Etude

Bain is forecasting holiday retail sales growth of 3% to 4% this year, up from 2.6% in 2013. Our forecast includes both in-store and e-commerce GAFO sales1 in November and December. Blurring channel boundaries make it increasingly challenging to attribute growth across specific channels, but we estimate in-store GAFO sales growth of 1% to 2% over last holiday season (versus 0.9% growth in 2013) and e-commerce sales growth of 15% to 16% (in line with 15.7% growth in 2013); we also expect e-commerce to account for an increased share of overall sales, from 12% to 14%. Lower unemployment, falling gas prices, higher disposable income and healthy financial markets should encourage spending growth this holiday season. However, slower sales growth to date signals consumer restraint and softens our expectations. While performance will vary widely by retailer, winners will be those offering the best of both digital and physical worlds.

Moderate growth across blurred channel boundaries

Bain expects total GAFO sales1 growth of 3% to 4% this holiday season, up from 2.6% last year (see Figure 1). We define holiday sales as sales during the months of November and December. Our forecast blends both in-store and online GAFO sales because these channels are increasingly difficult to separate. Customers follow complex pathways in their shopping journeys, moving back and forth across channels to browse, buy and pick up their purchases. This has made it increasingly difficult for retailers to distinguish the contributions of each channel, and has led many of them to report an overall sales figure that combines in-store and online sales.

While we can’t precisely attribute sales to a specific channel, we've made estimates in order to tie our forecasts to results reported by the Census Bureau. Bain forecasts in-store GAFO sales growth of 1% to 2% this holiday season. We expect in-store performance will improve slightly relative to last year’s growth of 0.9% (see Figure 2). As omnichannel capabilities increase, shoppers are being drawn back into stores: buying online and picking up in store, reserving online and paying in store, or buying in store and shipping to their homes (see "Digital-Physical Mashups" in the September issue of the Harvard Business Review).

Our forecast for e-commerce growth of 15% to 16% is in line with last year and reflects the momentum we’ve seen in online sales during the first half of this year (see Figure 3). Mobile commerce, which accounts for 11% of e-commerce, is contributing to this momentum with second-quarter growth of 47% over last year. We expect e-commerce to account for an increased share of overall GAFO sales, growing from 12% to 14%.

Economic indicators suggest that holiday spend will increase this year. Lower levels of unemployment and increased disposable income will benefit lower income households. Meanwhile, the continued increase in stock market values will bolster spending by upper income households over the holidays. However, slower sales momentum this year softens our expectations. Lower growth in year-to-date and back-to-school spending this year compared to last year signals consumer restraint (see Figure 4).

Economic conditions vary by household segment

Current economic conditions impact different segments of the population in different ways. Our analysis suggests that the economic indicators most closely correlated to holiday spending will mildly benefit the 50% of households earning less than $50,000 a year. With lower unemployment and higher levels of disposable income, these lower income households are on slightly better financial footing than they were a year ago, and have more savings and credit to draw on for holiday spending. In addition, higher income households earning $100,000-plus a year will benefit from continued growth in financial markets.

- Lower unemployment levels. "Headline unemployment"—the rate of unemployment based on the number of people who officially say they don’t have a job and are looking for work— is down by 130 basis points since this time last year, dropping from 7.2% to 5.9%, the lowest level since 2008. More important, the sum of unemployment, underemployment and discouraged workers is down by a total of 190 basis points, from 13.6% to 11.8%, suggesting an even greater impact on consumers’ confidence and ability to spend this holiday season (see Figure 5). Combined with a slight increase in nominal wage rates of 2% over last year, we should see a 4.6% increase in wage income, or an additional $4.3 billion in average weekly wages.

- Falling gas prices. At $3 a gallon, the average price of gas is the lowest it’s been over the last three and a half years and is 8% lower than it was a year ago. Prices have dropped 14% since the beginning of August. Lower gas prices mean consumers will have more dollars to spend going into the holidays. Although these savings may not have a significant impact on spending behavior in upper- and middle-income households, most lower-income households will feel the difference, with savings on gas representing 10% of their average holiday spending.

- Higher disposable income, savings rate and credit levels. Disposable income has increased 2.5% in real terms over last year, boosting consumer optimism. The Consumer Confidence Index and the Michigan Consumer Sentiment Index are up by 19% and 7% respectively this year, with strong momentum since July (5% and 6% growth respectively). And households are saving more, with savings growing year-over-year after declining in 2013. With greater confidence, consumers are willing to take on slightly more debt: Overall credit levels have increased 3.1%, or $26 billion, since this time last year due to rising revolving-credit levels, primarily in credit cards.

- Continued growth in financial markets. Despite recent volatility, the S&P 500 index is up 10% to date this year and has reached an all-time high. This continued upward trajectory bodes well for upper-income households earning $100,000-plus a year as two-thirds of their wealth is held in financial assets. These households make up only about one fifth of US households but account for over a third of total US consumer spending and have historically contributed a disproportionate share to holiday spending. Bain’s global luxury goods study, published in October, expects the personal luxury market to grow 5% in the United States in 2014.2

Slower sales momentum softens expectations

Year-to-date and back-to-school sales performance, strong predictors of holiday GAFO sales, have both seen slower growth as consumers shift their spending to new cars, health and personal care, and building materials. This slower momentum in GAFO sales signals consumer restraint heading into the holidays and softens our expectations.

