Snap Chart

It’s easier than ever for consumers to switch insurers

Price is the leading cause of searching and switching

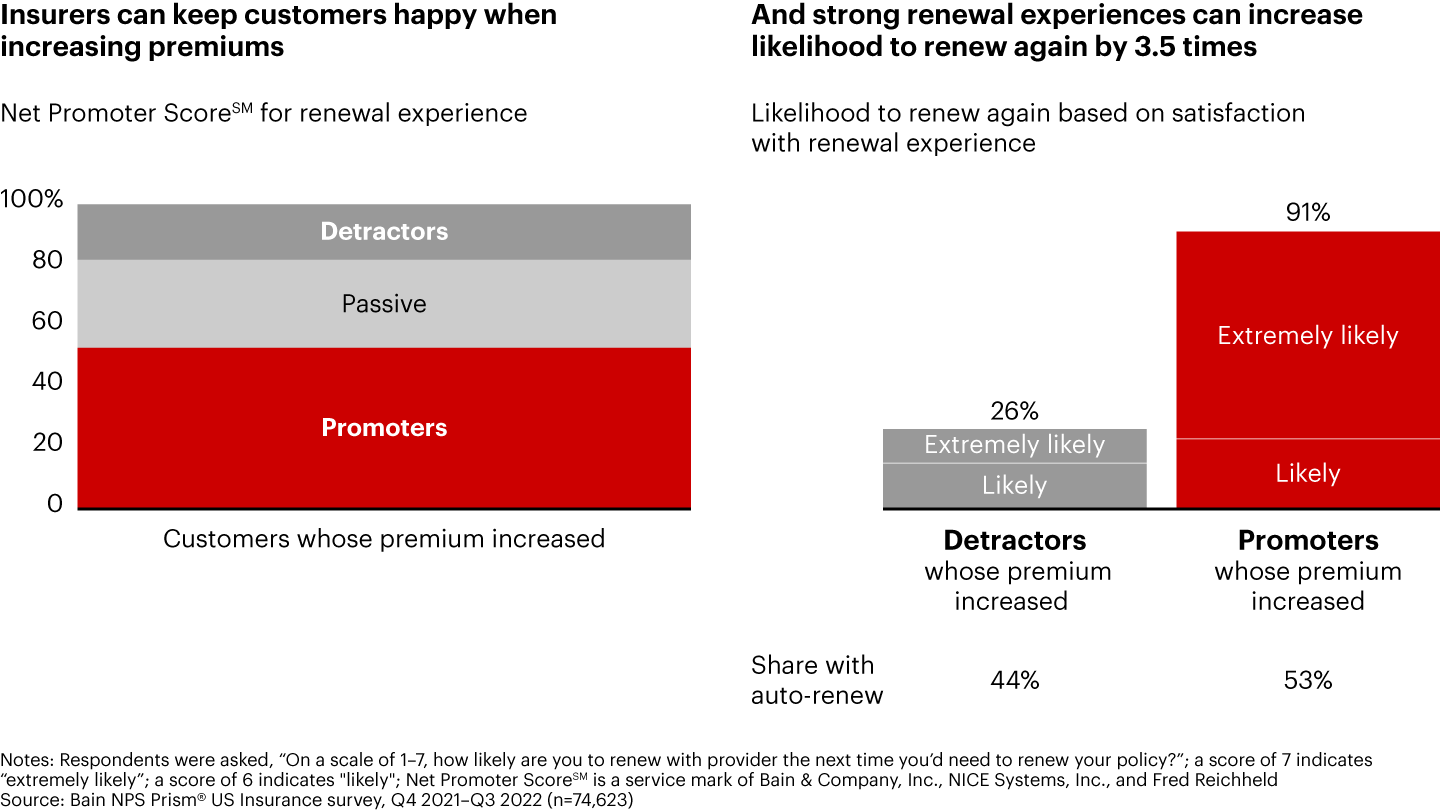

