Brief

At a Glance

- Medtech’s core principles—growth, category leadership, and simplification—remain vital.

- Enduring healthcare shifts, such as aging populations, cost pressures, and care decentralization, mean medtechs must adapt fast or risk falling behind.

- Four emerging trends—AI integration, strategic carve-outs, supply chain resilience, and simpler operating models—require renewed focus and urgency around industry fundamentals.

It’s a moment of historic potential. As aging populations, cost pressures, and evolving care models fuel demand for greater medical innovation, fast-moving technologies like generative AI are opening countless doors for medtech companies to deliver it. At the same time, tariff turbulence and geopolitical uncertainty are calling for bolder, more decisive strategy.

Even in this once-in-a-lifetime moment, the fundamentals of medtech haven’t changed. The same core principles that built great companies still work. What’s different, then, is how leading medtech CEOs apply them. In this evolving industry, winning requires not only recommitting to what works, but also bringing a fresh perspective on how to grow, where to play, and how to operate.

The fundamental truths

There are three essential truths in medtech, and they’re not going anywhere.

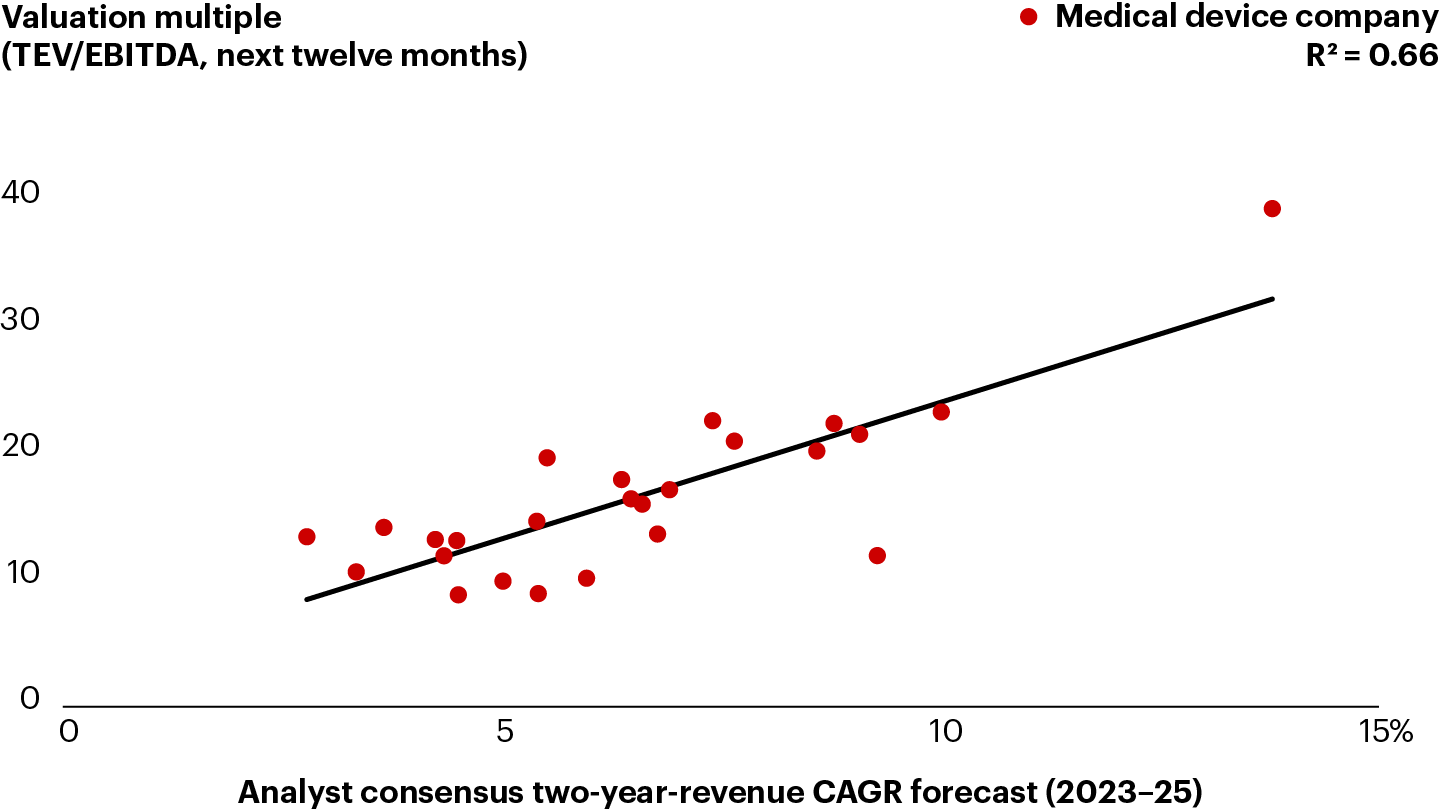

1. Growth is king. It’s the primary driver of medtech valuations—every 100 basis points of revenue growth can add roughly two turns of forward enterprise value multiple (see Figure 1). But today, growth isn’t about cutting costs or stealing share. It requires aggressive plays: pursuing category leading positions, targeting high-growth markets, honing the power of sales excellence, investing in emerging technologies, and leaning into strategic M&A. For medtech companies in particular, achieving growth isn’t simply a matter of doing more deals. It’s about doing the right deals—ones that back their broader strategy, enhance their category leadership, and are primed for seamless execution.

Notes: Only includes medical device companies with more than $3 billion in revenues in 2022; valuation multiples and forecasts as of January 14, 2024

Sources: Cap IQ; Bain analysis2. Category leadership beats overall scale. According to traditional industry dynamics, size typically enables benefits like lower costs, stronger brand recognition, enduring customer loyalty, and superior commercial execution. Yet in medtech, overall scale isn’t correlated with higher profitability or growth. Instead, companies that strategically build scale in specific markets reap these rewards. The categories are tightly defined, consisting of products and services for a specific set of end users, although definitions often shift as technologies evolve. With deeper physician relationships, category leaders gain unique insight into customer needs, informing R&D innovation and positioning them for more organic and inorganic growth. As healthcare providers consolidate, category leaders are more likely to thrive, thanks to cost and revenue synergies.

