스냅차트

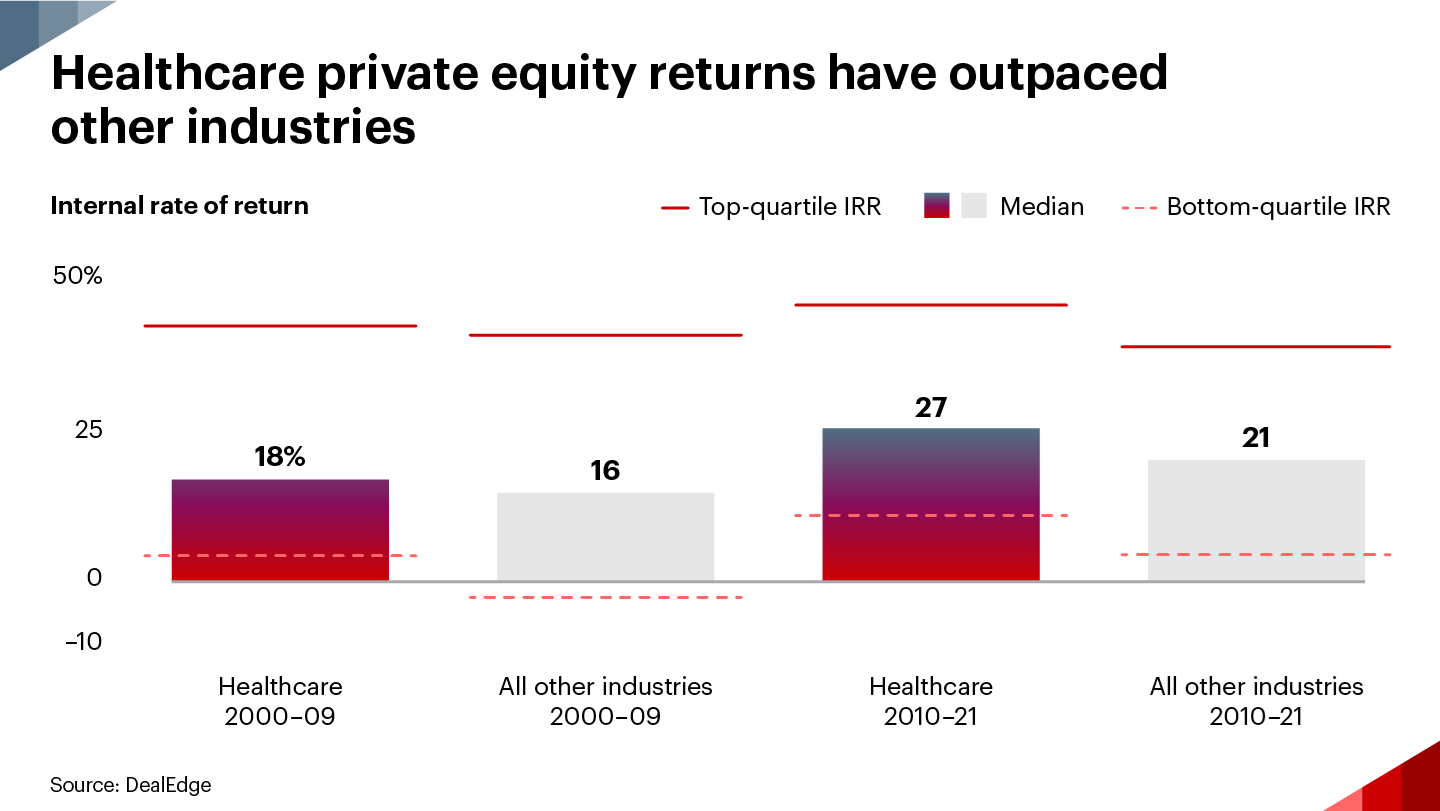

Private equity investors like the healthcare industry’s strong performance and recession-resistant return profile. From 2010 through 2021, the median internal rate of return for healthcare PE deals outperformed those in all other industries by about 6 percentage points, according to DealEdge® benchmarks created by Bain and CEPRES. But which factors are most important to the industry’s performance?

