Solution

Sharpen your strategic decision-making with private equity deal performance and operations analytics from DealEdge.

Solution

Sharpen your strategic decision-making with private equity deal performance and operations analytics from DealEdge.

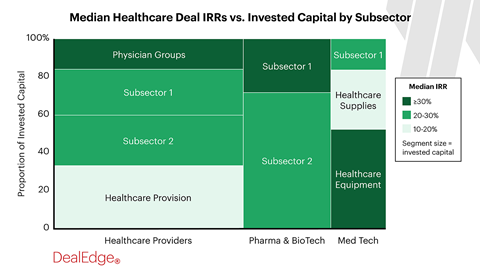

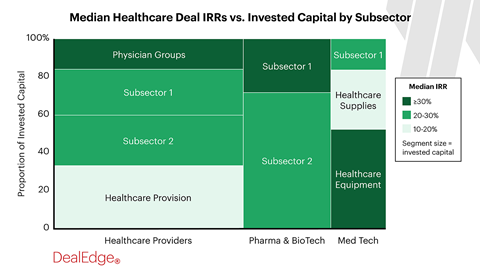

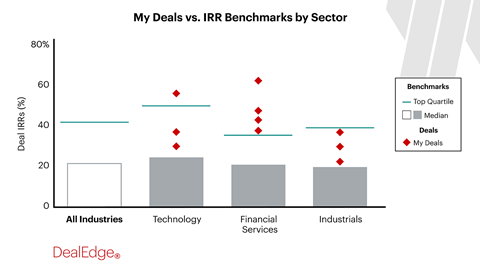

DealEdge is the private equity industry's premier provider of deal-level performance and operations analytics. It is the deepest and most granular source of deal-level insights available to the market. With DealEdge you can: refine your investment strategy, benchmark your portfolio, and tell the story of your performance using our sector-specific deal benchmarks like IRR, MOIC and CAGR, based on data for 37K+ transactions mapped against 560+ subsectors.

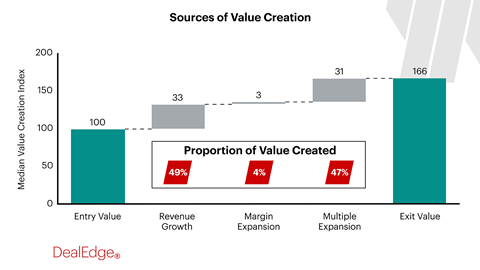

DealEdge gives investment professionals an unbeatable combination: Bain & Company's tried-and-tested analytics distil the experience of thousands of cases, and reflect the reality of the landscape you operate in. CEPRES's unrivalled cash flow data goes beyond top-level returns to show you granular real-world metrics that have never been available on this scale before.

Find out more about the private equity industry's pioneering provider of deal-level performance and operational analytics

Learn More Request demo

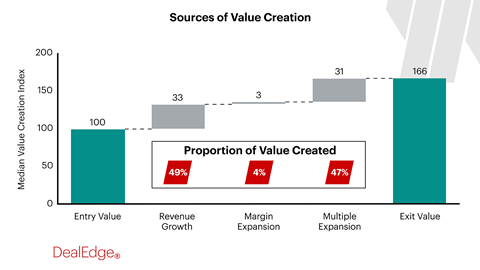

DealEdge lets you refine your investment strategy by answering your key questions with objective, comprehensive deal-level performance analysis. You can:

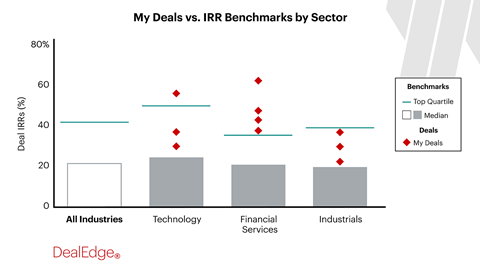

DealEdge lets you strategically monitor your portfolio performance by integrating your data directly alongside sector specific deal-level benchmarks. You can:

DealEdge lets you tell your story in greater detail than ever before, with detailed analytics for investor relations professionals. You can:

DealEdge lets you refine your investment strategy by answering your key questions with objective, comprehensive deal-level performance analysis. You can:

DealEdge lets you strategically monitor your portfolio performance by integrating your data directly alongside sector specific deal-level benchmarks. You can:

DealEdge lets you tell your story in greater detail than ever before, with detailed analytics for investor relations professionals. You can:

private market deals with performance and value creation data

sub-industries mapped to custom-built taxonomy

trackable metrics on performance, value creation, multiples, risks, and more

Get the latest data insights, research reports and product updates from DealEdge. Sign up to receive DealEdge insights.

Brady Akman, Director of Business Development – Healthcare

Welsh, Carson, Anderson & Stowe

CEPRES is the leading digital solutions provider for private markets, connecting thousands of professionals in the largest private investment network in the world. CEPRES combines a secure, confidential digital data exchange with sophisticated SaaS solutions and expert analysis to help decision makers gain deep insights, underwrite investment decisions and achieve better outcomes on their portfolio of funds, deals and operating companies assets, within a confidential yet fully flexible framework.

We are the leading consulting partner to the private equity industry and its key stakeholders, with a global practice more than three times larger than any competitor. Our network of more than 1,000 experienced professionals serves private equity and institutional investor clients across the investment life cycle. We support clients in all regions of the world and across all major sectors on a broad range of objectives, from deal generation and due diligence to portfolio value creation and exit planning.

Investors don’t simply need data—they need detailed, highly relevant data that helps them make the right decisions fast. Bain provides a rich array of analytics solutions to guide your deal-making journey.