Bain + Sylvera

Bain + Sylvera

The data, ratings, and insights you need to make carbon offsets a key part of your netzero strategy

The data, ratings, and insights you need to make carbon offsets a key part of your netzero strategy

If companies hope to make good on their pledges to achieve net-zero emissions by mid-century, they can’t afford to leave any stone unturned. Emissions reduction alone won’t be enough. Nature-based solutions and carbon credits have a vital role to play in making up the difference, but companies often underinvest because they lack reliable information about the design, quality, and efficacy of carbon-offset projects.

That’s why we partnered with Sylvera, the leading carbon intelligence platform. Our goal is to provide company leaders and investors with state-of-the-art, actionable insights on both nature- and technology-based carbon credit initiatives. Now you can identify and prioritize the projects that will yield the highest value and impact, to your business and the planet. The combination of Bain’s expertise in nature-based solutions and carbon transition strategies and Sylvera’s independent ratings, proprietary data and machine-learning technology enables you to confidently plan and benchmark your carbon reduction strategies and credit investments.

Bain’s expertise combined with Sylvera’s industry-leading carbon ratings platform ensures that your offset investments work hand-in-glove with the other components of your net zero strategy.

Sylvera’s state-of-the art technology and independent, standardized ratings provide the in-depth analysis and transparency you need to accurately assess a diverse array of offset options.

Companies that act now and develop a clear strategy can begin purchasing quality carbon credits and gain an advantage over their peers.

Our diagnostic quickly illuminates critical elements of your company’s strategy for a future-proof net-zero transition. From any starting point, we’ll help you know where you stand and how to reach an ideal end state. The tool enables you to:

