Brief

At a Glance

- Nontraditional providers will help transform primary care in the US, accounting for about one-third of the market in 2030.

- Population-focused models will be especially well positioned to take on the risk of value-based care, but headwinds exist.

- Retailers will need to address three main considerations if they hope to advance in this space.

Decades of research shows that primary care improves health outcomes, patient satisfaction, and health equity while reducing the total cost of healthcare. However, which organizations will be the main providers of this care in the United States, and which care models will predominate, continue to change.

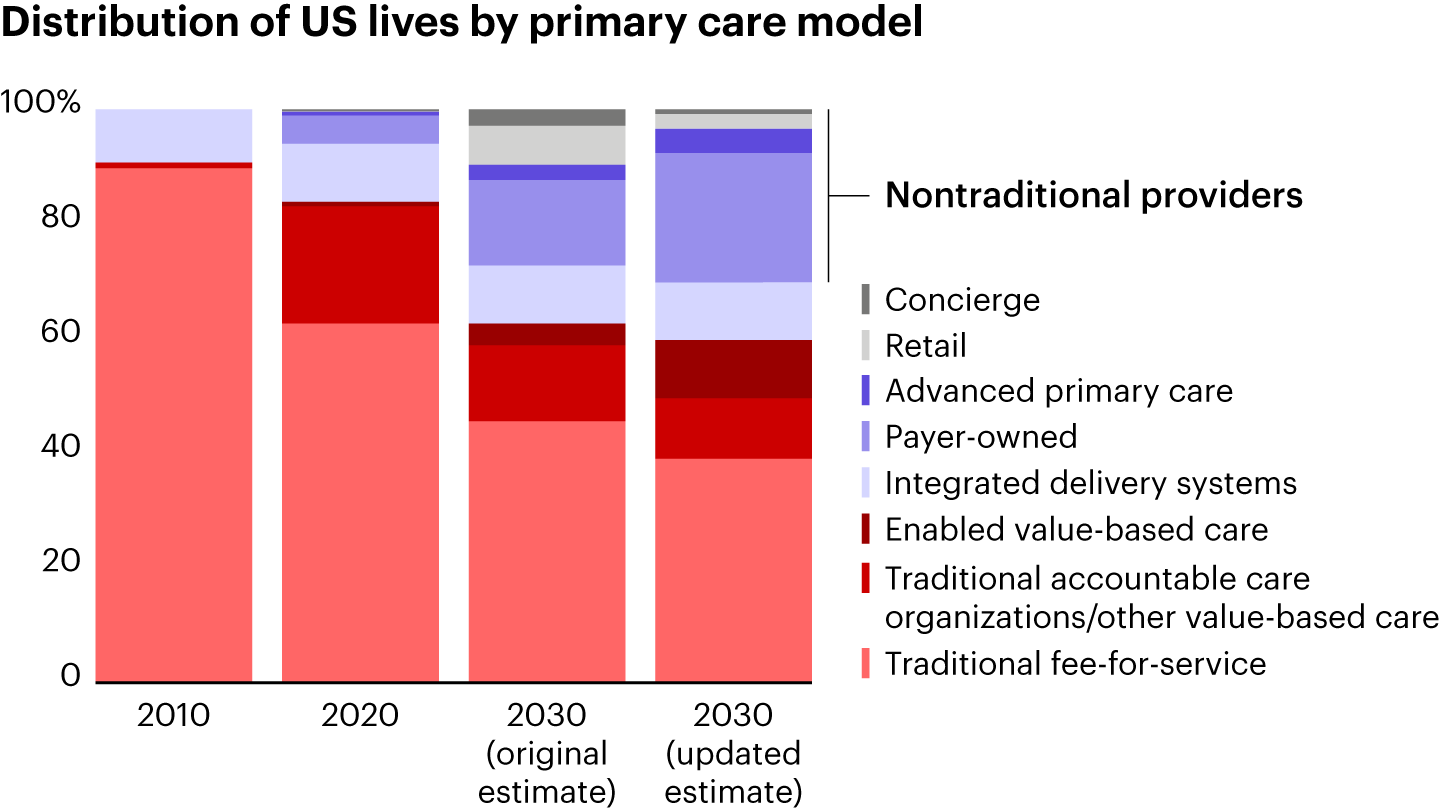

Two years ago, Bain & Company predicted how reimbursement, ownership, and care models might evolve over this decade and how those changes would lead to significant shifts in market share. At that time, we expected nontraditional care providers—retailers, payers, advanced primary care (APC) providers, and others—to capture 30% of the primary care market by 2030.

