The Situation

IndustrialCo* had lost its competitive edge after making several strategic decisions that changed the business. Instead of continuing to enjoy high profits, the company found itself struggling to survive as sales and revenues plummeted.

The organization wasn't operating at its full potential. Major acquisitions had never been fully integrated. The company had shifted the focus during the ecommerce bubble from its strength—manufacturing automation and power technologies—to becoming a "knowledge company," diverting funds away from its core and into Internet investments.

Other challenges included an inability to easily track costs and profitability at point of sales. Also, unclear roles and responsibilities jeopardized management's ability to make timely, effective decisions.

To stave off bankruptcy, IndustrialCo's CEO urgently needed to craft an organizational redesign that provided better accountability and decision-making—with a unified mission.

Our Approach

IndustrialCo needed to develop an organization that supported its ability to respond to changing market conditions. Bain worked with the CEO and senior managers to tackle three major changes: creating a simplified, more transparent organization, providing clear roles and accountability, and fostering companywide cooperation.

These changes would lead to faster, better decisions, resulting in stronger sales and reduced costs.

To achieve this, we led a three-step organizational review:

Conduct a thorough diagnostic of the organization's strengths and what was holding them back.

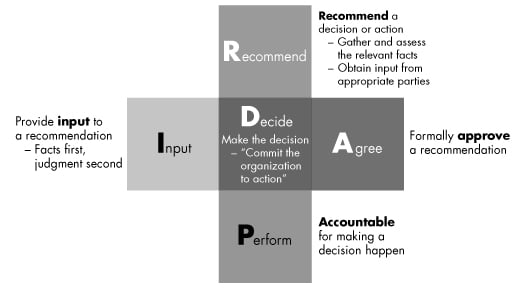

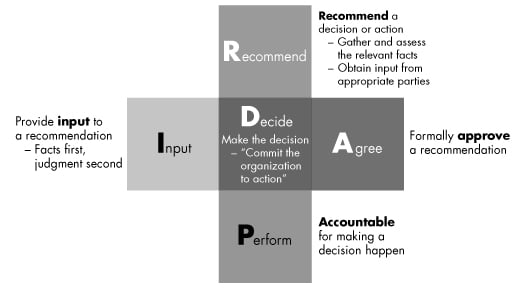

Redesign and simplify the structure, while also clarifying decision roles for critical decisions (using our RAPID® tool).

Align other elements of the organization, such as processes, measures and incentives to support new ways of working.

Our Recommendations

Based on our evaluation, we recommended to the CEO that IndustrialCo redesign and align five broad areas of the organization to fully support the objectives of its new business model.

- Give global business units full profit and loss responsibility so that they work as an integrated business.

- Decouple sales and operations—sales can focus on local demand while operations can take advantage of IndustrialCo's global scale.

- Make profit and loss margins transparent across the value chain.

- Change the way prices are set to better reflect market realities.

- Introduce local profit and loss to base decisions on customer demand instead of supply.

The Results

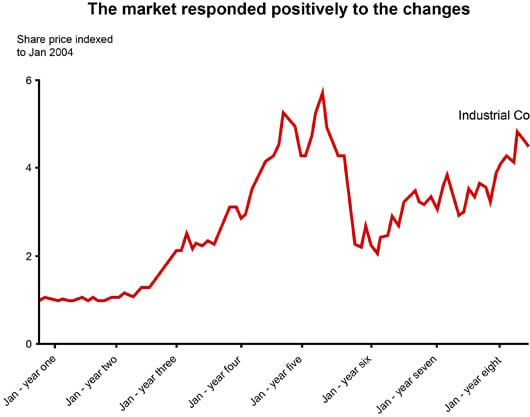

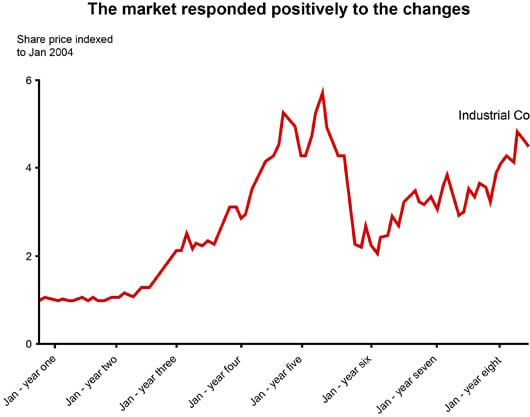

In less than five years, IndustrialCo completed a dramatic turnaround, transforming itself from a company near bankruptcy to a market leader. When we started working with IndustrialCo, its value had plunged to just $3 billion. But with a simplified, focused organization able to more effectively make crucial decisions, its valued soared to $75 billion.

The company's share price quadrupled in four years, significantly outperforming both the market and competitors. IndustrialCo's successful transformation also helped retain talented employees. When staffing the company's new executive team, it relied entirely on internal recruits.

* We take our clients' confidentiality seriously. While we've changed their names, the results are real.