Retail Holiday Newsletter

Executive Summary

- Despite a barrage of challenges, November results point to another season of high year-over-year holiday growth. In-store sales remain robust, even as foot traffic struggles to recover to pre-pandemic levels.

- This holiday season, consumer behavior has signaled a continuation of longer-term in-store shopping trends, including more purposeful trips, bigger baskets, and expectations for a seamless omnichannel experience.

- Leading retailers will cultivate loyalty and embrace new ways of shopping to keep up with evolving consumer expectations and make the most of lessons from this holiday season.

Holiday sales momentum continues, despite hurdles

Retailers are aiming to finish strong in a holiday period full of twists and turns. Heading into the season, sales momentum was powerful: Stores, in particular, enjoyed double-digit year-over-year growth, in sharp contrast to the modest gains that we saw at this time last year. But consumers have also grappled with higher prices, inventory shortages, delivery delays, and concerns surrounding the newly discovered Omicron variant.

While November’s month-on-month retail growth was in line with historical averages, it amounted to exceptional year-over-year comparable sales. According to the US Census Bureau’s advance estimates, sales in Bain-defined categories grew by 14.2% year-over-year in November, kicking off a remarkable start to the holidays and outpacing our forecast for the season. In-store sales growth reached 14.6% vs. 2020—the highest November jump on record. And nonstore sales—including e-commerce, mail order, and buy online, pick up in-store (BOPIS)—rose 12.8% over last year.

Overall, Thanksgiving weekend delivered substantial year-over-year growth: According to Mastercard SpendingPulse, total sales on the Friday through Sunday of Thanksgiving weekend grew 14.1% over last year, but results varied dramatically by channel. Brick-and-mortar retail had a strong comeback, with the National Retail Federation estimating that more than 100 million Americans shopped in stores over the Thanksgiving weekend, an increase of 14% over 2020. Meanwhile, online channels struggled to deliver growth after soaring sales last year: Adobe estimates $8.9 billion in Black Friday online sales, nearly flat with 2020’s $9 billion.

Thanksgiving weekend results also varied by category. While overall store foot traffic during the Friday through the Monday following Thanksgiving was up 26% over 2020, traffic diverged across categories, according to analysis conducted with Advan (see Figure 1). Despite booming store sales, foot traffic failed to exceed pre-pandemic levels in all but three categories, indicating consumers may have visited fewer stores than in past years. From a store-format perspective, malls and other large shopping centers did particularly well, with Black Friday traffic levels that mostly met or surpassed 2019.

This Black Friday weekend, most store categories grew foot traffic over 2020, but few surpassed 2019 levels

How is December faring thus far? Total sales in the first week of December showed more muted month-on-month growth than prior years, according to Earnest Research. Consumers may have started their holiday shopping a few weeks earlier this year in response to retailers’ push to launch early deals and spread out seasonal demand. They could also be spending more cautiously in the face of rising prices and ongoing Covid-19 uncertainty. That said, store momentum remains robust, with early December foot traffic remaining roughly in line with November’s year-over-year growth rates.

Despite these encouraging trends, retailers still face plenty of obstacles to delivering profitable holiday growth. Rising costs are causing headaches for consumers and retailers alike, even though inflation continues to boost nominal growth rates. Consumers’ real wage growth fell 1.9% year-over-year in November, and steep increases in fuel prices and home energy costs are also eating into shoppers’ budgets—all at a time when they are normally making final holiday purchases. Retailers are also feeling the squeeze: Walmart and Victoria’s Secret acknowledged the cost pressures of inflation in recent earnings calls.

Other holiday headwinds, including supply chain delays, labor shortages, and pandemic concerns, persist. The number of container ships delayed outside two Southern California ports—which account for nearly 40% of total imported goods in the US—grew from about 25 ships in March to 94 ships in early December. Many retailers are contending with reduced inventory levels, with inventory to sales ratios well below pre-pandemic averages. On the hiring front, retail labor vacancies ballooned to 1.2 million in October, up from 900,000 at this time last year.