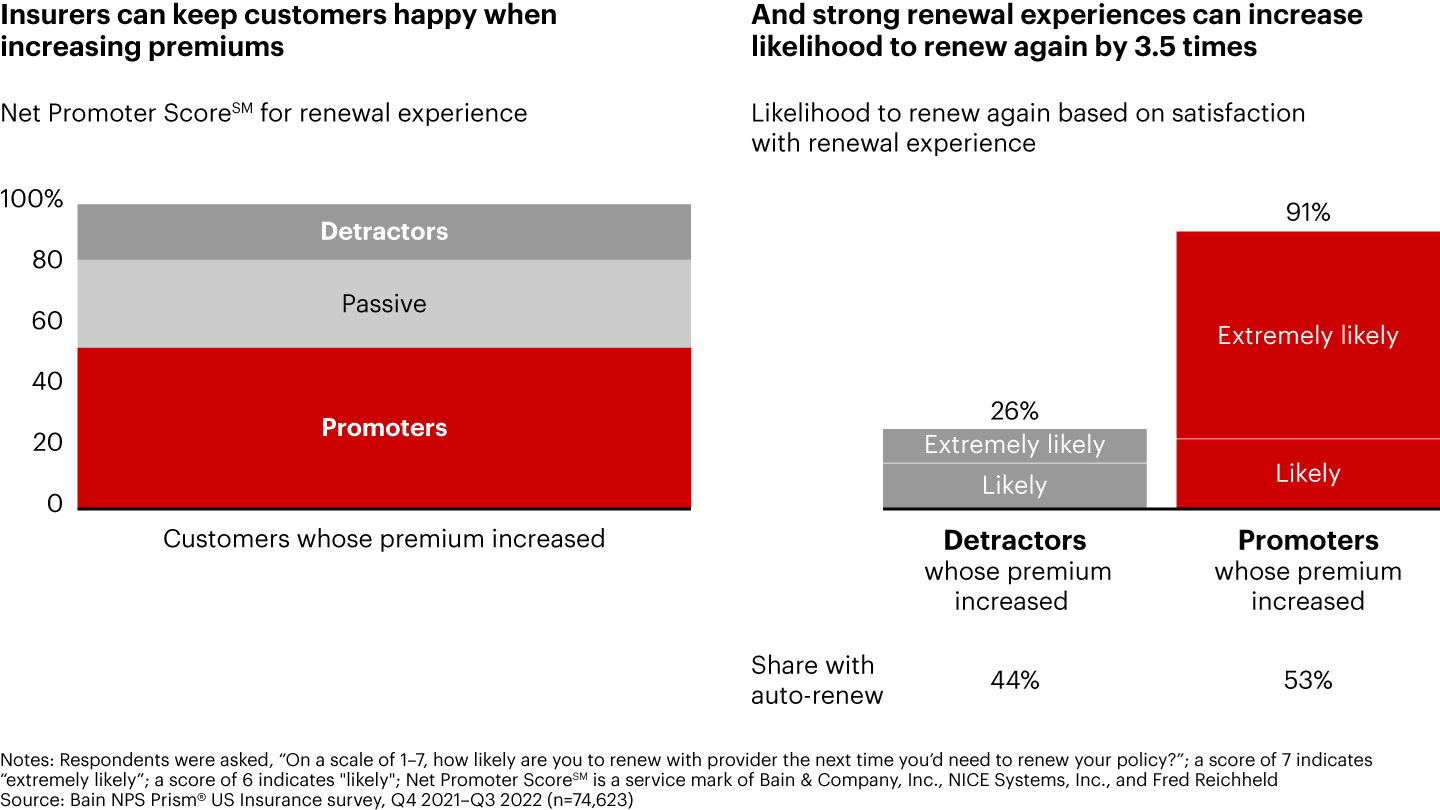

But even when prices increase, a good renewal experience can spur loyalty

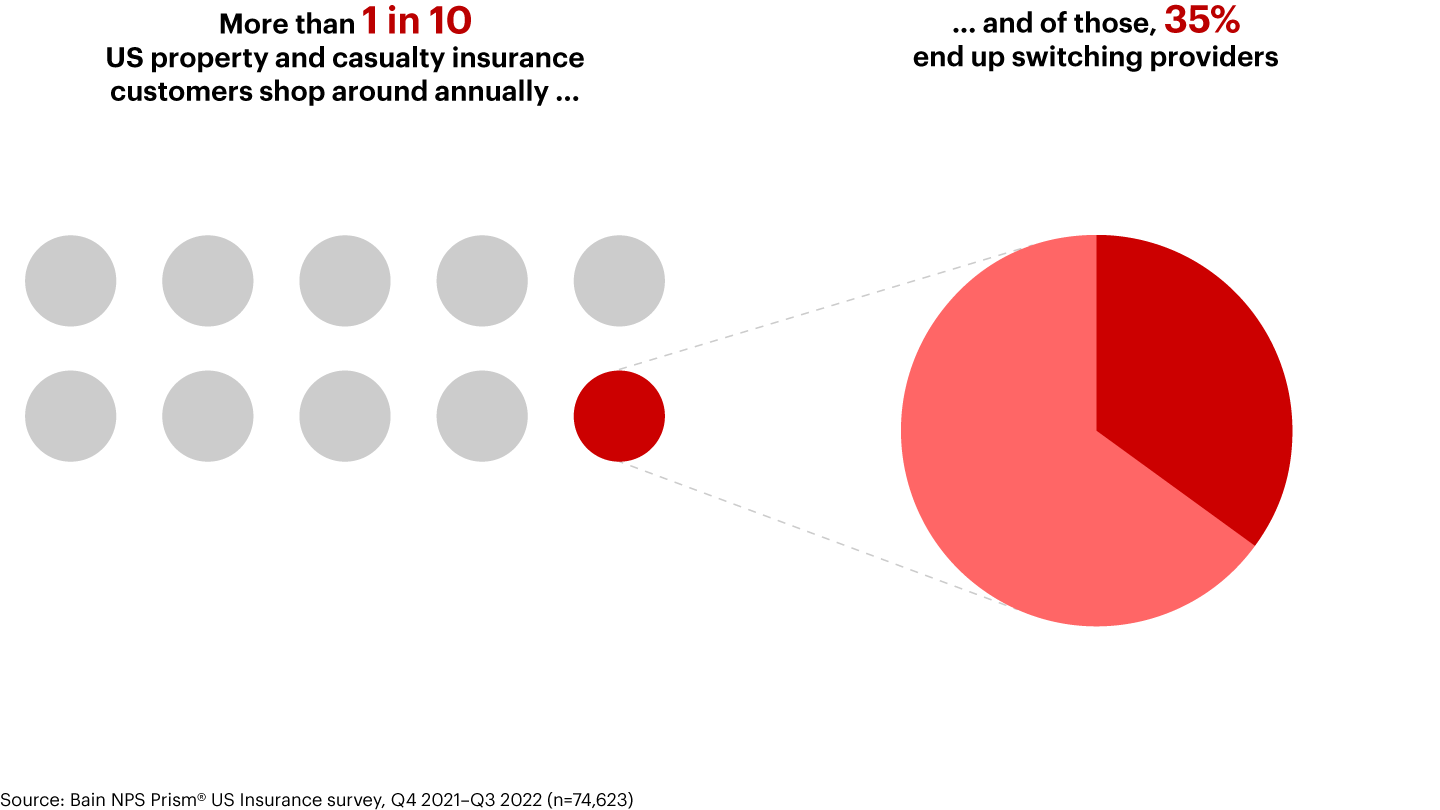

