Report

1. Asia-Pacific private equity: A tale of two extremes

Asia-Pacific private equity (PE) investors kept the party rolling in 2018, setting new highs for the industry after a record-breaking 2017. Deal value peaked, exit values hit an all-time high and returns were strong. However, fund-raising declined, and increased competition created tougher market conditions for many PE funds. Investors’ appetite for technology and Internet companies was undiminished, and deal size in these two sectors mushroomed.

But that powerful momentum masked three disconcerting market developments that could affect investment activity and returns in the coming year. First, US-China trade tensions have increased the risk of macroeconomic disruption in China and across the region. At the same time, deal prices have remained high while interest rates are rising steadily after a period of decline, a trend that will increase the cost of funding and could put a brake on future multiple expansion.

Third, and perhaps most worrying, the region’s private equity market has become sharply polarized between large funds with strong track records that dominate activity across the region, and smaller, less experienced funds that are having difficulty raising funds and exiting. The impressive headline figures for the Asia-Pacific PE market in 2018 mask the emergence of a winner-take-all dynamic.

These economic and market trends could slow the revenue growth and multiple expansion that propelled Asia-Pacific PE returns in recent years. In past recessions, the PE market has outperformed other asset classes. But if recession strikes, vulnerable and less differentiated funds are likely to disproportionately bear the brunt of the downturn. In other words, the party could end abruptly in 2019 for some investors.

The risk of a slowdown has fund managers seeking new ways to win in an increasingly selective market. Successful companies already have begun developing smart strategies to ensure strong returns and set themselves apart from the pack.

Looking forward, three important themes are playing an increasing role in the Asia-Pacific private equity market: the rush to invest in China tech and Internet companies; the use of advanced analytics as a tool to improve fund performance; and a shift toward environmental, social and governance (ESG) and impact investing.

China tech and Internet. Many general partners (GPs) have sharpened their focus on China’s burgeoning new economy to help maintain strong returns in a highly dynamic market. The Internet and technology sectors, which make up the new economy, have accounted for almost 85% of the growth in Greater China private equity since 2010. Alluring as that opportunity is, however, PE funds need to understand just how different the rules of the game are in China, the number of failures that litter the landscape, and the risk of betting on a speculative investment bubble that could burst.

Advanced analytics. One powerful strategy is the use of advanced analytics to gain sharper insights during due diligence and better assess the market opportunities and threats to portfolio companies in the new economy and traditional sectors. Some PE funds in Asia-Pacific already have internal or external partners helping them deploy advanced analytics tools to increase their competitive edge, and the trend is now accelerating.

Environment, social and governance investing. To respond to increasing public concern, comply with new demands from limited partners (LPs), and reduce their risks, more global GPs are investing with an eye to environmental, social and governance issues and committing a larger share of capital to impact investing. Until recently, most investors assumed that investing for social and environmental impact compromised returns. But a decade of experience has disproven that myth. As a result, ESG investing is gaining traction, allowing PE funds to further differentiate themselves from competitors and create value beyond financial returns.

In section 2 of this report, we will examine in greater detail how the Asia-Pacific PE industry performed in 2018 and highlight key trends that will shape the private equity landscape in the coming years. We have also included a snapshot review of each market in the region. In section 3, we will discuss three key trends affecting the Asia-Pacific market.

The good times may continue rolling in 2019 for many Asia-Pacific funds, particularly the best-performing ones. The region’s private equity industry has developed a strong momentum over the past few years and now represents a significant share of the global PE market. However, the sharp and growing divide between winners and losers that became more evident in 2018 means a significant number of funds may face hard times in the coming year. To win even in a tougher market, many already are working to raise their game.

2. What happened in 2018?

Lifted by strong momentum, the Asia-Pacific private equity industry set new records in deal value and exit value and achieved heavyweight status in the global PE arena. With $883 billion in total assets under management, Asia-Pacific now represents 26% of the global PE market, up from only 9% just a decade ago (see Figure 2.1). As GPs compete for deals against corporate players, increasingly they are winning. Private equity’s share of the Asia-Pacific M&A market rose 6 percentage points to 17% in 2018, from the previous five-year average of 11%.

Asia-Pacific now makes up a quarter of the global PE market

Despite continued robust dealmaking, however, several warning signs appeared on the horizon. Competition has grown even more intense, and macroeconomic headwinds are gathering. That combination could weaken the investment dynamic in the coming years. Exit value set a new record, for example, but the total number of exits declined sharply and large exits dominated the year’s results. Although a core of well-positioned funds raised capital with ease, overall Asia-Pacific-focused fund-raising was sharply lower in 2018, following a record high in 2017 (see Figure 2.2).

The Asia-Pacific PE market rose to new highs in 2018, but fund-raising slowed

Here’s how the year unfolded.

Dealmaking: China and India out in front

Asia-Pacific deal value rose to $165 billion in 2018, exceeding the all-time high of $159 billion of a year earlier and 48% greater than the 2013–17 average (see Figure 2.3).

Investment momentum has been on an upward trend since 2013

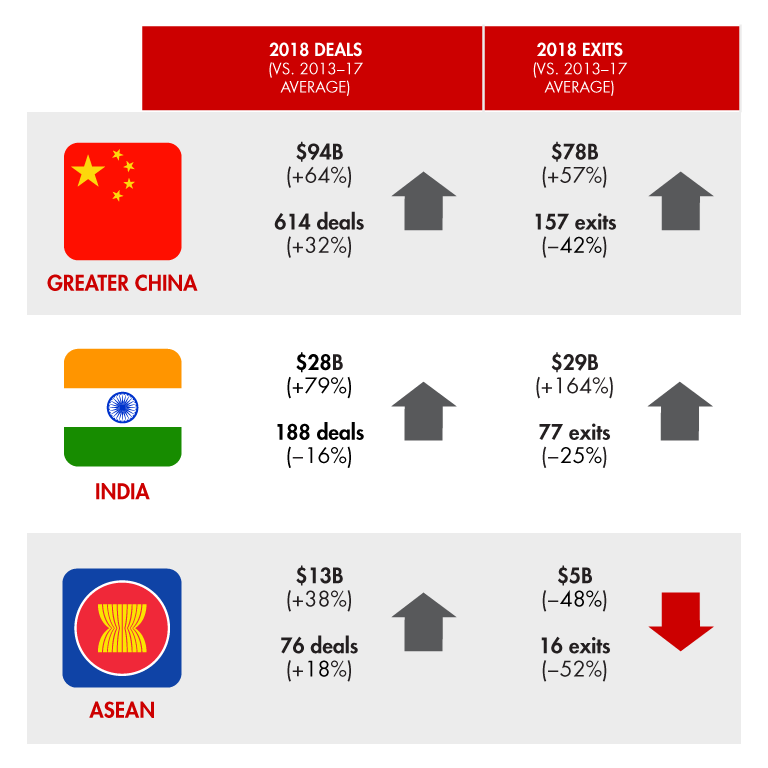

Dealmaking in China and India dominated investments in the region, making up almost 75% of total deal value (see Figure 2.4). Total private equity investment value in China rose to $94 billion in 2018, up 64% over the previous five-year average (see Figure 2.5). However, it’s important to recognize that China’s private equity market consists of two markets with very different dynamics: The market for transactions in renminbi, which is hardly accessible to nondomestic PE funds, and one in foreign currencies.

