Data Briefing

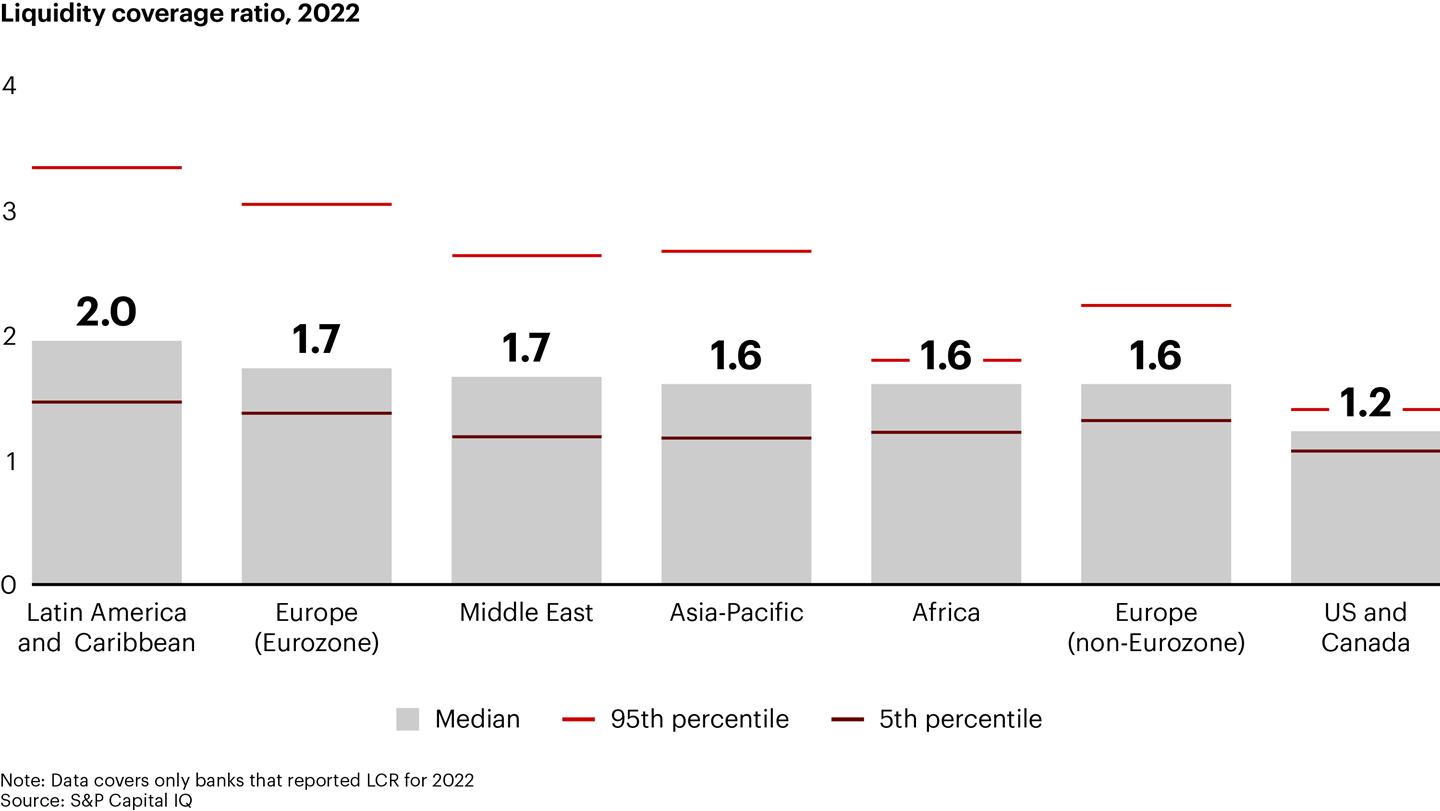

From a regulatory perspective, large banks are well-positioned in their liquidity coverage ratio