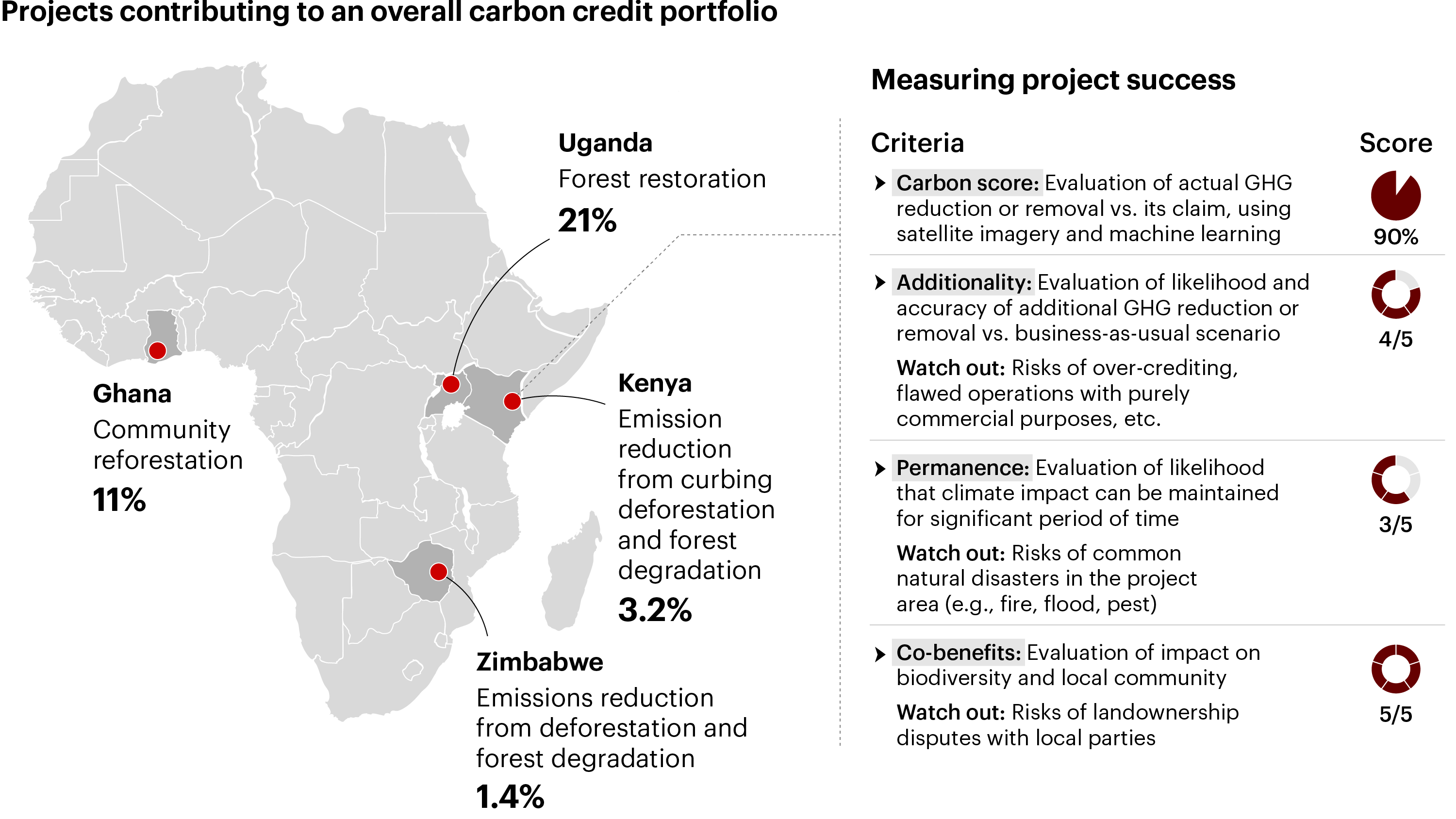

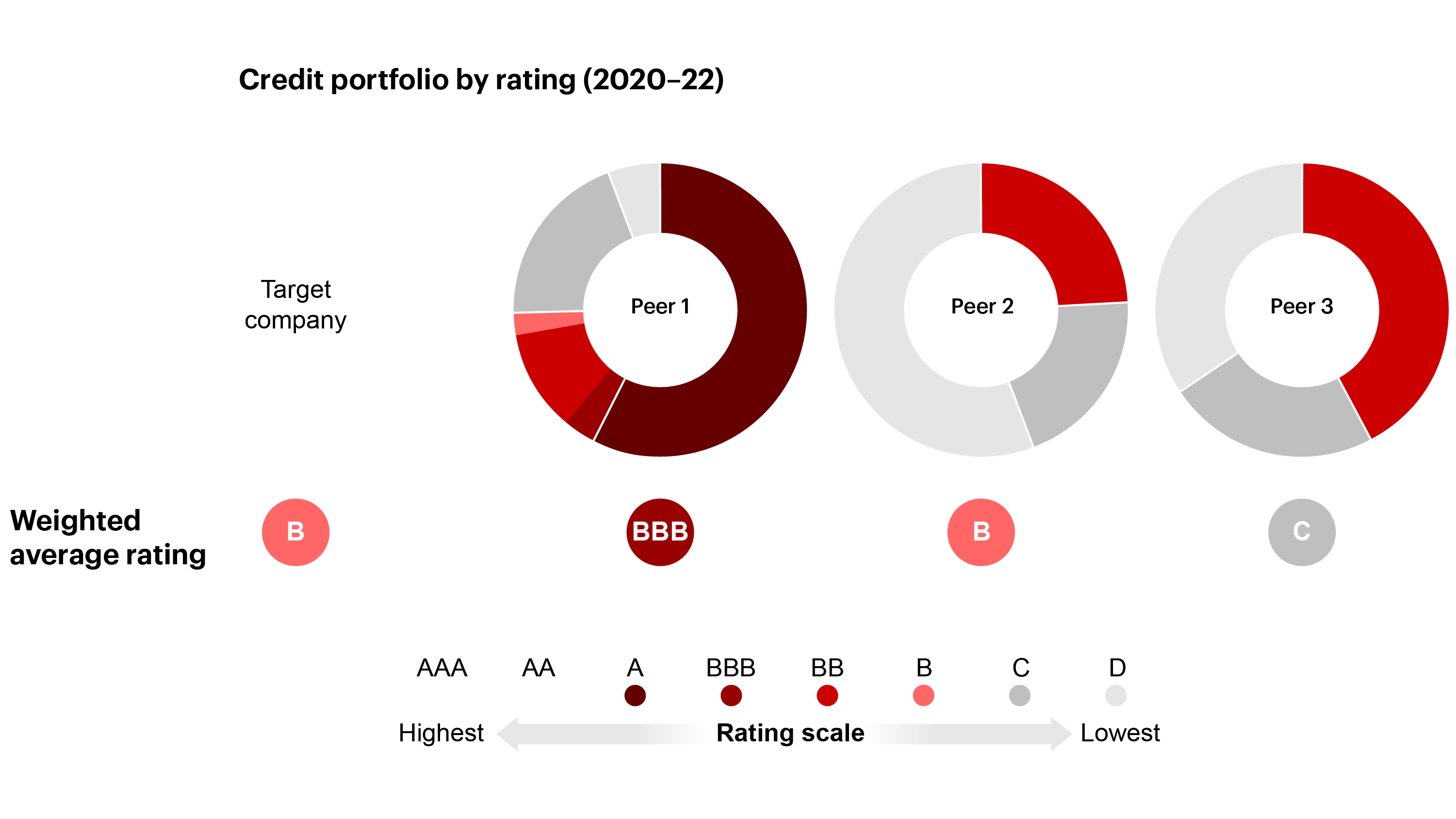

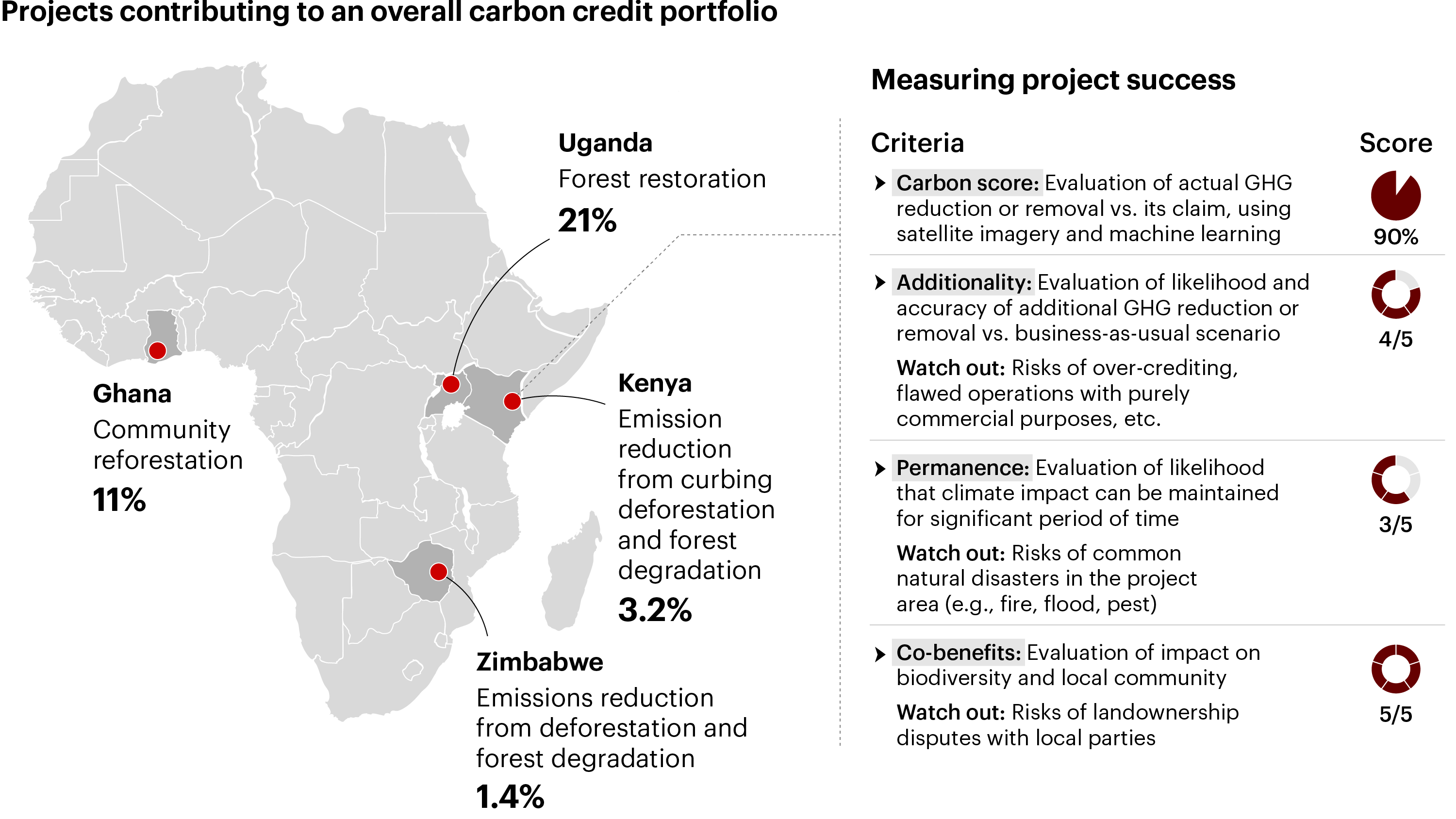