Greater China and India dominated the growth in deal value

Private equity investment in most countries was higher than the recent average

Investment activity in the region’s other markets was significantly higher than the 2013–17 average, except for Japan, where private equity deal value declined by 64% from the five-year average. LPs remain keenly interested in Japan, and the volume of deals in 2018 was slightly higher than the five-year average. But in Japan, large deals can skew the numbers. Corporate divestitures make up most of the large-deal segment of $200 million or more, and the number of large deals in Japan fell to three in 2018 from eight a year earlier. Fewer deals caused the average deal value to drop to $67 million last year from $344 million in 2017. The trend highlights a lack of pressure on sellers to dispose of quality assets. Japan’s hands-on shareholders tend to focus on other actions to improve the balance sheet.

Strong demand for Internet and tech

Internet and technology investments continued to dominate the market, making up 50% of deal count in 2018. Consumption-related sectors such as healthcare and services also represented a large proportion of total PE activity (see Figure 2.6). As the middle class in China and India continues to expand, businesses in these sectors are growing rapidly and seeking capital. With the risk of a recession looming, demand for technology, healthcare and consumer services—sectors that tend to thrive even in a downturn—may increase in the coming year.

Internet and technology companies made up half of total deal count

Thirty-two megadeals ($1 billion or more in value) pushed the average deal size to $151 million, on par with last year and up 27% over the previous five-year average of $119 million. These megadeals made up 39% of deal value, compared with an average 33% over the last five years.

Global and domestic GPs were the most active last year, and accounted for more than half of the deals by value. Government-linked investors increased their momentum, representing more than a quarter of the deal value in 2018 (see Figure 2.7).

The most active investors were global and domestic general partners

As we noted in previous years, a growing number of deals are giving private equity investors control. However, in 2018, this trend slowed. GPs we surveyed are still expecting that more minority deals will have a path to control—including board seats or decision rights for most important investments. But buyouts declined overall and as a percentage of total deal value. Growth equity deals, which are easier to do, rose sharply. Our survey indicates that about 35% of respondents found that sourcing and getting buyouts done vs. minority deals was harder this year than last year (see Figure 2.8). Ant Financial’s huge $14 billion fund-raising in 2018 through a consortium including GIC, Khazanah Nasional, CPPIB, Temasek and a few private equity funds was the largest growth deal in 2018, but nine more topped $2 billion.

Buyouts were harder to do in 2018

Although growth equity deals captured the headlines, deals that focused on restructuring, carve-outs and turnarounds rose in value to more than triple the previous five-year average, led primarily by South Korea.

Overall, prices in the Asia-Pacific region remained high in 2018, fueled by increasing competition across the region and soaring valuations in the Internet and technology sectors. The median EV/EBITDA multiple on Asia-Pacific PE-backed transactions rose to 14.5, setting a new high (see Figure 2.9).

Median deal multiples for M&A set a new record in 2018

Behind the numbers

Transactions with two or more investors reached a new high in 2018, helping PE firms tap into ever-larger deals. The number of deals involving multiple investors rose to 71%, compared with an average 56% over the past five years, and a growing number include five or more investors. In PE transactions worth $500 million or more, almost 80% involved multiple investors. The average number of investors per deal in the Asia-Pacific region in 2018 was 3.3, up from 1.7 in 2013 (see Figure 2.10).

Investors are increasingly combining forces as they seek larger transactions

A few trends continued to stoke private equity investment across the region, including greater overall acceptance of private equity and a shortfall of managers able to help companies achieve the next phase of growth. Company owners increasingly recognize that global GPs bring a network and capabilities that local and regional corporate investors can’t match.

Private equity investors are now choosing from a broader pool of companies across the region, thanks in part to secondary deals, or exits where the sale is to another PE owner. Secondary deals represented 10% of total deal value in 2018 and are likely to continue rising. However, this is well below the levels that we have seen in the US or in Europe, which averaged, respectively, 17% and 53% of the market value in the past five years.

Finally, most funds have a significant overhang of capital, enabling them to make investments. Dry powder—committed but unspent capital—set a new record. By the end of 2018, dry powder in the Asia-Pacific region had risen to $317 billion, or three years of future supply at the current pace of investment, from $267 billion in 2017 (see Figure 2.11). Sustained past fund-raising activity contributed to the surge, along with Preqin’s improved coverage of China funds.

There is no shortage of dry powder in the Asia-Pacific region

Exits: Winners take all—or nearly all

The value of Asia-Pacific private equity exits reached a record $142 billion in 2018, up 39 percent over the past five-year average. That dynamic continued to power a virtuous industry life cycle by creating positive cash flow for LPs on average.

Led by China, India and South Korea, the surge in exit value far outpaced the previous all-time high of $125 billion in 2014. However, large deals were more prevalent, and the total number of exits declined sharply. Exits of $1 billion or more were 58% of total exit value, and the average exit value doubled to $353 million from the 2013–17 average (see Figure 2.12). By contrast, exit values dipped sharply in Japan, Southeast Asia and Australia and New Zealand compared with the past five-year average.

Exit value reached a new record, despite low volume

Trade deals were the largest exit channel. Walmart’s $16 billion purchase of India’s Flipkart from SoftBank Vision Fund and others helped push trade deals to 63% of total deal value from 53% a year earlier. Other large trade sales included the sale of China’s Ele.me for $5.2 billion.

The value of total initial public offering (IPO) exits fell slightly from 2017 and the past five-year average, given greater stock market volatility. On the other hand, while the value of secondary exits fell 9% from 2017, it was almost 40% higher than the previous five-year average.

The amount of unrealized value in portfolios rose to $646 billion in 2018. If multiples begin to contract, PE funds may risk building up an exit overhang. But for now, GPs are maintaining a similar level of older vintages and increasing the share with vintages of three years or less (see Figure 2.13).

The unrealized value of PE investments surged in the past year, propelled by new investments

Exit data reveals a market increasingly split into two starkly different realities: Large, experienced PE-owned companies racked up the vast majority of successful exits and dominated total exit value, while smaller companies had increasing difficulty finding buyers. The number of exits of companies sold for less than $100 million plunged to 205 in 2018, down 58% from 493 in 2017. By contrast, the number of exits larger than $500 million rose 26% to 59 (see Figure 2.14).

Sales of smaller companies dropped sharply in 2018

Tougher market conditions for smaller and newer PE firms, as well as the decline in quick flips—assets held less than three years—is putting pressure on returns. The percentage of quick flips fell to 18% of total exit value, compared with 35% to 45% before the 2008–09 financial crisis.

