The Situation

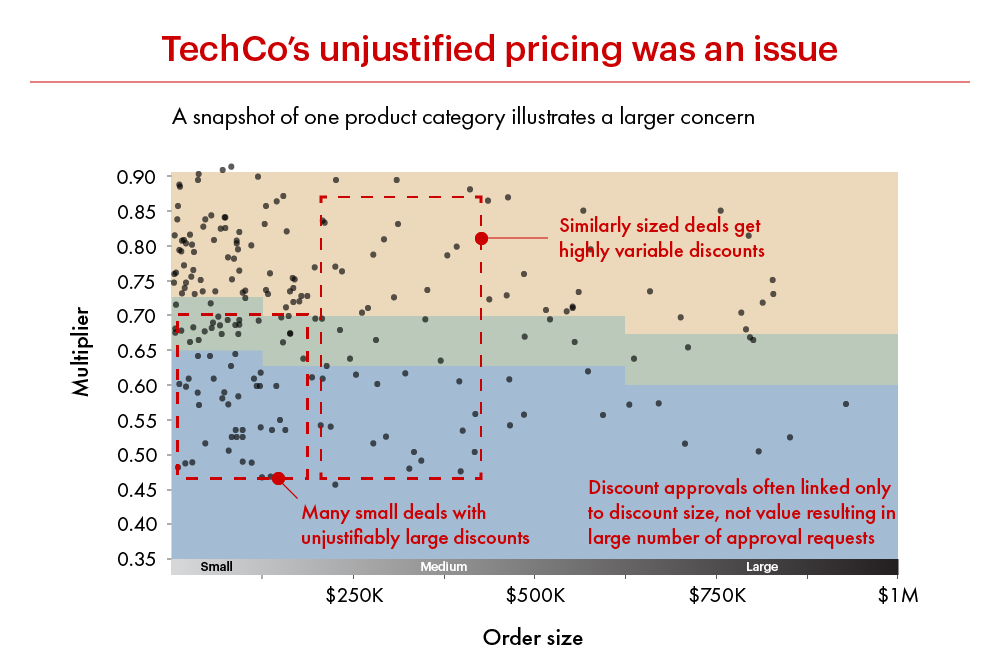

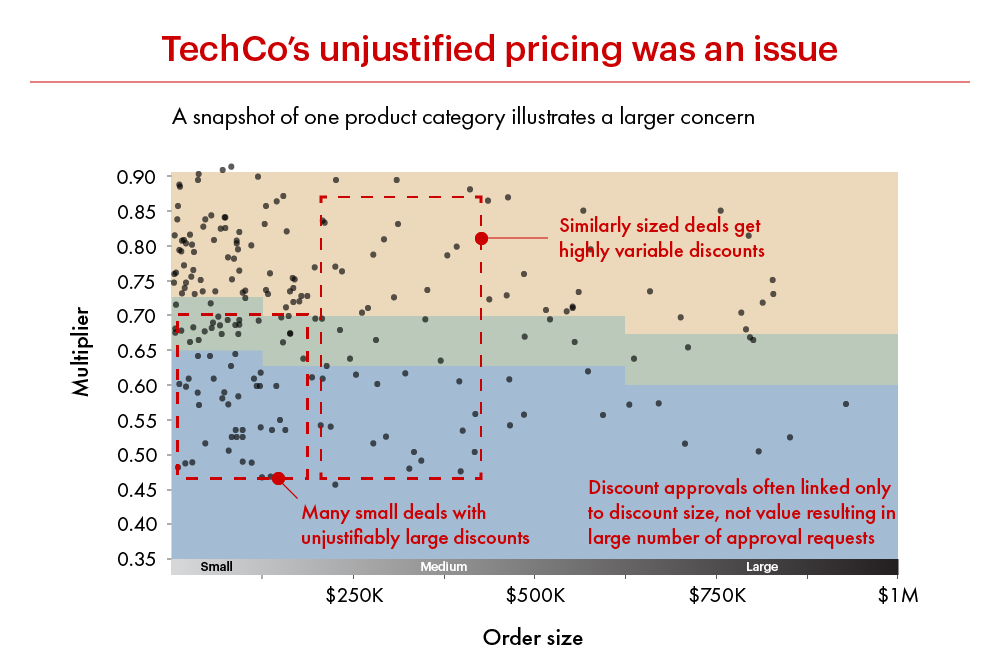

Having been purchased by a private equity firm, TechCo faced a number of transition challenges, with pricing quickly emerging as among the most critical. Unjustified differences in prices were common across its product line, and prices were set by varying criteria, based on a largely anecdotal understanding of value and customer perception (see chart below). The pricing-review process lacked standardization and rigor, and failed to consider deal characteristics such as competitive intelligence, market prices and other relevant data. Potentially lucrative customized products were priced on a cost-plus model, missing opportunities to increase margins. And list prices weren’t reviewed or updated as market conditions changed.

That lack of structure for pricing went hand-in-glove with a lack of visibility into what was, and wasn't, happening. Sales reps tended to set initial prices on gut instinct, rather than data. Sales and product leadership weren't measured on price targets, and sales managers lacked the tools, metrics and dashboards they needed to effectively manage TechCo's pricing strategy and performance.

