Brief

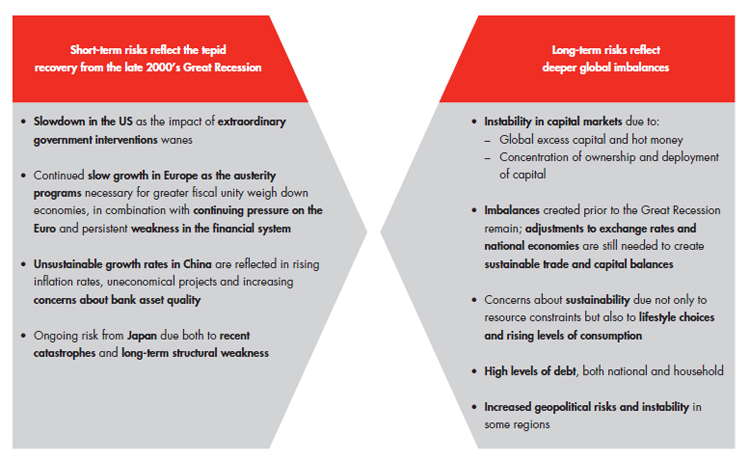

Daily turmoil on a global scale is giving business leaders and investors plenty of reasons to stay hunkered down as they confront huge challenges in the here and now. Spreading sovereign debt woes, volatile markets, unstable currencies, political gridlock and stalled growth plague the big developed economies. Meanwhile, China, India and other rapidly emerging economies are flexing their strength as they adjust to the phenomenal growth that has been the biggest economic story of the past two decades.

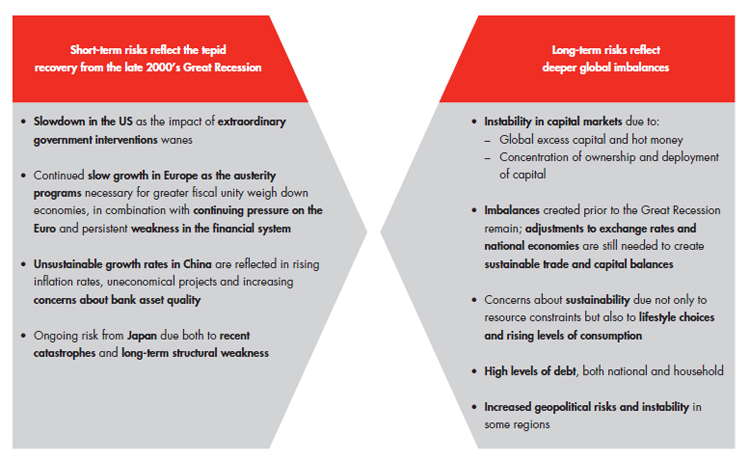

In the conventional view, the current turbulence portends deep, enduring structural shifts that will set the business agenda for the foreseeable future. We fully expect macroeconomic shocks over the coming decade, with discontinuities that will shape the options companies have to adapt and grow.

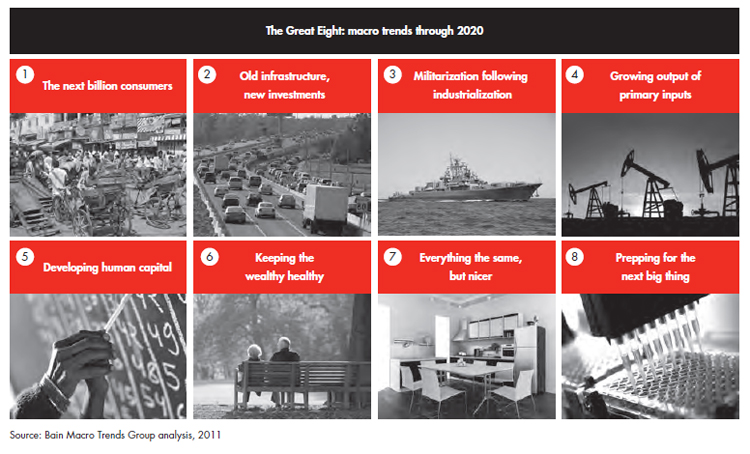

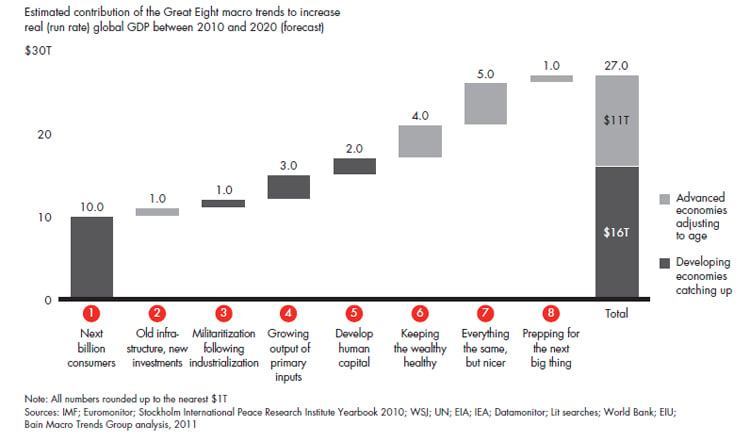

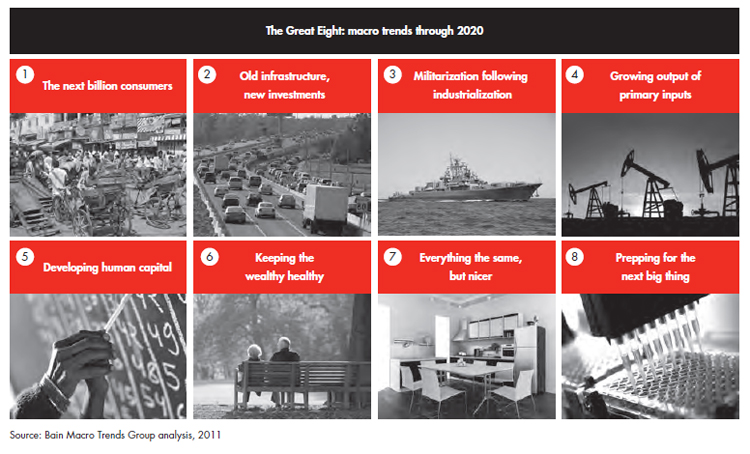

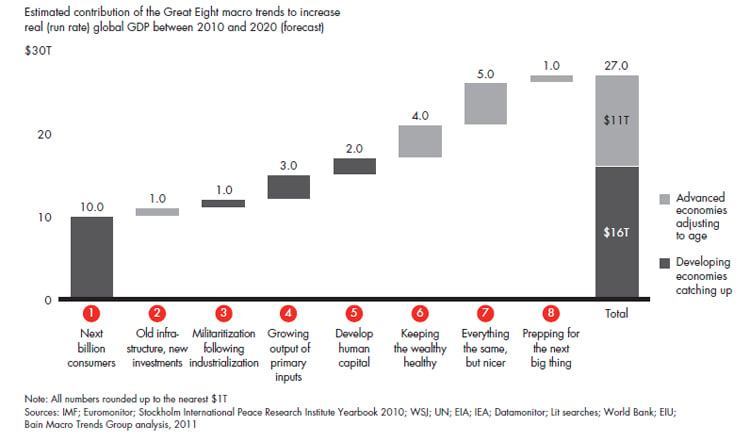

Yet behind the dire headlines and day-to-day frictions of the marketplace, eight trillion-dollar macro trends are at work in the global economy. The pursuit by businesses and governments of the macro trends’ growth potential will touch many corners of the globe.

Europe, Japan and the US certainly face an extended period of economic turbulence and slow growth, particularly in the first half of the decade. But as we will see, half of the macro trends affect both emerging and advanced economies. Thus, while we embrace the exciting opportunities in emerging markets, we also see opportunities where many commentators see none right now—in the home markets of many of the world’s leading businesses.

A shift in global growth. Although we will continue to see pockets of economic turbulence, look for the global economy to expand at a 3.6 percent annual rate over the longer term, resulting in world GDP swelling to $90 trillion by 2020—40 percent larger than it is today. The sources of economic growth will tilt increasingly toward emerging economies. Whereas the advanced economies currently generate two-thirds of global GDP, developing and emerging economies will contribute an outsized share of the growth in the future. By 2020, the advanced economies’ proportion of world GDP will drop to 58 percent, a sizable change over a relatively short period.

The growth of world population by 750 million, nearly all of it originating in developing and emerging economies, will account for about one-quarter of the rise in GDP. Increased productivity will generate the rest, as per capita GDP grows by 30 percent over that period. But, while we expect the next few years to remain challenging in the West, we can see a path for growth to accelerate in the latter half of the decade, particularly if governments begin tackling their public and private debt burdens. Indeed, our analysis anticipates that Europe and the US will contribute an additional $8 trillion to global GDP by 2020.

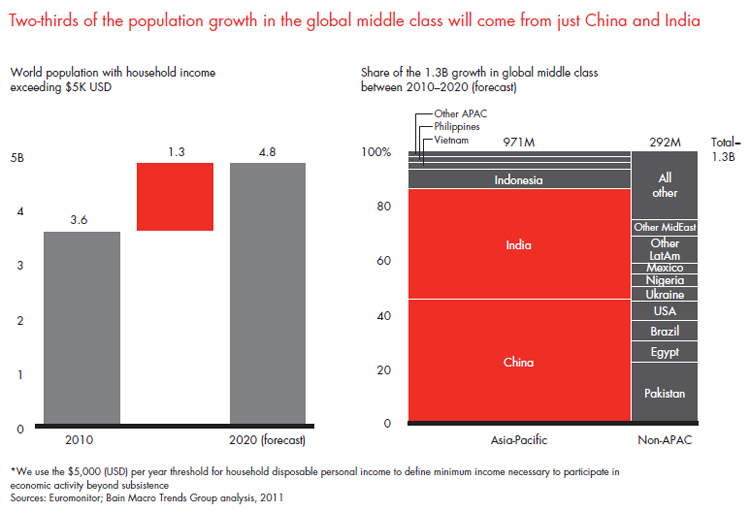

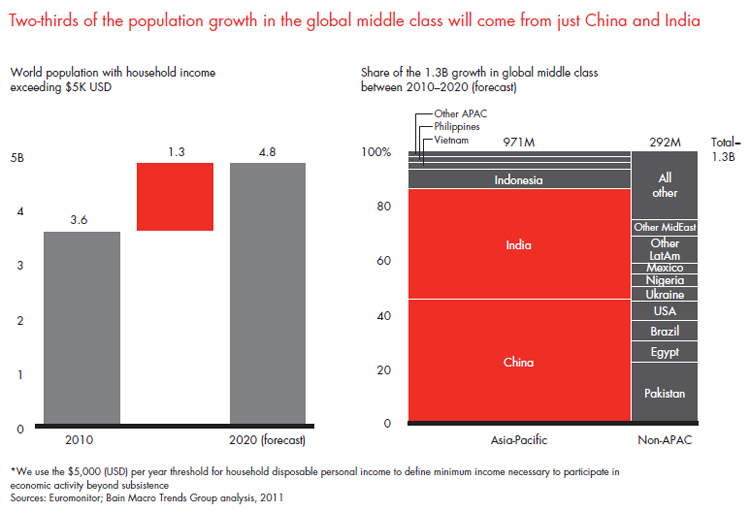

Macro trend: The next billion consumers. The rising wealth of emerging economies will continue to bring a broader range of consumption goods to huge numbers of new consumers. More of them will cross the critical annual household income threshold of $5,000, planting them in the ranks of the “global middle class” and enabling more discretionary spending. Although still considerably poorer than the middle-class consumers in the advanced economies, their vast numbers and increasing ability to devote more income to a broader range of goods and services will create an enormous new market. Estimated contribution to global GDP by 2020: $10 trillion.

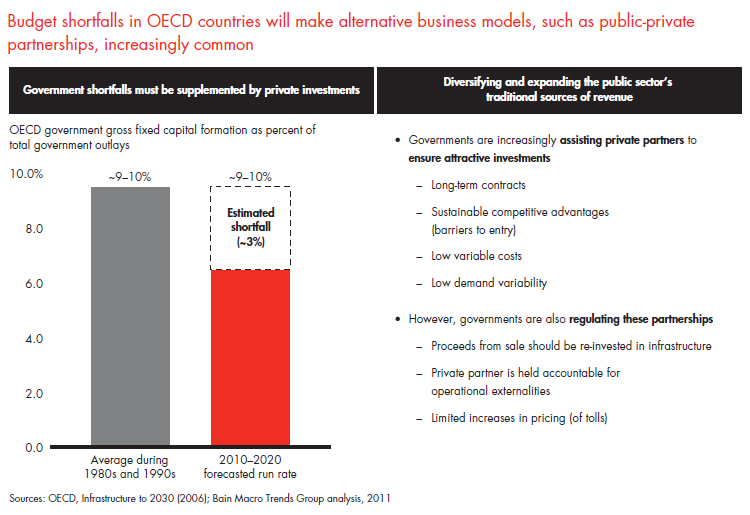

Macro trend: Old infrastructure, new investments. In the advanced economies, renewed economic vitality will require refurbishing and expanding critical infrastructure, much of which was built more than a half-century ago. But with public finances under strain, the job will increasingly present opportunities for public-private partnerships. In emerging economies, continued infrastructure development will be needed to accommodate growth and lay a foundation for future expansion. Estimated contribution to global GDP by 2020: $1 trillion.