As the risk of global recession rises, a tougher market for exits is doubly challenging. Two-thirds of Asia-Pacific GPs we surveyed said they intend to sell assets significantly or somewhat faster.

Fund-raising: The flight to quality continues as China closes the tap

Asia-Pacific PE fund-raising dropped by more than 50% in 2018 to $75 billion, or 34% below the previous five-year average. Overall, the share of global fund-raising for the Asia-Pacific market declined significantly to 14% in 2018 from 20% on average over the past five years.

Investors have not lost interest in Asia; LPs are keenly focused on the region’s strong returns and diversifying their investments. That helped push the global share of Asia-Pacific assets under management to an all-time high. Similarly, capital was in strong supply: the ratio of capital sought to capital closed was four, compared with a 2013–17 average of two.

But several trends have sharply curbed fund-raising. One is the previously mentioned record level of dry powder. At the same time, China has moved to enforce more stringent policies on wealth management products to improve transparency and reduce financial risk. Restrictions on banks and insurers’ investing in nonstandard asset classes, including private equity, led to a massive decline in renminbi fund-raising in 2018, although recent developments suggest that private equity sector limitations may be partly lifted (see Figure 2.15).

Asia-Pacific-focused funds raised less capital, as renminbi-based funds grappled with China’s new asset management rules

Fund-raising data underscored the shift toward a PE market where winners take all—or nearly all. The number of Asia-Pacific-focused funds that closed in 2018 plunged to 256, a 57% drop from 593 in 2017. But for funds that closed, the average size rose to a record $294 million, up 55% from the 2013–17 average. And they were 10% over target, compared with negative 1% for the previous five years (see Figure 2.16).

In fund-raising, the winners took all

Investors’ flight to quality—the preference for larger funds with strong track records—continued in 2018. Large firms were able to raise capital and close new funds quickly as LPs increasingly refocused their relationships toward those with scale and reputation, and made big bets. On average, experienced funds larger than $1 billion needed only seven months to close, and they met or exceeded their targets. PAG Asia Capital raised a $6 billion fund in 2018, exceeding its $4.5 billion goal. Similarly, Bain Capital raised its $4.65 billion Asia IV fund in six months, exceeding its $3.5 billion target. By contrast, smaller and newer funds had a much harder time raising capital. Funds that raised less than $1 billion required an average of 16 months to close, and new funds needed 27 months. Only 39% of smaller funds reached or exceeded their fund-raising targets (see Figure 2.17).

Large funds with established track records are benefiting from investors’ flight to quality

Returns: Still on track

Asia-Pacific PE returns remained barely positive for the first three quarters of 2018, and record exit value ensured LPs as a group remained cash-positive. Asia-Pacific private equity returns strongly outperformed public stock markets in the region. The pooled IRR for Asia-Pacific-focused funds with a five-year investment horizon was 14%, compared with 8% for Asia-Pacific public markets. The IRR for a 10-year investment horizon was 11% vs. 6% for public markets (see Figure 2.18).

LPs remained cash-positive in the third quarter of 2018, and private equity continued to outperform the stock market

Overall industry returns rose to a 12.4% median net internal rate of return (IRR). That compares with a median net IRR of less than 12% for the past 10 years. And the outlook remains positive. Although it is too early to know how younger vintages (2012–15) will perform, the estimated returns are promising, with a net IRR above 20% forecast for top-quartile funds (see Figure 2.19).

Returns were strong in 2018, and the outlook for younger vintages is trending up

However, as interest rates start to tick upward, funds will need to find new ways to create value. Over the past decade, declining interest rates have helped bolster PE returns and multiple expansion. When interest rates are declining, funds can borrow more and pay a higher multiple without putting more equity into a transaction. Median EV/EBITDA multiples for Asia-Pacific PE-backed M&A transactions are 60% higher now than they were five years ago. As interest rates rise, that multiple buffer will disappear and GPs will have to work harder to generate strong returns. PE funds we surveyed acknowledged that multiple expansion will not be as strong a source of return as in the past. Going forward, the most important factors will be internal—top-line growth obviously, but also margin improvement and M&A (see Figure 2.20).

The sources of value continue to shift in Asia-Pacific, forcing funds to develop new skills

The shifting sources of value in Asia-Pacific private equity will test the industry’s creativity. Many will need to build new skills to ensure strong returns in the coming years. Today, almost 45% of Asia-Pacific GPs we surveyed tell us they failed to achieve their targeted margin expansion for more than half of the companies they sold in the last two to three years. And more than two-thirds of Asia-Pacific-based GPs are concerned about how interest rates will affect their performance (see Figure 2.21).

Changing sources of value will test the industry’s creativity and resilience

Watch for a turning point

Several developments in 2018 signal change on the horizon. GPs have been buying assets at top prices, and the forces that have produced strong returns over the past decade—revenue growth and multiple expansion—could lose steam in the coming year. More than 70% of Asia-Pacific GPs say competition increased in 2018, especially from regional and local PE firms, making it more difficult to find attractive deals. Many also see a clear decline in proprietary deals. And most expect holding periods to expand, making it harder to achieve premium IRR.

As the macroeconomic climate becomes increasingly challenging and competition for deals grows more intense, the gulf between winners and losers could widen. Recent experience highlights the risk. Out of the roughly 500 Asia-Pacific private equity and venture capital funds (excluding real estate, infrastructure or natural resources) that were active in 2007, only 290, or about 60%, raised another fund in the wake of the global financial crisis. Roughly half of the multiasset-class investors had to withdraw from at least one of their asset classes (see Figure 2.22).

The 2008–09 global financial crisis caused many failures among Asia-Pacific PE funds

Successful funds already are looking for creative ways to improve returns in a tougher environment. Many are gaining an edge in due diligence by deploying advanced analytics to better understand markets and trends. Some GPs are playing smart in the Chinese market by focusing on new technologies. Finally, forward-looking investors are differentiating their funds from the pack by adopting environmental, social and governance (ESG) criteria when evaluating targets. Each of these approaches can help funds ensure strong value creation, even in shifting market conditions.

Private Equity in Asia-Pacific 2019

A look at the private equity highlights in the region from last year and the outlook for 2019 and beyond.

3. Looking forward—key trends in 2019 and beyond

Playing smart in China’s new economy

China’s new economy has expanded at a startling pace over the past few years. The country’s Internet and technology companies innovate and grow as rapidly as rivals in Silicon Valley—or faster. And Chinese start-ups are just as skilled in creating spectacular value. But perhaps most startling is the speed of China’s transformation from tech laggard to global challenger.

In 2018, Chinese start-ups received 32% of invested global venture capital, or $81 billion, up from 4% five years ago and not far behind the 47% received by US start-ups (see Figure 3.1). Greater China is rapidly producing unicorns—start-ups valued at $1 billion or more—and now counts almost as many as the US. One reason: China’s Internet giants, including Alibaba Group Holding Ltd. and Tencent Holdings, are keen on funding the country’s tech start-ups.

