Brief

“While the Green Revolution benefited many farmers, the adoption of promising agricultural technologies has remained particularly low among the poor.” —Agriculture Technology Adoption Initiative (ATAI) White paper, 2013

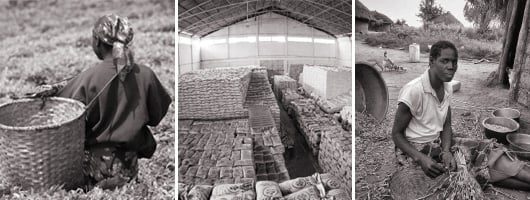

Agriculture is the primary livelihood for most poor people in the world today. We will not be able to address global poverty if we do not devise large-scale solutions that improve the livelihoods of smallholder farmers. The need to encourage smallholder farmers’ widespread adoption of agricultural innovations is especially relevant in the countries we focused on for this study: India, Pakistan, Uganda, Kenya and Ghana. More than a billion people earning less than $4 per day live in rural areas in these countries, and agricultural workers’ percentage of the national labor force ranges from 45% in Pakistan to 82% in Uganda.1

Why smallholder farmers matter

Smallholder farmers are important producers of agricultural goods. While many produce largely for their own consumption, they are increasingly becoming part of global value chains. For example, smallholder farmers produce more than 80% of the world’s coffee and 90% of the world’s cocoa.2

Yet farmers’ productivity in developing countries significantly lags behind productivity in developed markets: Cereal yield per acre in Africa is less than one-half of the global average, and milk production per cow is less than one-quarter of the global average (see Figure 2).3

This productivity gap is, in large part, the result of infrequent and inconsistent application of basic agricultural technology and techniques. Practices that are commonplace in wealthier countries and that have underpinned various “green” revolutions are largely absent in the poorer parts of the world. For example, sub-Saharan Africa has a regional average fertilizer usage of less than 10 kg per hectare compared with the world average of 11 times that number,4 and in India, 65% of arable land is still rain-fed.5 Previous research has shown that simple products like drip irrigation, fertilizer and high-yielding seeds could increase global crop yields by as much as 67%.6 This is all the more urgent as the world’s population approaches 9 billion and food consumption is expected, by 2050, to grow by 40% from today’s levels.7 If we cannot catalyze the widespread adoption of agricultural innovations, the twin blights of poverty and food insecurity will remain or may even worsen.

The challenges for smallholder farmers are numerous. Their incomes are low, many are relegated to marginal lands and growing populations and inheritance practices mean smaller and smaller farms, undermining the ability of these farmers to apply technologies that work in the developed world. We need more innovations optimized for these farmers, innovations that address immediate needs for productivity gains and that are sold in ways that reflect an understanding of how farmers really make decisions and how wealth is created and sustained across the agricultural system.

We found four factors, the Four A’s, to have the most explanatory power for what promotes adoption of these powerful agricultural innovations: awareness, advantage, affordability and access. The Four A’s help firms assess whether they have addressed the most immediate incentives of adoption for smallholder farmers. Although this paper emphasizes the specific practices relevant to smallholder farmers, the framework of the Four A’s can usefully be applied by pioneer firms serving low-income customers across a variety of sectors.

Why aren’t pioneer firms consistently delivering on the Four A’s of adoption today?

Pioneer firms are selling to what are perhaps the most challenging customers in the world: low-income, smallholder farmers whose decision to adopt an agricultural innovation directly affects household income and their ability to feed their families. The dispersion of these farmers across rural areas, the significant time lags between the use of a product (e.g., better seeds, an irrigation system) and their realized benefits (when crops are consumed or sold) and the diverse environmental and agronomic conditions in which these farmers operate all make it difficult for firms to serve these farmers efficiently and effectively.

As small start-ups targeting a hard-to-serve customer segment, the firms themselves can struggle to access personnel, low-cost capital and—critical in agriculture—partners across the value chain, from field to table. They struggle to formulate their strategy and operating model, given that every region they operate in presents new challenges and obstacles. This situation can often be further complicated by challenging market systems, including poor physical infrastructure or government intervention, as well as pricing policies that effectively restrict access to markets and reduce or eliminate incentives to compete.

Finally, exogenous factors like disease and weather can wipe out any gains from adopting an innovation. Consequently, agricultural innovations often do not spread far and wide enough, the firms that develop them have trouble reaching scale and profitability and large numbers of smallholder farmers fail to gain access to productivity-enhancing products and services.