To manage through delivery disruptions and rising costs, innovative retailers, such as REI, are promoting ship-to-store options to minimize reliance on third-party carriers. Others, such as Walmart, are rolling out advanced machine learning systems to optimize inventory and help provide more up-to-date information on in-stock items.

How the pandemic is reshaping in-store holiday shopping

The ups and downs of store-based retail are not new. Over the last 20 months, in-store growth rates have fluctuated wildly. While much of this tumult can be blamed on the pandemic, a few patterns suggest there will be lasting shifts in consumer behavior.

Early in the pandemic, stay-at-home orders and temporary store closures caused a steep drop in store sales. That dip was short-lived: Sales bounced back by the third quarter of 2020 in most categories, as stores reopened and consumers shifted their spending from services to goods. Ultimately, store-based sales grew 3% year-over-year in 2020, though growth rates varied significantly by category (see Figure 2).

Then came 2021—with unprecedented increases in store sales. During this year, most categories have grown at double-digit rates, with sales soaring in categories and store types that declined in 2020, such as electronics, department stores, and apparel.

In 2021, in-store sales have grown across categories, exceeding pre-pandemic levels

Now, three key themes are continuing to dramatically shape the trajectory of stores this holiday—and they could persist in the long term. Consumers are (1) engaging in fewer, more purposeful shopping trips; (2) spending more per trip; and (3) using more omnichannel features, which they expect to work seamlessly.

More purposeful shopping trips

The trend of making fewer shopping trips—and visiting fewer stores each time—isn’t a recent change. Retail foot traffic has remained below 2019 levels throughout 2021 and into the holiday season. Compared with 2019, November traffic was down by 13% for apparel retailers; 19% for home furnishings and décor retailers; and 24% for department stores, according to analysis we’ve conducted with Advan.

Despite declining foot traffic, November store sales increased across all categories relative to 2019 levels (see Figure 3). It seems holiday shoppers are making more efficient, targeted trips and visiting fewer stores just for browsing—an indication that they may be browsing online before going to the store.

In-store holiday sales have increased since 2019, but store visits are down in most categories