Intensifying competition for finite resources. Population growth, increased manufacturing activity, urbanization and expanding prosperity will set off a scramble for basic goods, particularly food, water, energy and industrial commodities. Competition from emerging economies for the same access to raw materials currently dominated by the advanced economies will likely fuel geopolitical instability, as more nations seek to secure and defend vital supply lines. Businesses should continue to invest in scenario planning to prepare for shocks and maintain flexibility in their business models.

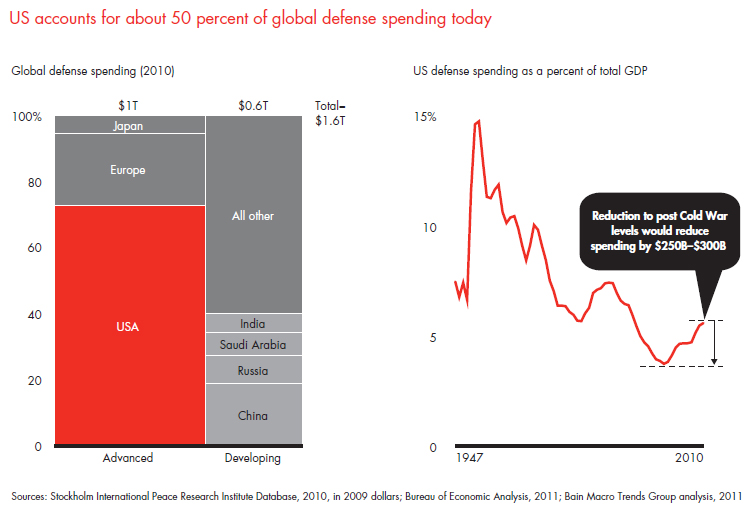

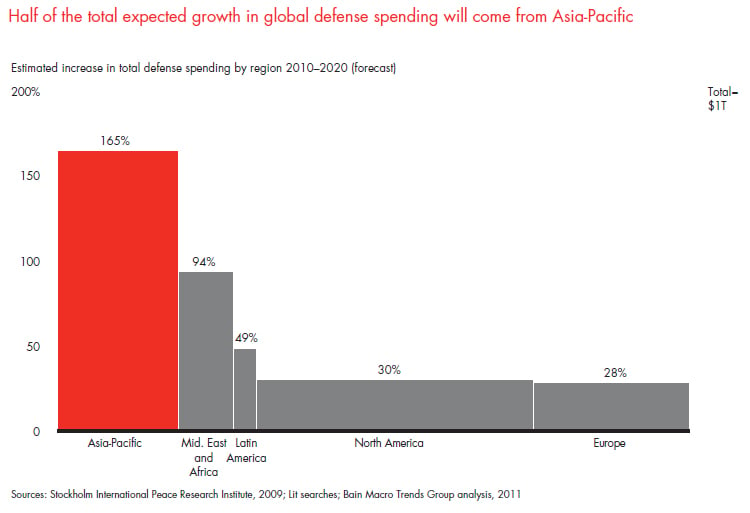

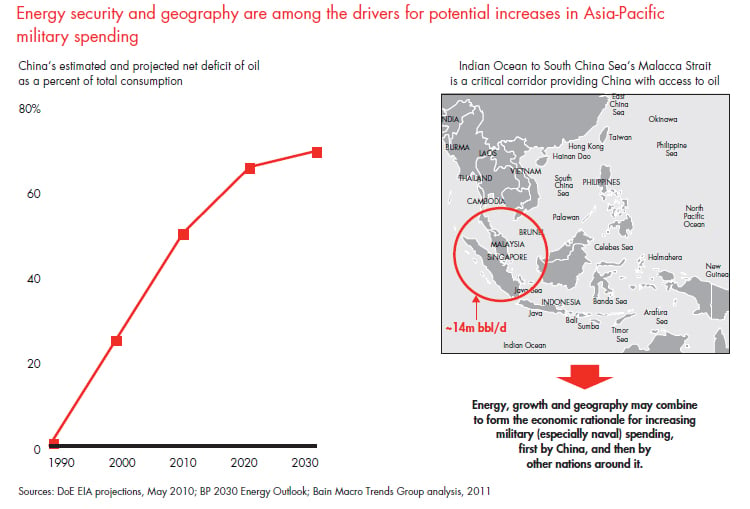

Macro trend: Militarization following industrialization. As economic power tilts toward Asia, political and military power will shift as well. In China, where defense spending has trended upward in recent years, both in dollar terms and as a proportion of GDP, military outlays reached some $160 billion in 2010—a 6.7 percent increase over the previous year, according to the latest available data. The stepped up spending is prompting China’s neighbors to respond with bigger defense budgets, increasing the risk of conflict over shipping lanes in the Indian Ocean and the South China Sea. The military buildups will present near-term opportunities for arms sales for US and European producers until the purchasing countries can ramp up domestic armaments production. Meanwhile, both nations and businesses are increasing spending on countermeasures to meet the ongoing risk of terrorism by non-state actors, insurgent threats in war zones, and the new challenges of cyber and electronic warfare. Estimated contribution to global GDP by 2020: $1 trillion.

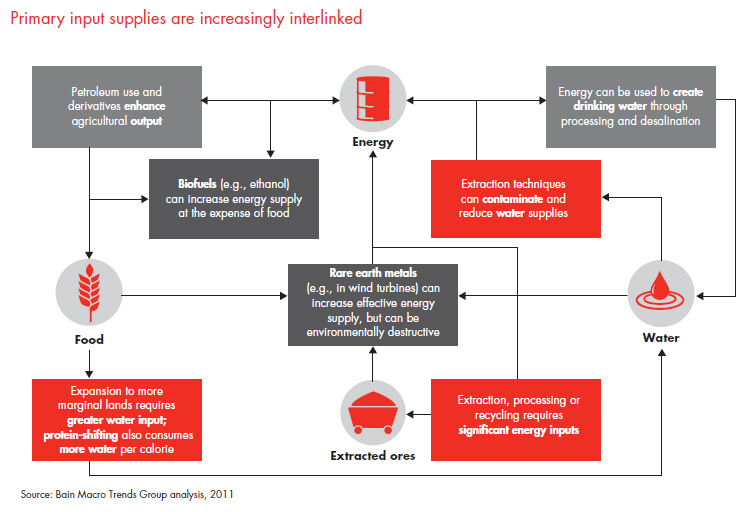

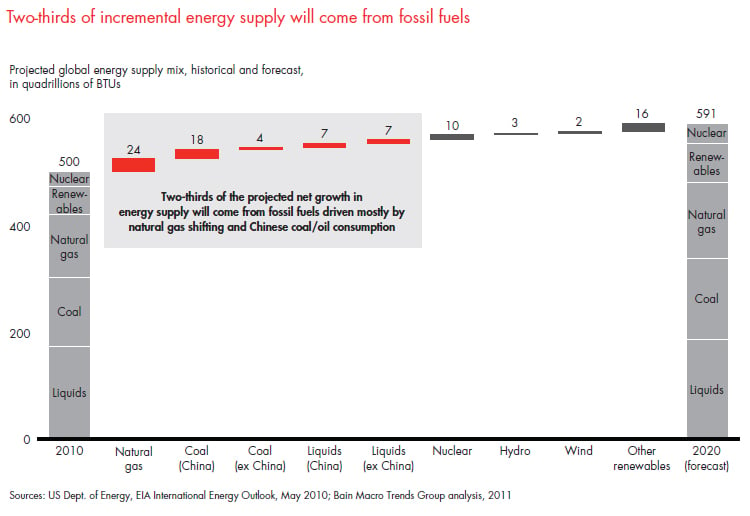

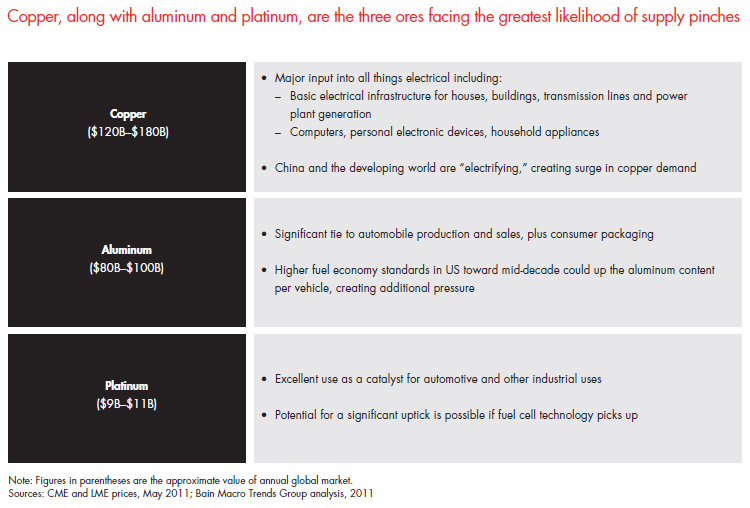

Macro trend: Growing output of primary inputs. Growing demand among more nations for oil and natural gas, grains and proteins, fresh water and extracted ores, such as copper, aluminum and rare earth metals, will create price volatility and transient shortages of a few of these commodities over the coming decade. Volatility and commodity price inflation will intensify as these key inputs are increasingly linked by new uses and as demand rises. For example, corn is now a major source of ethanol for transportation as well as a food crop. More water is diverted for use in the extraction of ores and fuel. Ores are finding their way into the manufacture of wind turbines to generate clean energy. And more fuel will be consumed in the desalination of new potable water sources. Investment in conservation measures, alternative supplies and technologies will increase in some areas, though new fossil fuel sources will reduce economic incentives to invest in alternative energy. Estimated contribution to global GDP by 2020: $3 trillion.

Smarter, healthier populations. Potentially the most powerful long-term growth force of all is the engine of human capital development, which drives economies forward and, through the deeper specialization and greater division of labor it enables, can break through resource constraints. Growth in most emerging economies is outpacing investments in their people’s health and education, creating potential constraints to growth but also opportunities to fill the gap.

Macro trend: Developing human capital. The massive population shift from farm to factory has altered the social landscape in the fast-growing emerging economies, but social infrastructure has not kept pace. Broadening access to education and improving its quality over the coming decade will be crucial if those economies will successfully navigate the transition to a higher value-added service and technology-based economy. Likewise, building a basic healthcare delivery system and weaving a stronger social safety net will absorb a far higher proportion of investment than in the past. Estimated contribution to global GDP by 2020: $2 trillion.

Macro trend: Keeping the wealthy healthy. Aging populations in the advanced economies, more and better medical treatments, and changes in payment systems to make healthcare spending more efficient will spur innovation and reform. Estimated contribution to global GDP by 2020: $4 trillion.

A new wave of technological innovation. We are already beginning to see innovations that will change the way we live, work and play in the advanced economies, spurring the next generation of entrepreneurial start-ups to bring novel products and services to market. Technologies like 3D printers will begin to unleash breakthroughs in manufacturing, enabling smaller batches of highly customized products at declining price points. Ongoing network and communications improvements will create the “no-collar” location-free worker, a technology-enabled change that will create interesting options for retaining elderly workers, for example. Juiced by such innovations, today’s slow-growth advanced economies could accelerate onto a new growth trajectory in the coming decade, tracing an upward sweeping “S-curve” from its current plateau.

