Interactive

Custom Air Travel Forecasts

Improve your financial, capacity, and commercial planning with granular air traffic demand projections.

Launched in May 2020, our air traffic forecast was originally designed as a response to pandemic uncertainties. It has since evolved into a comprehensive, forward-looking tool that incorporates macroeconomic growth, disposable income trends, and carbon mitigation costs. Now extended to 2040, this longer view reflects the growing importance of strategic planning in an industry increasingly shaped by sustainability goals, market forces, and shifting travel preferences.

The forecast is updated regularly using the latest information. Here is the outlook as of the end of the second quarter of 2025:

- Annual air travel demand returned to pre-pandemic levels last year, with revenue passenger kilometers (RPK)—the number of paying passengers multiplied by the total distance traveled—reaching nearly 103% of 2019 volume. We expect 2025 to reach a new high of almost 108% of 2019 levels (see Figure 1 above).

- The pandemic’s suppression of air travel will likely make the 2020s the industry’s slowest-growing decade ever. While the period from 2030 to 2040 may not bring the same pace of demand growth that the industry achieved prior to 2020, the long-term outlook remains broadly stable. By 2040, global RPK is projected to reach 14.8 trillion in our baseline scenario, equivalent to 178% of 2019 volume, thanks to strong fundamentals across emerging and mature markets. While the latest macroeconomic forecast reflects some softening—as a result of increasing tariff pressures and global trade uncertainty—these headwinds have been largely offset by evolving assumptions around sustainability. The anticipated easing of carbon cost pressures and delays in the implementation of certain climate-related levies have created more headroom for air travel demand growth, particularly in price-sensitive segments.