Greater China’s new economy has been moving at full steam

Equally impressive, China claimed more than 70% of the total value of Asia-Pacific Internet and technology private equity deals in 2018. Over the past eight years, China’s new economy accounted for 83% of the growth in investment in Greater China, making it the largest contributor by far to the growth of the Asia-Pacific region. Private equity investors poured $59 billion into China’s Internet and tech companies in 2018—more than 20 times the 2010 level. Without that new-economy engine, China’s investment growth would have been tepid.

China’s new economy differs from Western tech ecosystems in several important ways, starting with its large talent pool. China has six times more computer science graduates than the US tech sector.

Chinese tech firms tend to expand rapidly in multiple directions, fueled by consumers’ rapid adoption of new technologies. China’s Internet giants, for example, have acquired or invested in companies in financial services, gaming, education, healthcare and artificial intelligence (AI). New pockets of growth quickly attract dozens of rivals that copy the latest innovations.

Investors have rushed into China’s new economy, drawn by the dizzying growth of its Internet and tech start-ups. According to Bain’s 2019 Asia-Pacific private equity survey, 80% of Greater China-focused funds are considering or actively pursuing new economy deals. In 2017–18, more than 800 private equity investors acquired an Internet or technology company in China with a value greater than $10 million, up from about 170 in 2009–10.

China’s new economy, once dominated by venture capitalists, now includes traditional private equity houses, limited partners (LPs), sovereign wealth funds (SWFs) and the country’s Internet giants, including Baidu, Alibaba and Tencent. The most active PE funds in China’s new economy—those with five deals or more in the past five years—were involved in 68% of total deal value in 2018, slightly more than institutional investors and venture capital funds, which were involved in 60% and 53% of the deals, respectively.

The huge volume of private equity and venture capital flowing into China’s new economy has oversaturated the lower end of the market, prompting investors to seek larger investments. Average deal size rose to $213 million in 2018 from $30 million in 2013. The midsized and large deals (greater than $200 million) have attracted SWFs, LPs, PE funds and China’s Internet giants, while most venture capital funds have remained focused on the smaller deals (see Figure 3.2). At the same time, more investors are pooling their funds in each deal. More than four investors participated in each deal on average in 2018, compared with 2.9 in the five previous years.

The influx of investors in China’s new economy is pushing deal size up

Struggling with the reality on the ground

But investing in Internet and tech start-ups is no sure bet—and China adds another layer of complexity to dealmaking. The yardstick for evaluating traditional companies, based on earnings and cash flow, does not work well for new-economy firms, many of which generate losses. Estimating the current and future value of new-economy companies and assessing risk requires a different approach, whether they are in China, Silicon Valley or elsewhere.

The metrics that matter for technology and Internet companies, in addition to growth, are based on the path to profitability and customer lifetime value. Metrics such as daily or monthly average users or value are vital to gauging growth potential. But even with these guideposts, it is challenging to determine a likely exit multiple.

Our research shows 85% of private equity investors focused on Greater China consider it difficult to evaluate new-economy businesses for a variety of reasons. Two-thirds say traditional PE valuation techniques don’t work in China’s new economy. Sixty-three percent of investors find it difficult to justify investing in loss-making businesses, and 32% say it is more difficult to obtain a path to control with Internet and tech companies in China than with old-economy businesses (see Figure 3.3)

Investors say it is difficult to invest in China’s new economy

Only 6% of GPs focused on Greater China say they have a proven model to evaluate risks or successfully source new-economy deals. None said they are operating at full potential in adding value to tech and Internet companies in their portfolios (see Figure 3.4).

Most Greater China funds do not have the capacity to source, assess or add value to deals involving the new economy

In our experience, the private equity firms that are winning in China’s new economy have five common traits:

- experienced and dedicated sector deal teams with a deep understanding of the Chinese consumer, to identify where profit pools are shifting;

- strong partnerships with companies immersed in new-economy innovations, including local firms that provide access to skills and knowledge, help source best-in-class companies and help management teams maximize value creation;

- rigorous evaluation criteria and expertise assessing new-economy businesses, measuring potential disruption risks and building early exit plans; and

- investment committees well-versed in technology and Internet sectors, able to make quick decisions and timely evaluations in China’s overcrowded market.

Early warning signs

More worrying, China’s overheated new economy has produced a surge of speculative investment in Internet and tech companies—a bubble waiting to burst.

The warning signs are clear. Internet and technology companies are priced significantly higher than companies in other sectors. Median M&A deal multiples for Chinese Internet and tech companies, at 31 times EBITDA, are twice as high as other industries in Greater China, and 2.4 times greater than the median multiple for Asia-Pacific deals in 2016–18. Data on recent returns underscores the danger. China’s new-economy returns are in free fall: Median return multiples fell to less than 2 in 2016–18 from 4.7 in 2014–15 (see Figure 3.5).

High valuations make it harder to sell companies and deliver strong returns in China’s new economy

Just as worrying is the huge and expanding exit overhang of Internet and tech assets. Over the past five years, PE funds acquired about 1,000 Internet and technology companies in Greater China, each valued at $10 million or more, but they divested only about 130 in the same period. Recent IPOs are a case in point. Companies that went public in 2017 and 2018 on average lost 21% of their initial market capitalization 12 months after the IPO. And the losers lost big: 62% of companies that went public lost more than 30% of their value. By contrast, companies that went public in 2015 and 2016 gained an average 105% in value in the first 12 months after the IPO. Only 7% lost more than 30% of their value. As the IPO market softens and return multiples drop, funds that overpaid for companies in their portfolios see no alternative but to hold onto assets (see Figure 3.6).

There are signs that the China Internet and tech bubble may burst

What now?

The uncertainty hanging over China’s new economy will test the industry’s resilience and creativity. Nearly two-thirds of Greater China private equity investors we surveyed see a high to very high risk of the speculative bubble bursting in the coming years. That scenario, if and when it comes, will make it tough for GPs who have already invested heavily in Internet and technology companies to exit successfully. And the environment for exits is not likely to improve any time soon, given the backlog of companies sitting in portfolios that were purchased at peak prices.

As a result, private equity funds heavily invested in China’s tech and Internet sectors need to prepare for a tougher environment and create a stormproof portfolio. Two questions are key: Does the original investment thesis still hold water? If not, what moves will help maximize value in a more difficult market?

Successful PE funds adhere to a simple principle in turbulent times: double down on the winners and minimize the losses, while reevaluating the risks and planning for exits.

As PE and VC investors strengthen their portfolios, those with experience in China’s new economy should continue to consider new opportunities. But it is increasingly important to pressure-test the downside risks, and gauge what would happen to a company’s valuation in a worst-case scenario.

For PE firms with no significant investments in China’s new economy, now is a risky time to jump in. Waiting for prices to go down while strengthening the five winning traits we highlighted above will improve the odds of a successful entry. In the meantime, there are plenty of solid investment opportunities outside of China.