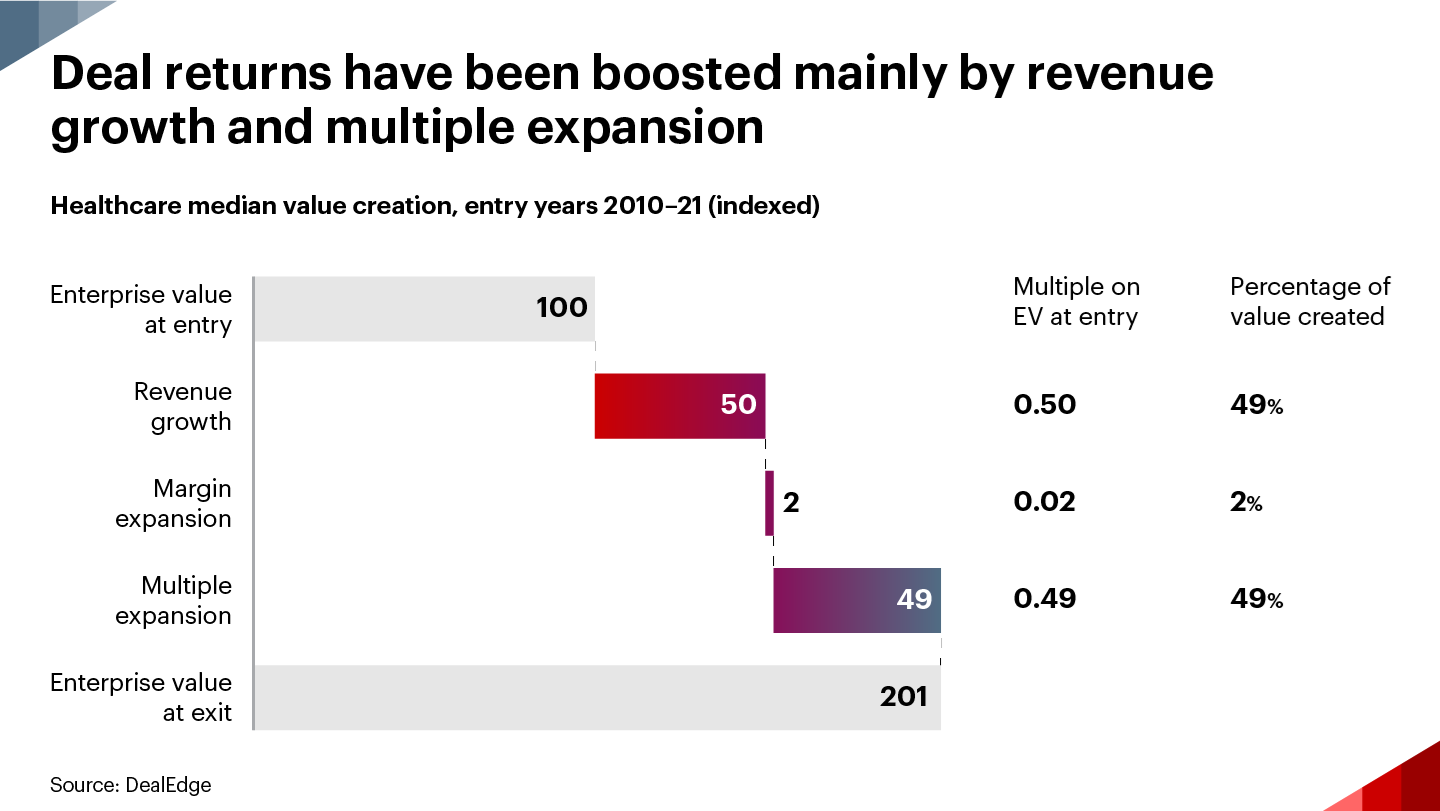

Over the past decade, healthcare deal returns have been influenced mainly by revenue growth and expanding multiples. Healthcare companies are finding new streams of revenue through geographic expansion, new technologies and therapeutics, and advanced care models. As deals become more competitive and entry multiples rise further, we expect margin expansion and revenue growth to become increasingly important sources of deal value. This will require deep diligence work to build conviction in value creation plans, and market insights to help identify pockets of value.

Healthcare Private Equity Deal Returns: Look to Revenues and Multiples

Margin expansion, currently a minor factor in returns, is bound to become more important.

DealEdge Sector Study: Healthcare Private Equity 2022

DealEdge® is the private equity industry’s leading provider of deal-level performance and operational analytics. Get groundbreaking deal-level analysis of PE healthcare performance, value creation, and more in our latest report. DealEdge’s inaugural Sector Study covers 1,500 deals across 62 healthcare subsectors, ranging from Retail Health to MedTech. Download now.