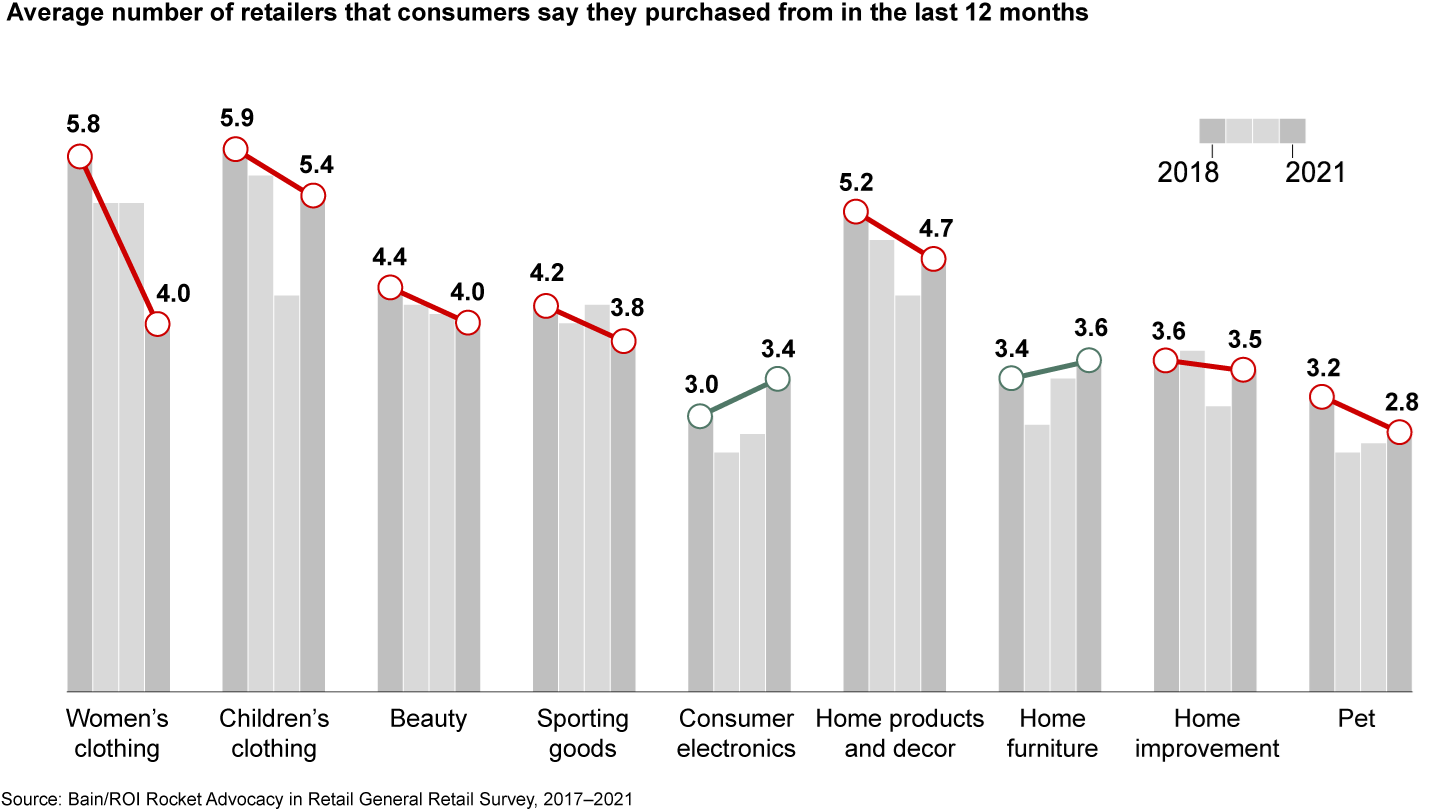

The shift toward more purposeful shopping is explained, in part, by a longer-term trend of narrower shopper repertoires, or the number of retailers that consumers shop from regularly in a given category. Research we’ve conducted with ROI Rocket over the past several years suggests that shoppers were already reducing the number of retailers they purchased from prior to the pandemic (see Figure 4). Relative to 2018, shoppers have reduced their repertoire in seven out of nine categories this year.

Shoppers are purchasing from fewer retailers in nearly every category

Bigger basket sizes

Consumers are also spending more per store visit this holiday, continuing a trend we’ve seen since the onset of the pandemic. According to analysis conducted with Pyxis, average in-store credit card transaction sizes in November 2021 were up about 10% over 2019. This is significantly higher than pre-pandemic annual increases, which were typically in the 0% to 3% range. Three factors contributed to this sizable increase:

- Inflation. Price inflation, as measured by the Consumer Price Index (CPI), reached 39-year highs in 2021. Prices have skyrocketed across retail categories: In November, they were up 5.0% in apparel, 8.4% in sporting goods, and 11.8% in furniture and bedding. And according to Digital Commerce 360, average retail prices from the Tuesday to Sunday of Thanksgiving week were up 13% over last year.

- Premiumization. As household financial conditions diverged during the pandemic, consumers evolved their product selections accordingly. While lower-income customers continue to report that they’re being more mindful of spending on nonessential purchases, other consumers have been treating themselves by trading up for more upmarket substitutes. Their total spending outpaces their thriftier counterparts, resulting in higher sales receipts overall.

- More units per trip. Consumers have increased the number of products they purchase per store visit. According to NielsenIQ data, which covers core grocery and fast-moving consumer goods categories, consumers tended to “pantry load” in the early months of the pandemic, purchasing 6% to 13% more grocery, dairy, and produce items in each store trip, relative to 2019. Although units purchased per trip have slightly normalized since, basket sizes remained elevated in the third quarter of this year, with consumers buying 5% more produce and 3% more health and beauty items per trip compared with 2019.

Increasing omnichannel demands

The pandemic didn’t just change the way consumers shop in stores. It also further blurred the lines between physical and digital channels. According to research conducted in partnership with ROI Rocket, between 2019 and 2021, the proportion of customers who reported shopping both online and in stores increased by more than 10 percentage points across retail categories. And this holiday season, more than 50% of US consumers intend to shop through both in-store and online channels.