But the future is digital. And China’s new economy is moving at astonishing speed. Its entrepreneurs are creating a new paradigm for growth and value creation. That is a wake-up call for fund managers. Those who focus on defining a strategy now will be well positioned to seize opportunities, especially in a post-bubble market. A few questions can help shape a clear approach for the future:

- What are the distinct capabilities that helped you win in the past, and which ones are transferable to new-economy markets in China?

- What conditions would prompt you to invest in Chinese tech or Internet companies in the future?

- If you entered this market, where should you invest first, and why?

- What capabilities or partnerships would you need? Which ones can be built or bought now?

China’s new economy is big and growing fast, but it is a risky bet for first-time investors. Even those with years of experience investing in China face challenging times. Producing decent returns in the coming years will require caution and creativity. In the long run, however, almost no investor can ignore this arena—new technologies and the Internet are shaping the economy of the future. PE funds with a clear strategy to navigate into China’s new economy will be on the front lines of a powerful growth opportunity when the market comes back into balance.

Gaining an edge with advanced analytics

Bidding for private equity investments in the Asia-Pacific region has become intensely competitive. Following the example of leading US and European funds, Asia-Pacific GPs are now starting to tap advanced analytics to rapidly access information about target companies and their competitive position and accelerate value creation of portfolio companies.

Advanced analytics can reveal early signs of industry disruption, pinpoint competitive threats to a company, and detail customer preferences. Those insights boost GPs’ confidence during the bidding process and help speed growth after the acquisition. Most tools are quick and inexpensive to deploy—the challenge is figuring out which one to use and how to use it.

Analytics is a complex field that is changing rapidly, and constant innovation creates a confusing array of options. Funds need a guiding hand to take full advantage of these powerful new tools. Mastering the technology requires teams of data scientists, coders and statisticians, and the technology to generate insights from big data. Bain works with leading funds to help them stay on top of emerging trends, choose the right tools, deploy them quickly and build partnerships with leading vendors.

Faster and better insights

Advanced analytics tools have become particularly strategic for private equity funds as competition in auctions escalates and the pressure to produce strong returns mounts.

What can these tools actually do? They address a large range of competitive issues. Some evaluate social media data on what customers say and think about a given product, compared with competing products, and assess how those attitudes change over time. PE funds use advanced analytics to quickly assess companies’ digital marketing opportunities and weaknesses. They also use these tools to identify growth potential of companies’ networks, by mapping their locations against population demographics and competitors’ location, and understanding key sources of performance (see Figure 3.7).

Advanced analytics tools address a range of competitive issues for PE investors

While Asia-Pacific PE funds are starting to adopt advanced analytics at a faster clip, they still use these tools less than US and European funds. Only 7% of Asia-Pacific GPs say they are operating at full potential and have a robust, repeatable process in place to use advanced analytics in due diligence. For post-acquisition work, the same proportion has begun taking full advantage of these tools. And about 57% of firms say they have a long way to go or are still experimenting when it comes to knowing what tools exist and how to use them (see Figure 3.8).

Asia-Pacific PE funds are making progress on advanced analytics

One reason for the slower deployment in Asia is language: Some tools work well only in English. For example, language may be a barrier for web-scraping tools, and some do not cover Asia-specific social media or e-commerce sites. Cost is another factor: For smaller target companies, primary research may be the most cost-effective way to generate insights.

Despite the slower pace of deploying advanced analytics across the region, leading funds already are generating big benefits from these tools. Some even combine tools and data sources to increase the confidence in their investment thesis. Here are a few case studies that highlight how web scraping, white-space analysis and predictive analytics, and digital X-ray tools can help fund managers make smart bids and improve portfolio performance.

Web scraping

Web-scraping technology, which allows users to extract data from websites, is the most common advanced analytics tool used by Asia-Pacific PE firms. It mines online data for interesting insights about customer sentiment, for example, or competitive intelligence on assortment and pricing. With the right set of target websites, web-scraping tools allow firms to access information on pricing, assortment, geographic footprint, employee count or organizational structure.

Web-scraping results may prompt a PE firm to change its mind about a target that initially seemed attractive. Take the case of an Asian PE fund that was considering acquiring an e-commerce firm in Asia. The company was operating in an attractive market with strong growth, and the initial investment thesis was based on the company’s cost advantage and the breadth of its assortment. But advanced analytics painted a different picture.

The fund worked with a data science team to first compare the e-commerce company to its competition on three key performance factors: product portfolio range, price competitiveness and customer satisfaction. To do that, the team pulled detailed information on millions of SKUs from the target and competitor websites to measure SKU count, product assortment and prices. Visualization software helped extract insights rapidly.

On the surface, data seemed to confirm the target’s prices were 20% lower than its peers in most categories. However, it also showed that the company had no significant price advantage against private labels, which were growing fast and gaining market share. Equally alarming, the SKU count revealed that the target’s range of products was weak compared with peers.

The data science team also analyzed multiple social media platforms to evaluate customer sentiment. User posts contained consistently negative customer feedback, including poor product quality and delivery problems. The detailed insights provided by web scraping weakened the investment thesis significantly, and the PE fund decided not to bid for the company (see Figure 3.9).

Web scraping uncovered insights that eventually changed a deal team’s view of its target company

Digital X-ray

Internet and technology companies represent nearly 50% of Asia-Pacific private equity deal count, and digital marketing is vital to most companies’ performance. For deal teams, it is increasingly important to evaluate a target’s digital position, competitive dynamics and potential upside. Leading PE firms have developed a rapid and systematic approach to evaluate a target company’s digital performance in each encounter with the end user. Skilled teams can create a digital X-ray of the firm in half a day by holistically evaluating user traffic, search terms, ads and social media. PE funds can also easily ask to access a target company’s Google AdWords and Google Analytics platforms, to gain further information on the firm’s market position and a raft of digital metrics. That approach provides a clear sense of how much the company could improve and what steps it can take on the first day of ownership.

Consider the case of an Asian PE investor group that decided to evaluate an Internet company. The investment thesis focused on the company’s ability to increase advertisers’ spending, but in-depth analysis of the company’s digital positioning raised several warning signs.

The deal team used skilled data scientists to conduct a digital X-ray and develop a comprehensive view of the company’s competitive position from the perspective of both users and advertisers. The analysis covered several key dimensions, including user profiles, advertising revenue trends vs. the competition, and website performance.

This digital X-ray highlighted that the Internet company appealed to a far narrower set of demographic groups than originally thought. It also provided an important insight into the target’s business model and its key risks: For advertisers, the company had a very niche position on multiple dimensions, including reach, targeting efficiency or ease of use. This suggested the company faced a disadvantage in competing for advertising revenue and demonstrated serious limitations in its ability to grow. These findings, among other factors, altered the PE fund’s view of the opportunity, and the deal team decided not to pursue the investment (see Figure 3.10).