3. Taming complexity will significantly improve performance. The industry’s perennial challenge—complexity—has only grown more acute. Companies have long grappled with sprawling product portfolios, fragmented supplier bases, and legacy operations, all while striving to meet high customer expectations. For example, medtechs often support an unwieldy number of product combinations due to varying customer preferences, use cases, and regional regulations. In our experience, companies that simplify their portfolios improve margins and fuel growth. Additionally, leading companies are revisiting their market entry approaches, streamlining their geographic footprint, redesigning their organizational structures, and narrowing their focus to their most valuable customers.

Enduring healthcare shifts

The macro forces reshaping healthcare today aren’t new: Shifting global demographics—marked by aging populations and the increasing prevalence of chronic conditions—continue to fuel demand for medical innovation. Inflationary pressures, though easing since the Covid-19-era supply chain disruptions, still sting—especially amid current tariff and geopolitical uncertainty. At the same time, consumers want more convenient, digital experiences on their terms.

Consolidation persists, which means medtechs are now serving larger health systems and adapting to vertical integration across sectors. Meanwhile, care is shifting to lower-cost settings. Ambulatory surgery centers (ASCs) are expanding fast, and in-home care is more viable with advancements in robotics, wearables, and telehealth.

These are likely lasting industry changes. Medtech companies must evolve quickly or risk falling behind. Take a company that plays in orthopedics without a clear ASC strategy—it’s already at a disadvantage.

Emerging medtech trends

While all healthcare companies must consider the forces reshaping the industry, we also see four emerging trends in medtech that are transforming how companies operate and compete. Each of the trends is rooted in the industry’s fundamentals—they are an attempt to achieve growth, leadership, and simplification. Together, they reflect what it takes to balance innovation, financial efficiency, and operational agility in an ever-complex environment.

1. Rapid AI integration. AI is a must-have, not a maybe. It’s already transforming how leading players operate and innovate. On the operations side, AI is revolutionizing complex workflows—for example, authoring faster, compliant regulatory submissions. Winners are setting their sights on the highest-value opportunities, such as tools to help improve salesforce productivity and agility. They are moving beyond AI experimentation to integrate scaled, repeatable programs into core business processes and customer engagement strategies.