Beyond merely shopping through multiple channels, shoppers are weaving together in-store and digital elements throughout their purchase journeys. In November, more than 25% of US apparel shoppers indicated their most recent trip to a physical store started with an online interaction—including trying on an item they first saw online and picking up or returning an online order.

The rise of BOPIS and curbside pickup is boosting this trend. Proliferating during the pandemic, these fulfillment options appealed to shoppers who wanted to avoid the health risk of visiting stores, while getting their items quickly and on their own schedule. Shoppers are now returning to stores: Their net comfort with in-store shopping at non-grocery stores rose to 47% in November, up from 17% in October 2020. Nevertheless, consumer demand for BOPIS and curbside has endured: Nearly 30% of US shoppers have used these fulfillment options for non-grocery purchases in November. What’s more, Gen Z and millennial shoppers are almost twice as likely to have used BOPIS or curbside in the last month compared with older shoppers (see Figure 5).

Younger shoppers are more likely to use BOPIS or curbside pickup

Today, it seems consumers, particularly younger ones, may be opting for BOPIS and curbside primarily for convenience. In a year when product shortages are top of mind, shoppers may also appreciate the ability to “reserve” desired items and pick them up later.

Lessons from in-store shoppers this season

There are diverging opinions on how long the inflation spike will last, but retailers can expect shoppers to keep making focused trips to stores, while demanding smoother, digitally enabled omnichannel experiences. And as consumers continue to consolidate their shopping trips, retailers will need to fight to retain—and grow—their share of wallet.

To keep up with these evolving consumer expectations and capture real growth in the New Year, retailers can focus on four key implications.

Work backward from customer needs to excel on omnichannel.

- The challenge: Retailers face several hurdles in crafting a smooth, convenient omnichannel experience, including legacy systems, data constraints, the complexities of managing multiple supply chains and assortments, and a dearth of frontline employees. At the same time, retail leaders are raising the bar for customer expectations—seamlessly blending the physical and digital businesses and creating efficient experiences for customers, including BOPIS and curbside pickup options. Traditional retailers that split their e-commerce operations from stores without a clear plan may find it difficult to retain consumers.

- How to win: Winning retailers will avoid treating stores and online channels as separate businesses. And they will continue expanding BOPIS and curbside availability, adding new, customer-friendly features. Target, for instance, recently added more than 18,000 dedicated curbside pickup parking spaces nationwide. It also introduced features that allow shoppers to purchase additional items after placing an order and assign a proxy to pick up their order. Retailers can also cater to customers who prefer researching online ahead of store visits, by adding real-time visibility into item availability and making it easier to locate desired items in stores. For example, Dick’s Sporting Goods’ inventory management software provides up-to-date product information and alternative recommendations when items aren’t available in a customer’s desired location.

Sharpen your store value proposition.

- The challenge: In an omnichannel world, the in-store experience still has a major impact on customer advocacy and loyalty. But with rising costs, labor scarcity, and ongoing shifts toward e-commerce, retailers are making tough decisions on where—and how much—to invest in improving the in-store customer experience. Retailers that settle for “good enough” will likely lose to competitors who emphasize excelling at a component of their offering, whether it be the lowest prices, most compelling assortment, best service, or most convenient location.

- How to win: To maintain share of wallet as consumers refine their shopping repertoires, top retailers will start by addressing the needs of their most loyal customers. An understanding of the unique sources of differentiation that encourage long-term customer advocacy and repeat purchases is critical. Investing in these elements of a store’s value proposition can yield a higher return than new customer acquisition initiatives, with the added benefit of word-of-mouth acquisitions. Customer-centric policies continue to play a key role: Consider Nordstrom’s easy, no-receipt-required return policy, or Publix’s promise to “treat customers like royalty.”

Optimize your physical network.

- The challenge: During the pandemic recovery, retailers may be tempted to take a wait-and-see approach to costly, slow-moving real estate investments. However, they may soon find themselves with a physical footprint that no longer serves their customers’ needs, leading to rapid sales declines and supply chain inefficiency.