Digital assessment changed an investor’s perception of the target’s business model

White-space analysis and predictive analytics

Funds are also turning to white-space analysis and predictive analytics to evaluate targets and boost portfolio company performance. The technology is not new, but advances and deeper access to demographic data have allowed vendors to sharpen the insights gleaned from these tools. They provide critical market understanding for retail companies, but also for bank or telecom outlets, healthcare clinics and infrastructure businesses that need to identify gaps in their networks.

Derived from geospatial tools, white-space analysis and predictive analysis are valuable in assessing the potential for store or outlet expansion. The tools allow a PE fund to evaluate a company’s existing locations and their performance, as well as those of competitors, based on consumer demographics. Analysis of the data highlights the geographic factors most critical to revenue growth.

One international PE fund enlisted data scientists to use white-space analysis and predictive analytics to better understand an Australian retail company. It wanted to pinpoint the retailer’s competitive position in the market and gauge the potential to improve the performance of existing stores and grow the network profitably.

The retail company already had expanded rapidly for several years and was among the market leaders in store count. Geospatial analysis quickly revealed that the stores were located in the best retail space within major malls and competition was only moderate in most cases. At the same time, the data showed significant room for expansion—none of the top players were present in many prime retail locations.

Next, the deal team and data scientists examined store economics using a multivariate regression analysis. The factors they analyzed included store performance, scale and reach of retail outlets, demographic variables such as household income and population density, and competitor intensity. The result showed store location was strongly linked to growth and profitability and that stores located in large shopping centers performed best. Statistically, proximity to competition did not affect store performance, indicating that the target’s business was strong. Based on the data, the team was able to predict revenue potential for current and planned stores, and concluded that management had overestimated average revenue per site by 25%.

However, based on geospatial data, the opportunity for expansion, or “white-space” opportunity, looked compelling. The retailer’s management team was planning to add 15 to 20 sites per year. But when data scientists performed independent diagnostics to identify high-productivity sites using the same regression model, the analysis suggested that management estimates were conservative and that the company could add twice as many high-productivity stores. Benchmarking competitors’ stores using industry participant interviews and web archives helped corroborate the findings.

By combining new-store projections and insights about each future site’s potential revenue, the team was able to suggest a better rollout plan for new stores, including locations that would offer higher revenue at store maturity. White-space analysis and predictive analytics revealed a 40% increase in revenue potential compared with the management plan, based on a higher number of stores and improved locations. The detailed view of store economics and an improved rollout plan gave the PE fund confidence to submit an aggressive bid (see Figure 3.11).

Geoanalysis helped optimize store rollouts and gave investors confidence to bid aggressively

Understanding shoppers

In consumer sectors, leading PE funds are working with advanced analytics teams to better understand the set of products that shoppers consider before making a purchase. Called partition analysis, it is based on shopper consideration sets. The aim is to look beyond traditional category definitions to understand the various products that a shopper considers, including products in other retail segments. Often neglected, this information can be invaluable in spotting underpenetrated segments or reveal hidden competitors.

Partition analysis typically relies on consumer surveys or shopper data on brands purchased over certain period of time. It shows how shoppers’ purchasing patterns overlap, based on combinations of brands. Analytics tools use multidimensional scaling algorithms to allocate brands into clusters (or partitions) based on customer segments and consumption occasions.

A global PE firm worked with data scientists to use partition analysis to evaluate the potential for increasing revenues at an Asian food company. One important part of the due diligence was identifying adjacent markets for the target to enter. The company’s portfolio included several categories of biscuit brands, and the leadership team saw itself competing in a broad biscuit category against other large rivals.

Partition analysis revealed distinct consumption occasions for similar biscuits—as a breakfast meal and as a between-meal snack—and the target’s brand was perceived only as breakfast food. This offered a clear opportunity to develop an additional biscuit product line without cannibalizing its top-selling brands. For the data science team, that insight translated into a potential 15% increase in post-acquisition sales. Coupled with other value-creation initiatives, partition analysis gave the PE fund confidence that it could add significant value to the target after the acquisition (see Figure 3.12).

Shopper-partition analysis revealed that the target company could improve its sales by 15%

What’s next?

Those are just a few of the ways PE companies across the region are tapping advanced analytics tools to improve deal analysis and portfolio growth. Based on global trends, we expect ongoing innovation in this area to transform how Asia-Pacific PE funds go about due diligence and manage their portfolio companies in the coming years. Here are some that several leading global funds are already using (for more information, please see the related article in our Global Private Equity Report 2019):

- Disruption assessment. Access to new data allows PE firms to think about disruptions more systematically and identify early warning signs in a given industry by examining innovation activity at incumbents and examining start-ups and venture capital investments.

- Web scraping 2.0. Advanced web-scrapping techniques offer greater access to visible and hidden data (metadata), and do this over time, allowing users to build a proprietary database with historical data.

- Mock product launch. Traditionally, companies have relied on customer interviews and expensive focus groups to gauge the potential demand for new products—a process that takes weeks or months. Now, leaders use test websites and online ads to attract target customers and see if they will engage—with results in a matter of days.

- Satellite images. High-definition satellite images are increasingly accessible. Companies can use orbital images of a given area to estimate store traffic precisely, get competitor insights on manufacturing facilities or view supply chain flows.

- Leveraging the power of the mass. Advanced PE funds rapidly compile critical data from scattered or remote locations, such as information on pricing or stock merchandise displays, by providing incentives to a virtual network of people who become an invisible data army.

Execution challenges

Advanced analytics offers PE funds a tantalizing array of new insights. But obtaining them requires dedicated expertise. Funds that assume they can manage the technology in-house often find the investment backfires. The reason is clear—staying abreast of complex new tools and techniques is a full-time job. PE funds that partner with external experts will be best positioned to master the technology quickly and efficiently—and stay on top of a rapidly evolving field.

Thinking ahead: Investing for impact

The idea that investors can improve society while seeking solid returns is rapidly gaining ground. Many funds are incorporating ESG goals into their strategies, and public interest in ethical investing has taken off. New publications track social and responsible investing, and the media eagerly depict large and small investors helping to make the world a better place.

Beyond the buzz, a wealth of data corroborates the trend. The number of fund managers who have signed the United Nations-supported Principles for Responsible Investment (PRI) grew to more than 2,000 in 2018 from 1,200 in 2013. The $82 trillion in assets under management by these signatories increased by a compound annual rate of 19% in the same period. Of 22,000 investors worldwide, 78% said they place more emphasis on sustainability now than they did five years before, according to Schroders 2017 Global Investor Study.

Ethical investing is rooted in long-term trends

The shift to sustainable portfolios and impact investing reflects growing public concern about global challenges such as climate change, plastics pollution, deforestation, social inequality or access to water. Retail investors, especially the millennial generation and women, are increasingly demanding that companies expose ethical issues linked to their investments. Millennials are twice as likely as the overall population to buy products from sustainable companies, according to Morgan Stanley’s Institute for Sustainable Investing. With an estimated $30 trillion of wealth expected to change hands from baby boomers to millennials in the next 30 years, the stakes for investors are huge.

