Forbes.com

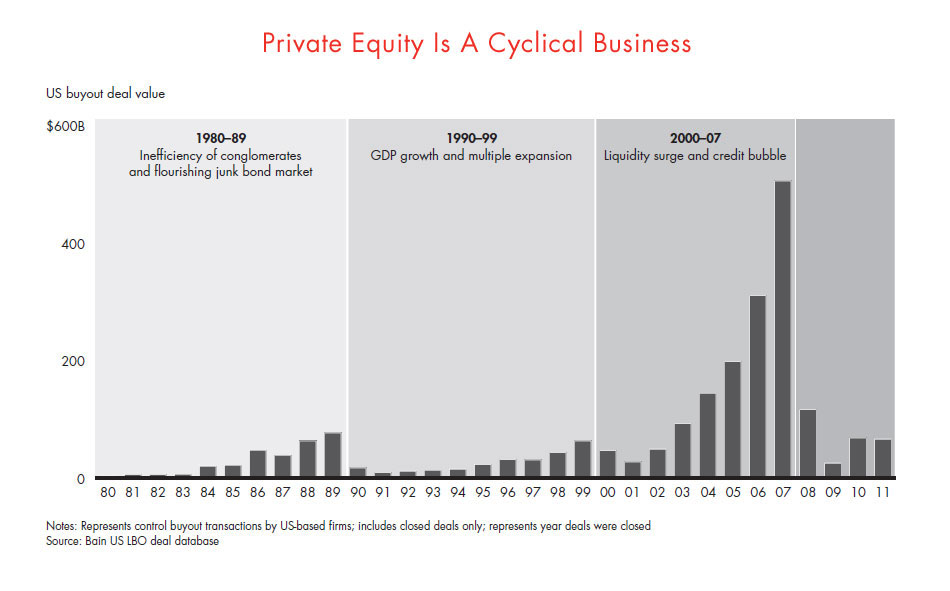

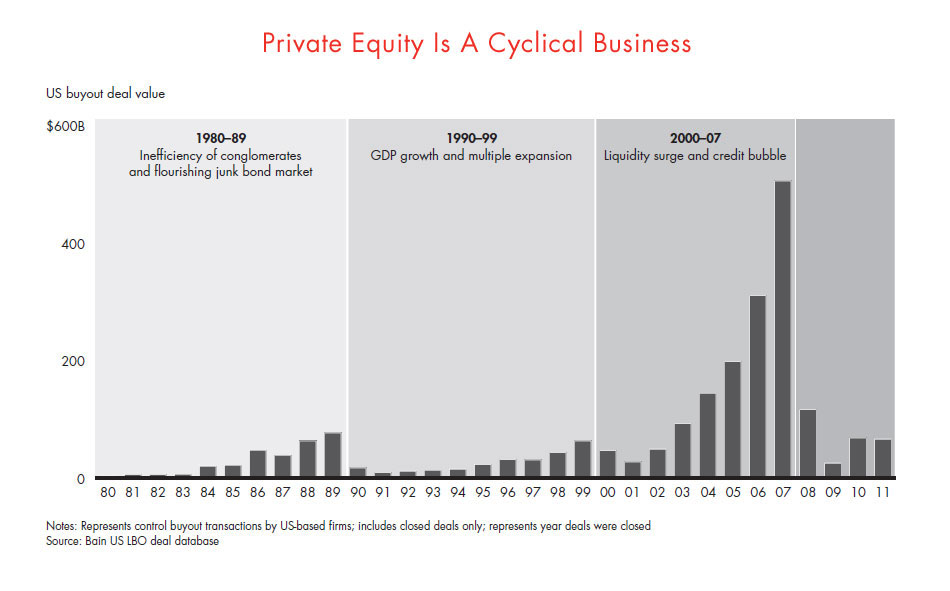

Like any industry sensitive to macroeconomic shifts, credit-market turmoil and volatile equity values, global private equity (PE) has had to navigate through booms and busts over the decades (see figure). But as we report in Bain & Company’s Global Private Equity Report 2012, the PE industry has seldom, if ever, experienced such choppy cyclical swings in so many variables that influence deal making, fund-raising, exits and returns as it has in the past two years.

Although for PE 2011 was lackluster overall, last year was a tale of two halves, with PE experiencing both boom and bust compressed into a single 12-month span. The first half of the year continued the strong upswing that got underway in 2010, and all signs pointed to an ongoing healthy recovery. Continuing, if unspectacular, GDP growth in both developed and developing markets—along with record-low interest rates, accommodating lenders, solid equity market gains and robust corporate profit growth—helped fuel PE investor confidence and propelled deal making.

Those benign conditions deteriorated sharply in the year’s second half, as global buyout deal value plunged to less than $11 billion by December, in response to the full-blown emergence of the EU sovereign debt crisis last summer and credible fears that developed market economies would slide back into recession. For PE funds, debt markets turned decidedly less favorable, while economic uncertainty triggered stock market gyrations that threw off PE valuation models and widened a mismatch between buyers’ and sellers’ price expectations. By late 2011, the PE recovery had petered out and conditions largely reverted to what they had been back in early 2010.

The continued rebound of the PE industry became a hostage to the stabilization and recovery of the global capital markets—a theme that has carried over into 2012. The global PE industry entered the new year surrounded by a dense fog of potentially destabilizing uncertainties. Though showing sparks of life lately, the US economy remains weak, hobbled by stagnant household incomes and hesitancy on the part of businesses to invest until the growth outlook clears. In the euro zone, policy makers have improvised patchwork solutions that have held the currency union together, but the risk is real that a misstep could cause the fragile stability to unravel, with potentially catastrophic consequences. With growth in China, India and Brazil falling below their recent torrid pace, the major emerging markets, too, face uncertain prospects in 2012. In short, PE investors will need to navigate a sea of global macroeconomic and geopolitical worries in a year characterized by choppy equity markets and nervous debt markets that could be capsized by any number of policy miscalculations or exogenous shocks.

In a series of posts over the coming weeks, we will describe how the interplay of macroeconomic conditions and circumstances unique to the PE industry are influencing private equity investments, exits, fund-raising and returns. We will explore new opportunities for PE in emerging markets, the revival of buy-and-build strategies as an investment theme well suited to today’s trying conditions, and the potential for PE funds to tap into the deep resources of sovereign wealth funds. Finally, we will explain how the new challenges PE funds will face will require them to rethink how they acquire and manage portfolio companies to deliver the superior returns their limited partners have come to expect.

We hope you will enjoy the journey!