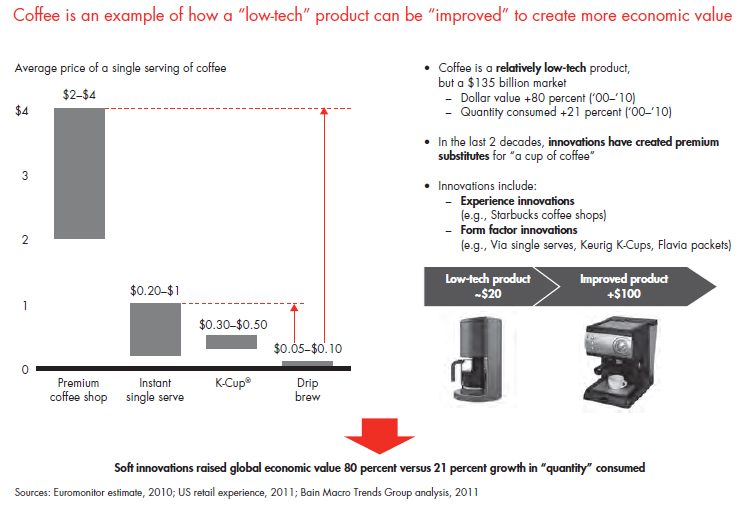

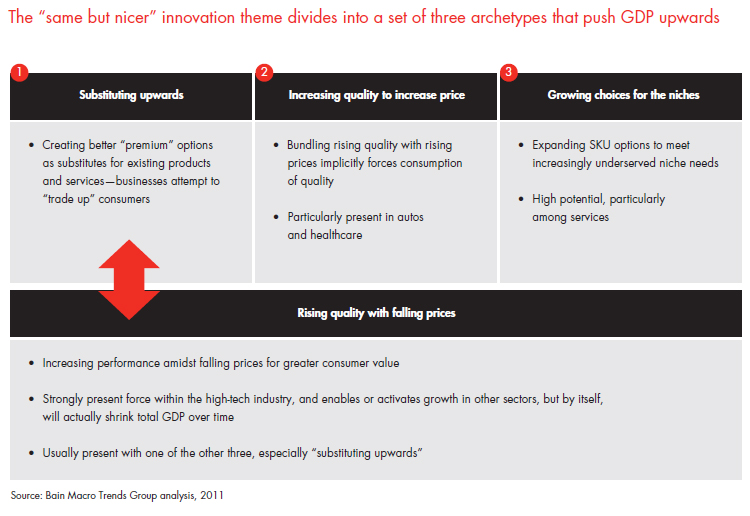

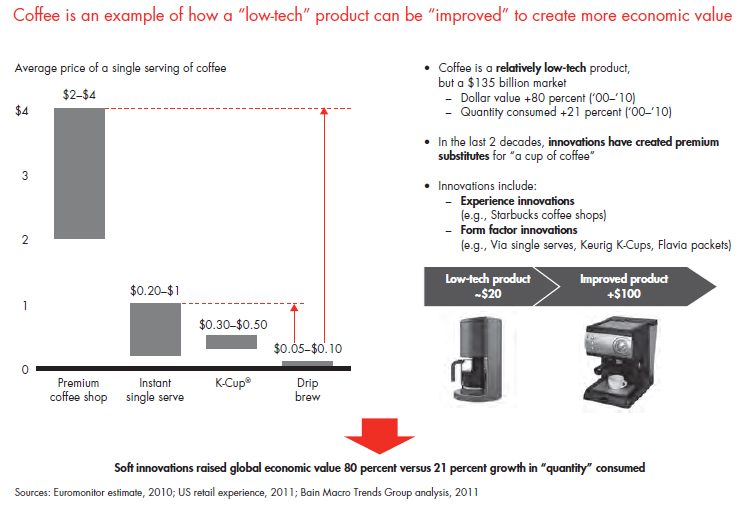

Macro trend: Everything the same, but nicer. Innovation will increasingly come in new forms beyond novel technologies like iPads and Twitter. Look for businesses to invest more heavily in “soft innovations,” which will offer affluent customers premium products and services as substitutes for common consumer purchases, better products commanding higher prices and a greater variety of niche products. Soft innovations will change our basic habits, from the way we drink coffee (think mochaccinos rather than drip brew) to the way we buy clothes (with matching outfits delivered to our doorstep rather than shopped for piecemeal in stores). Innovators will create businesses based on these insights. Estimated contribution to global GDP by 2020: $5 trillion.

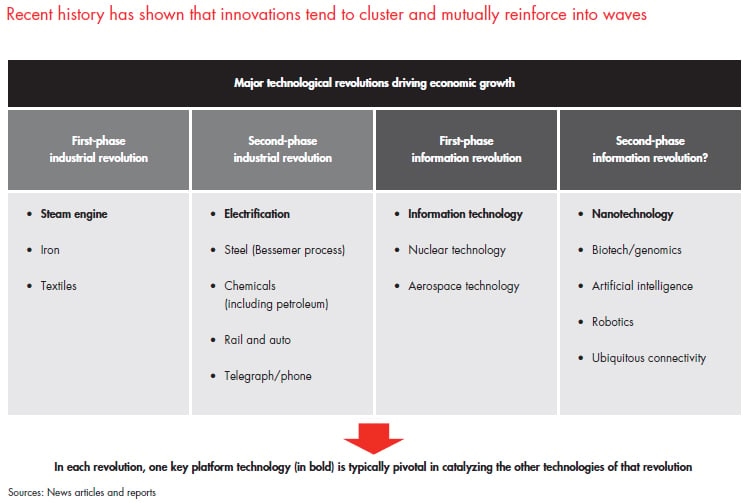

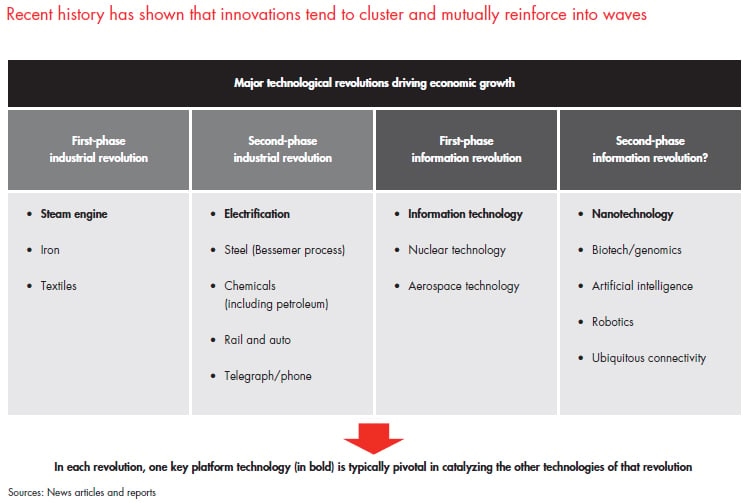

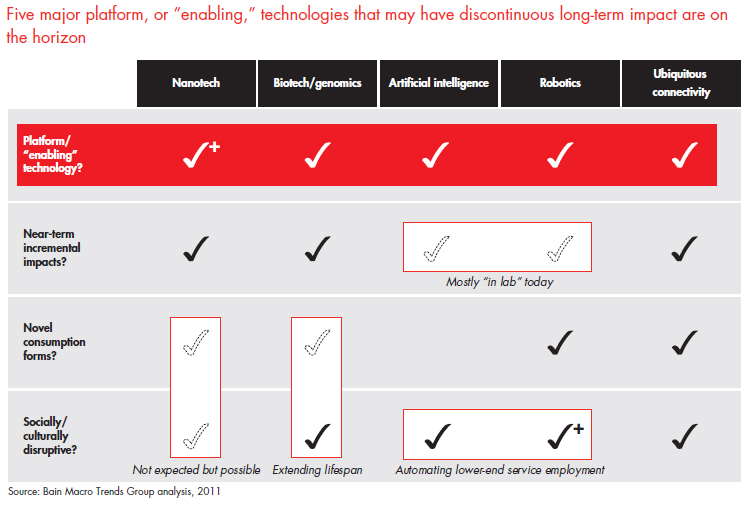

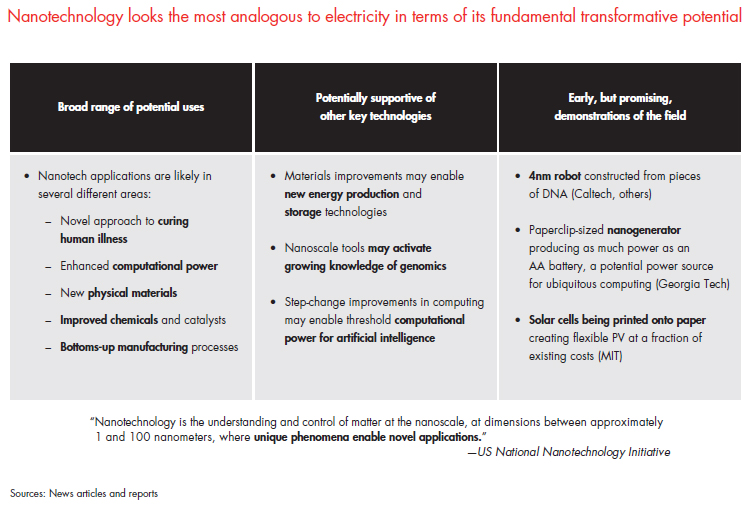

Macro trend: Prepping for the next big thing. Innovations tend to cluster in waves, and five potential platform technologies—nanotechnology, genomics, artificial intelligence, robotics and ubiquitous connectivity— show promise of flowering over the coming decade. In many cases, developments across technologies will be mutually reinforcing. For example, advances in nanotechnology will enable the enhanced computational power necessary for breakthroughs in artificial intelligence. Nanotechnology will also spawn new technologies for manipulating DNA, which will accelerate advancements in genomics. As technologies move from research concepts and prototypes to find applications in affordable consumer goods and industrial processes, mainly toward the end of the decade, they will generate step-change efficiency improvements that will accelerate growth. Estimated contribution to global GDP by 2020: $1 trillion.

As businesses ponder how best to position themselves to profit from the Great Eight macro trends, they will need to be mindful of these implications:

- The next billion consumers are not “another billion.” They are and will remain different than consumers in advanced markets, with median yearly household incomes remaining well under $20,000 throughout this decade. This market now holds the potential for large volume sales at lower price points and an important window of opportunity to influence the tastes of those transitioning into the middle class over the coming years. But emerging market consumers will seek a different basket of goods than those purchased by shoppers in advanced markets, due to their lower incomes. To target the new consumers effectively, multinational companies will need a different cost structure. They should also expect price points to remain at a lower level rather than assuming that buyers will migrate up the price ladder across all product categories.

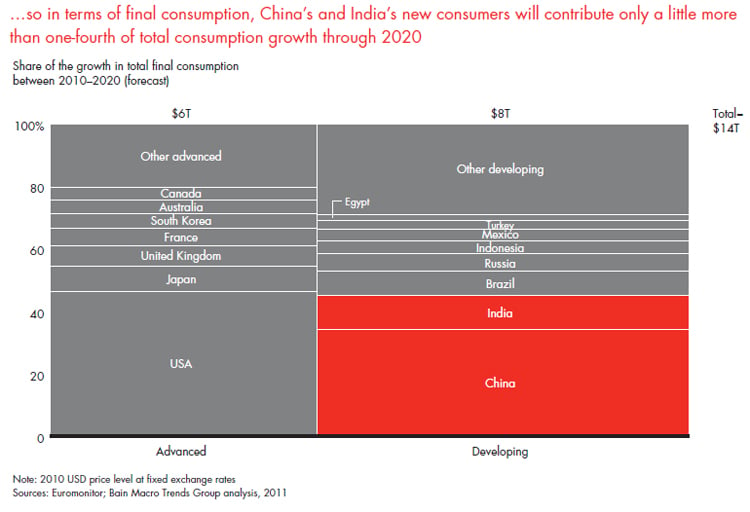

- Don’t give up on the West. Even as rapidly as their economies are expanding, China and India together will contribute little more than one-quarter of the next decade’s forecasted $14 trillion growth in consumption. The US and other advanced economies will account for $6 trillion, or more than 40 percent of the total, and will continue to contain the majority of the global upper middle class. Their aging populations represent new challenges, not a petering out of opportunities. Not only will the advanced economies be a source of substantial growth, they may well be on the cusp of acceleration into a new “S-curve” after slowing down at the top of the last one.

- “Soft innovation” will reap profits. The coming decade will reward creative businesses that innovate by tweaking existing products and services into premium offerings. The possibilities of such soft innovations are as big as marketers’ imaginations—covering everything from food and housewares to transportation and entertainment. They show up in retailing concepts like fast fashion and fast food. They are appearing in recreation, leisure and personal services—even in public utilities where deregulation is opening opportunities for companies to differentiate their services on grounds other than price. Soft innovations are potent because they intersect with, and are enabled by, hard innovations like mobile devices and social networking. They amplify consumption by adding premium features that create new experiences customers are willing to pay for. Nearly every company will need to invest in soft innovations and the marketing, customer service and other soft skills that create them. If they do not, they will be left behind by their competitors who do.

- The “war for talent” will intensify. Population aging in the West and continuing economic advancement in China and India will result in a shortage of management talent that will be felt worldwide. Companies in advanced and emerging economies alike will share an increasingly mobile white-collar labor pool. Companies will also be vying for talent against the entrepreneurial opportunities that will be available to the cohort of young, well-educated workers. To remain globally competitive, companies will need to attract, develop and retain world-class talent. Part of the solution will be to make better use of the experience and skills of older workers and retirees, possibly leveraging technology that will make it easier for them to work on their own terms. Likewise, companies will need to develop flexible work models that will enable the growing proportion of women—and their significant others—in the skilled and managerial workforce, to balance career and family. Hiring, training and retaining skilled managers will become a more prominent point of competitive advantage.

Businesses will need to devote significant energy to managing through the economy’s current bumps, which may get even worse over the next few years. But as they maneuver through more near-term turbulence, they will also want to begin marshalling resources and positioning themselves to capitalize on these longer-term macro trends.

1. The next billion consumers: Big demand is coming on line, but the emerging market “middle class” will be poorer overall

What is behind the trend?

- China, followed by India and other emerging Asian economies, is creating a vast new population of consumers, whose growth will continue into the coming decade.

- These consumers will breach the $5,000 annual household income level, while some will push deeper into the “global middle class” and consume even more.

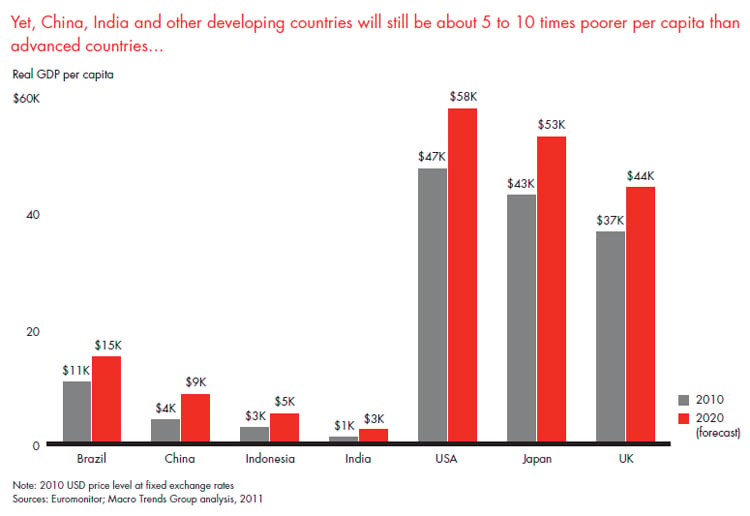

- Yet this new middle class will be considerably poorer than today’s middle class in the advanced economies. In China, for example, peak income will average about $18,000 per year in current dollars—more like a giant Poland than another US.

