Forbes.com

As 2011 began, fund-raising looked to be poised for a modest recovery after hitting what many thought to be the cyclical bottom in 2010. Limited partners (LPs) that had dramatically scaled back their commitments to new funds since the downturn were ready and able to get back into the action. Many had used the period since the market crash to fundamentally reassess their PE exposure. In interviews conducted for Bain & Company's Global Private Equity Report 2012, LPs told us they were determined to selectively seek out pockets of opportunity and resolved to be much more discerning in their selection of GPs with whom they would invest.

GPs were also reawakening from their bear-market hibernation. Most had been subsisting on their stores of dry powder accumulated during the boom years. With time passing and investment activity beginning to revive by late 2010, many GPs found themselves at a natural point in their fund cycle to refocus attention once again on fund-raising.

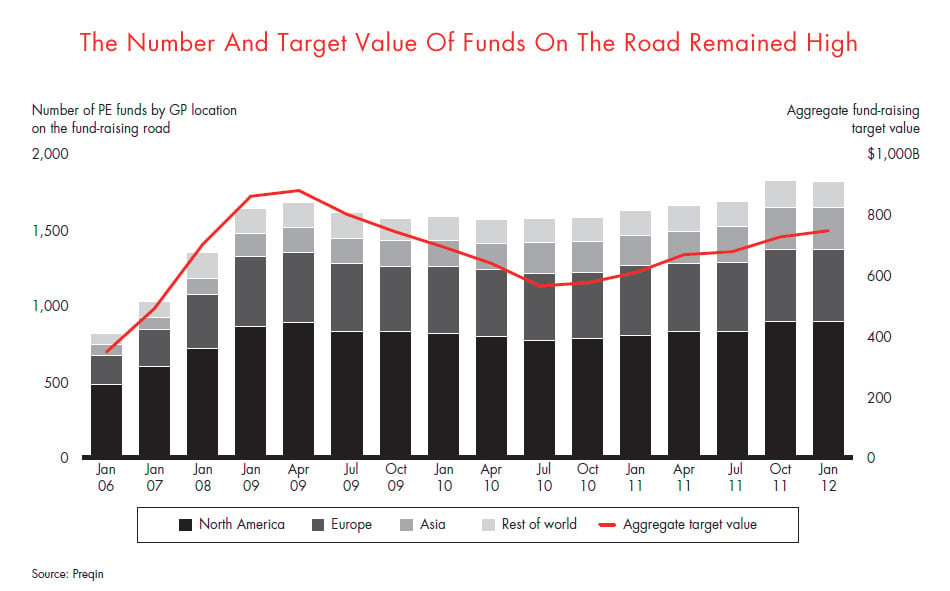

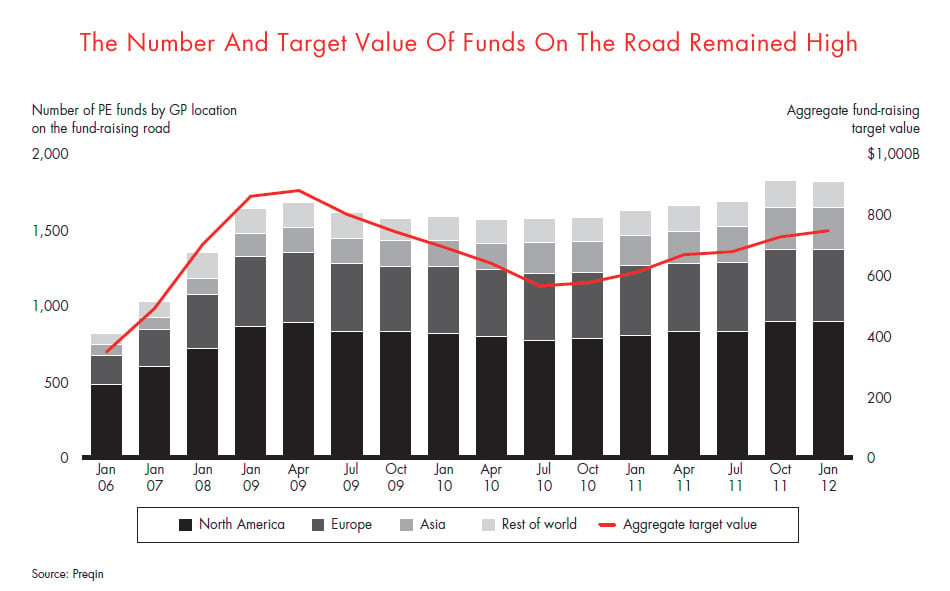

They found plenty of company. At the beginning of last year, more than 1,600 PE funds were pitching new funds with an aggregate target value of more than $600 billion (see figure). The addition of so many new fund-raising campaigns on top of the already large number of funds added to the global oversupply, greatly intensifying competition as the year began.

Nevertheless, fund-raising conditions remained auspicious through the year’s first half. The initially strong market for PE exits kept LPs who were sitting on mature PE portfolios awash in liquidity. For many LPs, distributions through June were the best six months on record. The liquidity wave added to LPs’ confidence that they could make new fund commitments while continuing to meet capital calls on past pledges.

But what began so promisingly unraveled in the year’s second half, and PE fund-raising for the full year ended no higher than it had been in 2010 across nearly every PE category in all major regions, with the exception of Europe. It did not take much to push new fund-raising off the rails. The sudden decline in exit activity turned off the distributions tap that had made new fund-raising possible. Deteriorating equity markets pushed more LPs up against their PE allocation ceilings, resulting in a significant drop in new commitments.

For GPs, the heightened selectivity by LPs in 2011 created a bifurcated market, with an elite group having very successful campaigns, while fund-raising languished for the large majority. Making the LPs’ short list was a distinct advantage. For PE funds that closed in 2011, nearly three-quarters of the top-ranking GPs met or exceeded their fund-raising target compared with just over half of their less well-performing peers. In spite of the overall lackluster year, buyout funds sponsored by successful PE firms with a distinctive, sharply focused approach that was in favor with LPs were generally able to attract significantly more capital to their latest fund than they had to their previous fund.

The winnowing process did not favor only a narrow set of well-established incumbents. LPs were willing to make the difficult decision to say "no" to an existing GP relationship in order to sign on with a new GP they felt offered better prospects for returns. In a survey of LPs conducted at midyear, more than 85 percent of the respondents said they were willing to consider forging new relationships with GPs that inspired their confidence. Those new relationships that won LP commitments in 2011 were often the result of a courtship lasting months or years. "We have a good list of managers we want to do business with, and we've mapped that out for the next two or three years," a US endowment executive told Bain in an interview.

In our next post, we'll look at what this flight to quality means for fund-raising this year.

This post was written by Graham Elton, Bill Halloran, Hugh MacArthur and Suvir Varma, leaders of Bain & Company’s Private Equity Group.