- Slower sales growth to date. Both year-to-date and back-to-school sales growth are strong predictors of holiday sales, with a combined R-squared of 0.47. This year, in-store GAFO sales increased just 1.0% year over year from January to September, and back-to-school sales grew 2.2% for the months of July and August. Although these rates are only slightly under last year’s (see Figure 6), they are appreciably below growth rates in 2012 of 4.1% and 3.2% respectively.

- Continued shift in spend to non-GAFO categories. Consumers have shifted their spending away from GAFO categories toward durables and consumables. Consumer spending on motor vehicles between January and September increased 8.1%, a function of easy credit and an aging fleet. Health and personal care also experienced significant growth of 6.0% during this period, while building and gardening grew 4.5%, reflecting sustained growth in sales of new homes.

Retailers are gearing up for the holidays

With the stretch between Thanksgiving and Christmas being short again this year (five days shorter than it was in 2012), more and more retailers are starting the season early. Walmart, Toys “R” Us and Target revealed their holiday top toys in September; holiday displays have been popping up in store windows across the nation; and the season’s first promotions have long been announced.

There are a number of reasons retailers want to extend the holiday season. First, a longer season means less chaos in stores, which means a more-productive shopping environment, and that means higher sales. A longer season also gives retailers a chance to restock merchandise and eases the need for extra distribution capacity. It reduces overtime costs, too, as well as the need to recruit, train, supervise and then dismiss large numbers of temporary workers and extra security personnel. Finally, it lessens the risk of bad weather keeping last-minute shoppers away from stores or delaying deliveries to their homes.

