Forbes.com

Private equity exit activity began 2012 just as it ended 2011—dead in the water. PE-backed sales to strategic buyers, normally the mainstay of global buyout exits, plunged late last year on fears that the fragile US recovery could unravel and worries that eurozone problems might spill over to the global economy. IPOs could not get out of the gate, and sponsor-to-sponsor deals stalled. As we discuss in detail in Bain’s Global Private Equity Report 2012, it is difficult to see how exit opportunities will improve until those clouds of uncertainty lift.

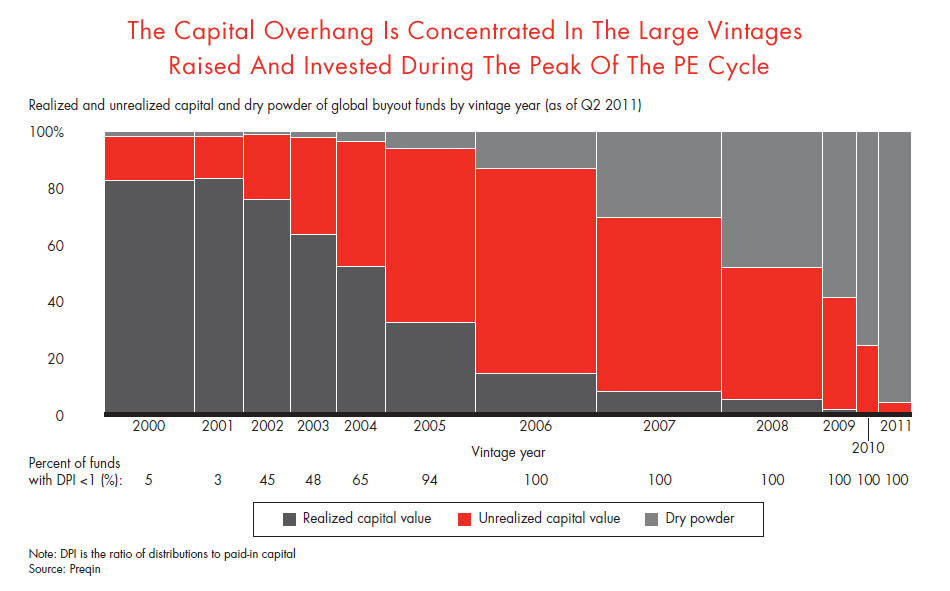

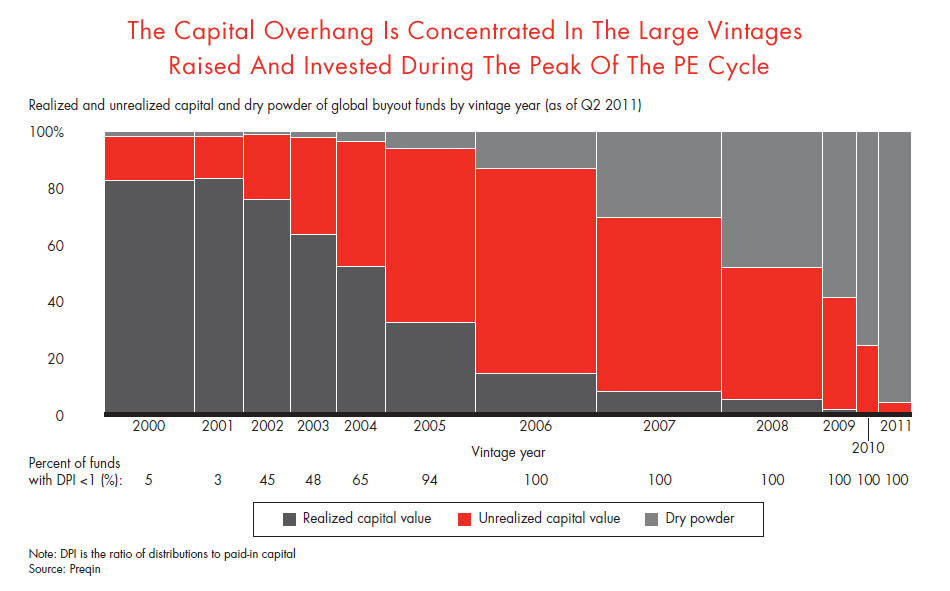

The exit bottleneck continues to aggravate a problem that has plagued PE firms since the 2008 downturn and dominated exit conditions in 2011—the increasing amount of unrealized capital frozen in their portfolios and the stubborn dilemma of when and how it can be monetized. The value of unsold assets swelled to nearly $2 trillion, two times more than all of the dry powder GPs were looking to invest. Working through the backlog will not be easy. The vast bulk of the unrealized capital stems from huge buyout fund vintages that closed from 2006 through 2008 and is tied up in investments made at peak value before the downturn (see figure).

That puts GPs in a bind. They cannot return cash to LPs and their investment professionals until they liquidate these frozen holdings, but the assets are not ripe for sale in today’s market on terms that are attractive to GPs. PE fund managers have successfully nursed their high-priced portfolio companies through the downturn, but GPs still hold the overwhelming majority of them at valuation multiples below what they need to reap to earn their carry. They will need to continue to work with their portfolio company managers to prepare them for eventual sale by creating additional value.

Meanwhile, the pressure to return capital to LPs increases. The pace of distributions to LPs as a ratio of the capital they paid in to recent fund vintages has been glacial. For example, five years into the lifecycle of 2005 vintage funds, the median buyout fund had returned only about 20% of their LPs’ paid-in capital. At an equivalent point in the lifecycle of the 2001 vintage funds, GPs had distributed more than 70% to their LPs.

What could cause exit activity to perk up in 2012? Certainly there is considerable pent-up interest on the part of buyers to purchase PE assets as there is on the part of GPs to sell them. Growth is high on the agendas of corporations that are looking to put their deep cash reserves to productive use in M&A activity. Likewise, there is no reason to believe that interest in sponsor-to-sponsor deals will fade. GPs on both sides of these transactions are keenly interested in putting money to work as investors and returning capital to LPs as sellers. The global IPO pipeline is also filled with filings for new PE-backed listings, with more than 80 portfolio companies biding their time until market conditions stabilize. Most IPO hopefuls will continue to battle market headwinds as they wait for volatility to subside, but high-quality companies with compelling growth stories could break through.

As they weigh the exit prospects for 2012, what PE funds in both the mature and emerging markets need more than anything else to spark their animal spirits is confidence that global economic growth is firmly on track. Lacking that elusive ingredient, the exit outlook will likely be lackluster.

This post was written by Graham Elton, Bill Halloran, Hugh MacArthur and Suvir Varma, leaders of Bain & Company’s Private Equity Group.