Étude de cas

Forecast backs a bet on shale services

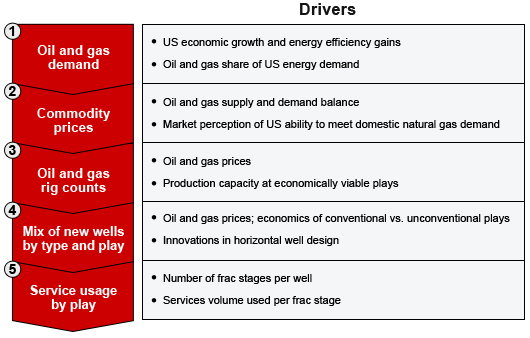

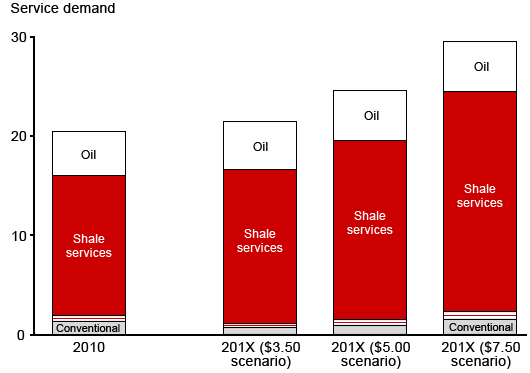

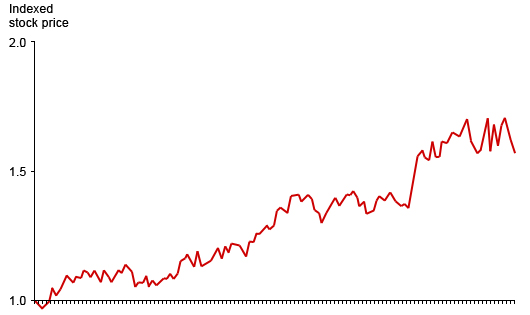

When a private equity firm needed to assess the sustainability and growth prospects of their shale gas acquisition target, they asked Bain to perform due diligence. Bain forecasts suggested that demand trends and price scenarios for the shale services company’s products would grow. Since the successful acquisition, the stock price has greatly appreciated.