- As a result, advanced economies will still account for 40 percent of the growth in consumer spending power.

What does it mean for business?

- This is a large market but at a much lower price point for many purchases. Due to the new consumers’ relatively lower incomes, the overall basket of goods and services will differ from what consumers in advanced economies purchase.

- Companies will need to target emerging markets with a different cost structure. Expect price points to remain at a lower level rather than assuming migration upwards across all products.

- Marketers will have a transient opportunity to impact the tastes of those moving into the middle class.

Two-thirds of the population growth in the global middle class will come from just China and India

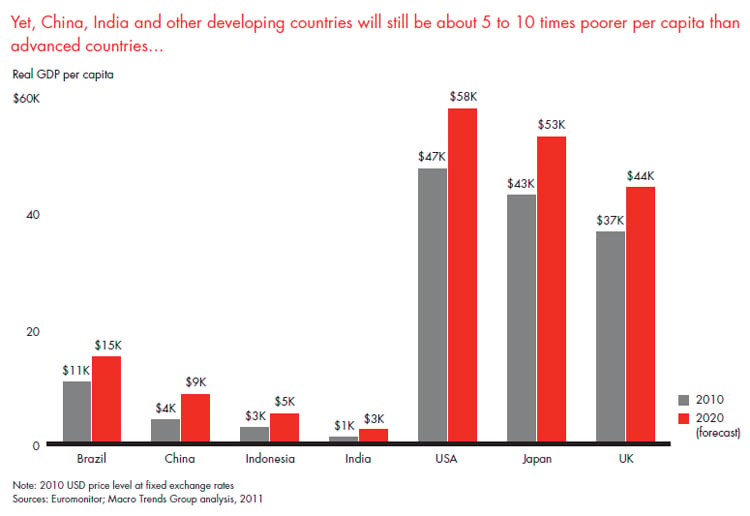

Yet, China, India and other developing countries will still be about 5 to 10 times poorer per capita than advanced countries…

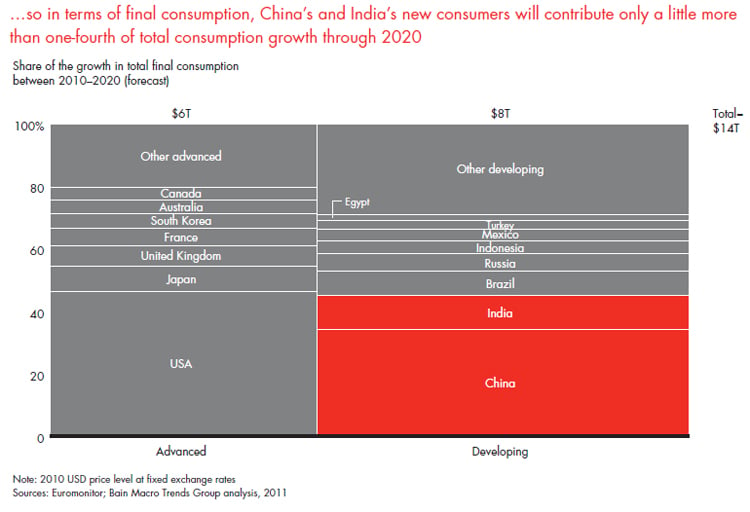

…so in terms of final consumption, China’s and India’s new consumers will contribute only a little more than one-fourth of total consumption growth through 2020

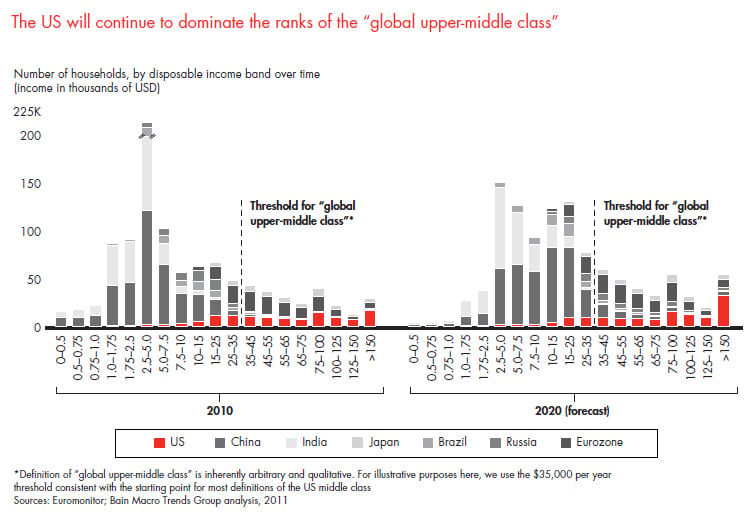

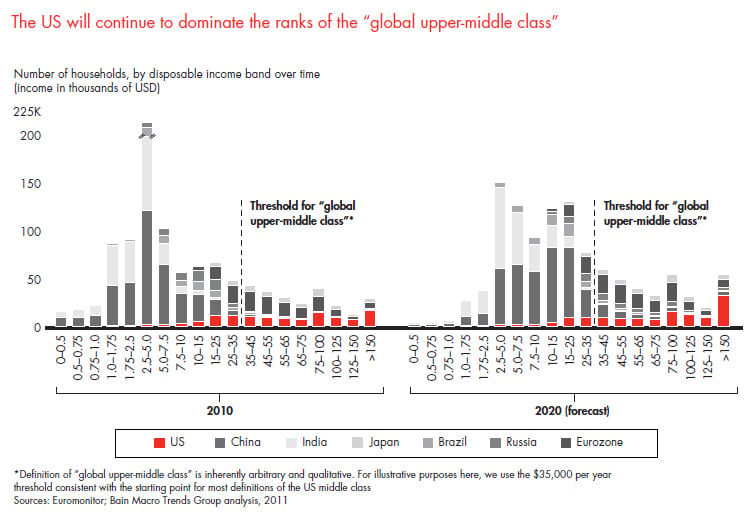

The US will continue to dominate the ranks of the “global upper-middle class”

2. Old infrastructure, new investments: Urbanization in developing nations and obsolescence in developed nations will spur infrastructure spending

What is behind the trend?

- Much of the critical infrastructure in developed countries was built more than 50 years ago and needs to be replaced.

- With public funds scarce, opportunities for public-private partnerships are likely to increase given adequate returns. For example, there has already been an upsurge in tollroad privatization.

- Developing nations will also need new infrastructure and new spending. For example, despite the prevalence of wireless, its bandwidth limitations prevent wireless from substituting for expensive new fiber optic lines for all purposes.

- China, the largest developing economy, may already suffer from overinvestment or misalignment of infrastructure.

What does it mean for business?

- There will be major lower-risk investment opportunities in developed markets through public-private partnerships.

- Opportunities in developing nations, where governments fund and operate infrastructure investments, will likely be limited to providing indirect support through the provision of supplies and sales of heavy capital equipment.

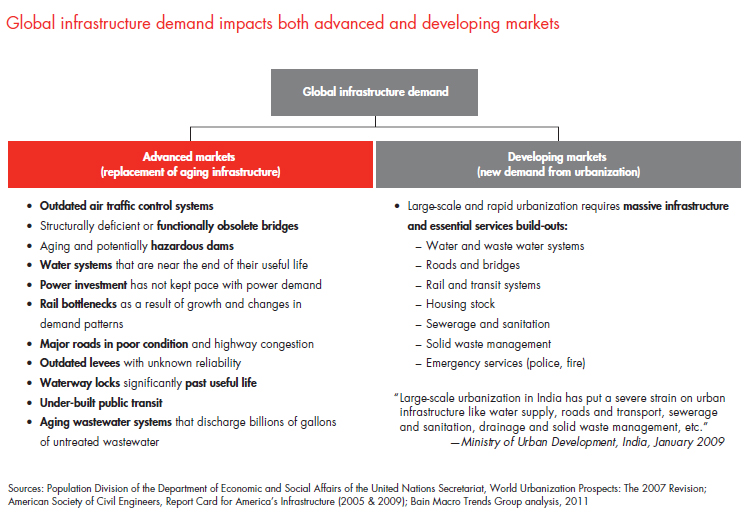

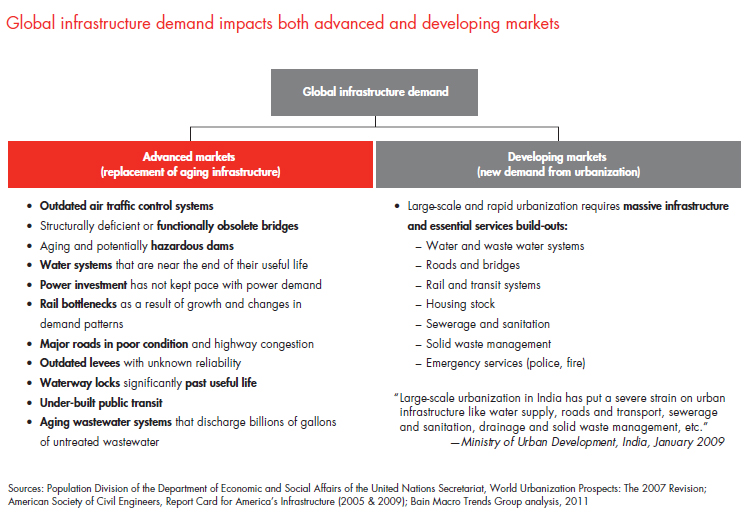

Global infrastructure demand impacts both advanced and developing markets

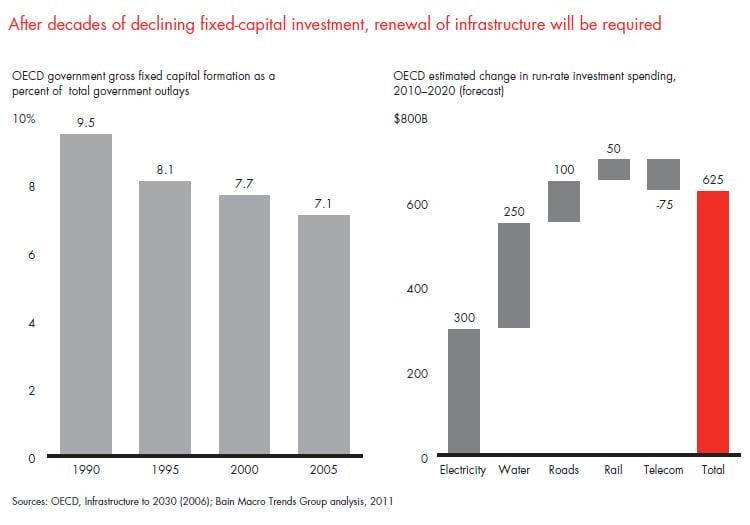

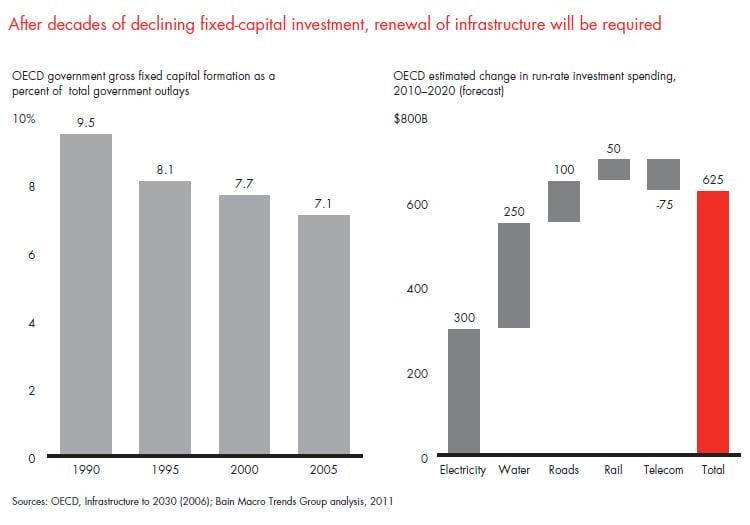

After decades of declining fixed-capital investment, renewal of infrastructure will be required

