Forbes.com

This article originally appeared on Forbes.com.

There’s an advertising arms race on in US personal lines property and casualty insurance, because few new customers are entering the market: Last year, just 1% more in auto and 4% in home, for a total 2% in P&C, as reported in Bain & Company’s new survey of nearly 26,500 US consumers, conducted by Research Now. Most acquired customers are people who switch from a competitor.

As a result, many carriers may feel like Alice in Wonderland, running flat out with barely any forward motion. With annual population growth in the US at just 0.7%, carriers have seen slow overall growth in net premiums written, just 2.7% over the past five years, according to SNL Financial.

As carriers seek to improve their growth rates, they rely on acquiring and retaining customers. But very few carriers excel in both areas; most have to make a choice. Bain’s survey analysis helps inform carriers how they can succeed in both endeavors.

Customers report that they buy home and auto insurance primarily on price, followed by the carrier’s reputation. That has been reinforced in advertising of the past few years, with most ads conveying one of two themes—low price or peace of mind. The payoff is clear: Ad spending correlates directly with customer acquisition rates, Bain’s analysis shows. The top performers in acquisition, like Progressive and GEICO, spend 50% more per customer on advertising than the average performer, through a drumbeat of price-based themes. Their direct model, using no or few agents, has structurally lower expense ratios than a traditional insurer, allowing them to deliver on their low-price promise.

The catch is that highly price-sensitive customers are more prone to defect to a competitor because of price. Of those who do defect, more than half move to a carrier with which they save less than 20% on their premium.

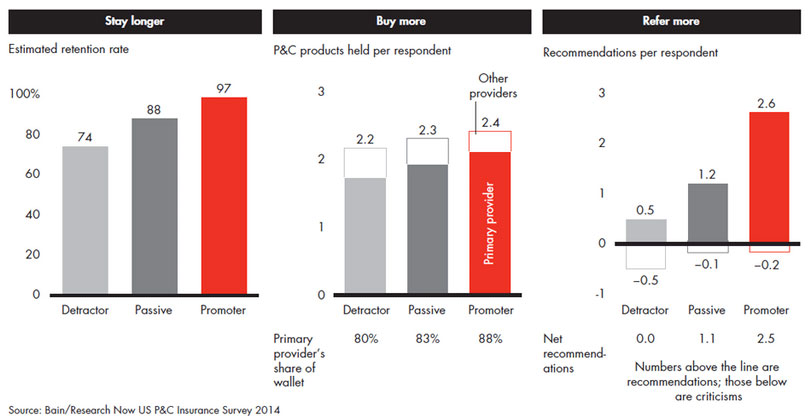

Companies that lead in retaining customers take a different tack. Our survey analysis finds that retention correlates strongly with higher customer loyalty, as measured by Net Promoter Scores. Customers who are promoters of their primary carrier stay longer and buy more products, and they make more referrals to friends and colleagues (see figure below). As a result, promoters are worth nearly seven times more than detractors. And greater retention accounts for three-quarters of that additional value.

The survey analysis has practical implications for all carriers, whether they emphasize acquisition or retention.

First, carriers should refine their marketing to be more selective in which customers they acquire. Attracting only price-sensitive customers will likely generate higher churn down the road, so carriers that choose this route will have to continually manage costs down to attract an outsize share of new customers and maintain their market position. As the arms race escalates, moreover, there may come a point of diminishing returns from advertising, so insurers would benefit from exploring how to make advertising and direct marketing more effective now.

Carriers that focus ad themes on peace of mind or convenience could shift from a broadcast to a narrowcast mode, so they can target the most attractive customer groups. And they could intensify tailored marketing once the customer is on board, to provide information that customers value or to reassure them that “we’ve got your back.” Advanced analytics can help mine demographic, behavioral and other data to build predictive models that improve the accuracy of matching tailored products to target segments. USAA, for instance, mines customer data to inform its targeted marketing, which may be triggered by a life event, such as offering additional auto insurance to a family when a child turns age 16. The second major implication involves retaining price-sensitive customers. This requires insurers to step up their pricing and product innovations, so customers have strong reasons to stay and buy more products.

Some innovations lean on price-related features. Nationwide’s Vanishing Deductible rewards safe driving, and many majors, including Allstate, offer “accident forgiveness,” where a higher-priced policy buys no increase in a premium after the first accident. Other innovations stem from advances in digital technologies, notably in-vehicle telematics programs, which typically record driving behavior and use the data to inform the underwriting process. With the exception of Progressive’s Snapshot program, though, telematics has not yet achieved high penetration rates for most insurers, because some customers have been wary of the intrusion and insurers have been reluctant to push the technology aggressively.

As mobile technology continues to advance rapidly and more people accept location tracking services, telematics seems certain to flourish. Start-ups already offer other telematics-based innovations. An example is MetroMile’s launch, in several states, of an auto policy that sets price by the number of miles driven. Route-based pricing could soon appear, as evidence mounts that certain highways are statistically safer than city streets.

For most P&C insurers, reigniting organic growth involves a choice between excelling in acquisition or retention. Both models, however, benefit from a dedicated focus on earning customers’ loyalty because of the value created by greater retention, cross-selling and referrals.

Read the full report: Customer loyalty in P&C insurance

Written by David Whelan and Sean O’Neill, Chicago-based partners with Bain & Company’s Global Financial Services practice.