- How to win: Tomorrow’s leading retailers will ensure that consumers continue to view stores as a convenient and valued part of their shopping journey, even as they shift more purchases online. Longer-term shifts in where consumers live, work, and shop will play a large role in these forward-thinking retailers’ footprint strategies. They will make smarter inventory-related localization and allocation decisions, build out more efficient omnichannel fulfillment capabilities, and allow demographic data to inform new storefront development. They’ll also carefully assess the role of their footprint, moving access points closer to customers to reduce “last mile” emissions and achieve sustainability goals—while cutting carbon costs.

Embrace technology across all facets of operations.

- The challenge: Too many retailers are frozen, waiting for big investments and the “perfect” 360-degree data to launch their technology transformations. While algorithms and big data can provide useful customer insights, leading retailers will start delivering a more personalized, digitally enabled experience now, with the “small” data they have on hand.

- How to win: With Amazon and Walmart leading the charge on digital investments, other retailers will fall behind if they don’t put technology at the core of the customer experience. Winning retailers won’t just pilot more technologies, they’ll roll them out at scale: Bain research shows that digital retail leaders scale new technologies at nearly twice the rate of laggards, despite similar levels of piloting. Retailers like Sam’s Club are embedding innovation into their operations with store locations dedicated to incubating new technologies, such as the ability to place direct-to-home orders in the aisle by scanning merchandise with a smartphone camera.

Retailers should take a closer look at their performance across each of these imperatives, as they work to delight their customers through store experiences in the new year. Winners will identify their key successes and pain points from the peak season and integrate the lessons learned into a dynamic, adaptive strategy. While 2022 will likely present new challenges, building in resilience and flexibility across the organization will ensure that retailers are prepared for the road ahead.

Looking forward

We hope you enjoy wonderful holiday celebrations in the coming weeks. We’ll be back in January with a final recap of holiday results and a broader look at longer-term priorities for retailers, including managing talent strategy in turbulent times; evolving from a reactive to a proactive stance on technology investments; and embedding environmental, social, and governance initiatives across the business. As always, we welcome your feedback and questions.

About our research partners

Advan provides hedge funds, real estate investors, retailers, and businesses with insights into foot and vehicle traffic that enable them to make better business and investment decisions. Advan processes billions of daily foot traffic observations on 150 million locations and more than 3,500 companies across all sectors. Advan is headquartered in New York City. For more information, please visit www.advan.us.

Earnest Research provides market and consumer research, which draws from the transaction data of millions of anonymous US-based consumers, to consultants; investors; and corporate clients. Using a proprietary full-wallet methodology and longitudinal cohort analysis, Earnest Research provides insight into consumer behavior trends and a comprehensive, unbiased look into competitive market dynamics. To learn more about Earnest Research, visit www.earnestresearch.com.

ROI Rocket is a leading provider of full-service research, fulfillment, and digital and direct marketing support to a broad client base of consultants, investors, publicly and privately held corporations, agencies, and market research firms. ROI is a Bain customer advocacy benchmark partner in grocery and 10 other retail categories. For details, visit www.roirocket.com or contact Noah Seton (noah.seton@roirocket.com).

NielsenIQ is a leader in providing a comprehensive, forward-looking view of consumer behavior, globally. Fueled by rich analytic capabilities, NielsenIQ’s consumer data platform enables bold, confident decision making for the world’s leading consumer goods companies and retailers. NielsenIQ, an Advent International portfolio company, has operations in nearly 100 markets. For more information, visit NielsenIQ.com.

About the Research

Data powered by Dynata, a leading global first-party data and insights platform.

Pyxis combines alternative data, AI-driven analytics, and institutional investor-led insights to reveal where, how, and why consumers buy, how they pay, how much they spend, how their needs and demands are changing, and much more.

The authors would like to acknowledge Emily Harris, Licia Figueiredo, Jackson Shain, Emma Hand, and Isabel Romeu for their contributions to this newsletter.