Opportunity

A private equity firm had the opportunity to acquire one of the largest service providers to shale gas producers.

The client brought in Bain to underwrite the sustainability of, and growth prospects for, the service the target provided.

Approach

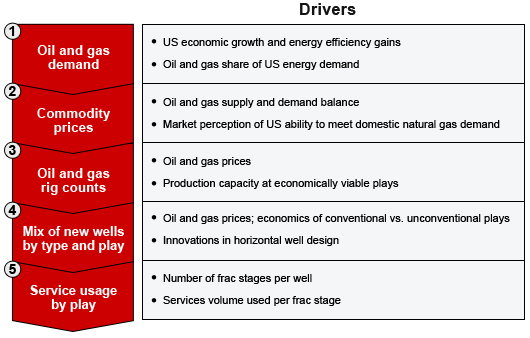

A key part of the diligence was for Bain to forecast the market demand for the private equity firm's key products.

Recommendations

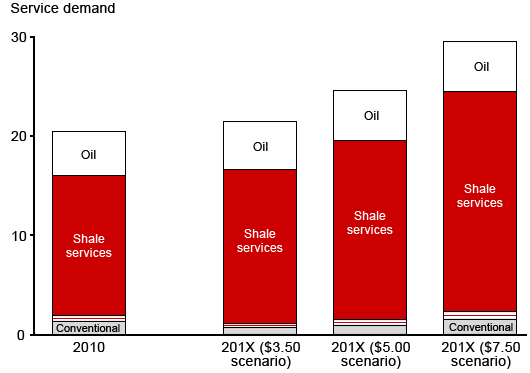

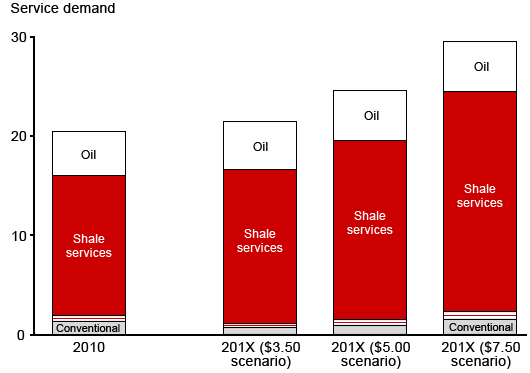

Bain forecasts suggest that the market for the service is expected to grow across plays and price scenarios.

Results

The private equity firm recently purchased a controlling stake in company.

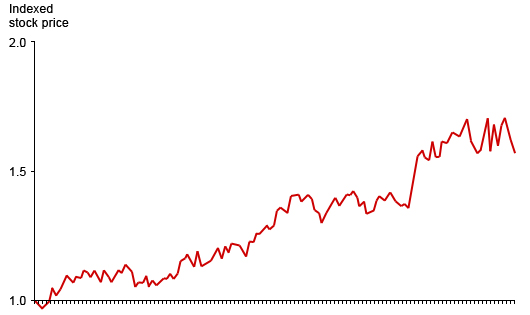

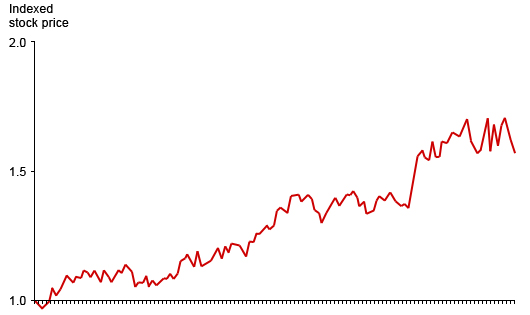

Since the time of the acquisition, the stock price of the other scale player in this market has appreciated nearly 50 percent.

* We take our clients' confidentiality seriously. While we've changed their names, the results are real.