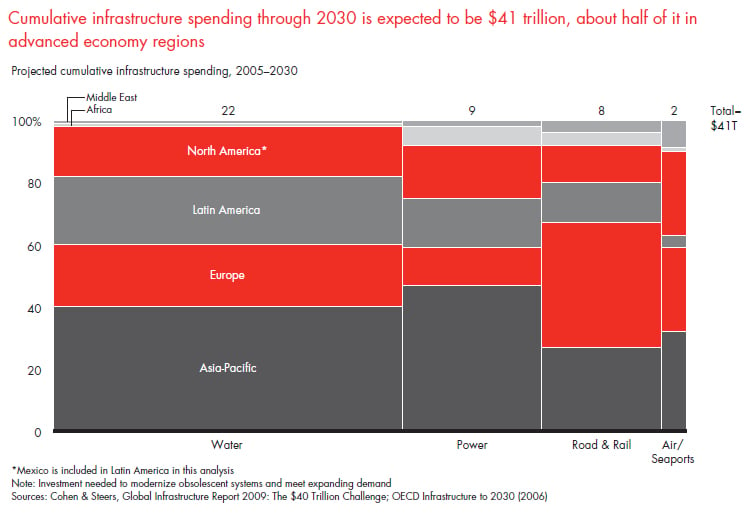

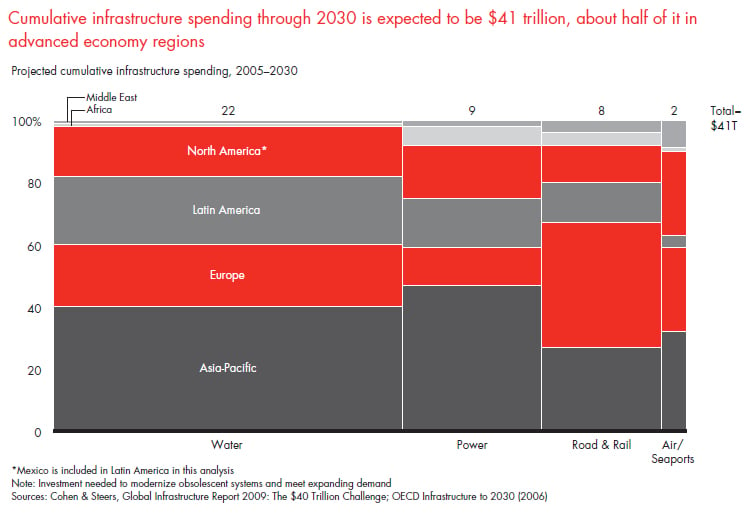

Cumulative infrastructure spending through 2030 is expected to be $41 trillion, about half of it in advanced economy regions

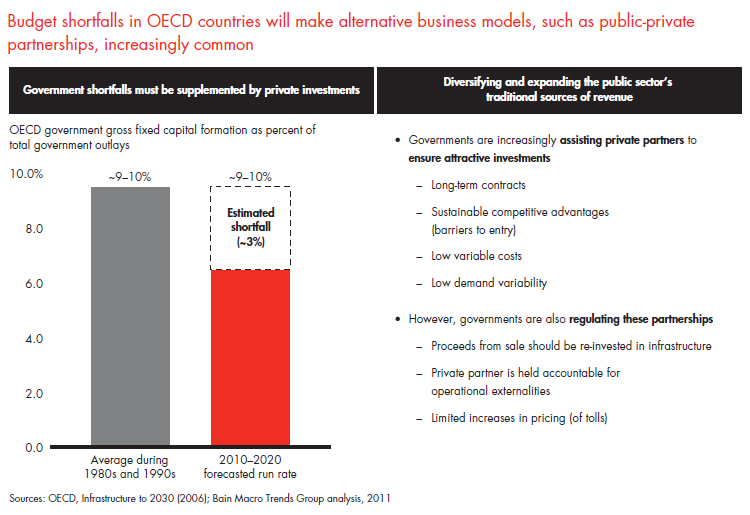

Budget shortfalls in OECD countries will make alternative business models, such as public-private partnerships, increasingly common

3. Militarization following industrialization: A transient opportunity for defense contractors

What is behind the trend?

- Because its growth depends on raw material and component imports, China is expanding its military to protect its supply chain.

- China’s spending is prompting spending increases in Japan, India and other countries. Increased military spending creates an elevated risk of local armed conflict in the region. It would be unusual to have an entire decade devoid of any military conflict.

- Historically, the world has relied on the US to patrol the Pacific sea lanes. Local players are increasingly concerned with protecting the Indian Ocean and the South China Sea, though dependence on US for security in the Pacific will remain throughout the decade.

What does it mean for business?

- There will be a transient opportunity for arms-producing nations to sell weapons to developing nations. Total arms sales from the top 100 global defense companies increased 8 percent from 2008 to 2009 to reach $401 billion. Seventy-eight of the top 100 companies (and 92 percent of revenues) are located in the US and Western Europe.

- Given its strategic importance, military production will likely be brought in-country over time, limiting the long-run opportunity to multinational defense companies.

- For companies that rely on supply chains passing through the Asia-Pacific region, consider the risks of political and military instability and possible alternative supplier options in the event of an emergency.

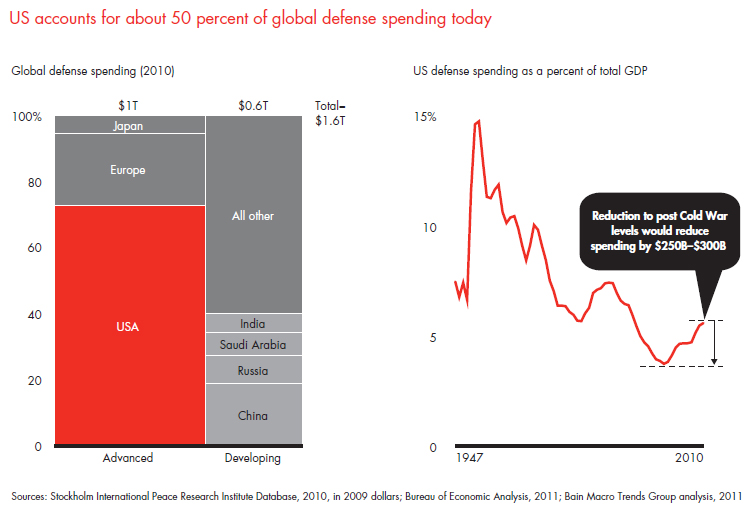

US accounts for about 50 percent of global defense spending today

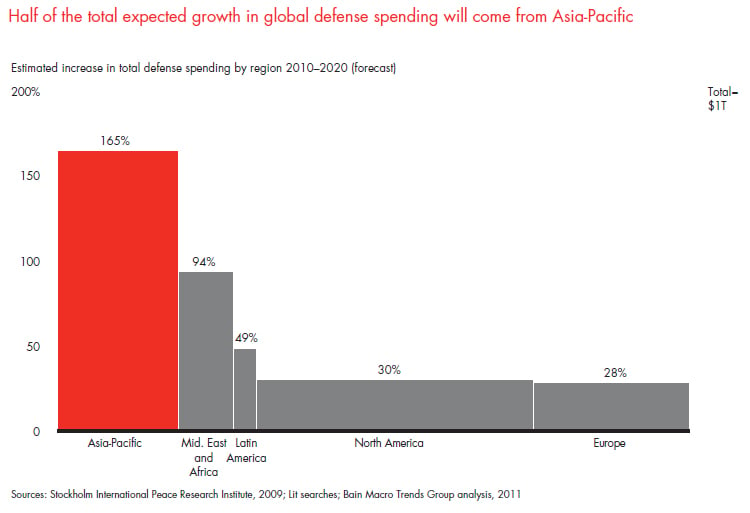

Half of the total expected growth in global defense spending will come from Asia-Pacific

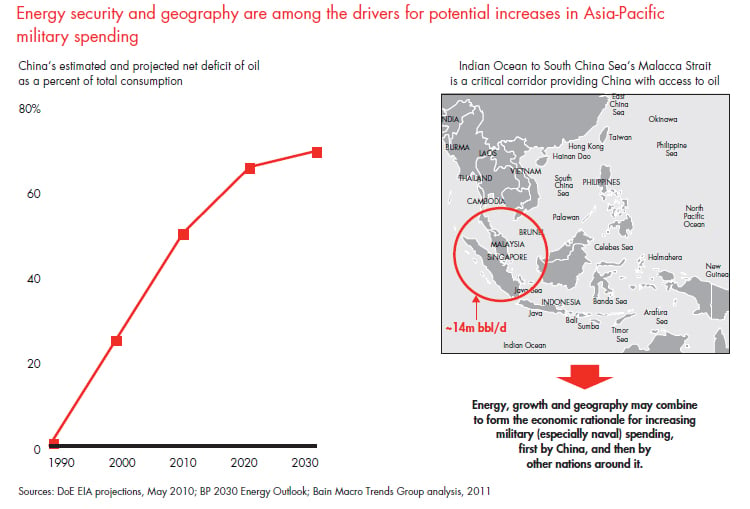

Energy security and geography are among the drivers for potential increases in Asia-Pacific military spending

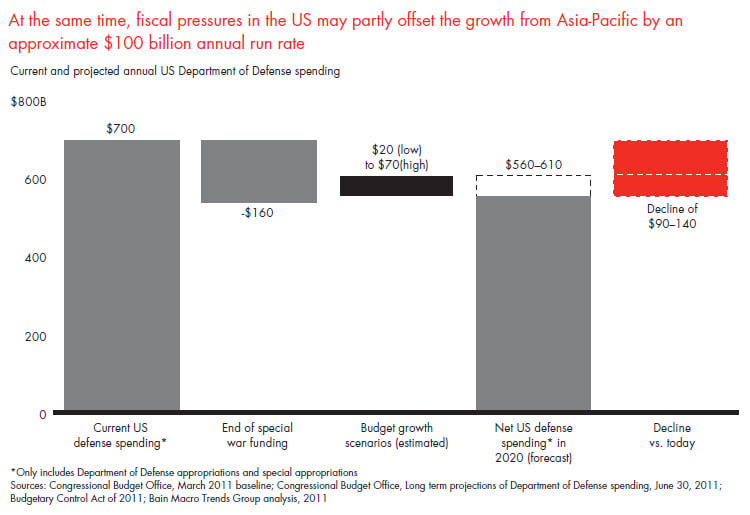

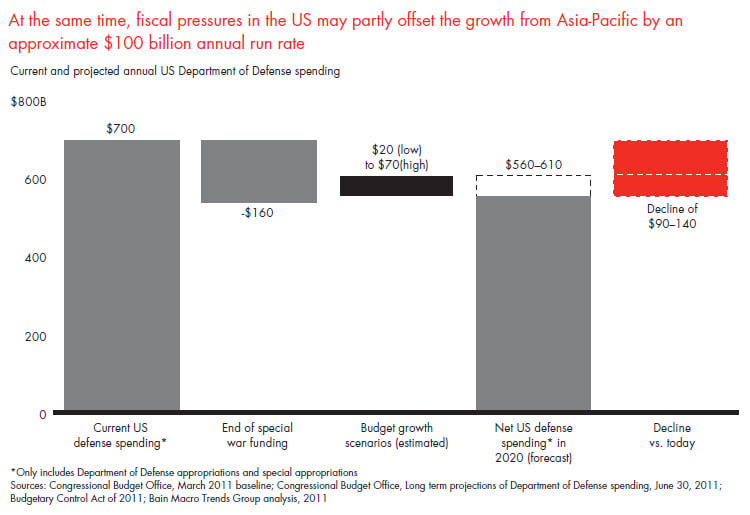

At the same time, fiscal pressures in the US may partly offset the growth from Asia-Pacific by an approximate $100 billion annual run rate

4. Growing output of primary inputs: Increased demand for basic commodities

What is behind the trend?

- Demand for all commodities will rise. Increased consumption of oil, food, water and ores is a function of population growth but has been amplified by the industrialization of emerging economies.

- Basic commodities are under pressure not only from their own higher demand but also from increasing alternate uses. For example, corn will be needed for food and ethanol. Water will be required for consumption, agricultural production and energy production.

- Only a short list of commodities is likely to result in real constraints this decade. But for all, rising prices and volatility are likely to be the norm. Ore supply will also gradually adjust to meet demand, although not until the end of the decade. To meet food demand, a sustained period of rising production efficiency will be necessary to forestall the alternative—sustained food price inflation.

What does it mean for business?

- Expect upward price pressure on commodities throughout the decade, with the exception of oil (although energy prices may become very volatile).

- General price volatility will increase, partly reflecting the global surplus of financial capital seeking investment returns, which amplify demand-price shifts.

- Business challenges are likely to come from holdups and shortages of copper and rare earth metals rather than from shortages of energy, food and water.