Greater transparency and ESG focus in company reports is helping fuel the ethical investing trend. More than 90% of the world’s 250 largest companies published corporate social responsibility (CSR) or sustainability reports in 2018, compared with 45% in 2002. A number of governments support greater financial disclosure requirements through, for example, the Taskforce on Climate-Related Financial Disclosures (TCFD). The group develops recommendations for clear and consistent disclosure and enables companies to more effectively measure and evaluate their own risks and those of suppliers and competitors. A few progressive governments and groups have begun pursuing legal action against companies that flout good ESG practices.

Social and environmental impact improves financial returns

While pressure is growing on fund managers to pay greater attention to environmental and social issues, many also realize that ESG and impact investing can generate strong financial returns. For years, investors assumed a commitment to environment, social and governance performance would automatically lower profits—and many Asia-Pacific investors still believe that.

However, a growing number of studies are disproving it. A comprehensive 2015 review by the German investment fund DWS and the University of Hamburg of more than 2,000 studies found that 63% showed a strong correlation between ESG performance and positive returns, while 10% showed a negative effect.

It is too early to know if private equity impact deals can consistently generate returns that match investors’ expectations. But there are some promising signs. We took a sample of about 450 PE-led exits conducted in the past five years in the Asia-Pacific region and isolated those that either involved impact funds or focused on sectors that score high on ESG, including clean tech, ecology, renewables, education, waste or water. Interestingly, the median multiple on invested capital was 3.4 for deals with social and environmental impact, compared with 2.5 for other deals. We also saw lower variability in returns for these deals (see Figure 3.13). Of course, these companies tend to be smaller and funds hold them longer, which affects their absolute returns and fund IRR. And one could argue as well that some of these sectors benefit from strong growth. But the findings are an important signal for a market strongly focused on financial profits.

Deals in environmental and socially responsible sectors correlated with better results in Asia-Pacific PE

Private equity funds take action

As public concern about the environment and social issues grows, private equity funds are starting to act—to mitigate risks to their finances and reputations and to build sustainable portfolios.

LPs are now making ESG a priority. In 2017, Japan’s Government Pension Investment Fund, the world’s largest pension fund, with $1.5 trillion in assets under management, required its fund managers to incorporate environmental, social and governance factors into investment practice and to become PRI signatories. It also announced plans to allocate 10% of its funds to socially and environmentally responsible investments. Some of the world’s largest PE funds are also selling assets that do not meet environmental or social investing guidelines. For instance, New Zealand’s NZ Super Fund SWF divested $650 million in fossil-fuel investments in 2017, providing a strong signal to the market and adding momentum to the Global Fossil Fuel Divestment and Clean Energy Investment Movement. In Southeast Asia, Khazanah and Temasek are among the leaders in ESG investing.

With an eye to mounting investor concerns about the environment and social issues in the public equity market, LPs are increasingly insisting that private equity funds take ESG factors into account in investment decisions. Our research shows 60% of Asia-Pacific-focused GPs feel increased pressure from their investors to focus more on ESG.

In response, global and Asian GPs are scrambling to demonstrate that they comply with ESG guidelines and that they are doing more deals that advance ESG principles. About 90% of the Asia-Pacific GPs we surveyed have accelerated their effort to invest sustainably over the past three to five years. The same number of funds plan to increase their effort and focus on sustainability in the next three to five years. However, this effort is still nascent, and some of it is simply lip service, instead of real action. According to Preqin, 55% of Asian LPs still don’t have an ESG investing policy for private equity. And 60% of Asian PE funds do not require their portfolio companies to report on ESG issues or responsible investment. Our research shows that only 13% of Asia-Pacific GPs say they have fully integrated ESG considerations at the investment committee level or take concrete actions to improve the ESG performance of their portfolio (see Figure 3.14).

Investors increasingly take environmental, social and governance considerations into account, but it is still a nascent trend

Impact investing, which dedicates capital to companies that generate social or environmental benefits, also is on the rise and attracting a growing number of PE funds. What used to be the terrain of core impact investors like Bamboo Capital Partners or LeapFrog Investments now is luring some of the largest PE funds, including TPG, KKR and Bain Capital. TPG’s $2 billion Rise Fund 1 was the largest pool of capital dedicated to social and environmental impact when it closed in 2017. The group is now aiming to raise $3.5 billion for Rise Fund 2, and plans to dedicate a significant part for investment in China. KKR is fund-raising for a $1 billion Global Impact Fund, with India as a key investment destination. Overall, impact investing still represents a small share of total fund-raising, but it is growing, and Asia-Pacific has an important share of the pie.

Where to start

Fund managers keen to adopt an ESG focus often feel confused about the right approach. One reason is that investors and the media use the labels—ESG investing, social and responsible investing, and impact investing—interchangeably, blurring the boundaries between different aims.

For the sake of clarity, we distinguish between ESG-focused investors and impact investors as follows (see Figure 3.15):

Investors can pursue different investment models to achieve environmental, social and governance goals

ESG risk mitigators evaluate ESG compliance and risks during due diligence and ownership, focusing on all or only a subset of ESG issues. They typically exclude investments in a number of countries, sectors or companies, and some help their portfolio companies with ESG-related work.

ESG opportunity seekers look for investment opportunities to support environmental, social or governance progress. Some work with their portfolio companies to increase their environmental or social impact, and almost all pursue investments in ESG-linked sectors such as renewables, waste management and education.

Both types of ESG investment leaders in Asia focus on risks and opportunities. But no one strategy fits all.

Singapore’s Temasek pledged in 2014 to advance the sustainability agenda through its Ecosperity platform. The haze that enveloped Southeast Asia in 2015 increased Temesek’s commitment to work with portfolio companies and partners on environmental issues and social inclusion, giving a strong signal to the market. In 2016 the fund set up the Sustainability & Stewardship Group (SSG) outside the investment group, with the mandate to lead the firm’s efforts in these areas. Temesek’s initiatives include managing and integrating ESG factors into the investment analysis and understanding ESG risks and opportunities in the portfolio, based on defined criteria. The fund also invests in capability building, to address long-term challenges affecting Singapore and the region. Temasek now takes direct stakes in impact funds and companies.

Government-linked investors are not the only ones leading the way.

Emerging market fund Actis, with $7.8 billion under management, has a dedicated ESG team that seeks opportunities to create long-term and sustainable value. Its due diligence process highlights gaps in ESG management to be addressed after acquisition. Actis then works with its portfolio companies to strengthen ESG performance, embedding ESG value-creation commitments into 200-day plans. The management team also tracks ESG key performance indicators at each portfolio company.

Permira, a global fund with €7.5 billion under management and an extensive presence in Asia, uses ESG criteria to screen assets and rejects those that are too risky. During due diligence, it assesses a company’s ESG track record and includes environmental and social impact in its 100-day post-investment plan.

Impact investors, unlike ESG investors, invest only in assets with significant social and environmental impact. They build ESG capabilities at portfolio companies and most develop tailored performance indicators to measure ESG impact in addition to financial returns.