"Innovations" and "adoption" in the context of smallholder farmers We regard “innovations” as products and services that are new to farmers, not necessarily ones that have been recently developed. Drip irrigation methods, for example, have been available for decades. But a microdrip irrigation product is an “innovation” from the perspective of smallholder farmers who could not have afforded to purchase a traditional drip irrigation product. “Adoption” occurs in two parts. There is the initial, trial adoption by a farmer and the sustained adoption that permanently changes a farmer’s practices. The ultimate goal for pioneer firms is the sustained, paid-for adoption. Throughout this paper we are concerned with the practices that result in this outcome. |

||

The primacy of the firm

Much of the conversation surrounding the power of the private sector for development has rightly focused on the ability of private companies to scale up to serve hundreds of thousands or even millions of customers. The recent Monitor–Deloitte study Beyond the Pioneer: Getting Inclusive Industries to Scale8 highlights the importance of creating the right enabling environment to accelerate firms’ success. The report focuses on the role that “industry facilitators” can play in addressing barriers to scale for firms and for the wider business system in a given sector and region.

We agree that sector building is vital, and we make specific recommendations in this report for ways corporations, foundations and development agencies, investors, NGOs and governments can individually and collectively enable sector development and growth, based on examples of what has worked. However, we also believe that insufficient focus has been placed on the pioneer firms themselves, especially on their development and execution of strategies and operating models as they scale and, in the process, drive adoption of their innovation. Although there are certainly major capital gaps and a dire need to develop the right enabling environment in which firms can succeed, nothing will happen without a larger number of successful pioneer firms finding ways to profitably serve these hard-to-reach customers at scale. By understanding what is working in this primary point of contact between firms and end customers, whether in agriculture or otherwise, and how to better enable this success, all the relevant actors in this system can better assess what they should and should not do.

That is why the pioneer firm is our starting point for analyzing how to put more smallholder farmers on the path to prosperity. This report provides a foundation for understanding and addressing issues of adoption by starting at the center of this challenge.

As pioneer firms know all too well, the challenges to achieving sustained adoption at scale are formidable. Acquiring a clearer understanding of smallholder farmers as customers and building Repeatable Models in frequently underdeveloped systems are notoriously hard and can take a long time. Our research reinforces the notion that patience is a necessity rather than a virtue when seeking to overcome the barriers to smallholder farmer adoption at scale.

Shining a spotlight on 11 pioneer firms

We conducted in-depth research into the practices of 11 pioneer firms that develop products and services to meet the needs of smallholder farmers. Throughout this report, we use these case studies to illustrate practical solutions to the challenges of delivering on the Four A’s and developing Repeatable Models. Although pioneer firms are only one type of actor in a complex system, they are well positioned to understand the needs of smallholder farmers and connect them to broader value chains in a fairer and more transparent manner. Consequently, these case studies offer insights that can help to unlock value throughout the system.

To ensure that the case studies covered a diverse cross-section of organizations, we selected firms from Acumen’s agriculture portfolio as well as other companies and organizations. We sought diversity with respect to four dimensions:

- Regions served: The selected firms serve farmers in South Asia (India and Pakistan) or sub-Saharan Africa (Ghana, Kenya and Uganda).

- Sectors served: Firms offer products or services relating to cash crops (for example, chili peppers and cotton), staple crops (rice, maize and sorghum) or livestock (cows and poultry).

- Value-chain segment: Some firms provide agricultural inputs (irrigation equipment, seeds or comprehensive packages), whereas others purchase outputs (crops or milk) or offer services.

- Stage of maturity: The firms range from early-stage companies in their first one to two years of operation to mature companies operating for more than 10 years.

To understand each of the firms we studied, we analyzed internal company data and conducted extensive interviews with the founders, key members of the management team and frontline staff. As would be expected, some of these companies have struggled at various times to determine their optimal business model. We highlight their challenges as well as their successes in this report so that other firms can benefit from the full range of their experiences.

Among the 11 firms we studied, five are featured most prominently:

Global Easy Water Products (GEWP) markets and distributes low-cost microdrip irrigation products to smallholder farmers in India. The firm began operations in 2004 as a for-profit spin-off from International Development Enterprises India (IDEI), an NGO specializing in irrigation. In 2013, GEWP had approximately 21,000 customers and revenues of $2.3 million. GEWP is an Acumen investee.

GEWP’s most successful product is drip tape, a simple irrigation solution that the company produces in different thicknesses to correspond with requirements for short-term crops (e.g., vegetables) and long-term crops (e.g., tree crops). The company procures microdrip irrigation equipment from local contract manufacturers and distributes its products through a network of private local distributors and retailers. The firm also provides accessories for the installation of microdrip irrigation systems, including control valves, filters and fertilizer systems.

Juhudi Kilimo is a microfinance company providing asset-backed loans to smallholder farmers in Kenya that enable them to buy productive assets, such as dairy cows. The firm also provides business support and technical assistance in the form of training for their borrowers. Juhudi Kilimo was founded in 2004 as an agribusiness initiative within the K-Rep Development Agency, a microfinance NGO. By 2009, Juhudi Kilimo had become an independent for-profit social enterprise. In 2013, its loan book totaled approximately $5.8 million with revenues of $1.7 million. The firm serves 20,000 clients and has set a target of reaching 100,000 clients by 2015. It has approximately 150 employees across 20 branch offices in southwestern Kenya. Juhudi Kilimo is an Acumen investee.