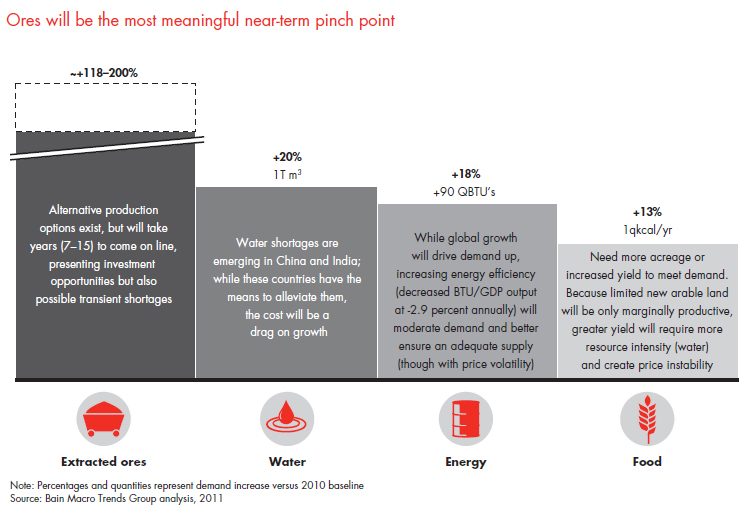

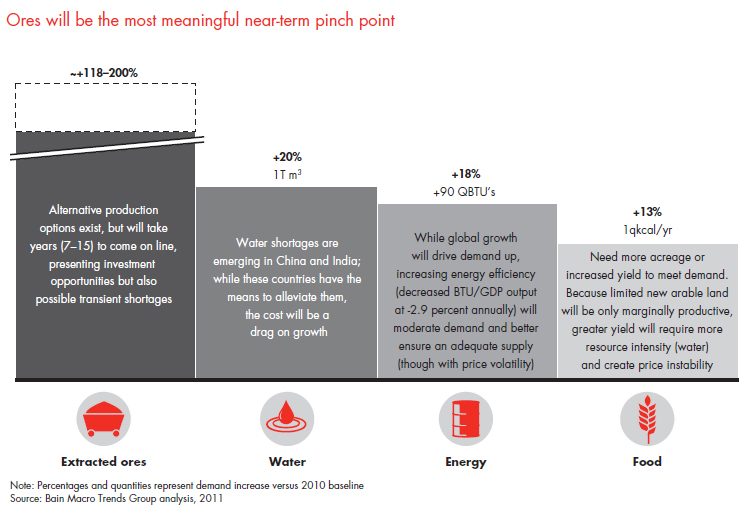

Ores will be the most meaningful near-term pinch point

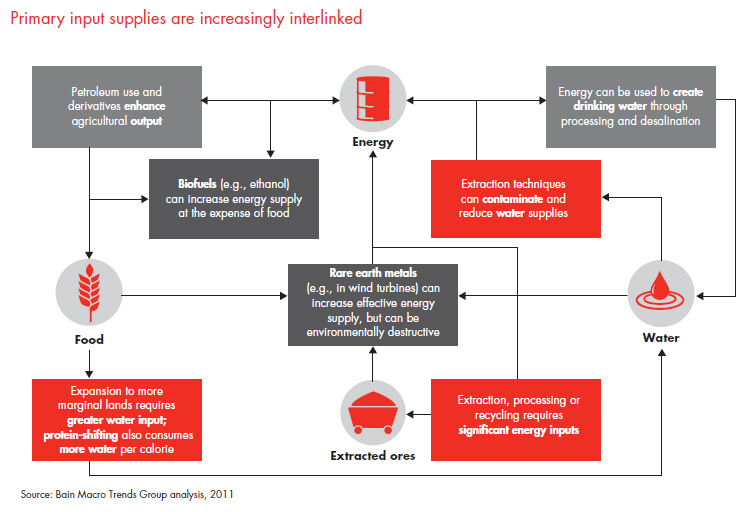

Primary input supplies are increasingly interlinked

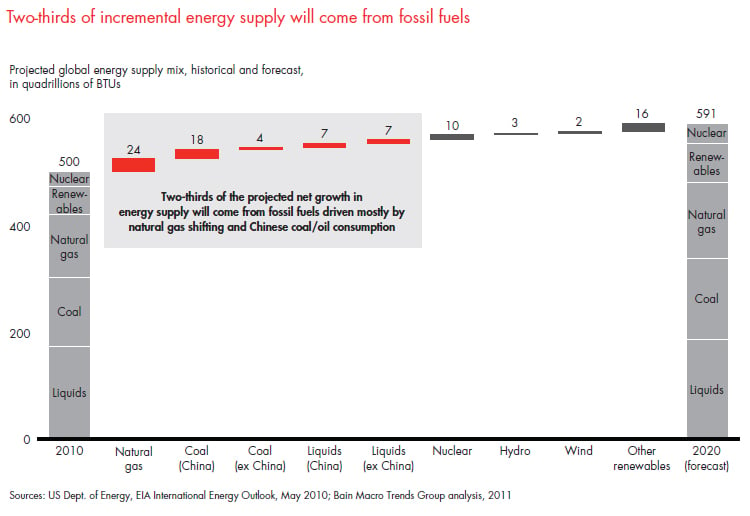

Two-thirds of incremental energy supply will come from fossil fuels

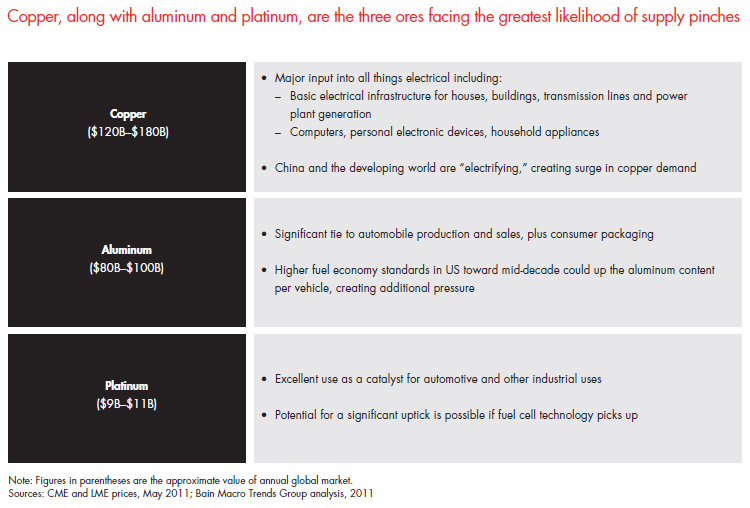

Copper, along with aluminum and platinum, are the three ores facing the greatest likelihood of supply pinches

5. Developing human capital: Investments in workforce training will be required to lift skill levels in new markets and to remain competitive in developed ones

What is behind the trend?

- Nations that are home to “the next billion” need to invest in their social infrastructure (healthcare and education) or risk stunting their development into more balanced economies, both in terms of stalling workforce productivity and consumer spending power.

- Creating a consumer class in China (followed by India and Indonesia) will require social safety net investments in healthcare and education. An aging population requires either additional savings to support itself in retirement or a public support alternative.

- In advanced economies, growth will be strongest in sectors like technology and healthcare that require skilled labor and entrepreneurship. Opportunities for the poorly educated in advanced economies continue their long-term decline.

What does it mean for business?

- Expect a shortage of management talent for some time in emerging markets as economic growth outstrips home-grown talent growth and managers in advanced countries choose entrepreneurship in increasing numbers.

- Hire to grow—companies that plan to expand in China, India, Indonesia and other fast-emerging markets need to hire promising managers early and invest in their training and retention, as finding fully capable managers in-market will be extremely challenging.

- For advanced economies, the US in particular, the talent shortage means more enriching career opportunities for the elderly and for university graduates, a majority of whom are now women. Work models better able to adapt to the needs of women raising children will create an advantage in the hiring and retention of this majority group.

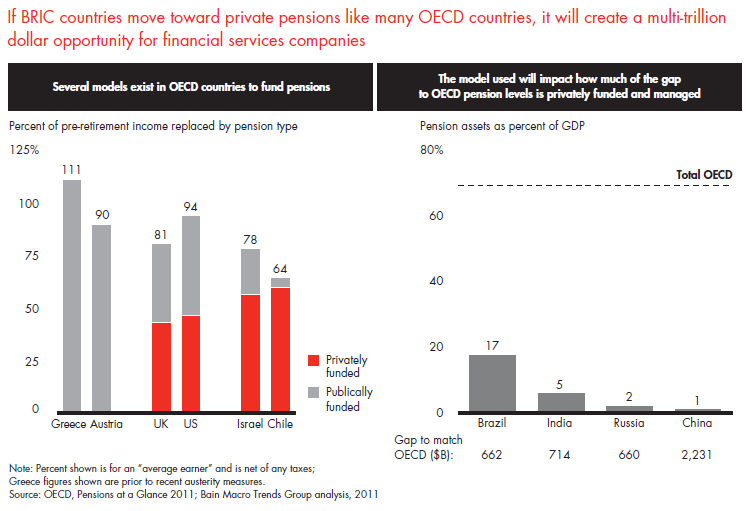

- Financial services companies may have an opportunity to create better savings vehicles (public or private) to create or augment a retirement safety net.

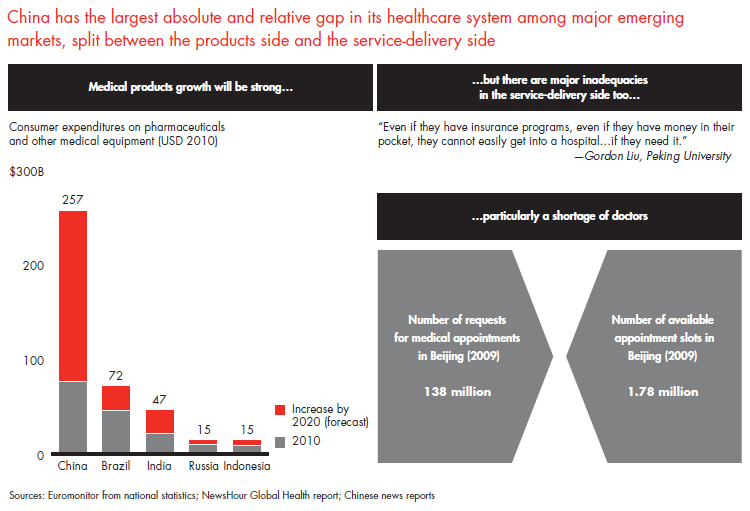

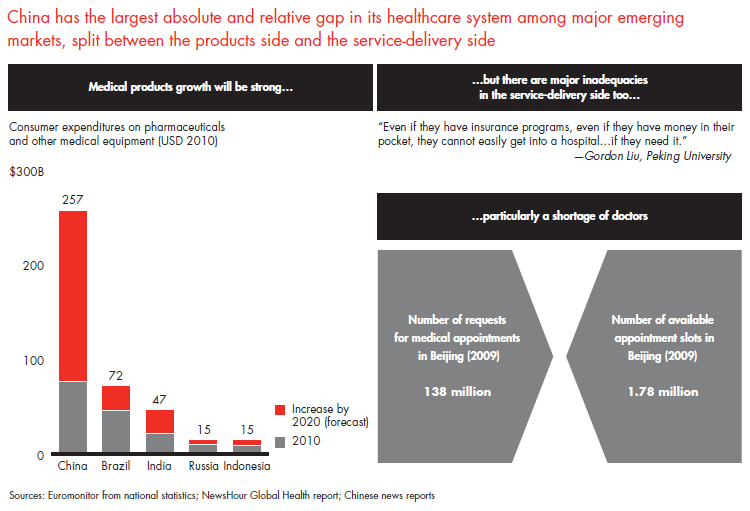

China has the largest absolute and relative gap in its healthcare system among major emerging markets, split between the products side and the service-delivery side

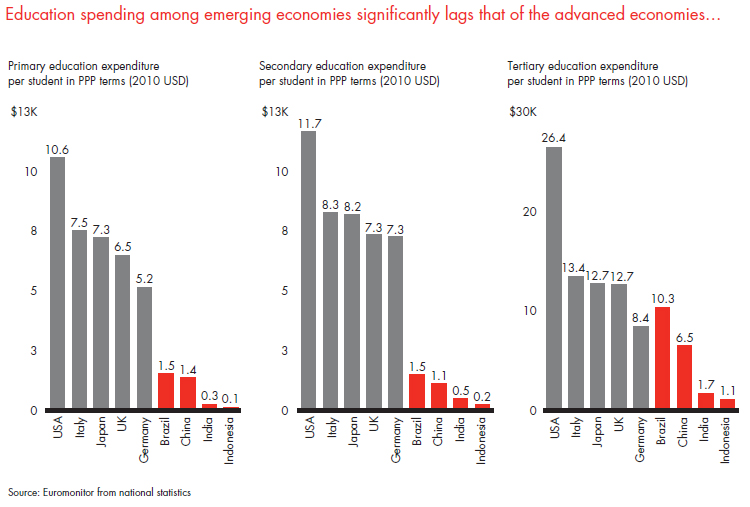

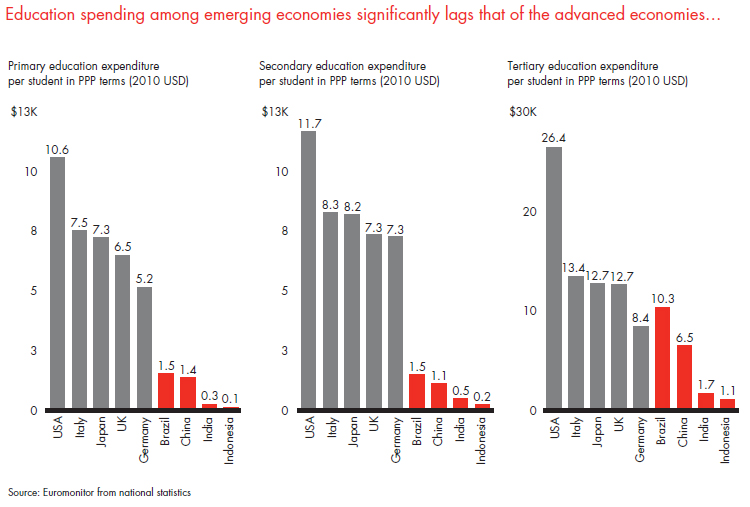

Education spending among emerging economies significantly lags that of the advanced economies…

