Brief

When faced with angry customers, rocketing fuel prices and IT meltdowns, utility executives don’t often think of the guys in hard hats as their top priority. It’s easy to say that field service operations could run more smoothly, but it’s harder to say how—and even harder to make it happen. But achieving full potential in field service can save utilities a lot of time and money. Productivity and efficiency reviews targeted at field service operations, done correctly, can reinforce other areas of the business by increasing customer satisfaction and improving safety and quality. For many utilities, it’s worth another look.

Historically, field service units—the crews that install, maintain, repair and replace various components of the core utility infrastructure—have been highly decentralized. Often run as mini and distinct geographic businesses with little oversight from the corporate headquarters, many field service units haven’t kept up with industry best practices. Additionally, it has also often been difficult to fully assess the field service opportunity due to inconsistent, and often poor, data quality. But with an increase in big IT automation projects and the accompanying emphasis on functional expertise, companies can ill afford to let their field service units flounder in isolation.

Why is field service so often a company’s weakest link? First, in major markets around the world we have seen a rapid increase in both the workload and the costs associated with field service activities due to increasing capacity utilization and aging networks, the introduction of complex new technologies, and growing demand from customers (and regulators) for a wider range and greater reliability of services. Second, many field service units operate with low expectations for employee efficiency or engagement. The legacy of public-sector ownership includes corps of unionized field service workers who are sometimes inflexible and resistant to change. They are often skeptical of process simplification and look warily (if at all) at recommendations from corporate headquarters. And yet the increasing complexity of new technology has created real skill gaps for many field service workforces. Finally, with the difficulty in accurately measuring productivity, it’s hard to know when things are working well and when they aren’t.

Getting to “full potential” first requires a definition of the opportunity for improvement, but even this can be difficult. Benchmarking usually falls short, in part because most companies lack reliable, comparable productivity metrics. The variation in work types (e.g., new business vs. maintenance vs. breakdown), a mix of different resource levels and types across units, and geographic differences further complicate the process. Instead, a more effective approach is a holistic diagnostic, which breaks down the various components of field service operations to see how efficient they really are.

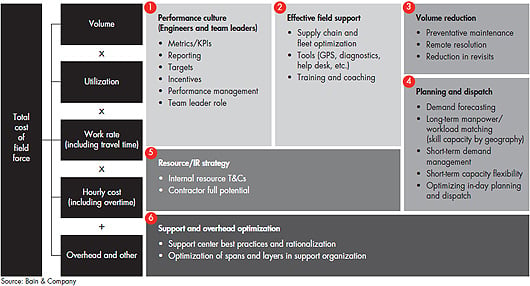

This includes a broad look at the entire workflow process—not just field service personnel themselves. To be most useful, the diagnostic should provide efficiency ratings for the key areas of activity:

• Volume of jobs, which can be classified as good (e.g., good plans or job designs), potentially avoidable (e.g., modified by field or scheduling) or bad (e.g., rejected by field or scheduling);

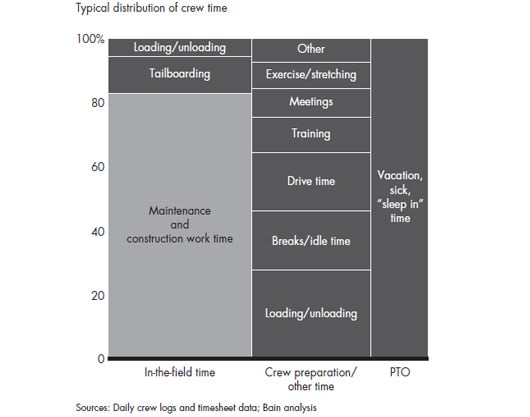

• Utilization, which measures a crew’s productive hours as a percentage of the total (i.e., actual time spent working contrasted with nonscheduled time, idle time, sick time and holidays);

• Work rate, which measures the rate at which employees can complete jobs due to optimization of jobs designs and scheduling;

• Hourly cost, which analyzes the total cost of labor, including overtime (for in-house work vs. contractors);

• “Overhead and other,” which addresses the costs of supporting nonfield activities (e.g., resource planning, dispatch) and nonlabor costs (e.g., fleet).

Recognizing that unique units and divisions do—and often should—operate differently, an effective diagnostic looks closely at day-to-day operations in multiple areas. Once completed, the diagnostic quickly brings inefficient processes to light. It also provides a robust data baseline from which to measure and prioritize opportunities for improvement. In a diagnostic conducted by one US utility, for example, an analysis of how crews spent their time revealed that less than 50 percent was spent on actual maintenance or construction work. The upshot: in order to make crews more effective, executives would have to address key challenges in the areas of work order quality, scheduling, work support and performance management.