Many of our predictions hold true today. Value-based care enablement is attracting greater investment and new players, fueling the shift toward this form of reimbursement. Ownership of primary care practices continues to move toward nontraditional players. Population-specific scopes remain a key contributor to success in risk-based payment models, and APC providers with such models continue to scale. At the same time, regulatory pressure on Medicare has increased, which particularly impacts population-focused providers and enablers.

As this space continues to evolve, we have refreshed our view of the future primary care landscape in the US (see Figure 1).

Most of our updates reflect three things: the strategic repositioning of major retailers and APC providers; accelerated growth of payer investment, primarily through existing primary care delivery capabilities; and greater growth for enablers. All in all, we expect the share of primary care patients served by traditional pure fee-for-service providers to shrink faster than we had previously projected.

We still anticipate that nontraditional providers will play a pivotal role in transforming primary care in the US, serving approximately 30% of primary care patients in 2030, but evolving competitive dynamics and recent moves by some of these participants point to a different mix among them.

Retailer primary care: facing challenges

Retailers have taken different approaches to primary care—some building their own clinics (such as Walmart), some establishing partnerships with existing providers (such as Walgreens and VillageMD), and others acquiring primary care delivery assets (for example, CVS Health/Oak Street Health and Amazon/One Medical).

Many have shifted their approach over the past two years. Walmart, after trying to build health centers organically, exited the space earlier this year. Walgreens, which invested in VillageMD in 2020 and became majority owner in 2021, is scaling back its clinics’ footprint and plans to reduce or sell its stake in the company. We believe these moves reflect a growing recognition of how challenging it is to succeed in comprehensive primary care, particularly while balancing the needs and goals of two very different business models: retail and care delivery.

Retailers that continue to pursue primary care will benefit from focusing on three key objectives: building the right model, investing to evolve their brand, and ensuring that the right healthcare expertise exists within their organizations.

The model matters. Fee-for-service primary care delivery relies on providers conducting a high volume of low-margin patient visits. At the same time, the need to take risk as a path to profitability requires a narrower patient population focus. This is a point of tension for retailers that see their broad consumer base as a competitive advantage, which may be challenging to capitalize on if they aim to participate in full risk-bearing models.

Retailers will need to assess whether their care delivery model can reach their financial and nonfinancial goals. This will require organizational alignment on their purpose for being in healthcare delivery, crafting clinical and business models consistent with that purpose, and evaluating the business case to determine if they can achieve their goals. This all should be done ahead of taking up or expanding commitments in the space.