LeapFrog Investments began as an impact investment fund providing microinsurance to the poor, helping finance small business investments. Its first fund, which closed in 2010, raised $135 million and was oversubscribed by 35%. LeapFrog subsequently closed a second fund of $400 million and is now raising a third fund. Its mission has broadened to investing in high-growth companies making significant social impact while generating top-tier returns. Today, LeapFrog focuses primarily on financial services and healthcare in Asia and Africa and typically invests $10 million to $50 million. The Asia-based investment team assists value creation by providing portfolio companies with deep operational and management experience. LeapFrog Labs, a nonprofit R&D hub, helps portfolio firms win grants for innovation investments that are too risky for commercial lenders. LeapFrog has invested in more than 20 companies and says revenues of its portfolio companies have grown an average of 40% a year since investment, while creating more than 120,000 jobs. Though it is still too early to see a return track record, the fund has several successful exits, such as Bima, a microinsurance business that it exited through a trade sale to Allianz in 2018.

Laying the groundwork

ESG and impact investing can help funds stand out in a crowded market. They ensure portfolios will be sustainable in the coming decades and can generate top returns. But before fund managers start seeking opportunities, they need to get a few things right.

An important first step is ensuring the leadership is aligned on a vision for environmental and social impact, and on balancing ESG goals with financial returns. The leadership team also needs to agree on the right investment model, based on its values, differentiated capabilities and sector attractiveness.

Finally, funds need to choose reliable measures to evaluate their environmental and social impact. The United Nations’ Sustainable Development Goals provides a framework with 17 clearly defined objectives, which can help funds focus on tangible ESG goals. To measure results, however, no single approach works for all funds. The criteria are likely to be different for ESG risk mitigators, ESG opportunity seekers and impact investors.

That said, industry-specific ESG benchmarking standards are starting to emerge, including business impact analysis (BIA) and the Global Impact Investing Ratings System (GIIRS). Sophisticated investors such as TPG Rise and LeapFrog have developed their own measures of impact, based on a single indicator. LeapFrog’s Financial, Impact, Innovation and Risk Management (FIIRM) framework integrates financial and operational performance indicators and governance indices benchmarked to global best-practice standards. TPG Rise’s Impact Multiple of Money (IMM) calculates the net positive social and environmental impact created by a company’s products in 30 areas aligned with the UN’s Sustainable Development Goals. TPG’s investment committee evaluates the impact alongside financial and business factors throughout the deal cycle.

Environmental and social considerations will play a bigger role in investment decisions in the coming decade as part of a fundamental societal shift. Alarm bells are ringing in capitals around the world, and governments are increasingly committed to tackling global environmental and social challenges. Just a decade ago, PE investing mostly involved risk-return considerations, where risk assessments already included most material ESG risks and return meant only IRR. Impact funds were microscopic in size and positioned on the margin of the industry.

Today, the number of impact firms is increasing, and no private equity fund can do without an ESG policy. In the coming years, we expect more GPs to incorporate ESG and impact considerations into their strategies. Ultimately, greater commitment to environmental and social goals will help private equity funds create value beyond financial returns.

4. Conclusion

It was another robust year for Asia-Pacific’s private equity investors. Deal value and exit value set new highs in 2018, and the Asia-Pacific region attained prominent scale, with 26% of the world’s total PE assets under management. However, competition has grown even more intense, and macroeconomic conditions are in flux. As a result, Asia-Pacific PE investors face new challenges in 2019 and beyond. The most important warning sign: an increasing polarization between large funds with strong track records and less experienced funds that are starting to have difficulty raising funds and exiting. If the economy slows, weaker funds are likely to struggle.

As PE funds investing in the region review their strategies for 2019 and beyond, leaders are taking steps to ensure they can prosper in a more difficult market. They are strengthening their business models and improving their ability to seize new opportunities. Many are tracking the key trends highlighted in this report: the rush to invest in China tech and Internet companies, the use of advanced analytics to improve fund performance, and the shift toward ESG and impact investing. These three themes will affect how funds compete and perform in the coming years. Understanding the dynamics behind them will help GPs better navigate a changing landscape.

Market definition

The Asia-Pacific private equity market as defined for this report

Includes

- Investments and exits with announced values of more than $10 million

- Investments and exits completed in the Asia-Pacific region: Greater China (China, Taiwan and Hong Kong), India, Japan, South Korea, Australia, New Zealand, Southeast Asia (Singapore, Indonesia, Malaysia, Thailand, Vietnam, the Philippines, Laos, Cambodia, Brunei and Myanmar) and other countries in the region

- Investments that have closed and those at the agreement-in-principle or definitive agreement stage

Excludes

- Franchise funding, seed and R&D deals

- Any non-PE, non-VC deals (e.g., M&A, consolidations)

- Real estate and infrastructure (e.g., airport, railroad, highway and street construction; heavy construction; ports and containers; and other transport infrastructure)

Acknowledgments

This report was prepared by Kiki Yang, a Bain & Company partner based in Hong Kong, who coleads the firm’s Asia-Pacific Private Equity practice; Usman Akhtar, a partner based in Jakarta, who leads Bain’s Southeast Asia Private Equity practice; and a team led by Johanne Dessard, practice director in Bain’s Global Private Equity practice.

The authors wish to thank Suvir Varma, senior advisor to Bain’s Global Private Equity practice, for his contribution. They are also grateful to Axel Seemann, Jenny Davis-Peccoud, Juan Harris, Gerry Mattios and Clare Tovey for their perspectives on ESG and impact investing; Richard Lichtenstein for his perspectives on advanced analytics; Andrew Tymms, Vinit Bhatia, Michael Thorneman, Weiwen Han, Arpan Sheth, Lalit Reddy, Wonpyo Choi, Jim Verbeeten, Ray Hass and James Viles for their perspectives on regional dynamics; Joy McConnochie for her contribution; Rahul Singh, Shilpi Bansal and Pallavi Singh for their analytic support and research assistance; and Gail Edmondson for her editorial support.

We are grateful to Preqin and Asia Venture Capital Journal (AVCJ) for the valuable data they provided and for their responsiveness.

This work is based on secondary market research, analysis of financial information available or provided to Bain & Company and a range of interviews with industry participants. Bain & Company has not independently verified any such information provided or available to Bain and makes no representation or warranty, express or implied, that such information is accurate or complete. Projected market and financial information, analyses and conclusions contained herein are based on the information described above and on Bain & Company’s judgment, and should not be construed as definitive forecasts or guarantees of future performance or results. The information and analysis herein do not constitute advice of any kind, are not intended to be used for investment purposes, and neither Bain & Company nor any of its subsidiaries or their respective officers, directors, shareholders, employees or agents accept any responsibility or liability with respect to the use of or reliance on any information or analysis contained in this document. This work is copyright Bain & Company and may not be published, transmitted, broadcast, copied, reproduced or reprinted in whole or in part without the explicit written permission of Bain & Company.