Brief

Ask a friend whether he would recommend his mobile phone, Internet or cable provider, and chances are you won’t be convinced to sign on with that company. The truth is, across all three markets, customers typically go with the provider they feel is “least objectionable” rather than one they feel strongly about using—or even better, one that they would recommend to friends. This apathy doesn’t need to exist. Wireless customers, for example, are often quite enthusiastic about the devices they use (consider the passions of iPhone vs. Android users). But few service providers win true affection or loyalty.

As long as subscriber numbers continued to grow, providers accepted being “good enough” in customers’ eyes. In cable and Internet services, the absence of significant competition helped. But companies in all three markets now compete on a changed playing field. With penetration flattening (wireless penetration in the US, for example, is nearly 100 percent) and competition intensifying, companies must fight for market share as never before.

As a result, the strategic priority for communications service providers has shifted dramatically from simply acquiring customers to keeping the customers they already have. What does this mean? Having an acceptable performance is no longer good enough. To be successful, providers will need to earn their customers’ love—in large enough measure for customers to choose to stay loyal when tempted by competitive offers.

Providers understand the theory of retaining customers and reducing churn. The first step is to eliminate the factors that would make a customer walk away—factors like poor network coverage or an inefficient and frustrating customer call center where customers are transferred four or five times before reaching the right agent. Many are making the organizational and process changes required to solve these and other problems that cause customer dissatisfaction.

That’s a necessary step, but it’s not sufficient to win customers’ hearts and minds and truly differentiate against competitors. The fact is that the ultimate industry leaders will be those companies that deliver consistently on the basics and then go the extra step to delight customers, as opposed to just avoiding offending them. These winning providers will spark a “wow” effect with the people who buy and use their services—as Apple does with customers of its computers and handsets. Put another way, the long-term winners will be those that create true customer promoters of their products and services.

One effective way to measure the level of customer enthusiasm, and learn how to improve it, is with the use of the Net Promoter® system. To start out, companies should measure their Net Promoter score (NPS®) by asking customers a single question: “How likely are you to recommend [this company or product] to a friend or colleague?” Respondents giving marks of nine or 10 are promoters, the company’s most devoted customers. Those scoring their experience at seven or eight are passives, and those scoring it from zero to six are detractors. NPS is the percentage of promoters minus the percentage of detractors (see below: NPS 101— Building a Net Promoter system with closed-loop feedback).

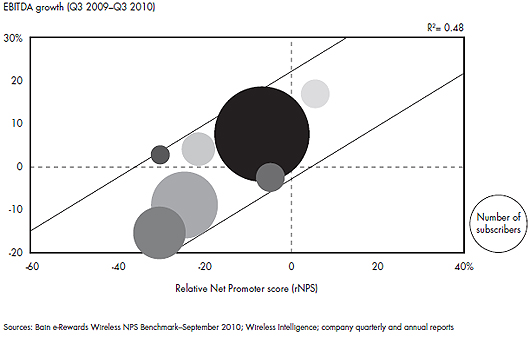

Clearly, a company’s promoters and its NPS relative to competitors’ are critical to its success. To understand the value each promoter brings to a communications service provider, Bain & Company recently surveyed almost 3,000 US customers in the three communications service markets: wireless, fixed Internet and pay-TV. We found an empirical link between profitable growth and a company’s NPS relative to its competitors’. There is a link to several value creators, including reduced churn, increases in revenue per user and referrals. In other words, customers stay longer, buy more and tell their friends. They also give useful feedback that can help improve the business.

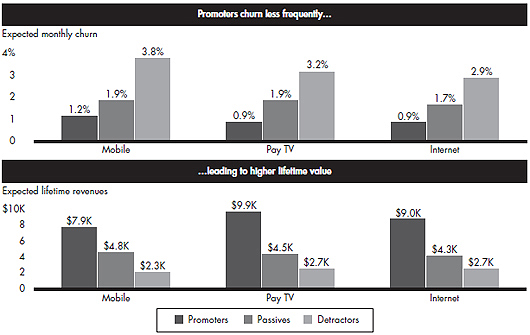

Each of these elements can be quantified. We found that, across the board, promoters are consistently far more valuable than detractors. In the wireless market, for example, promoters generate on average nearly 80 percent higher lifetime revenue than passives and nearly two and a half times more revenue than detractors, based on their longer tenures. They are far less likely to churn than passives and detractors.

Just as important, promoters—as the name implies—are more willing than other customers to recommend the provider to potential customers. In wireless, for example, promoters recommend to six people on average. In Internet and cable, they generate on average 4.6 referrals, according to our study. They also serve to lower the cost of acquiring subscribers. Because promoters are essentially doing some of the marketing, companies don’t have to spend as much as their competitors. Clearly, in an environment marked by increased competition and slower growth, promoters have the ability to dramatically swing momentum toward—or away from— individual providers.

To turn customers into advocates, providers need to know what customers love

Despite the importance of promoters, NPS scores are, on average, low for communications service providers vis-à-vis many other industries, with many companies facing more detractors than promoters. So the challenge for mobile, Internet and cable providers is to understand the key factors that turn customers into promoters.

Bain’s recent survey gave us important insights into what companies can do to gain ground with customers. First, customers want companies to satisfy their needs in the basic areas such as price, network coverage and customer service. These are the table stakes. But to gain a competitive advantage, operators must then exceed expectations on some elements of the customer experience. Providers need to figure out which areas matter for their customers and determine where there is significant value in over-delivering. In short, providers need to prioritize investments based on the risk of angering customers and the potential of wowing them—and to focus on those dimensions that are perceived as most valuable for the customer. These sources of differentiation are likely to vary by customer segment.