Unlike traditional microfinance, which primarily provides loans for working capital, Juhudi Kilimo finances specific agricultural assets that offer immediate and ongoing income for farmers. Loans for dairy cows make up approximately 45% of its portfolio. Other financed assets include poultry, irrigation equipment and transportation equipment. These assets are insured to protect both clients and Juhudi Kilimo from business losses. The company reduces farmers’ risk of further indebtedness by using the assets as a form of collateral in case of default. Groups of clients (typically groups of five) co-guarantee their loans and support one another with oversight from Juhudi Kilimo’s loan officers. Farmers within these groups share ideas and encouragement, learn about new products and services and organize for access to better pricing and markets.

Through training, technical assistance and capital, Juhudi Kilimo helps smallholder farmers develop larger agribusinesses. To grow markets for smallholder farmers, it also supports rural enterprises such as milk-chilling plants, coffee mills and mango-processing plants.

One Acre Fund (OAF) is a nonprofit organization providing smallholder farmers in East Africa with a comprehensive “market bundle” that includes farm inputs on credit, delivery of inputs, training and facilitating harvest sales. OAF began operations in Kenya in 2006 and has expanded to Rwanda (2007), Burundi (2012) and Tanzania (2013). By 2013, it was serving 130,000 farmers operating on more than 87,000 acres. It has set a target for 2014 of serving more than 200,000 farmers operating on 137,000 acres. According to OAF, its farmers have raised their incomes by 52% per acre planted, representing an increase in annual profit per farmer of $139.

In Kenya, OAF provides an $80 loan per one-half acre in the form of farming inputs: seeds and fertilizer. It delivers these inputs within walking distance of the farms it serves and offers training to farmers on how to use them effectively. OAF also helps increase harvest sales by providing safe storage and connections to local traders.

OAF has approximately 2,600 full-time employees. To grow the customer base, staff members visit new markets and use training and demonstration pilots to educate farmers on the market bundle’s benefits. OAF maintains its presence in the villages through weekly training conducted by its field officers.

Sidai operates franchised and branded Livestock Service Centers that provide inputs and veterinary services to farmers in Kenya. The company is working to address the significant problems farmers face in getting access to quality products and services. There are many substandard or counterfeit products on the market, and most retailers are unqualified to give reliable technical advice to farmers. As a result, farmers waste a lot of money on unnecessary purchases and often don’t use what they purchase correctly. Founded in 2011, Sidai is a for-profit company of the nonprofit Farm Africa. The firm currently has six company-owned stores and 70 franchised centers across Kenya and had revenues of $1.4 million in 2013. It intends to establish a network of at least 150 service centers by 2015.

Sidai offers numerous products for livestock, including antibiotics, vaccines, feeds and multivitamins. It also sells crop inputs, including agrichemicals, fertilizers and seeds. The firm complements these offerings with on-farm services to provide preventive healthcare for livestock and improve productivity.

The company’s service centers are owned and run by veterinarians, livestock technicians and other livestock professionals. To support franchisees, Sidai obtains quality products, offers business training and, if required, helps franchisees gain access to finance to launch or grow their operations.

SV Agri provides an end-to-end value chain for smallholder potato farmers in India by delivering necessary inputs (including high-quality potato planting materials) and connecting farmers with commercial buyers. The firm, which began operations in 2008, was started by a team with 40 years of combined experience in managing agribusiness supply chains for major corporations. It currently has more than 125 franchisees operating in seven Indian states.

The firm focuses on creating value across the potato supply chain by blending knowledge of agriculture, processing and technology. It supplies good-quality potato planting material to farmers with the support of the Central Potato Research Institute in Shimla for the transfer of aeroponic technology to produce tubers at significantly lower costs. Its rural distribution program provides smallholder farmers with pesticides and fertilizers in addition to planting materials. The firm also seeks to improve the performance of small and midsize processors by providing technical solutions and equipment.

SV Agri recruits franchisees with a commitment to the firm’s mission and supports the franchisees by providing training, marketing and financial guidance.

Our discussions with six other firms were valuable in shaping the insights discussed in this report:

BASIX Krishi is a part of the BASIX Group, a pioneer in providing services for rural development. It started operations as the Agricultural Business Development Services division within BASIX Group’s microfinance arm. The organization is now piloting the provision of services for other institutions, including the National Bank for Agriculture and Rural Development and the state government. BASIX Krishi is an Acumen investee.

