The Situation

Real EstateCo* is a leader in residential property, with high-end apartment houses in select US markets. It was acquired in a leveraged buyout based on a key premise: the company could sell off targeted assets to reduce its debt obligations.

But that plan was jeopardized when the real estate bubble burst, resulting in plunging residential housing market values and the credit crisis.

To survive—and rebound, the commercial real estate giant had to quickly improve its cash flow and lower operating costs along with its long-term capital structure and portfolio strategy. The company's turnaround also had to include a redesign of both its long-term capital structure and portfolio strategy to generate improved value for stakeholders.

Our Approach

Drawing on its extensive turnaround experience, Bain advised Real EstateCo's CEO on developing a transformation plan that would rapidly deliver results.

Together, we helped the company assess three critical areas:

Strengthen financial performance: We conducted a comprehensive review of its working capital programs, liquidity risks, options for restructuring its balance sheet and cash flow forecasting and reporting. We also designed tools for improved financial management.

Increase organizational effectiveness: We developed a model to promote teamwork between the company and its property managers as well as a blueprint for reducing overhead.

Streamline and improve operations: We identified ways to increase revenues while significantly cutting costs.

Our Recommendations

Based on our assessment, we recommended that Real EstateCo's CEO and senior management team rapidly implement several initiatives to achieve its goal of selling assets to reduce the company's debt:

- Use new tools to improve cash flow forecasting and decision-making; tighten financial controls and free up working capital.

- The new tools allow senior manager to see how shifts in processes and operations affect cash flow in real time.

- The tools allow closer scrutiny of cash spend and flexibility to manage against revised budgets.

- Launch initiatives to improve productivity and efficiency through increased teamwork and lower overhead.

- Boost revenues with new rental pricing model.

- Reduce costs by optimizing property staffing and increasing procurement savings by taking advantage of scale.

The Results

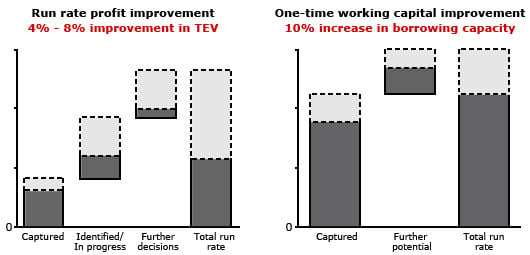

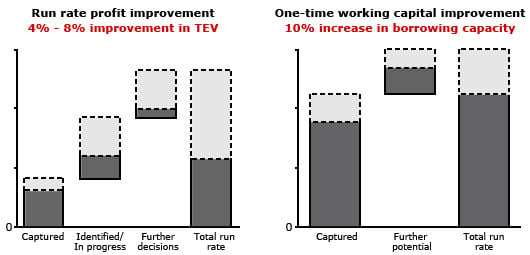

The turnaround plan we designed with Real EstateCo delivered strong financial results, allowing the company to achieve its goals amid continuing economic uncertainty.

The residential property leader sold off designated assets and improved pricing on remaining portfolio holdings. It also increased revenues by raising rents while managing to maintain occupancy rates.

These steps allowed the company to restructure and lowered its debt, stockpile more working capital and increase its borrowing capacity by 10 percent.

Finally, Real EstateCo has a framework in place that promotes collaboration and sustained improvement in the organization's performance.

* We take our clients' confidentiality seriously. While we've changed their names, the results are real.