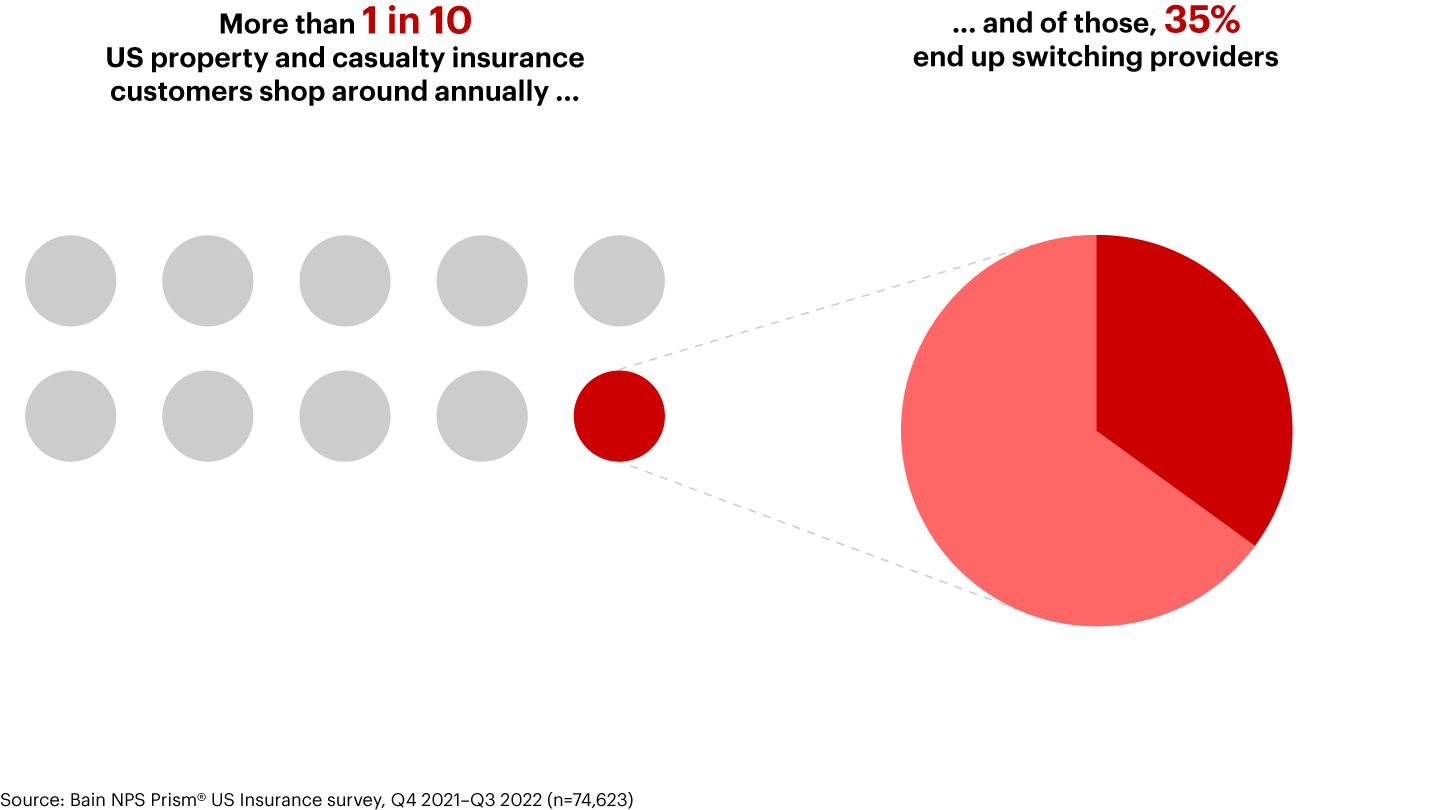

Competitors are just a click away. Thanks to the digitalization of property and casualty (P&C) insurance, it’s easier than ever for US consumers to shop around for new providers. More than 1 in 10 consumers do so annually, according to NPS Prism® data (see Figure 1). And more than one-third of those end up switching.