Gulu Agricultural Development Company (GADC) is a commercial cotton ginnery established to revitalize the agricultural economy in war-ravaged Gulu, Uganda. The firm procures its raw cotton directly from smallholder farmers while providing farmers with access to key inputs and extension services. Recently, the organization has evolved its business model to support sesame and chili farming in addition to cotton. GADC is an Acumen investee.

The Global Agri-Development Company (GADCO) is an integrated agri-food business in Ghana focused on rice production and processing and the marketing of cereal and protein-based foods. The company launched the Copa Connect program in 2013 to integrate smallholders into its rice value chain to supplement its existing 800-hectare nucleus farm. Through Copa Connect, GADCO uses technologies from its nucleus farm to benefit smallholders by providing inputs on loan, training and market access. The company has invested in a processing facility and continues to strengthen partnerships with leading organizations across the value chain. GADCO is an Acumen investee.

KK Foods aggregates fruits and vegetables produced by smallholder farmers in Uganda and exports them to Europe. It encourages farmers to switch from consumption crops to cash crops (such as chilies) and supports them with both inputs and training. The company currently accounts for up to 70% of the export of fruits and vegetables from Uganda and aggregates output from approximately 40,000 smallholder farmers.

The National Rural Support Programme (NRSP) is an agriculture-focused microfinance bank in Pakistan that specializes in providing working capital microloans to smallholder farmers for purchase of key farming inputs. NRSP is an Acumen investee.

Western Seed produces high-yielding hybrid seeds in Kenya, with a specialty in maize. The company provides a range of seeds designed for varying altitudes, ecological zones and crop life cycles. Western Seed is an Acumen investee.

Farmer profile: Pamela

An early One Acre Fund farmer

Pamela* owns several acres of land in western Kenya and grows almost a dozen crops, including maize, chilies, sorghum and sugar cane, which she rotates regularly. She shares her home with her husband and children. Pamela was trained as a teacher before she began farming and raising her family.

Pamela used to buy seeds from agricultural retail stores, or “agrovets.” The seeds were inexpensive but of low quality. Sometimes the seeds would contain seed rot; often, the seeds did not produce the expected yields. In addition, these retailers required upfront cash payment. Pamela’s purchasing ability was greatest right after she had sold her harvest. However, this money would often already be spent by the time she needed to buy inputs for the next growing season.

Pamela heard about OAF in 2010: “A field officer came and pitched the idea to me in 2010. She said that we will teach you how to plant better and our inputs will improve your yield.” Although OAF’s inputs were more expensive than those offered at the agrovets, Pamela joined OAF because she could buy the inputs on credit and repay the loan on her own schedule, based on what she has week to week. She receives the seeds and fertilizer at a location in Kibochi, a few kilometers from her farm.

According to Pamela, “The One Acre Fund seeds have never failed, and they are always there when I need them before planting. I’ve personally convinced five neighbors to join the program.” Pamela finds that the seeds perform as promised and are delivered at the right time for the planting season, and she has access to the financing she needs to be able to purchase them.

* Full name and select personal details have been disguised

NEXT · CHAPTER 2 · Why farmers adopt: A focus on the Four A's

1 Based on data from United Nations Department of Economic and Social Affairs, Population Division, 2014 Revision of the World Urbanization Prospects and CIA World Factbook entries for India, Pakistan, Uganda, Kenya, and Ghana.

2 Fairtrade Foundation, Powering Up Smallholder Farmers to Make Food Fair: A Five Point Agenda, London: Fairtrade Foundation, 2013. World Cocoa Foundation, Cocoa Market Update 2012. http://worldcocoafoundation.org/wp-content/uploads/Cocoa-Market-Update-as-of-3.20.2012.pdf.

3 Food and Agriculture Organization of the United Nations, FAOSTAT, http://faostat.fao.org/.

4 International Fertilizer Development Center, “Improving Fertilizer Supplies in sub-Saharan Africa,” IFDC Report 37, no. 2 (2012).

5 Jamil Ahmad, Dastgir Alam, and Shaukat Haseen, “Impact of Climate Change on Agriculture and Food Security in India,” International Journal of Agriculture, Environment and Biotechnology 4, no. 2 (2011): 129–37.

6 Mark W. Rosegrant, Jawoo Koo, Nicola Cenacchi, et al., Food Security in a World of Natural Resource Scarcity: The Role of Agricultural Technologies, Washington, DC: International Food Policy Research Institute, 2014.

7 Nikos Alexandratos and Jelle Bruinsma, “World Agriculture Towards 2030/2050: The 2012 Revision,” Food and Agricultural Organization of the United Nations, http://www.fao.org/docrep/016/ap106e/ap106e.pdf.

8 See Harvey Koh, Nidhi Hegde, and Ashish Karamchandani, Beyond the Pioneer: Getting Inclusive Industries to Scale, Mumbai: Deloitte Touche Tohmatsu India Private Limited, 2014.