Reviews and approvals were similarly ad hoc, with a one-size-fits-all approach resulting in a highly inefficient, ineffective deal-approval process that wasn't aligned to the opportunities to drive better results. In addition, reviewers lacked the data and context needed to award discounts consistently and logically, and system constraints slowed down the review process.

Our Approach

The Bain team began by applying its proprietary pricing diagnostic, quickly assessing TechCo’s pricing capabilities and identifying several notable gaps.

Price setting. TechCo lacked an effective process for setting list/target prices and updating as the market evolves.

Unjustified variability in discounts. TechCo’s discount, rebate and promotional programs were inconsistent and undisciplined.

Discount decision rights. The company’s existing process was ineffective and not oriented to value-seizing opportunities.

Data. TechCo wasn’t making good use of the data it had, missing opportunities to look clearly into pricing decisions and monitor pricing impacts.

The results of the diagnostics were combined with extensive interviews with TechCo senior management, customers and resellers, enabling the Bain team to further explore the issues and opportunities, with a focus on:

- Understanding the true value of TechCo’s products

- Determining why and where prices varied

- Identifying products that could command higher prices, and identifying customers with low price sensitivity

- Analyzing the commission structures across various sales channels

- Assessing TechCo’s deal- and discount-review processes, along with the IT capabilities that support pricing decisions

The Results

The structure, processes and tools put in place to improve TechCo’s pricing discipline produced clear—and in some cases, instant—benefits.

Reviewing TechCo’s portfolio of products, the Bain team quickly identified five that were underpriced. Adjusting those list prices resulted in several million dollars of revenue within six months.

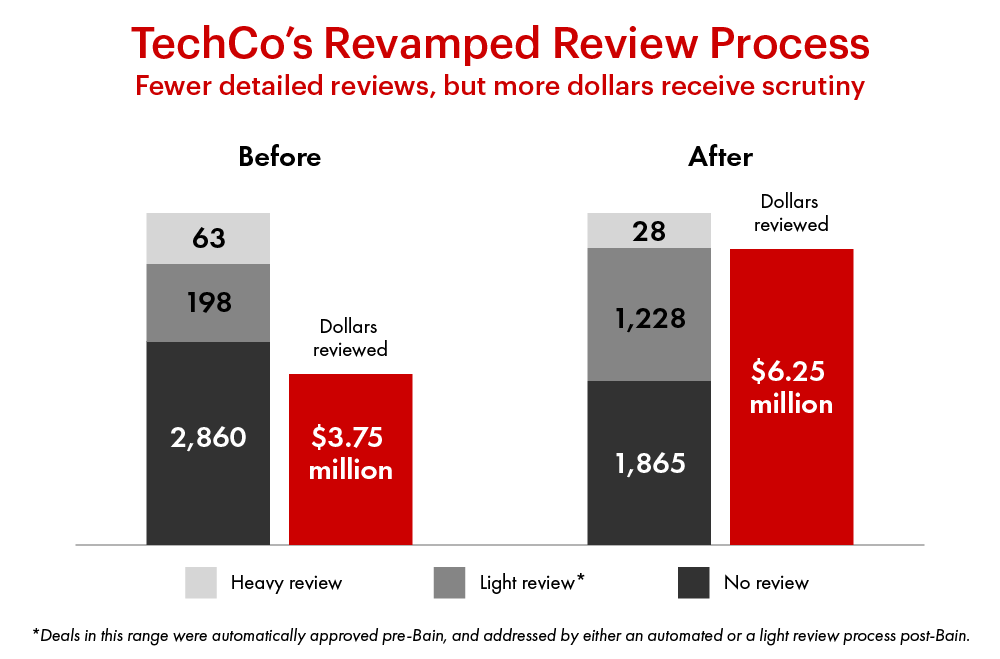

The Bain team recommended the implementation of “strike zones” to provide rigor in discounting and trigger reviews dynamically based on deal size, customer spending, customer type, competitors and other factors. Strike zones provide a clearly defined range of prices, varying by customer attributes and deal criteria, within which a salesperson can approve a deal without a manager’s involvement. Prices below the strike zone may require a manager’s approval, or, depending on the distance from the strike zone, a more senior manager.

Using strike zones not only empowers the front line, but leads to a better review process, with fewer deals being reviewed, but more dollars receiving scrutiny. To help salespeople apply the new processes, Bain developed pricing tools that gave reps quick access to pricing guidance for deals of similar size, complexity and other attributes. Bain also developed a family of dashboards for reps, office/regional managers and review teams, designed to monitor and enhance price realization, and to provide a historical view of like-for-like deals to aid in discount approvals.

The new pricing processes and tools were deployed to more than 1,000 frontline sales reps, and influenced more than $700 million in annual revenue. TechCo already projects an annual profit increase of more than $9 million, and that figure is expected to grow as the new pricing processes cover more product lines.

Bain also worked with TechCo to enhance the company’s approach to decision rights, positioning them to capture more value without adding employees or cost.

* We take our clients' confidentiality seriously. While we've changed their names, the results are real.