On the product side, AI is powering a new wave of smarter, faster, more personalized healthcare solutions. The FDA has already authorized more than 950 AI/ML-enabled devices, with more than 75% in radiology, followed by cardiovascular care, according to the agency’s database.

While some companies are still dabbling with haphazard pilots, tomorrow’s leaders are making bold, deliberate bets. Consider how Johnson & Johnson, after generating 900 use cases in generative AI, decided to devote resources to its highest-value projects and cut the rest. Medtechs that scale top use cases with intent will accelerate speed-to-market, boost profitability, and deliver superior clinical outcomes.

2. Strategic carve-outs. The carve-out is having a moment—and for good reason. Healthcare carve-out deals grew at an estimated 17% compound annual rate from 2010 to 2024, and in just over the past year, at least half a dozen medtechs with revenues over $500 million announced carve-outs or spin-offs. It’s easy to see why. Revenue growth contributes to total shareholder returns roughly seven to nine times more in medtech than all other levers combined. Thus, by shedding lower-growth businesses, companies can boost overall growth rates, free up capital for higher-growth plays, and improve shareholder returns. What’s more, with the appropriate investments, new owners can be “better parents” that attract and retain top talent, propel growth, and support multiple expansion.

Getting it right is hard, but worth it. Unlike typical buyouts, carve-outs demand immediate operational continuity and a long-term value creation plan. That complexity leads to a higher margin for error and more variable outcomes. Yet, when executed well, carve-outs outperform buyouts by nearly 20 percentage points in internal rate of return.

The best performers proactively manage their portfolios, avoiding the value erosion that so often happens when non-core assets are starved of resources. They also execute cleanly to minimize stranded costs, manage complexity, and plan a smooth transition for the remaining organization. With strong spin-off capabilities, a bold vision for what comes after, and a clear roadmap to get there, leading CEOs use carve-outs to position the firm for growth, financial flexibility, and sustained competitive advantage.

3. Supply chain resilience. Tariffs and geopolitical uncertainty are yet another blow to supply chains built for a world that no longer exists. As a result, medtech executives—much like leaders across industries—are diversifying supplier locations, expanding supplier bases, relocating manufacturing hubs, and more.

But companies that merely “manage through” tariffs and other disruptions will find themselves in a constantly reactive state. Thriving demands a more dynamic approach. Leading medtech CEOs are taking a hard look at the end-to-end value chain to evaluate transitory disruptions and structural risks. They are redesigning their supply chains by working backward from the customer, prioritizing resilience where it matters most.

Emerging leaders also realize supply chain resilience isn’t just a logistics challenge. It’s an enterprise-wide imperative that must align with financial, operational, and sustainability goals. These companies make explicit trade-offs around cost, efficiency, and agility, always anchored in their unique long-term strategy. That’s how they play both defense (react and recover from shocks) and offense (anticipate and prepare for them).

Finally, true resilience requires more than a one-time fix. CEOs with world-class supply chains make bold, ongoing investments in digital tools, supplier diversification, and proactive risk management. By treating resilience as a core business strategy, they position their companies for operational continuity and long-term success.

4. Simpler operating models. After constantly grappling with complexity, many medtech leaders have found power in simpler operating models. Through carve-outs and restructuring, they’re gaining efficiency, agility, and profitability. Some are decentralizing their operating models, giving individual business units greater autonomy and full profit and loss ownership. Others have also centralized shared services in areas like IT, HR, and finance to become more efficient while maintaining business unit flexibility.

These changes aren’t purely cosmetic. They’re a deeper recognition that speed—in decision making, innovation, and customer responsiveness—matters more in a world of higher cost pressures, bigger investor demands, and harder-to-achieve growth. Some companies are more successful than others. But those that can honestly evaluate if their current operating model supports their strategic and financial goals and streamline accordingly are primed for growth.

These trends don’t render the medtech playbook obsolete; they reinforce it. Growth, category leadership, and simplification remain the spine. But the most proactive leaders will rewrite the next chapter. Those that harness AI, build resilient supply chains, and simplify both their offerings and ways of working will have the sustained growth and competitive edge needed to thrive in the future.