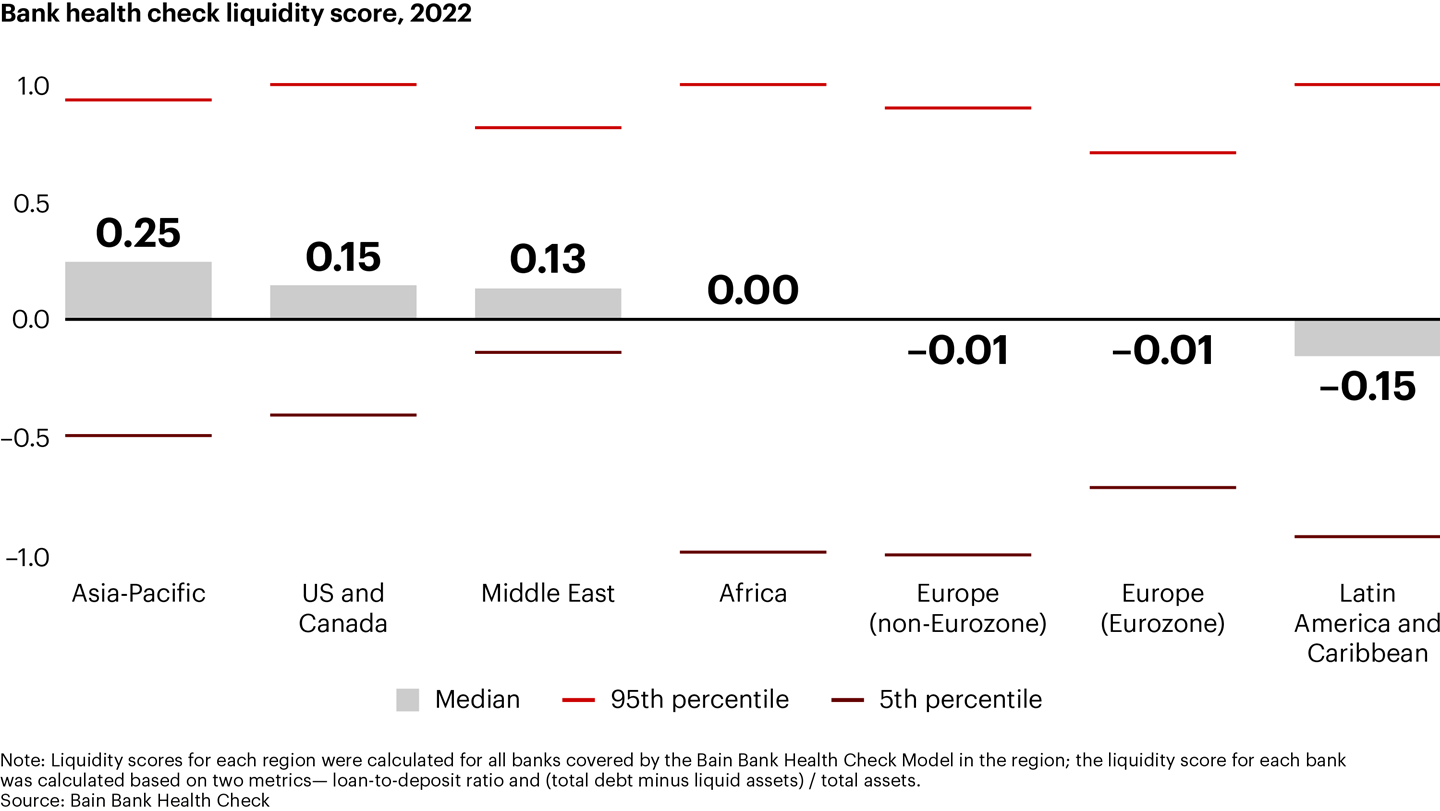

From a managerial perspective, banks’ positions are far more varied

Bain’s bank health check reveals substantial variation in how well banks manage liquidity. As deposit rates rise, it’s easier than ever for customers to shift their funds to new competitors. So traditional banks face big risks if they misjudge the balance between preserving profitability and retaining deposits. A five-fold plan will help them navigate the choppy waters.

Disequilibrium in Banking: Five Actions to Restore Balance

A new period of uncertainty will test banks’ ability to manage through financial and operational turbulence.

Banking Liquidity: Is The Talk of Crisis Fair?

Listen to Episode 11 of Deciphered as experts dive into the current climate of fiscal stimulus, loose monetary policy, and banks’ handling of excess liquidity and attempt to answer the question: Is the talk of a banking crisis fair?