Snap Chart

Only 6 in 10 UK customers who join a bank consider it their “primary” bank

High street banks are more successful at turning clients into primary customers than neobanks

Not all customers are equal in the eyes of UK banks; Bain research shows that some are considerably more valuable than the rest. Customers who consider a bank to be their “primary,” or main, bank are key to unlocking growth.

These are repeat buyers who, on average, are more than three times as likely to hold multiple products at the bank than other customers. They are also more loyal, as fewer say they are likely to switch banks than nonprimary customers. And these primary customers are more likely to recommend the bank to friends or family, giving it an average Net Promoter ScoreSM that is more than triple that of other clients at the same bank.

Identifying UK Banks’ Most Valuable Customers

Primary customers are more likely to be loyal, repeat buyers who recommend their bank to others.

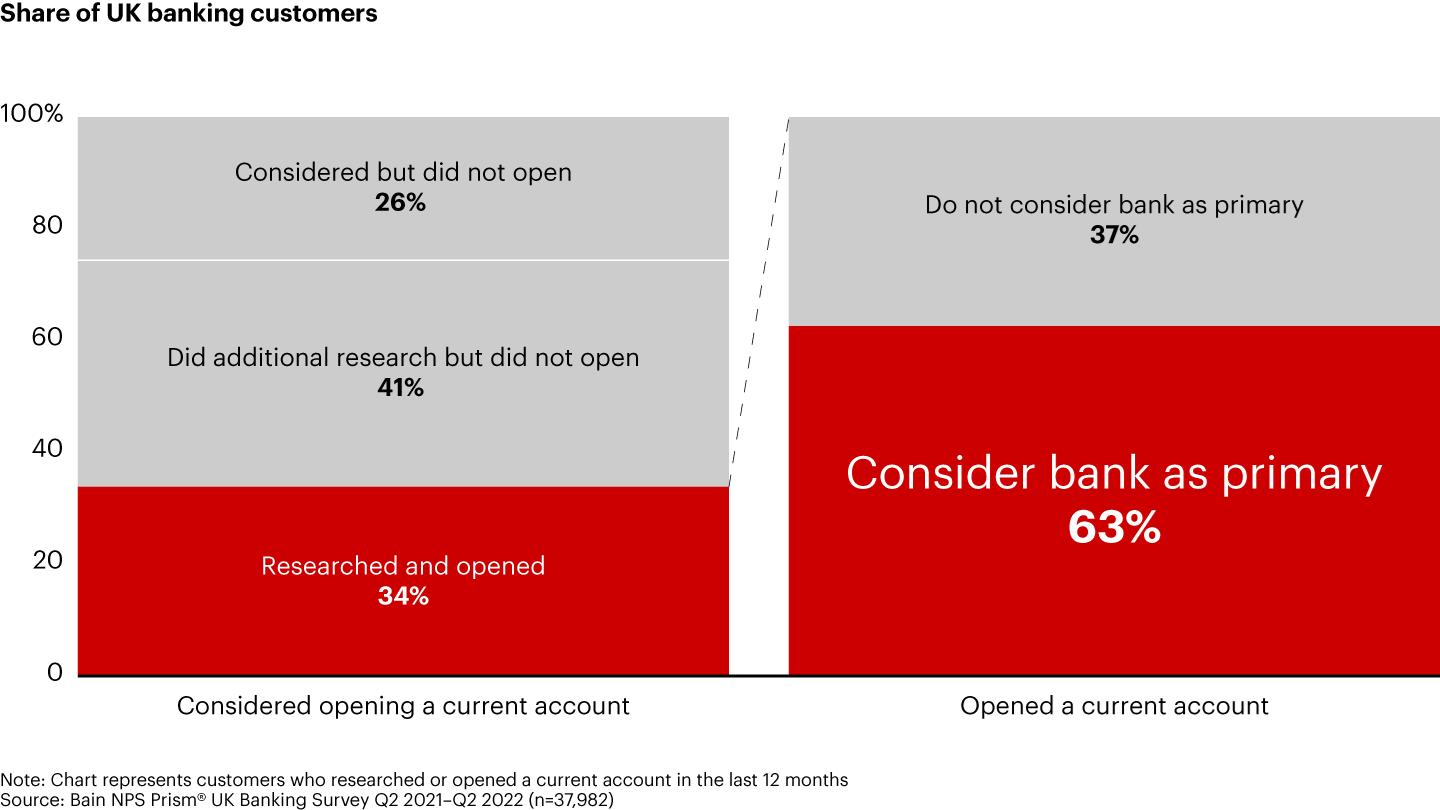

But how effective are UK banks at converting new clients into primary banking relationships? Data from Bain’s NPS Prism® benchmarking platform, collected in partnership with Dynata, shows that only one out of three consumers who are considering opening a current account with a bank will actually do so (see Figure 1). And of those who open an account, only around 60%, on average, will consider that bank to be their primary bank. Banks that can increase this share will see repeat business and recommendations propel them to new heights.