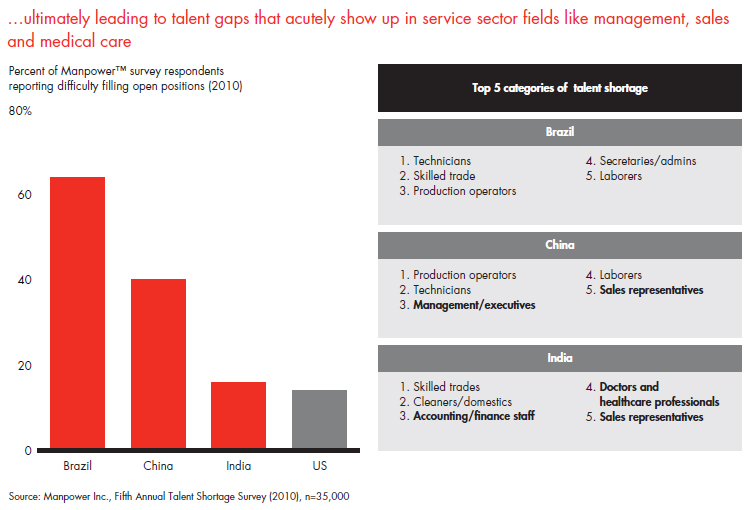

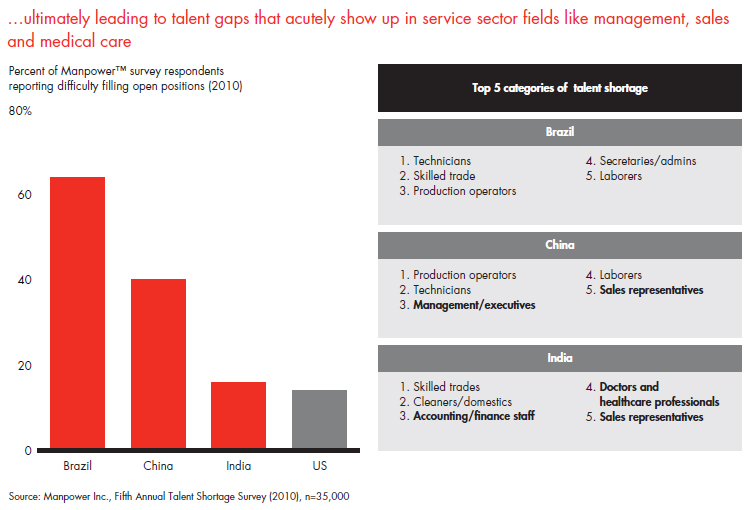

…ultimately leading to talent gaps that acutely show up in service sector fields like management, sales and medical care

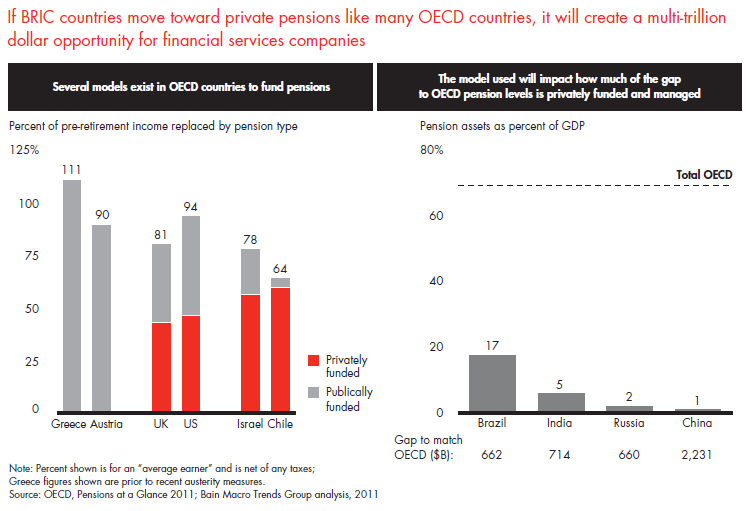

If BRIC countries move toward private pensions like many OECD countries, it will create a multi-trillion dollar opportunity for financial services companies

6. Keeping the wealthy healthy: Healthcare spending will continue to grow, but at slower rates

What is behind the trend?

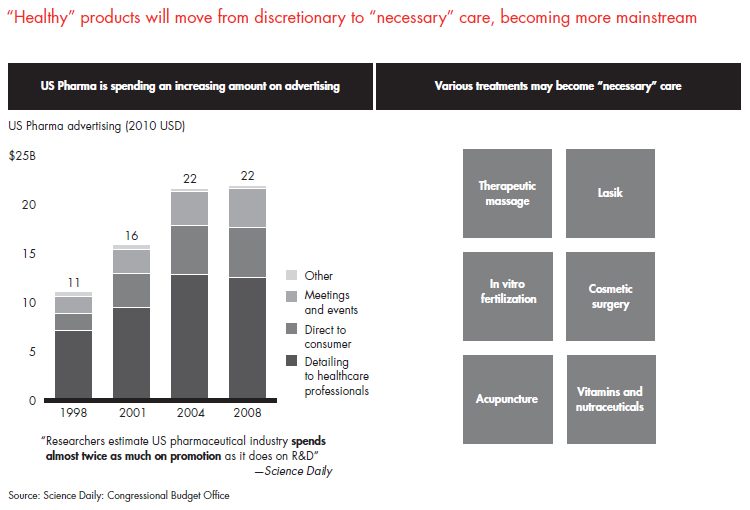

- In advanced markets, aging populations and increasing rates of chronic conditions, such as obesity and diabetes, will continue to inflate healthcare costs. The continued expansion of healthcare as a “consumer good” will also create demand for new product and service innovations, in some cases broadening the scope of what constitutes necessary care.

- The recent economic downturn and the need for government fiscal reforms will create significant cost pressures on public and private payers. Responses will vary, but they will include some mix of direct control of input costs, the setting of protocols for healthcare delivery and the pursuit of integrated care models that better align incentives. At best, these efforts will reduce cost inflation to the level of GDP growth.

What does it mean for business?

- Profit pools will remain under pressure across all sectors, but there will be significant opportunities for innovation.

- Manufacturers, care providers and payers will make a major push to improve the productivity of healthcare delivery systems. Increased efficiency, reduced per capita costs and demonstrated, measurable improvements in patient outcomes will continue to earn premium returns.

- To reduce reimbursement exposure, companies and financial investors will see opportunities in more consumer-oriented healthcare products and services that patients are willing to pay for out of pocket.

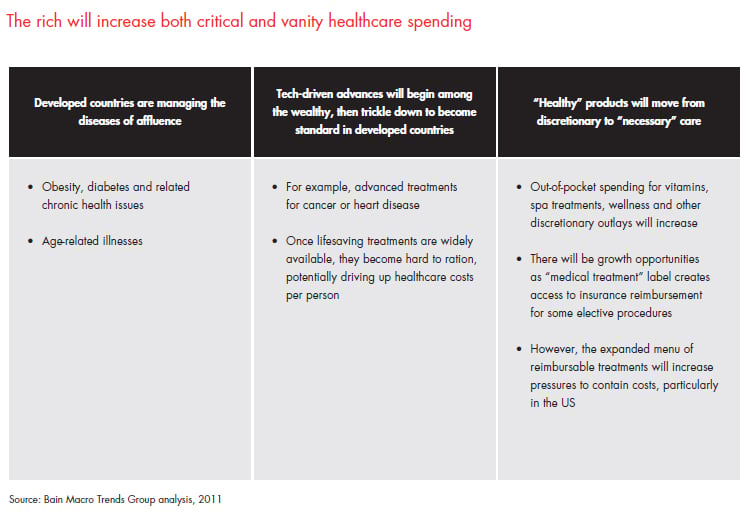

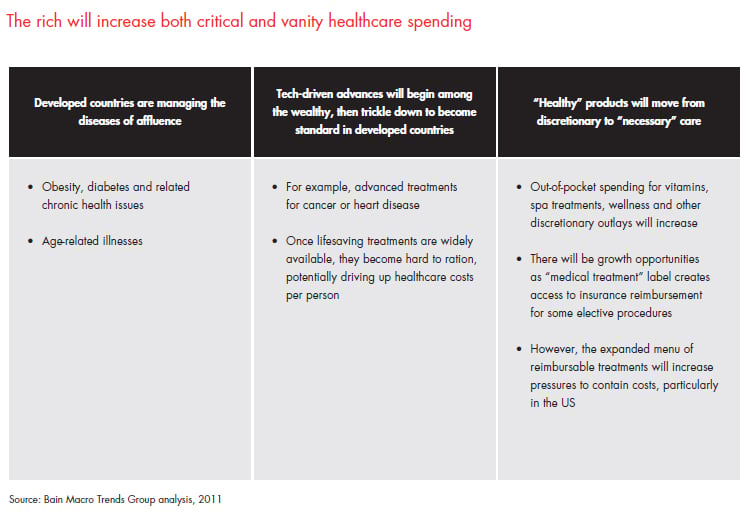

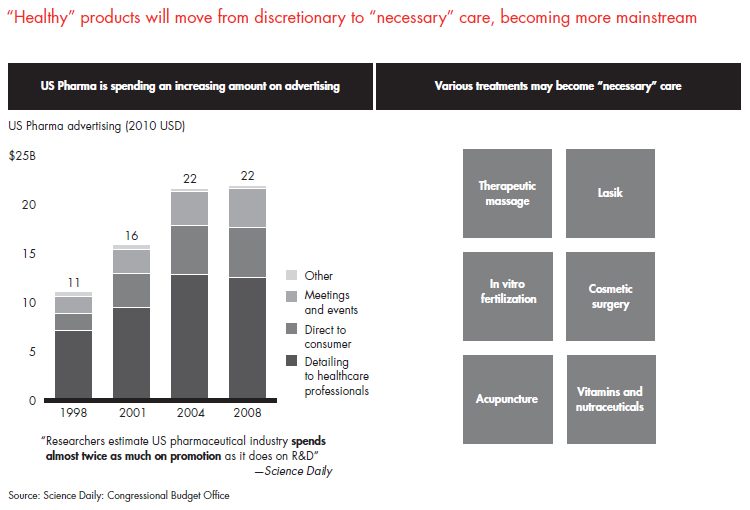

The rich will increase both critical and vanity healthcare spending

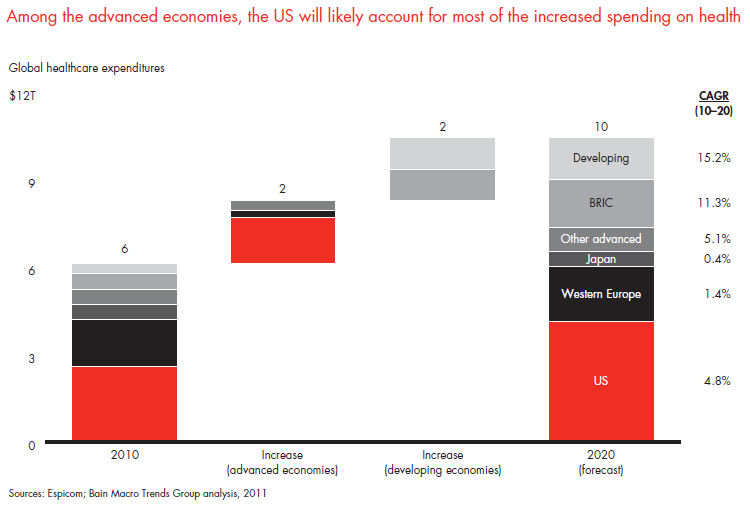

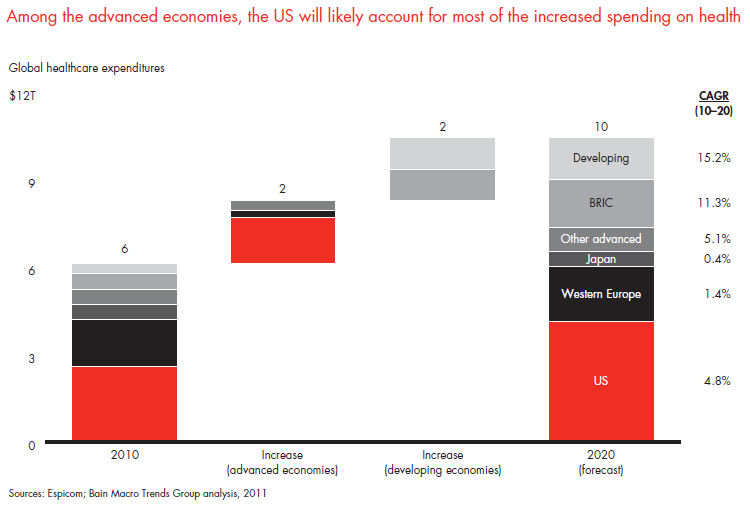

Among the advanced economies, the US will likely account for most of the increased spending on health

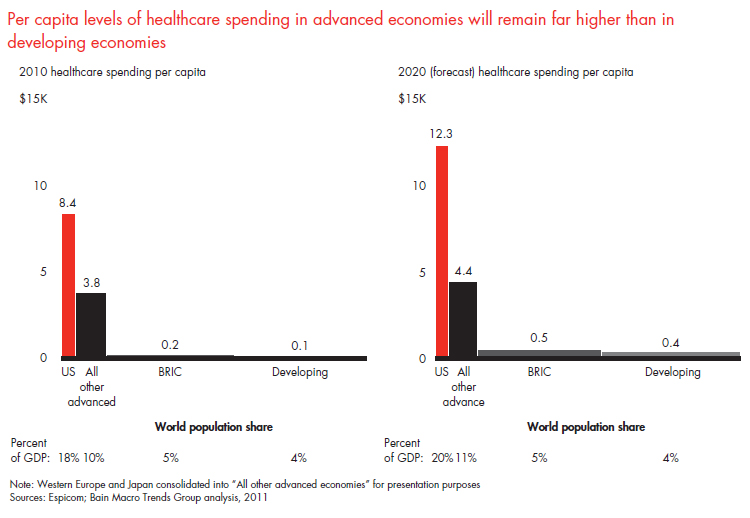

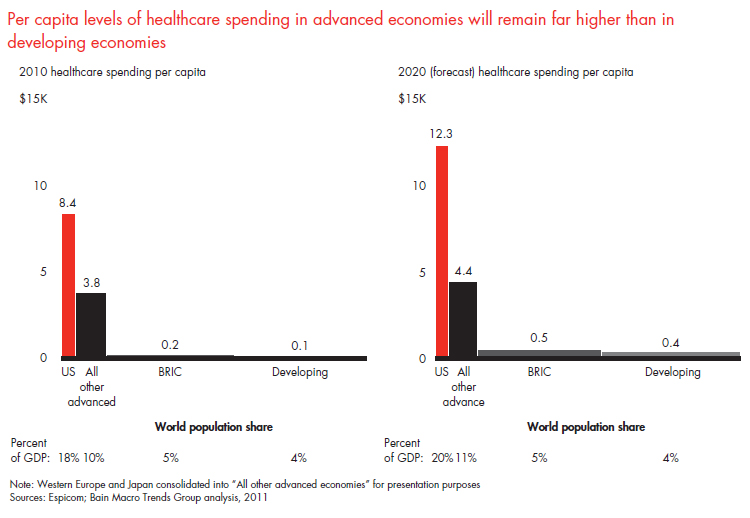

Per capita levels of healthcare spending in advanced economies will remain far higher than in developing economies

“Healthy” products will move from discretionary to “necessary” care, becoming more mainstream

7. Everything the same, but nicer: For the affluent, the search for quality improvement rather than quantity will drive consumption trends

What is behind the trend?

