’s standalone value and unmask problems that could jeopardize the outcome.

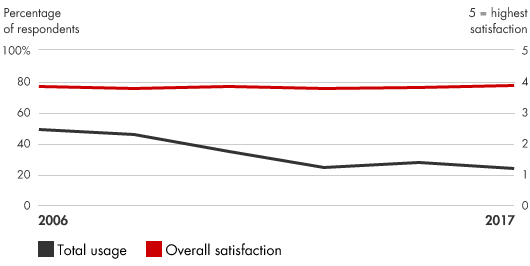

Usage and satisfaction among survey respondents

How Mergers and Acquisitions work:

Successful integration requires understanding how to make trade-offs between speed and careful planning and involves these steps:

- Set integration priorities based on the merger’s strategic rationale and goals

- Articulate and communicate the deal’s vision by merger leaders

- Design the new organization and operating plan

- Customize the integration plan to address specific challenges; act quickly to capture economies of scale while redefining a business model; and sacrifice speed to get the model right, such as understanding brand positioning and product growth opportunities

- Aggressively implement the integration plan; by Day 100, the merged company should be operating and contributing value

| RELATED TOPICS | HOW BAIN CAN HELP |

|---|---|

Companies use Mergers and Acquisitions to:

Mergers are used to increase shareholder value in the following ways:

- Reduce costs by combining departments and operations, and trimming the workforce

- Increase revenue by absorbing a major competitor and winning more market share

- Cross-sell products or services

- Create tax savings when a profitable company buys a money-loser

- Diversify to stabilize earnings results and boost investor confidence

Management Tools & Trends

Five key trends emerged from Bain's survey of 1,268 managers.

Selected references

Bruner, Robert F., and Joseph R. Perella. Applied Mergers and Acquisitions. Wiley Finance, 2004.

Frankel, Michael E. S. Mergers and Acquisitions Basics: The Key Steps of Acquisitions, Divestitures, and Investments. 2d ed. John Wiley & Sons, 2017.

Gaughan, Patrick A. Mergers: What Can Go Wrong and How to Prevent It. John Wiley & Sons, 2005.

Gole, William J., and Paul J. Hilger. Corporate Divestitures: A Mergers and Acquisitions Best Practices Guide. John Wiley & Sons, 2008.

Harding, David, and Sam Rovit. Mastering the Merger: Four Critical Decisions That Make or Break the Deal. Harvard Business Review Press, 2004.

Harding, David, Sam Rovit, and Alistair Corbett. “Avoid Merger Meltdown: Lessons from Mergers and Acquisitions Leaders.” Strategy & Innovation, September 15, 2004, pp. 3–5.

Kanter, Rosabeth Moss. “Mergers That Stick.” Harvard Business Review, October 2009, pp. 121–125.

Lajoux, Alexandra Reed, and Charles M. Elson. The Art of M&A Due Diligence: Navigating Critical Steps and Uncovering Crucial Data. 2d ed. McGraw-Hill, 2010.

Lovallo, Dan, Patrick Viguerie, Robert Uhlaner, and John Horn. “Deals Without Delusions.” Harvard Business Review, December 2007, pp. 92–99.

Miller, Edwin L., and Lewis N. Segall. Mergers and Acquisitions: A Step-by-Step Legal and Practical Guide. 2d ed. Wiley, 2017.

Rosenbaum, Joshua, Joshua Pearl, and Joseph R. Perella. Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions. 2d ed. Wiley, 2013.

Schweiger, David M. M&A Integration: A Framework for Executives and Managers. McGraw-Hill, 2002.