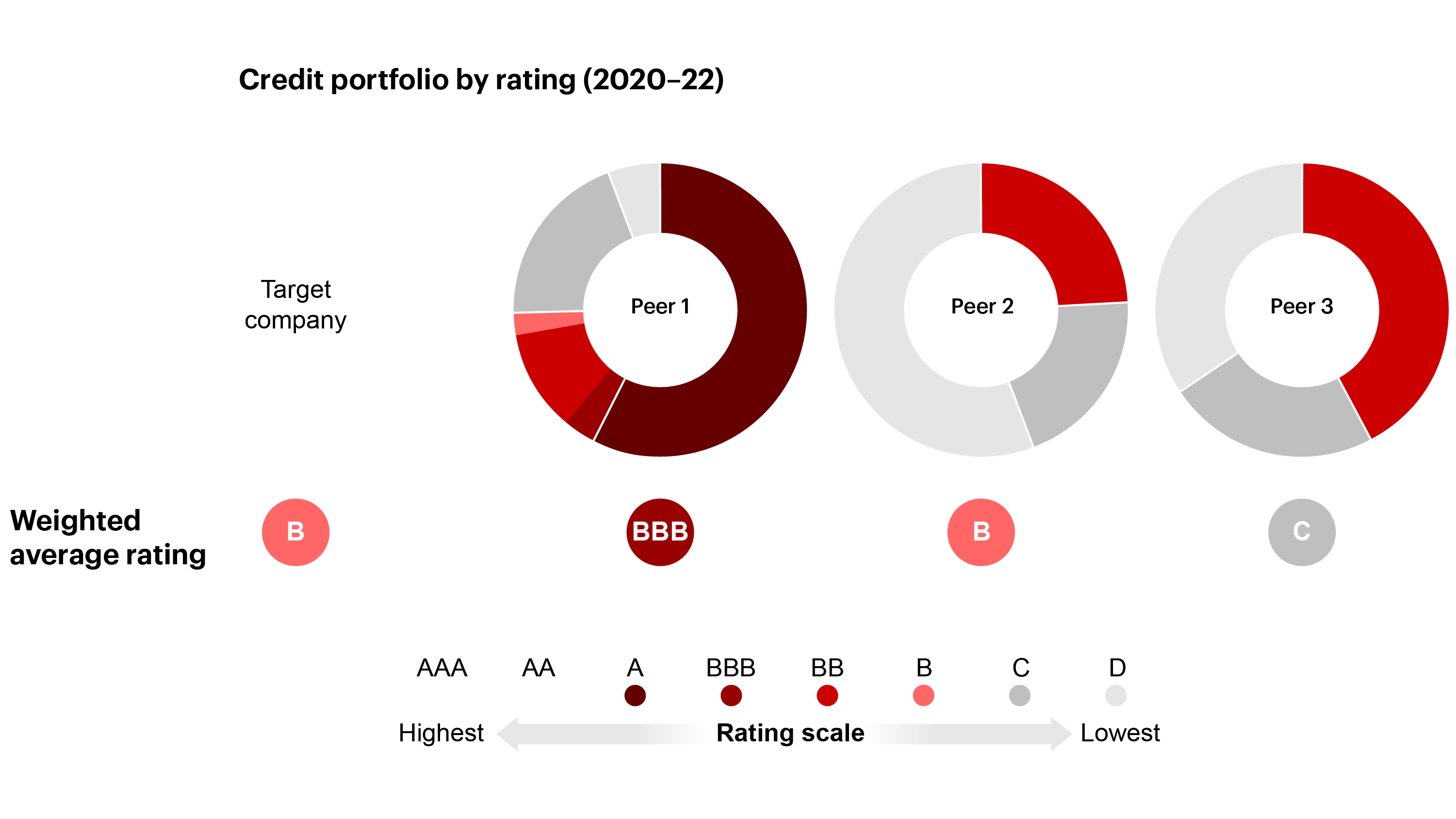

The diagnostic generates ratings scaled from AAA to D. These ratings are based on satellite imagery, machine leaning, and other factors. You can compare your portfolio’s performance with that of peers in terms of additionality, permanence, and other elements.

An additional dimension, co-benefits, reflects impacts on biodiversity and the local community.

