FashionCo.

FashionCo.

Advise a player in the fashion market on why it has experienced declining revenues for the past five years.

A CEO needs to build a path forward

Our client is FashionCo, a player in the women's fashion market. It’s been in the industry for a long time, but has experienced declining revenues each year for the past five years.

FashionCo wants to understand:

- What is causing this decline?

- What can the organization do to drive revenue?

FashionCo will have a management meeting at the end of the week, and the CEO wants a recommendation from Bain on how to proceed.

What can they do to drive revenue?

Case Setup

Start any case by understanding the question you're asked to solve. Ask your interviewer questions if you feel confused or need more information. We want you to succeed in your interviews!

Take the time (1-2 minutes) to think about how you would approach the problem. Always structure your thinking, and communicate your ideas with your interviewer.

Here are some sample questions to ask yourself:

• What are the possible drivers of declining revenue?

• What are customers' key purchase criteria?

• What are the quantitative and qualitative ways to solve FashionCo’s problem?

Analysis

After formulating your framework, it's time to walk your interviewer through your structure and analysis step by step.

Once you’ve walked through your thinking, propose where you would like to start. In this case, start by deep-diving into developing a better understanding of current marketing and consumer trends.

-

Ask the interviewer questions to gain additional information

Market trends

-

What have sales looked like in the women’s fashion market in the past 5 years?

- What are the greatest recent advances in the industry?

- Are any new companies disrupting the market?

Consumer trends

- Which styles do we offer?

- Do we know what consumers want these days?

-

-

Provide additional suggestions to continue the conversation

Additional suggestions to continue the conversation include:

- There may be a bigger percentage of stores online versus brick-and-mortar.

- Competitors may be integrating technology into their stores in new and interesting ways.

- There may be an increase in loyalty apps, through which customers can pay via mobile.

- Consumers may want an easier way to return clothing or more overall online shopping options.

- There may be a bigger percentage of stores online versus brick-and-mortar.

After understanding the different market and consumer trends, brainstorm ways the company can drive revenue.

• A good answer includes different types of ways to increase revenue.

• A better answer includes the pros, cons and practicality of each idea.

-

A good answer

Ways to increase revenue include:

- Consider changing the style to shift more towards social wear since it appeals to shifting consumer trends

- Raise the prices to make more money per item

- Increase volume through sales and advertising to drive more traffic to the store

- Consider changing the style to shift more towards social wear since it appeals to shifting consumer trends

-

A better answer

Shifting styles

- Pro: Might help with customer acquisition, if it appeals to more/younger customers.

- Con: Might not align with current brand positioning and could alienate the core customer group.

Raise prices

- Pro: As long as sales stay constant, we would increase our revenue.

- Con: This is an unlikely assumption and requires more research to understand our elasticity of demand. The assumption is that volume would fall if we increased the price, making the likelihood of success unclear.

Increase volume through sales and advertising

- Pro: Don't have to change merchandising or pricing strategy.

- Con: Need to ensure we're not spending more than we're bringing in.

- Pro: Might help with customer acquisition, if it appeals to more/younger customers.

The CEO will most likely need to approve a new sales and advertising strategy, so the CFO and CMO will narrow it down to two possible options:

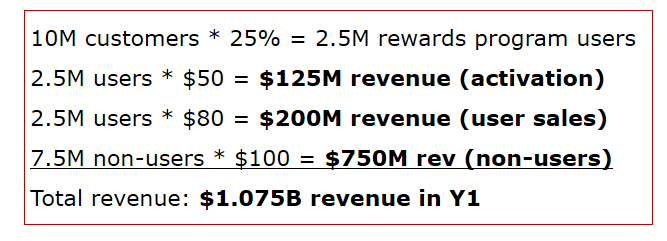

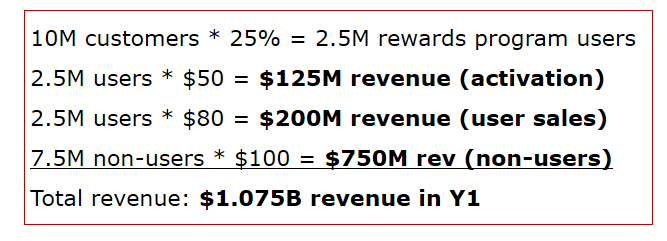

Option A: A rewards program

• Estimated number of customers participating in Y1: 25%

• # of customers: 10M (assume flat)

• Average pre-sale spend per person, per year: $100

• One-time customer activation fee: $50

• With the rewards program, customers always receive 20% off

Option B: Intermittent sales

• Customers (flat): 10M

• Average pre-sale spend per person, per year: $100 (assume evenly distributed across years)

• Model: 20% discount 3 months per year

• Assumption: Discount would increase pre-sale purchase sales by 100% over those 3 months

Which one would result in more revenue this year?

-

Option A: Rewards Program

Click to enlarge

-

Calculation for Option B: Intermittent Sales

Click to enlarge

Case Recommendation

After understanding and researching the facts, what are your recommended next steps for FashionCo?

-

A good answer

We recommend using the intermittent sales strategy (Option B), as it is projected to generate $50M more than the awards program (Option A).

-

A better answer

A better answer would include additional risks and next steps for FashionCo.

Risks and additional considerations:

- Option A might be a better long term strategy if there is an increase in customer sign-ups in Year 2.

- Not changing the style or introducing more tech into the clothing could be a big issue if market trends continue their current trajectory.

Further steps:

- Test if the rewards program might make loyal customers spend more in Year 2 and beyond, given the 20% discount.

- Revisit digital and style questions with CEO; conduct survey to ground in data.

- Option A might be a better long term strategy if there is an increase in customer sign-ups in Year 2.