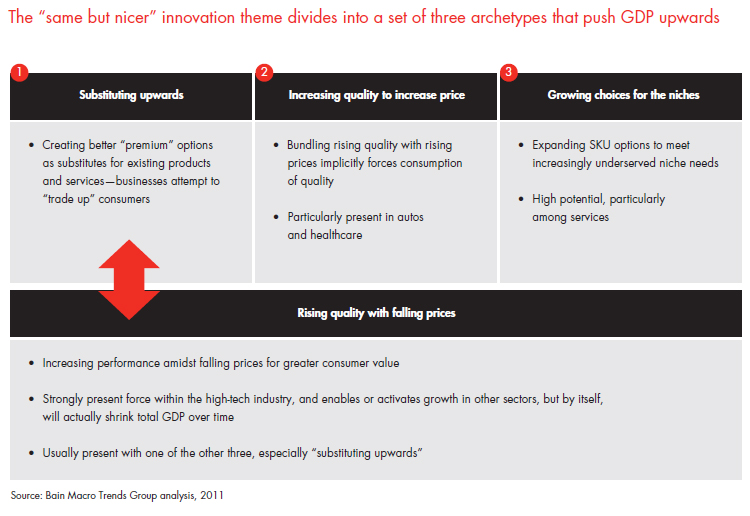

- In advanced economies, a significant proportion of GDP growth will come from a broad range of incremental improvements to existing offerings.

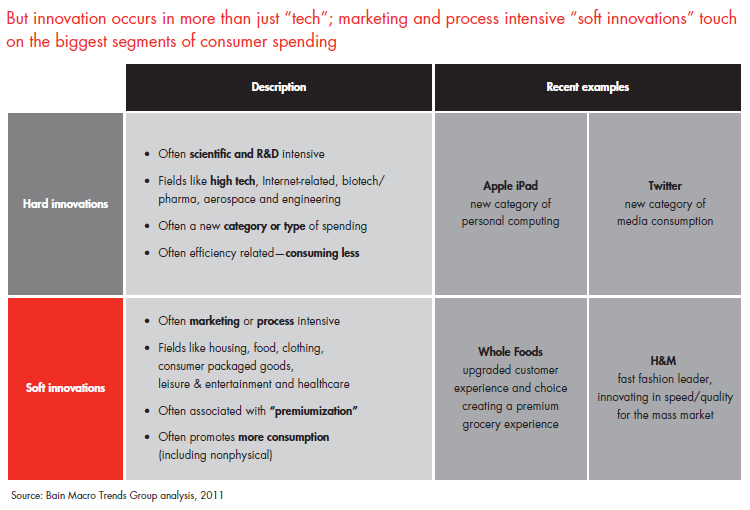

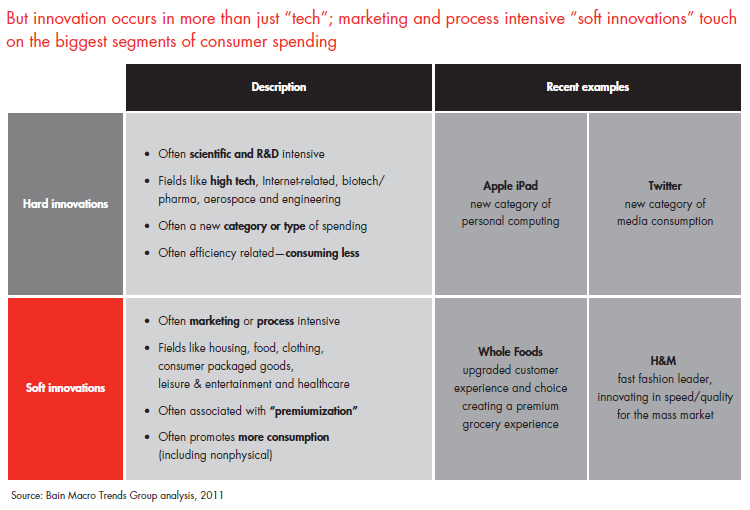

- Particularly important will be “soft innovations,” distinct from big breakthroughs or “hard innovations.” Soft innovations are improvements that may be generated from market or customer insights and process or business-model inventions. They have not been part of the traditional definitions of the center of innovation but will become more central.

- The result of soft innovations will be to increase total consumption, including the greater consumption of nonphysical (intangible) value, in contrast to just efficiency innovations that only drive down costs and price points.

What does it mean for business?

- For businesses, increased commitments to invest in soft innovations are not just competitive imperatives, but creative ones— making spacious new markets out of crowded old ones.

- Marketing, customer research, process improvements and business model inventions will continue to be critical to creating incremental economic value above and beyond “stealing share.”

- Services, especially in the consumer space, may be poised to expand rapidly and diversify, mirroring (and in response to) the explosion of diversity in product SKUs.

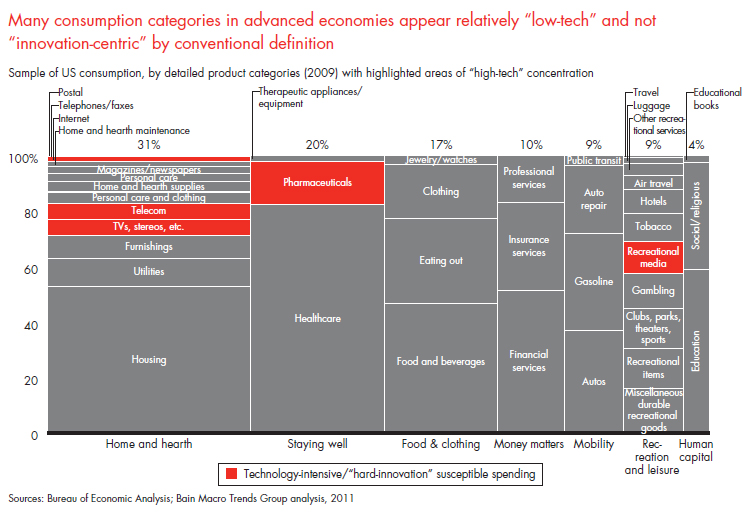

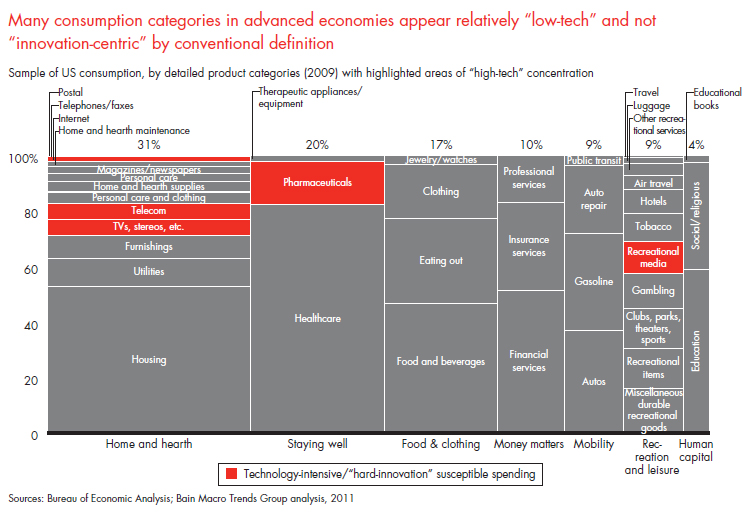

Many consumption categories in advanced economies appear relatively “low-tech” and not “innovation-centric” by conventional definition

But innovation occurs in more than just “tech”; marketing and process intensive “soft innovations” touch on the biggest segments of consumer spending

The “same but nicer” innovation theme divides into a set of three archetypes that push GDP upwards

Coffee is an example of how a “low-tech” product can be “improved” to create more economic value

8. Prepping for the next big thing: The next platform breakthrough isn’t here yet, but the seeds are beginning to sprout

What is behind the trend?

- Critical breakthroughs, like railroads, electricity and the Internet, have outsized impact by triggering changes far beyond their immediate uses. For example, the railroad network laid the foundation for the telegraph network, in addition to creating faster and more reliable transport.

- These breakthroughs free up resources and replace labor by automating physical functions, mental functions or both.

- Developments currently underway hint at upcoming breakthroughs, but are at least two steps away from commercialization. Examples include personal robots to perform household functions, 3D printers to create at-home prototyping and nanotechnology innovations across a wide range of applications including manufacturing and healthcare.

What does it mean for business?

- Big bets—and big wins—are on the horizon.

- A financial system that funnels capital to the right set of start-ups and smaller-scale opportunities, as “angel” and VC investors in the US do, may confer advantages in nurturing these wins. Larger players, like sovereign wealth funds, could use their greater resources to create idea incubators or portfolios, similar to how pharma companies run drug development, for example.

Recent history has shown that innovations tend to cluster and mutually reinforce into waves

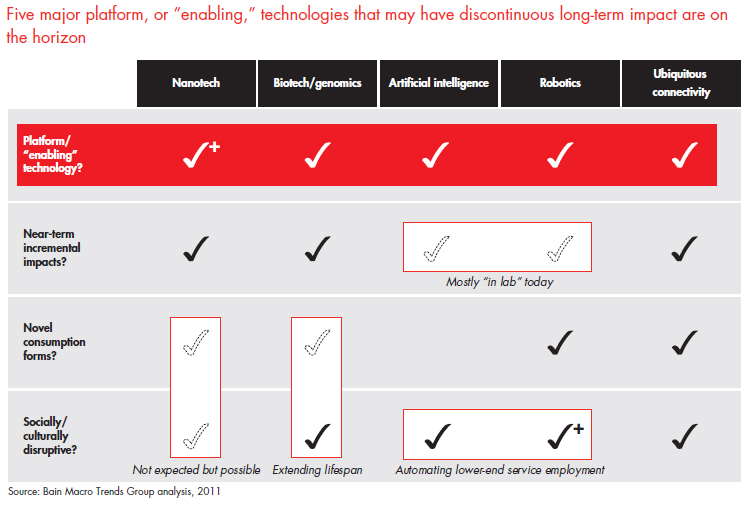

Five major platform, or ”enabling,” technologies that may have discontinuous long-term impact are on the horizon

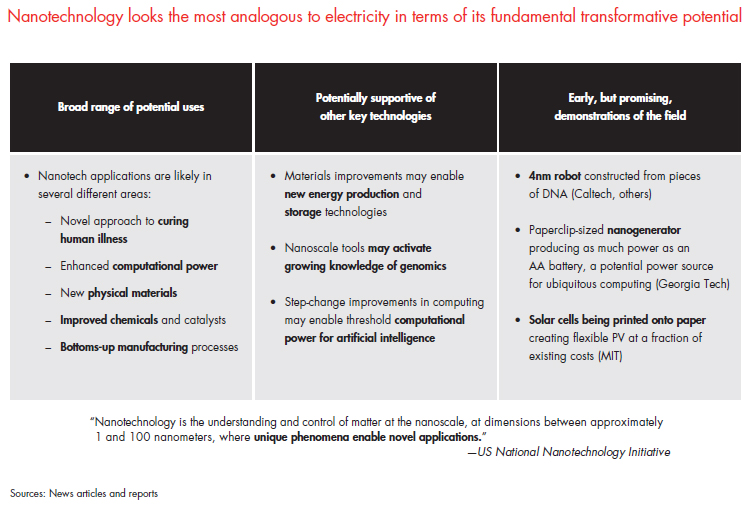

Nanotechnology looks the most analogous to electricity in terms of its fundamental transformative potential

Technological innovation could trigger many social responses that will transform how we live, work and play