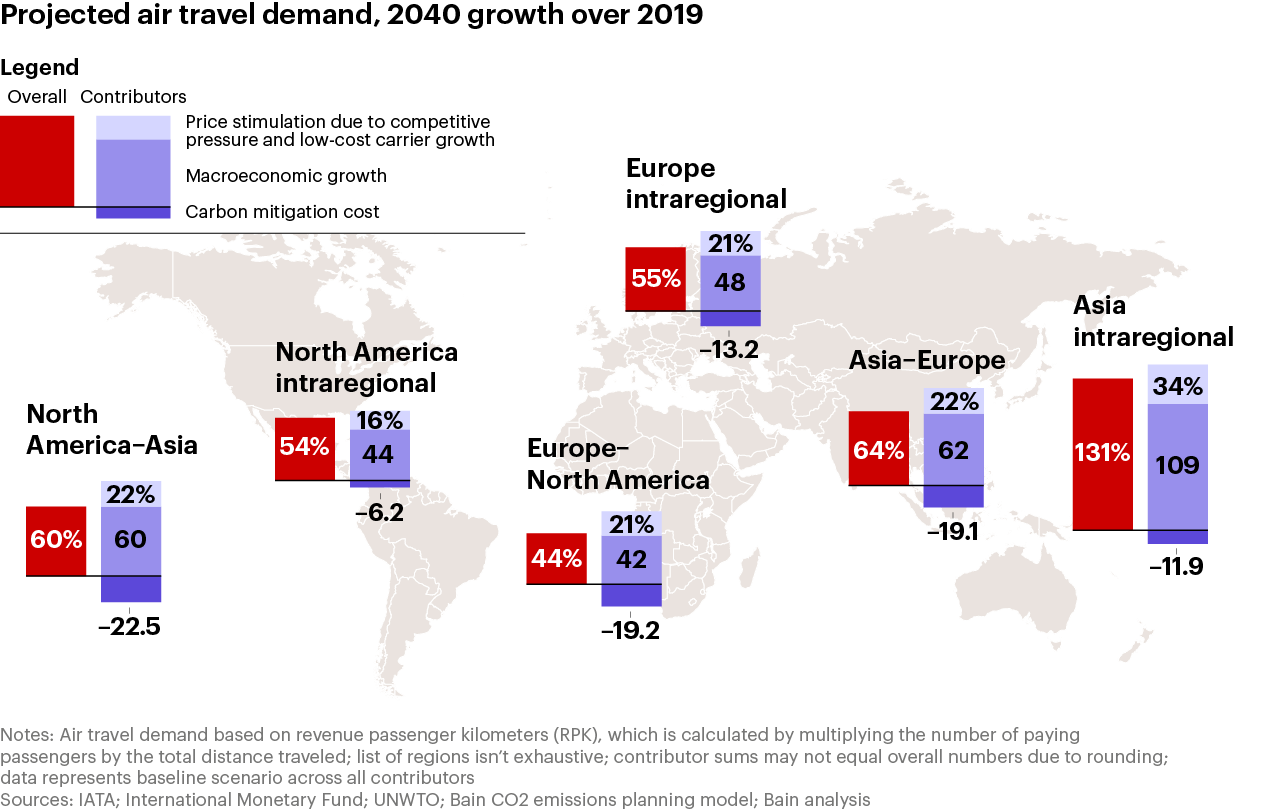

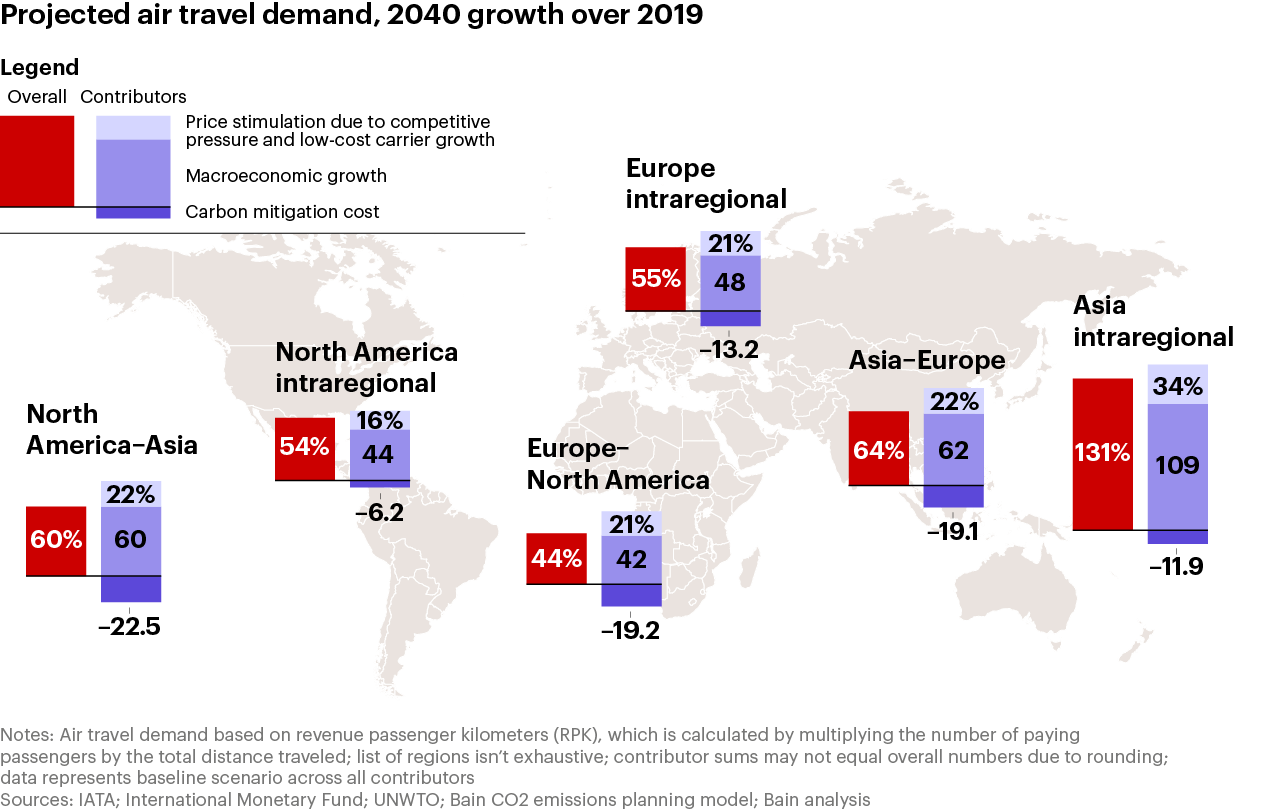

- Regional trends remain dynamic (see Figures 2 and 3). We anticipate Asia will continue to fuel global demand growth, with intraregional traffic forecasted to increase by 131% from 2019 to 2040. Continuing its strong trajectory postpandemic, China is expected to remain one of the fastest-growing markets; our model forecasts that China’s overall air traffic in 2040 will be more than double the 2019 level.

- North American intraregional demand will continue to rise steadily, increasing by 54% from 2019 to 2040. While more modest, the growth in traffic between Europe and North America will maintain momentum with about 44% growth over that same period.

Projected market and financial information, analyses, and conclusions are based (unless sourced otherwise) on external information and Bain & Company’s judgment. They are intended as a guide only and should not be construed as definitive forecasts or guarantees of future performance or results. No responsibility or liability whatsoever is accepted by any person, including Bain & Company, Inc., or its affiliates and their respective officers, employees, or agents, for any errors or omissions.

Bain's Quarterly Airlines Newsletter

Subscribe to receive our airlines insights in your inbox every quarter.