Brief

There’s a good reason why supply chain efficiency has never been a major priority for technology companies. As part of a rapidly growing and evolving industry, companies pursued—and reached—ambitious growth goals by aggressively delivering platform innovations and increasingly sophisticated products. But as many technology segments started maturing, rampant SKU proliferation resulted in supply chain complexity and an inability to effectively manage the operations. Then, when industry-wide growth ultimately slowed, companies were faced with rising costs, which were growing faster than revenues. A maturing market also meant that supply chains were becoming an increasing point of competitive differentiation, and customers were quick to shift their purchase volumes to those companies that could deliver reliably.

Now, late to the game, many technology companies have begun looking at their supply chains in earnest. They see supply chain efficiency as a way to manage costs in order to improve margins. More important, leaders now realize that, because customers increasingly care about response times and supply assurance—and are demanding scheduling accuracy and flexibility—the effectiveness of a company’s supply chains can help it lock in key strategic accounts.

But when companies assess the state of their supply chains, too often they are disappointed by what they see.

To understand how technology companies stack up, we conducted an in-depth analysis of the supply chains at six leading technology companies. We found a wide disparity in both the efficiency and effectiveness of their operations. We also found that these companies lacked the supply chain sophistication of their counterparts in more mature industries. For example, at the technology companies we analyzed, supply chain data typically is so poorly tracked that only two of the six companies were able to provide either a comprehensive or a product segment list of supply chain costs. By contrast, such capabilities are common among consumer products and retail companies.

Lacking basic information is one clear sign that a technology company falls short of achieving its full supply chain potential. Several additional signs are:

- The company operates a single, undifferentiated supply chain offering across a range of customer and product types.

- The company lacks clear supply chain targets, and even when targets are in place, there are no specific incentives associated with supply chain performance.

- The company can’t identify the executive ultimately in charge of the supply chain. Governance and accountability are fragmented and unclear across the organization.

- There is no formalized integration between demand and supply planning—the Sales & Operations Planning (S&OP) process is not effective or is not used.

- The company lacks integrated systems and automation. So its processes, such as S&OP, include a number of inefficient manual touchpoints and inconsistent baseline data.

- Finally, the company is not meeting the supply chain needs of its most important customers.

Based on our work with technology companies, we’ve identified the three most important areas for improvement:

1. Capture actionable data to support critical decisions

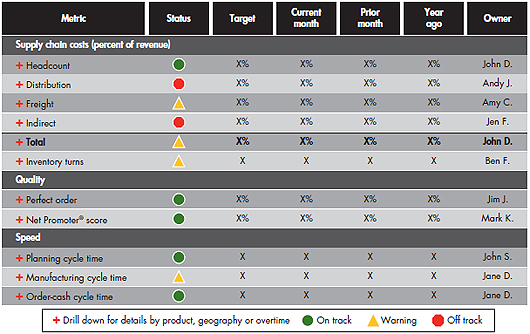

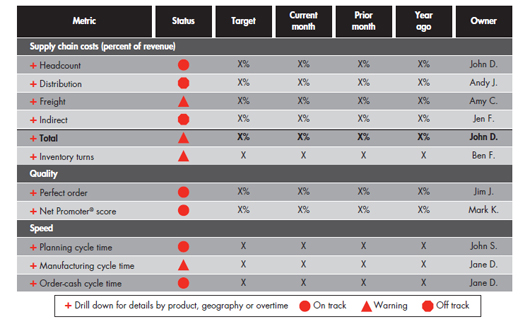

Companies need to track key performance metrics for their overall supply chain, as well as for key business segments, while ensuring that data is easily accessible through a single integrated system. The trouble is that most technology supply chains simply don’t include sophisticated data capture and management systems.

Among the companies participating in our survey, the difficult benchmarking process typically requires more than five individuals and two to seven weeks to extract and provide key data. Despite IT advances, many supply chains still run poorly integrated legacy systems. There may be disparate systems for demand planning, supply planning, manufacturing and warehousing—with a variety of spreadsheets required to move and analyze data.

When supply chain metrics are tracked, they’re often lacking two dimensions. Many metrics may be tracked for specific parts of the organization but not consolidated into a view of the total supply chain costs for the company. Also, while many companies conduct customer-level tracking to comply with service-level agreements, they have limited ability to aggregate the data and differentiate performance and cost-to-serve for different business segments.

To see what works, consider how supply chain metrics typically are tracked in the fast-moving consumer goods (FMCG) industry, which has developed well-honed systems—processes and technology—for tracking data to help executives make better decisions. Decision makers for consumer products companies often have ready access to key supply chain data—an overall supply chain view of costs including people, warehousing, freight and other factors. They can break down costs by segment, if not by unit, which facilitates cost management and service trade-off discussions.

2. Segment your customers and products to define differentiated service offerings

Technology companies lose a tremendous opportunity by not segmenting their offerings based on product type and customer importance. The goal is to provide better service to higher-priority customers or product segments. Companies can’t offer their best service to every customer or for every product.