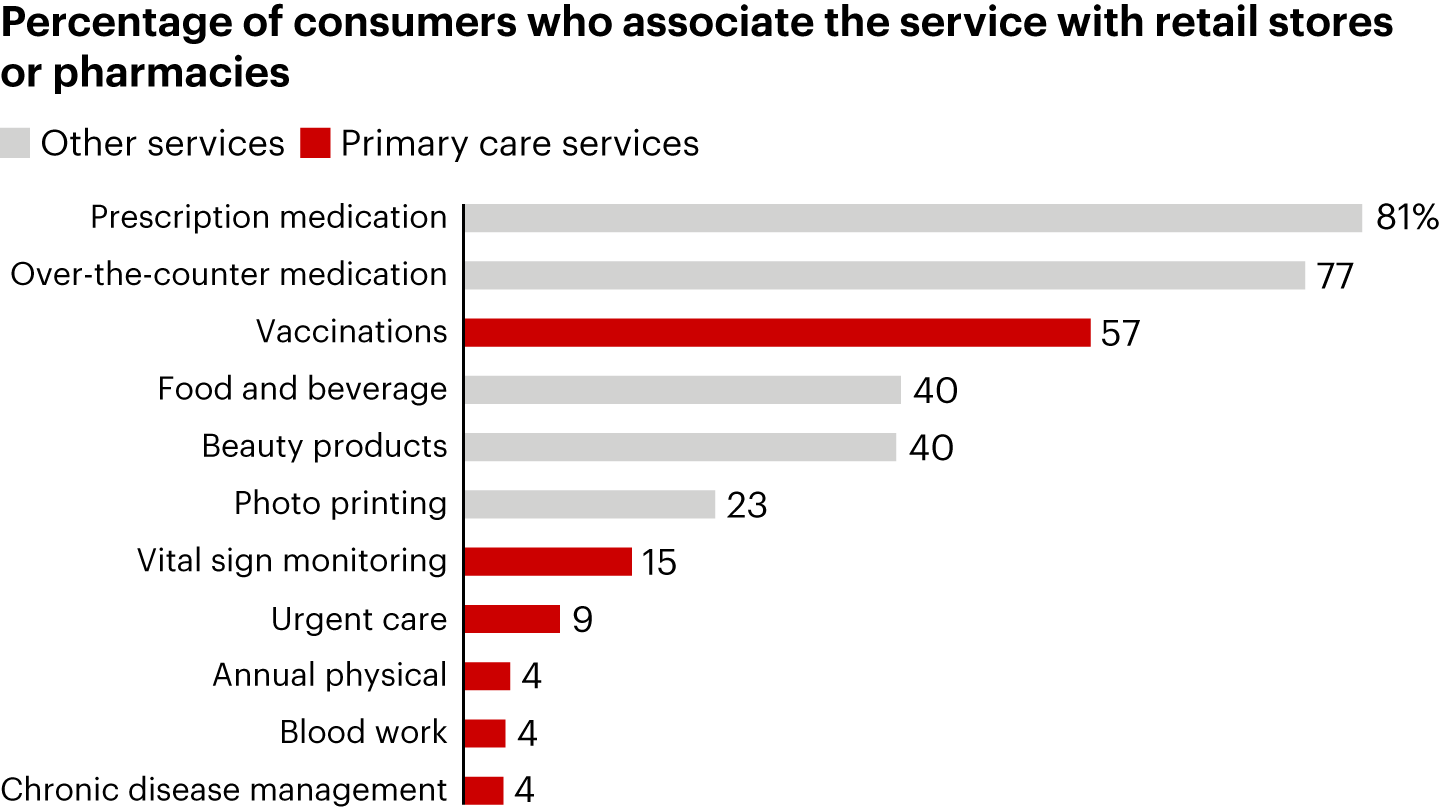

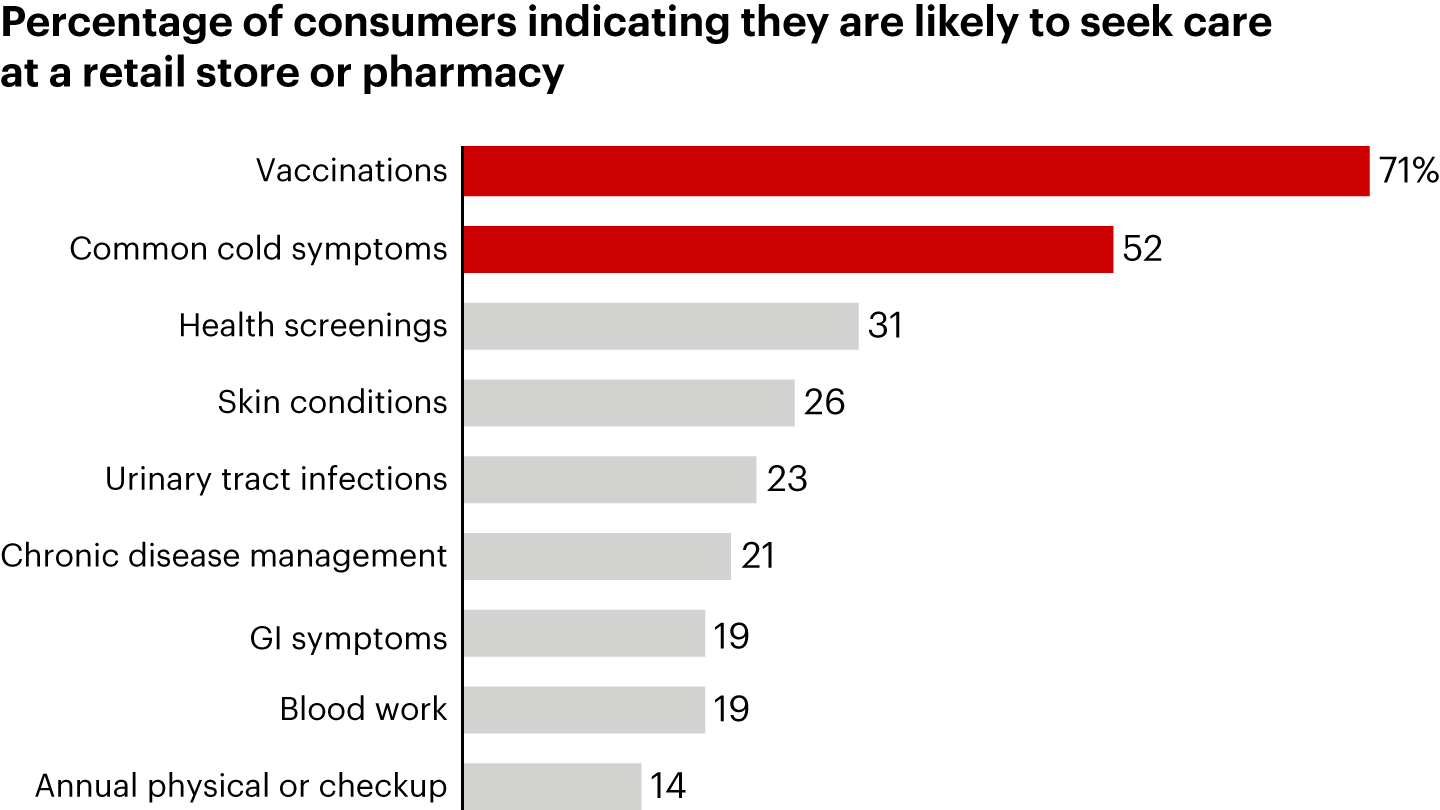

It takes time and investment to build brand association and customer engagement. Several retailer forays into healthcare service delivery illustrate that success is not as easy as “build it and they will come.” Our recent Front Line of Healthcare Survey found that most US consumers do not associate care delivery services beyond vaccinations with retail stores or pharmacies (see Figure 2). Less than one-third are likely to visit a retail store or pharmacy for primary care indications beyond vaccinations and common cold symptoms (see Figure 3). This holds true across rural, suburban, and urban geographies. To establish themselves as credible primary care providers, retailers will need to offer comprehensive services—from diagnosis and treatment to ongoing management of chronic conditions—as well as invest sufficiently in marketing to ensure that patients begin to associate their brands with high-quality care delivery.

Healthcare expertise is critical. The clinical, administrative, and regulatory complexities of healthcare delivery, especially in value-based models, are very different from those of retail or pharmacy. For retailers building care delivery business models in-house, developing the necessary execution know-how requires a team with deep clinical, strategic, and operational healthcare expertise. Alternatively, acquiring or partnering with existing organizations that have deep healthcare expertise, such as APC providers, can speed results. With either approach, if the business case for investing in care delivery relies on synergies across two businesses—increasing retail sales in conjunction with clinical care delivery, for example—it will be critical that retail and healthcare management teams collaborate closely.

Healthcare payers: set up to navigate challenges

We anticipate that payer-owned primary care will account for approximately 20% of the market by 2030. Payers are well positioned to navigate industry challenges and scale effectively thanks in part to their historical investments in care delivery. Having entered the care delivery space over a decade ago through their respective health services organizations, Optum and CenterWell, UnitedHealth Group and Humana have developed the differentiated capabilities required to manage complex primary care delivery. In addition to network curation and physician practice management capabilities that support successful care delivery, these payers have extended key capabilities in care management, navigation, and coordination to their primary care practices. These capabilities empower payer-owned providers to achieve the quality and cost outcomes essential to thrive in value-based care arrangements.