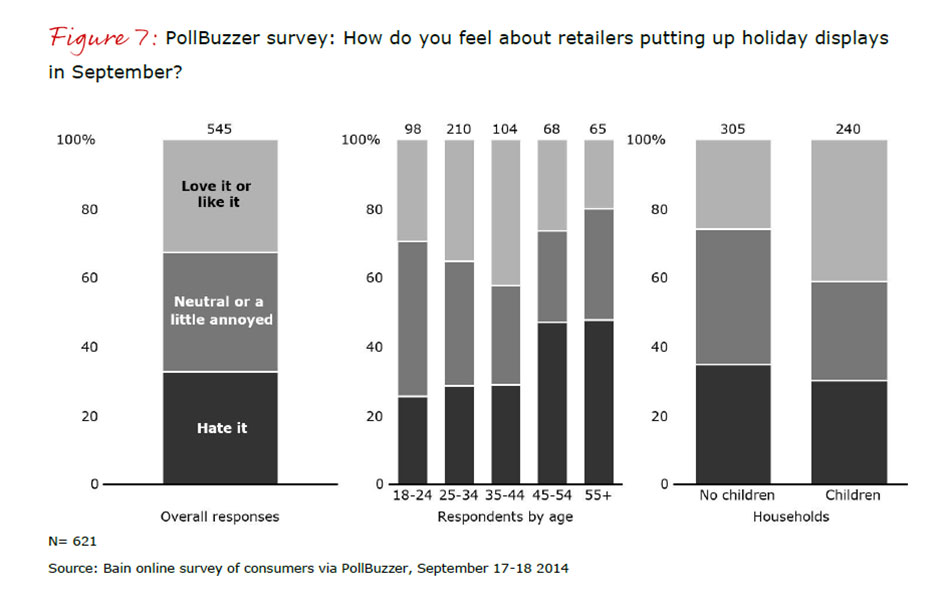

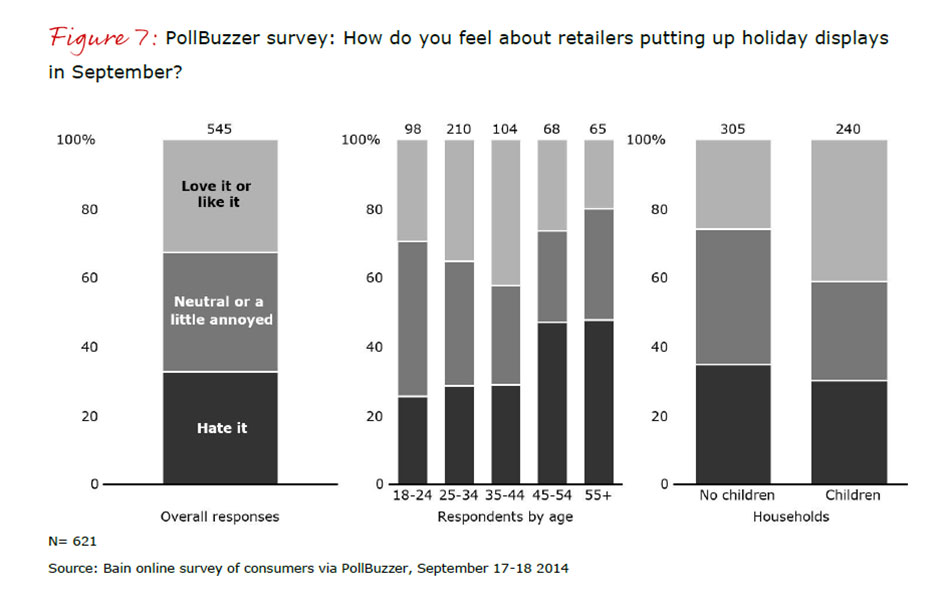

And survey data seem to support the idea that a longer holiday season is a better one. According to the National Retail Federation, 20% of consumers started their holiday buying in September, and 40% were shopping by Halloween. We conducted our own study with PollBuzzer in September and surveyed 550 adults in the United States.3 When asked how they felt about retailers putting up holiday displays this early, one-third claimed that early launches drive them crazy, one-third was largely indifferent or found the displays “a little” annoying, but a surprising one-third said they liked or even loved early holiday promotions (see Figure 7). The positive responders report that early holiday marketing puts them in a good mood, keeps them from procrastinating and gives them helpful ideas. Those most likely to appreciate early promotions include shoppers under 45, those with children in their households and those with annual incomes under $20,000. This last group may welcome the chance to spread holiday spending over a longer period.

Amazon may be showing signs of weakness, but it’s bigger than ever this holiday season

E-commerce is front and center this holiday season, and we’ll be watching closely to see what Amazon has in store. The company’s recent earnings announcement disappointed investors in both revenues and profits. Although Amazon continued to show growth in North America in the third quarter, rising costs resulted in a razor-thin operating margin of 0.7% (versus 4% in 2009). Low levels of investor confidence have led to a 25% decline in the company’s market capitalization year to date, falling from $182 billion to $137 billion.

Yet the online retail giant, which accounts for more than 20% of US online retail sales by gross merchandise value, continues to outpace US e-commerce growth year over year. It has continued to solidify its leadership through broad assortments, low prices and quick delivery. Expanding its product range by about 10% this year to offer more than 250 million SKUs, it stocks 2,000 times as much as an average superstore. In a single month, Amazon has up to 120,000 unique visitors, three to five times what the largest US retailers see. It continues to raise expectations for rapid fulfillment: It currently offers same-day delivery in 12 cities and plans to offer Sunday delivery to 50% of the nation’s population by the end of the year. With more than 50 distribution centers in the United States, 8 new “sortation centers” (which send packages to nearby post offices), expansion of Amazon Lockers into new markets and the trial of its own delivery network in select urban centers, Amazon continues to set the bar for what it takes to win the last mile.

Heading into a season of heavy promotions and last-minute deliveries, we expect to see Amazon use its scale to win pricing and distribution battles throughout the holidays. And this year the online giant is hoping to counter the one advantage traditional retailers have over online pure plays: stores. Amazon will be operating two pop-up stores in California during the holiday season and is rumored to be opening its first permanent physical store in the middle of New York City. This permanent space would allow customers to browse the company’s latest technology products and give them the added convenience of picking up or returning items in store.

Looking forward: Drivers of success this holiday season

Although there is potential for growth this holiday season, as reflected in our forecast of 3% to 4% omnichannel GAFO growth, there will be winners and losers across categories. Retailers that come up with new ways to offer the best of both physical and digital worlds will come out on top. New technologies are improving in-store shopping experiences, reducing checkout times, customizing offers, enabling safe mobile payments and more. Improved fulfillment capabilities and innovative third-party players are helping retailers compete in the last mile. And, as every year, we expect heated pricing battles. This should be a very exciting holiday season to watch.

We look forward to discussing these themes and sharing insights on what winners are doing this holiday season in the upcoming editions of our Retail Holiday Newsletter:

- Issue #2 (mid-November): Spotlight on technology

- Issue #3 (early December): All eyes on shipping as retailers sprint toward Christmas

- Issue #4 (mid-December): The art and science of pricing

- Issue #5 (late January): Post-holiday outlook

Please let us know if you have specific topics you would like to learn more about. We look forward to sharing news of innovations and interesting strategies with you this holiday season.

For a list of selected references, please view the full article.

Appendix

1 GAFO sales include sales at general merchandise stores; clothing and clothing accessories stores; furniture and home furnishings stores; electronics and appliances stores; sporting goods, hobby, book and music stores; and office supplies, stationery and gift stores. See Exhibit 1 in the Appendix for definitions of GAFO and other sales measures.

2 For a copy of Bain’s "Global Luxury Goods Worldwide Market Study, Fall 2014 Update," please contact Dan Pinkney at dan.pinkney@bain.com.

3 PollBuzzer™ (www.AskPollBuzzer.com) offers a real-time consumer opinion survey product. According to PollBuzzer, clients use demographic, geographic and socioeconomic filters to build customized panels drawn from PollBuzzer’s proprietary national respondent pool, build their own surveys using a do-it-yourself Web interface and receive Excel-formatted results in as little as one hour after launch.