Typically the output of a diagnostic focuses on six categories of high-value initiatives. These include performance culture, effective field support, volume reduction, planning and dispatch, resource strategy, and support and overhead optimization. Most companies find that the greatest need and the largest payoff come from focusing on performance culture and planning and dispatch.

Performance culture. In getting field service units to full potential, developing—and applying—a succinct set of key performance measures is critical. This is especially true in planning, scheduling and working in the field. In planning, good metrics include comparing estimated with actual job times and measuring the percentage of “good” job designs. In scheduling, they measure the percentage of jobs cancelled and output per hour (as a proxy for resource utilization). And in the field, they focus on output per hour (by work location, team lead and individual) and cost per unit of output (based on overtime percentage). Good metrics are easy to measure and hard to argue with. They aren’t just statistics for quarterly reports, but rather useful tools for improving your business day to day and driving a healthy sense of competition.

Good managers use the right metrics to hold people accountable and reward strong performance. The next step in improving performance culture involves using incentives to bring out the best in employees. Some industry leaders have produced positive results with creative designs. One UK utility, for example, took an unorthodox approach: letting their engineers “opt-in” to incentive plans of their own choosing—including one that offered more vacation days as an alternative perk to bonus pay. Both morale and performance jumped significantly.

Planning and dispatch. For utility field service units across the spectrum—large, small, those focused on one-hour jobs and those working on multi-year major construction projects—scheduling plays a critical role. High performance is all about getting the crews to the right place at the right time with the right tools and information and the right amount of work. As all utilities know, it’s harder than it appears. One US utility struggled with a seesaw of inefficiency in their scheduling. At first they scheduled their work crews too tightly and ended up missing customer visits and compliance dates. Then to ensure they met commitment dates, they scheduled their crews too loosely and ended up with idle crews 50 percent to 60 percent of the time. To find the right balance, the best companies blend “schedule stability” (avoiding cancelled or last-minute scheduled jobs) with the amount of work that gets done (output per hour).

A bottoms-up, integrated solution. Many ideas for improving field service aren’t new. Many have been tried and tested—often with lackluster results. So what is it that so often goes wrong in field service redesigns? The most common mistake: developing the solution at corporate headquarters and then rolling it out to the business with little input from the field. Not only can this lead to resentment and resistance, but it genuinely fails to account for real operating differences across divisions. For example, rural and urban units might serve very different types of customers and crews working in wet climates might face very different conditions from those working in arid ones. By ignoring these differences, companies handicap their workforces with bad metrics and planning. Instead, the most successful companies get buy-in from the center, but develop their solutions bottoms-up using real input from those on the ground. They also strike a balance between implementing standard rules and frameworks across units and allowing for flexibility and contingency plans.

The second biggest pitfall companies encounter is trying to redesign field service operations in piecemeal fashion when what’s needed is an integrated solution. One US utility revamped its processes and found that while each individual function operated better, much of the benefit was lost because of the lack of coordination. The units didn’t know how to talk to one another, and because each unit measured productivity differently, they operated on different timescales and with different objectives. After a full process redesign, common metrics were applied across different functions, and each group was held partly accountable for success in the next phase. This accountability made everyone eager to talk more and drop the ball less. Different functions were suddenly “in it together,” so they proactively addressed issues before they could become real problems.

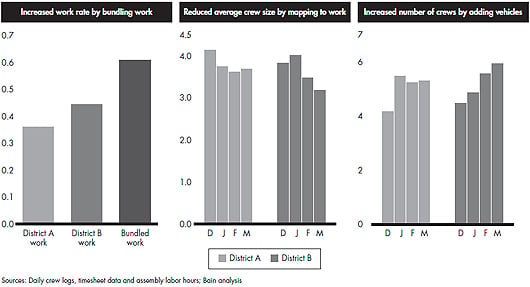

One US electricity transmission and distribution utility used a field service diagnostic to identify solutions in work scheduling, work rate management, work support and performance management. They developed an integrated field service solution and set 20 percent to 30 percent productivity improvement targets. The new initiatives have started to pay off: bundling work across districts has led to a more than 30 percent improvement in wrench time; mapping crews to work type has resulted in a reduction of crew size by up to 20 percent; and increasing the number of vehicles available has bought about an increase of 10 percent to 20 percent in the number of crews per district.

Full potential. Getting your field service operations to reach its full potential is challenging, and it takes time. Effective implementation counts as much as good ideas. But when you make it work, you can reduce costs and increase productivity significantly. This translates into better service—and happier customers, employees and shareholders.