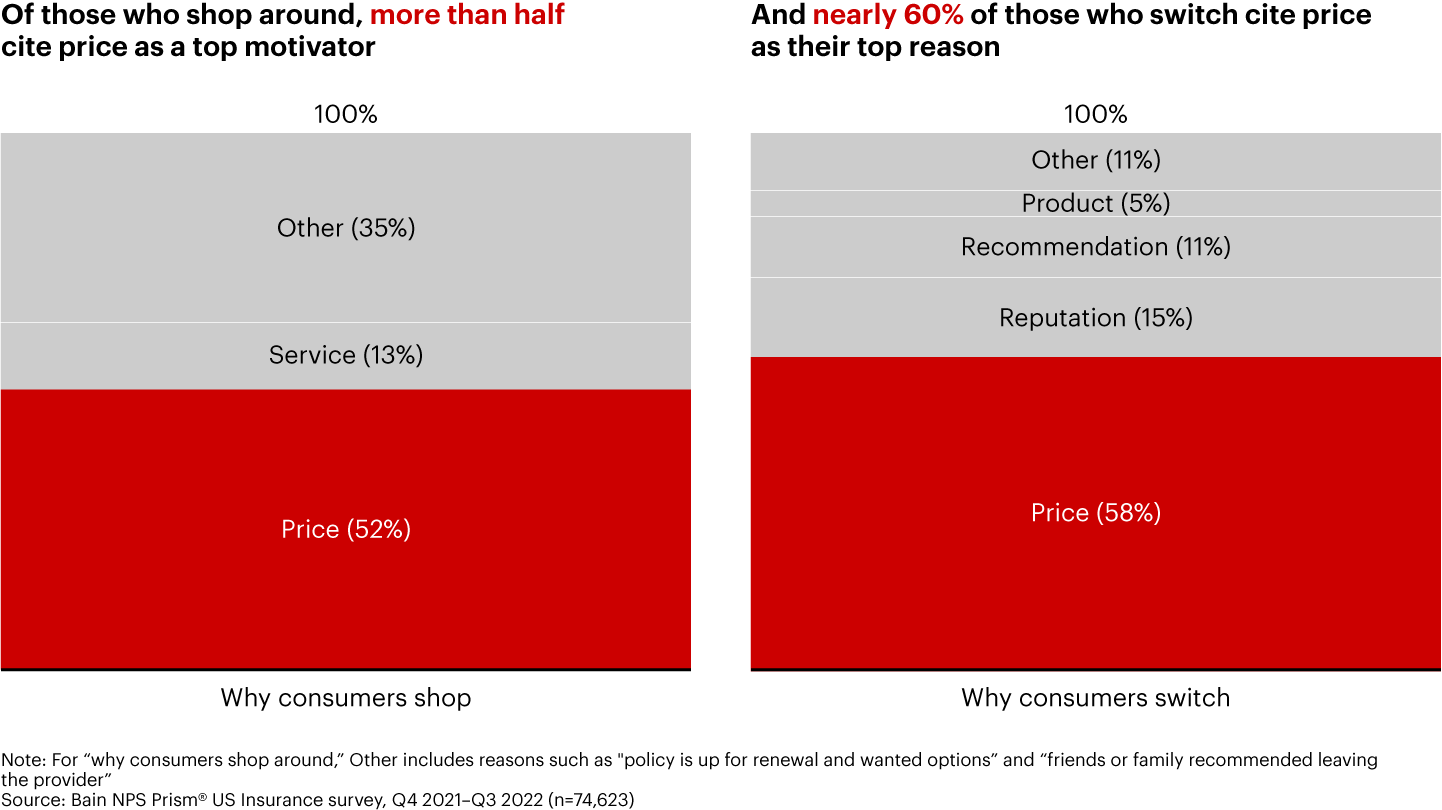

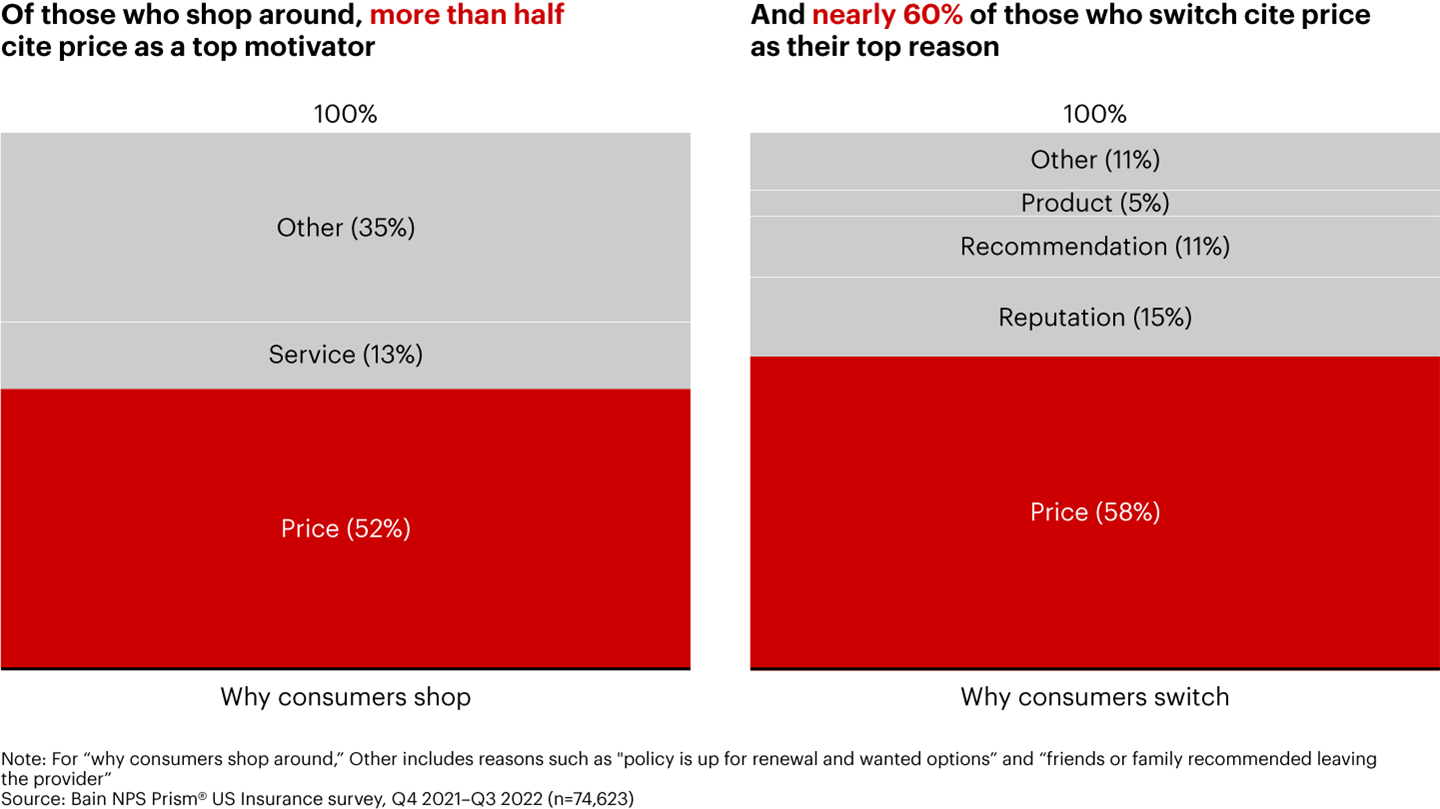

Most are seeking savings. More than half of those shop around and switch say they were motivated by price (see Figure 2). That makes it hard for providers to win them back without engaging in costly price wars.

But price isn’t everything. Bain research shows that a good customer experience, particularly during renewals and claims, can help insurers retain their hard-earned customers—even when they increase premiums.

In fact, more than half of customers whose premiums increased at renewal were still satisfied with their experience. And these “promoters” are 3.5 times more likely to renew with their current provider again in the future, compared with “detractors”—customers who had negative renewal experiences (see Figure 3). Promoters are so loyal that those with a premium increase of less than 10% say they're almost as likely to stay with their provider as customers with no premium increase.

Why? Promoters cite common themes: Nearly 90% of those who are likely or very likely to stick with their insurer in the next renewal cycle say that overall communication at the time of renewal was helpful. These enthusiastic customers also have higher rates of auto-renewal enrollment.

Positive claims experiences also boost retention. Around half of customers who felt satisfied with their claims experience say they're likely to renew, compared with only a third of those who were dissatisfied.

Of course, insurers still need to be mindful of customer perceptions when determining the timing and amount of price increases. But it’s worth noting that some of the dissatisfaction with price could stem from a poor service experience. Industry leaders will improve those experiences by focusing on clear and helpful communication, expectation setting, and optimal timing.

Deliver an unparalleled experience

Use NPS Prism® as your window into how your customers want to be served.

Learn How

NPS Prism® is a registered trademark of Bain & Company, Inc.