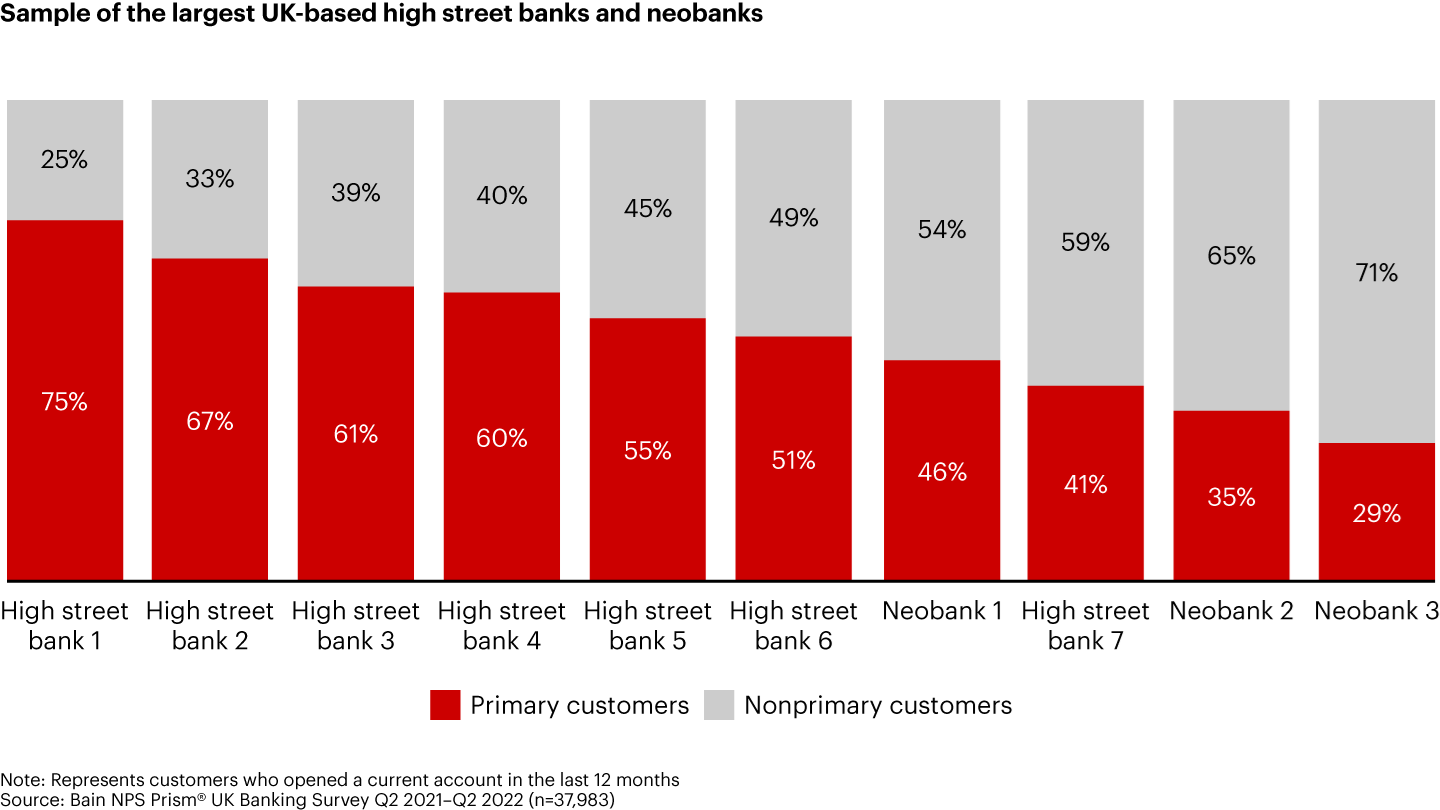

The share of primary vs. nonprimary customers varies widely from bank to bank. But in general, large, traditional retail banks, or high street banks, are more successful at converting new current account clients into primary customers (see Figure 2). In comparison, neobanks, or predominantly digital new market entrants, have lower success rates. They have, however, won over some, with a higher concentration of primary customers ages 18 to 34.

As banks strive to boost revenue growth from returning customers and their referrals, understanding consumer perceptions will be essential. The more clients that banks can turn into primary customers, the more benefits they will reap.

Deliver an unparalleled banking experience

Use NPS Prism® as your window into how your customers want to be served.

Learn How

About the Research

Data powered by Dynata, a leading global first-party data and insights platform.