Advanced primary care: poised to scale, but under regulatory pressure

APC providers will continue to scale, particularly those focused on seniors. To maintain their competitive edge, however, they will have to adapt to tighter economics and regulatory shifts. Medicare Advantage plans continue to face headwinds, including decelerating growth, updates to risk adjustment by the Centers for Medicare & Medicaid Services (CMS), and star rating reassessments. The transition from risk adjustment model Version 24 to Version 28, for instance, is expected to decrease reimbursement, reducing care provider revenues by approximately 2% to 4%, with an even greater impact on the bottom line. This increases our conviction, first asserted in 2022, that the ability to meaningfully lower the total cost of care while achieving high-quality clinical outcomes will become increasingly important, determining the winners and losers among these players.

Traditional and enabled primary care providers: accelerating adoption of value-based care

Traditional independent primary care providers cannot escape the growing pressure on fee-for-service payment. While many may hope to maintain their business as usual, payers are unlikely to negotiate higher fee-for-service rates moving forward. More and more, providers who want to remain independent will seek to partner with enablers that can help them successfully transition to value-based payment models.

Venture capital and private equity investment in value-based care enablers has been rising, mirroring steep growth in these organizations over the past few years. As a result, we now expect primary care providers that have partnered with value-based care enablers to hold around a 10% share of primary care lives in 2030, compared with the roughly 4% we anticipated two years ago.

Nevertheless, enablers are facing the same headwinds from increasing regulatory pressure as advanced primary care providers. The impact of Version 28 on enablers will largely depend on their model choices and average risk adjustment factor (RAF) scores. Pure-play Medicare Advantage or Medicare enablers and providers with populations with higher average RAF scores will be more exposed. To thrive, value-based care enablers must demonstrate their ability to achieve high-quality health outcomes while reducing overall healthcare costs. Data indicates that the top performers in the Medicare Shared Savings Program—including enablers like Privia Health and Aledade—realized cost savings of more than 7% in 2022, according to a Jefferies analysis of CMS data. Promoting the effective use of primary care services to reduce costly hospital admissions will remain a key driver of success for both value-based care enablers and the doctors they support.

Health systems: forced by competition to make choices

Under pressure from population-focused disrupters and nontraditional providers, many traditional health systems face a challenging road ahead. The degree of difficulty will be largely determined by the competitive dynamics where they operate.

In highly competitive markets, we expect health systems to pursue different strategic paths. One strategy would be to become the preferred specialty and tertiary care provider for risk-taking primary care providers. This secures referrals but requires the health system to be highly competitive on specialty care cost. Another strategy would be to develop innovative care models that change the way the health system provides primary care. Consider what Corewell Health has done, segmenting its patients into cohorts in order to capitalize on the benefits of population focus, tailoring operational and clinical capabilities to the specific needs of different patient populations and payers. A third option might entail developing direct-to-employer models that allow for greater risk-taking.

These health systems must assess how their existing primary care assets impact their overall business and mission, carefully weighing the benefits and costs of investment in this space. Those looking to reinvent will focus on bridging gaps in key areas such as enhancing patient experience, deploying digital and technological advancements, improving care management, and adopting a more multidisciplinary approach to care delivery. Luckily, health systems don’t have to go at this alone. Multiple enablers are already helping them advance their adoption of value-based care by providing several of these key capabilities.

In markets where health systems have a high relative market share, we believe leaders will be more insulated from such pressures, allowing them to maintain their competitive positions longer without undergoing significant change.

Primary care in 2030

Ultimately, the primary care landscape of 2030 will be defined by the ways in which providers adapt to changing competitive dynamics and succeed in value-based care. The ownership structure will continue to evolve, with nontraditional providers poised to capture significant market share. Population-focused models, whether for care delivery or care enablement, will continue to be well positioned to take on payment risk but will face regulatory and reimbursement headwinds. Significant questions remain regarding the ability of retailers to deliver comprehensive primary care effectively given the challenges they face.

One thing is certain: Primary care delivery will continue to be a focus of creativity and innovation, increasingly gaining the recognition it deserves for its vital role in US healthcare.