Even though technology companies have for years understood the value of segmenting, few have succeeded in making the most of these opportunities to cater to customers based on their diverse needs. Different customers have different requirements for cost, availability and speed. It’s not effective for suppliers to provide the same high-level service to everyone—which is what they usually try to do today. The resulting costs are high, and that level of performance is not necessary for many of their customers.

Leading companies use customer tiering to determine the appropriate fulfillment model and customer service target, breaking customers into three to five groups based on the current revenues they generate and their potential for future revenues. To determine the best fulfillment mode, companies apply a similar tiering model to their products, segmenting according to the level of volume or margin, or by whether they are new, mainstream or end-of-life. Like customers, different products also have diverse needs for cost, availability and speed. Higher-margin products are less sensitive to cost fluctuations but are more sensitive to missing a potential sale. Lower-margin products may be more sensitive to cost increases and, in some cases, less sensitive to availability delays.

Based on the results of their segmenting efforts, companies use three approaches to differentially serve customers. The same customer can receive a different level of service for different product categories.

When it comes to creating a fulfillment model, higher-priority customers can be served through consignment or vendor managed inventory, resulting in a higher level of service. For customers who buy standard products on a relatively predictable schedule, inventory can be reserved—rather than pooled with products that will be distributed to other customers whose demand is not as stable. For lower-priority customers and for low-volume products with less predictable demand, distributors can serve as aggregators of customers or of product demand.

Companies can take advantage of service-level tiering by creating three or four levels of service based on customer priority. For example, top customers can have flexible lead times, better delivery performance and multiple shipping methods. Lower-priority customers will face more rigid lead times, lower delivery performance and limited shipping options.

Customer support can be similarly segmented. For top-priority customers, provide personalized support, supplying direct lines for executives seeking customer service and offering them preference when allocation issues arise. Some companies reserve extra stock to support higher-priority customers or pull inventory back from distributors when supply is constrained. On the other hand, lower-priority customers receive low-touch—or even no-touch—customer support. In some cases, the majority of communication may be from a distributor, not the manufacturer, or through Electronic Data Interchange (EDI)—with support limited to extraordinary circumstances.

Successful segmentation requires multiple process and delivery options to serve the different segments. For example, low-margin products may call for lower-touch supply chain options to ensure profitability. High-volume, low-margin products may use automated pathways and direct-to-customer logistics. High-margin products may have higher priorities in the production cycle to ensure that a sale is never missed.

It’s important to be able to provide high- and low-touch supply chain options without creating multiple separate supply chains—and the resulting complexity. Leaders develop different pathways through their supply network to enable flexibility, managing the overall organization centrally to maintain control.

3. Establish operational excellence throughout the organization

Once your company establishes the infrastructure to generate and track data and the processes for a segmented offering, you can use standard supply chain tools to make incremental, but significant, improvements.

Manage the cost base by focusing on optimizing inventory, driving down cycle times and achieving the efficiencies gained through experience and scale.

For example, use statistical safety stock rather than heuristics to establish target inventory levels. Many technology companies still use weeks-of-sales metrics to manage their inventory. They’re not adjusting their inventory to consider all the factors that affect the need for buffers, such as demand variability, manufacturing and materials lead-time variability, or required service levels. A weeks-of-sales metric does not account for these variables, but companies often apply it across a wide range of products and customers because it is easy to calculate. A manufacturer might need very little safety stock for a product with stable demand and lead time, but a product with a volatile lead time and unstable demand will require a much higher safety stock to meet service-level targets.

Improve forecasting by leveraging best practices, performing more advanced historical analysis (such as diffusion modeling) and upgrading systems. Technology products have much higher demand volatility and shorter life cycles than more stable consumer products, which may be available in stores for many years. Because this places a lot of stress on the supply chain, any efforts to improve forecasting accuracy will pay huge dividends in both higher availability and lower costs.

Drive down cycle time in manufacturing, materials and planning. Cycle time in semiconductor manufacturing, for example, is particularly long, especially given the lead times for key raw materials. Efforts to eliminate unnecessary touchpoints, hold times or planning delays can have a significant impact on increasing supply responsiveness.

The competitive landscape in the technology sector won’t get any easier in the foreseeable future. Focusing on supply chain performance can provide a strategic advantage, helping bring products to market faster, at the right service levels and in a cost-effective way. Done right, the trade-offs among cost, speed and availability will balance real benefits with incremental costs and potential risks, and ensure that investments are carefully scrutinized for a good ROI (return on investment). Decisions must be made based on a solid fact base, incorporating both internal data and external benchmarks. By applying these concepts, supply chain professionals will address many of the challenges they face and put their companies on the path to supply chain leadership.

Sam Israelit is a partner in Bain & Company’s San Francisco office. Pratap Mukharji is a Bain partner in Atlanta. François Faelli is a partner in Brussels. Ray Tsang is a partner in Shanghai.

Net Promoter® and NPS® are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.