Harvard Business Review

The current economic downturn is likely to be steep, long and turbulent. What are the right moves now and over the coming months to adjust and play to your strengths?

A critical first step is determining exactly where you stand. A tropical storm viewed from a weather satellite looks more or less uniform, as if it is affecting every area it touches with equal force. On the ground the picture is different. One home loses its roof while others on the street come through intact. One community is devastated while its neighbor a mile away escapes unscathed.

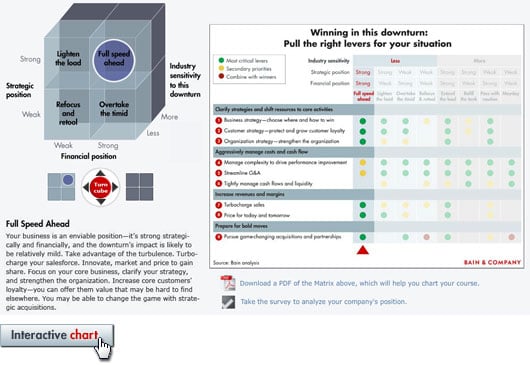

So it is with business storms: even a sharp downturn affects everyone differently. Each company has particular strengths and vulnerabilities. Each will have different answers to three critical questions: How is the slowdown affecting the industry I compete in? What is my company's strategic position within that industry? What level of financial resources can my company draw on to weather the downturn?

Your best strategy in a downturn depends on where you stand on these three dimensions. For example, if your company has a strong financial position, then your strategic and industry position gives you a variety of options. You could outinvest competitors in marketing to increase customer loyalty. You could attack or even acquire weaker competitors; you could price products to gain share. You may be well positioned to lead consolidation within your industry, or to dominate critical market niches by concentrating your financial and marketing strength.

If your company has a weaker financial position, by contrast, you face a different set of possibilities. Depending on your strategic position and your industry's volatility, your best options may be to divest non-core assets and restructure the balance sheet, or accelerate decisions around reducing cost and debt. You may need to seek alliances or merger partners and dispose of anything that is not essential to survive. Or you may choose to reposition your business by selling weak operations and focusing on a sustainable core business.

You have already seen the threats from the current situation, and you are doubtless addressing them as part of your strategic and financial planning for 2009. It's equally important to take a close look at the opportunities the downturn presents. But there is no one-size-fits-all set of prescriptions. Understanding the specifics of your situation enables you to quickly put to work the right combination of tools.

Read a PDF of the full article on Harvard Business Publishing's website, which takes a closer look at the situations companies can find themselves in and the opportunities each one presents.

Darrell Rigby is a Boston-based partner at Bain & Company and leads the firm's Global Retail practice.