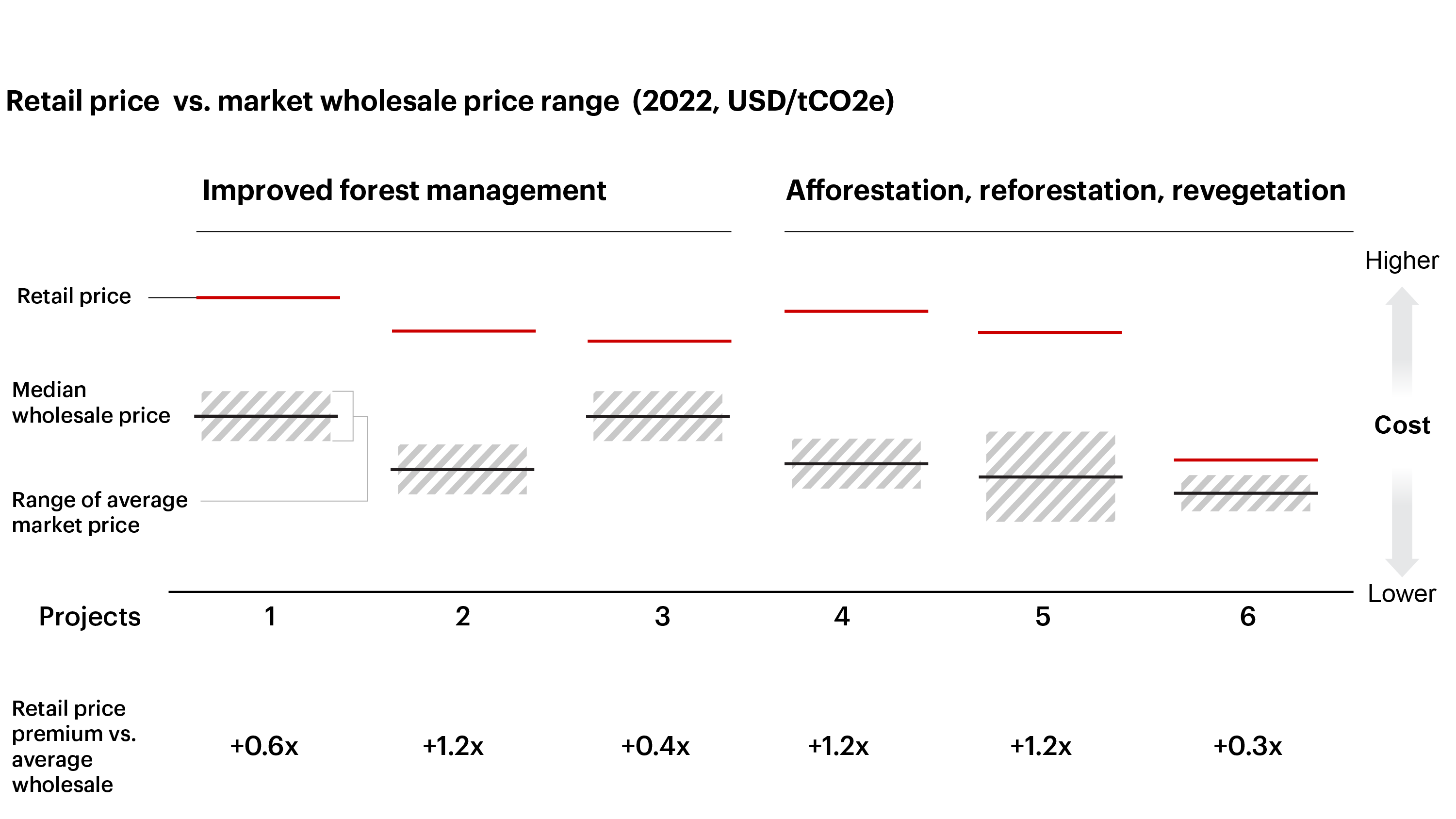

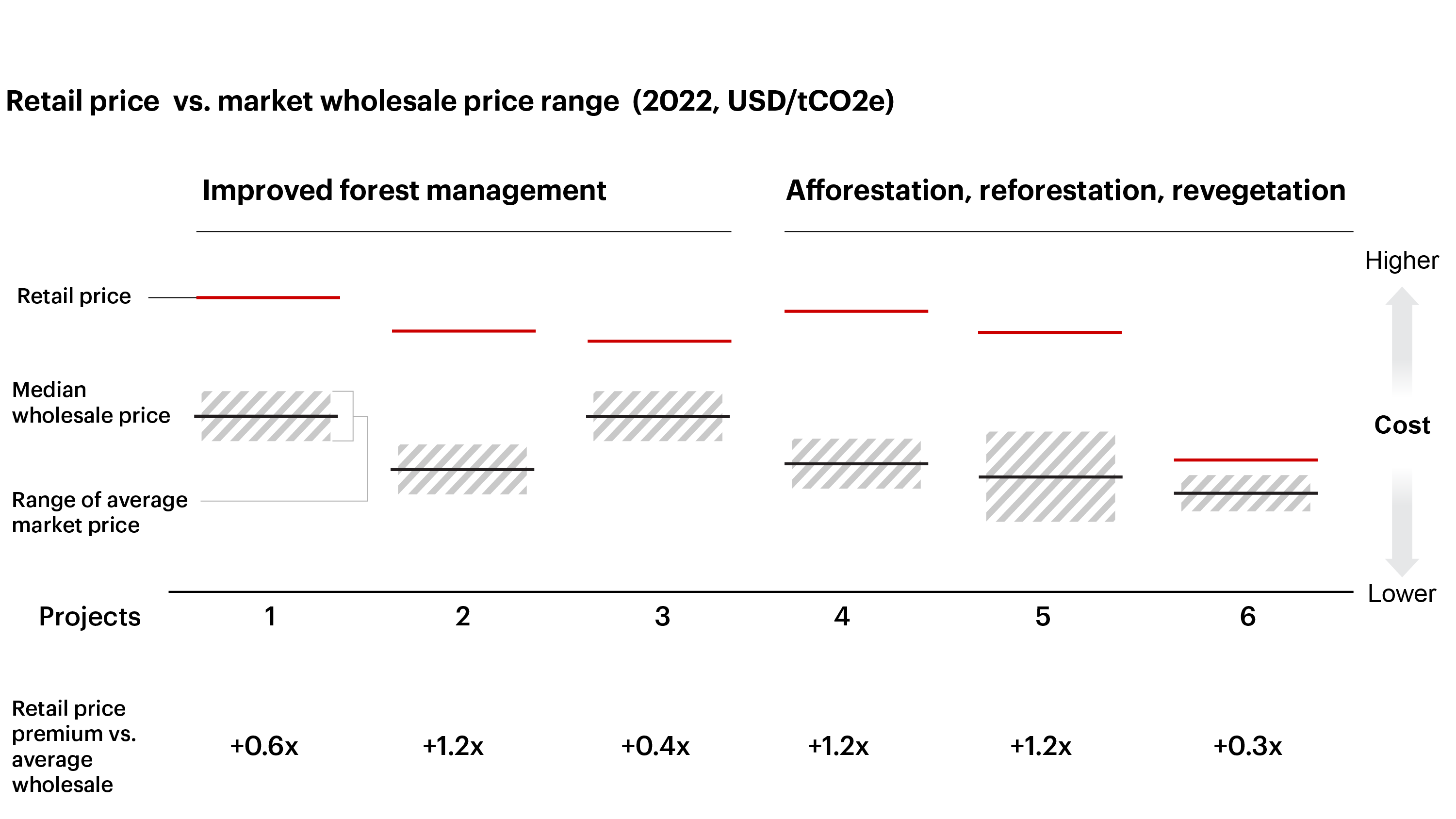

The diagnostic’s benchmarks help you secure quality projects at a reasonable price, unlocking procurement cost savings. You can use it to tailor a smart procurement strategy in a market that currently has little pricing transparency.

Our diagnostic quickly illuminates critical elements of your company’s strategy for a future-proof net-zero transition. From any starting point, we’ll help you know where you stand and how to reach an ideal end state. The tool enables you to:

The diagnostic generates ratings scaled from AAA to D. These ratings are based on satellite imagery, machine leaning, and other factors. You can compare your portfolio’s performance with that of peers in terms of additionality, permanence, and other elements.

An additional dimension, co-benefits, reflects impacts on biodiversity and the local community.

The diagnostic’s benchmarks help you secure quality projects at a reasonable price, unlocking procurement cost savings. You can use it to tailor a smart procurement strategy in a market that currently has little pricing transparency.

Effective decarbonization strategies require a price to be put on carbon. Few countries do this, which makes the voluntary market critical.

Effective decarbonization strategies require a price to be put on carbon. Few countries do this, which makes the voluntary market critical.

Sylvera is a carbon intelligence platform that helps you evaluate and invest in high quality carbon credits. Our team of experts leverages proprietary data and machine learning technology to produce the most comprehensive and accessible insights on carbon projects. We deliver independent, in-depth and up-to-date project reports and market intelligence through our online platform and API.

LEARN MORE

A sharpened focus on five key areas can accelerate your decarbonization approach and unlock real value.

See more

We’re bringing the full force of our talent and expertise to create a more sustainable, equitable and inclusive world.

See how