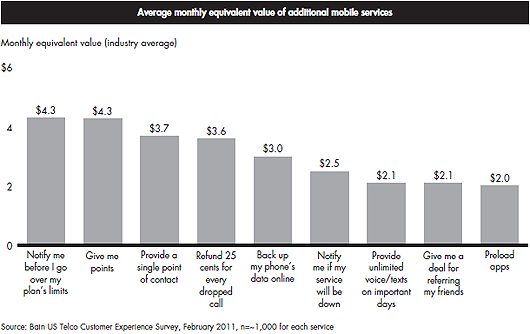

In wireless, for example, we found that many customers like to be notified if they go over their plan limits. In fact, they find such notification as attractive as a $4 monthly discount on their bill. We also determined the value of other possible benefits. Giving customers a single point of contact would be worth the equivalent of $3.70, and offering a 25-cent refund for every dropped call could be as valuable as a $3.60 discount. In other areas, our survey found that it isn’t even worth investing unless you can exceed expectations. These include offering bundled deals or the flexibility to change plans.

By analyzing customer data for all product and service elements, we identified the 10 critical dimensions of the customer experience in which companies have the biggest opportunity to win, delight and keep their customers.

Win me!

- Find out what excites different customer segments, and create a value proposition to satisfy them.

- Get the customer to talk about your positive attributes to the right people, especially on social media.

- Be passionate about educating customers when you sell to them, and make installation and activation as smooth as possible.

Delight me!

- Deliver an exciting product experience that makes you different from competitors in at least one area important to your customers.

- Nobody likes receiving bills, but at least keep customers from complaining by providing bills that are clear and accurate.

- Be a champ about resolving issues.

- Create pleasant and effective processes for upgrading, cross-selling, renewing and relocation services.

Keep me!

- Let your high-value customers know they are your high-value customers—and shower them with rewards.

- Know how to proactively detect when your customers are disappointed—and know how to change their minds.

- When customers opt to cancel, have a plan for bringing them back (at least the ones you want to keep).

Learning from the best

Communications service providers can innovate and differentiate on these dimensions to generate “wow” effects and earn the passionate loyalty of their customers. In doing so, they can draw ideas from customer experience leaders in their own markets and in others.

Win me!

Find out what excites different customer segments, and create a value proposition to satisfy them. The truth is that communications service providers have much room for improvement when it comes to customizing product or service packages for particular customer segments. However, some providers are finding success in this area. For example, MetroPCS Communications tailors its service to price-sensitive customers—those who want to make sure they’ve got the least-expensive deal. There are no bill surprises. It’s all prepaid, with no need to count minutes. And it’s simple to understand. In an industry known for complicated bills and hidden charges, this creates the highest NPS scores in the industry. Or consider DirectTV, which has been pursuing a different segmentation approach. Until now, most cable companies’ TV offerings have been fairly standard, comprising a basic package with only a few premium options (which often require customers to buy channels that they don’t want in order to get the ones they do want). DirectTV was willing to wager that a segment of customers would pay premium rates for the best sports package—a large number of sports channels and interactive services. The approach has paid off for DirectTV, which has earned an NPS of 23 percent, far above the industry average of 6 percent.

Get the customer to talk about your positive attributes to the right people, especially on social media. Customers are highly influenced by friends. That’s why winning companies work hard to enable customer promoters to convince friends about the benefits of their service, particularly friends who are likely to become promoters themselves. Today, there’s no substitute for social media as the channel for creating buzz and referrals. Dell is one company working to make the most of social media. The company’s @DellCares service allows it to interact with potential customers online and facilitate promoter interactions with potential customers. Its Social Media Listening Command Center proactively monitors the Internet for potential customer complaints. Under the program, forums facilitate customer-tocustomer support, customer service issues are addressed on Twitter and YouTube videos provide self help. Meanwhile, Dell Outlet offers engaged customers flash promotions through Twitter. Corporate blog Direct2Dell facilitates customer-to-company leader discussions. Finally, IdeaStorm.com allows customers to propose product and service improvements.

Be passionate about educating customers when you sell to them, and make installation and activation as smooth as possible. Many service providers tend to overlook the sales process as the first opportunity to build long-term loyalty. In contrast to some of its peers, UK-based mobile operator O2 developed a winning approach. Throughout its retail stores, the company employs approximately 400 technology gurus who assist customers as they buy a new smartphone, demonstrate how to use the product and set up the new customer’s personal account. The customer walks out of the store already proficient on the product. A digital guru, easily accessible via a smartphone icon, also becomes a way for the customer to obtain remote assistance after purchasing the phone.

Delight me!

Deliver an exciting product experience that makes you different from competitors in at least one area important to your customers. There are two ways to create a “wow” product experience. One is to introduce new features, as Netflix did with its adaptable video-on-demand interface, which allows users to customize the video format to their viewing preference. The other is to differentiate on one specific dimension of the product experience, like user-friendliness, speed, coverage or handsets, as AT&T was able to do with its iPhone exclusivity.

Nobody likes receiving bills, but at least keep customers from complaining by providing bills that are clear and accurate. Customers often cite billing as one of the most frustrating aspects of their relationship with their service provider. They complain about confusing bills, mistakes (actual or perceived) or simply the inability of the provider to resolve issues. While it’s not easy to use billing to delight customers, some companies have taken steps to reduce dissatisfaction due to bill frustration. American Express, a loyalty leader in financial services, differentiates its billing program by using online tools that make it easy for customers to review their bills and understand what they’re buying. By making the billing process less painful, companies can not only avoid frustrating customers to the point of detraction, they can actually increase satisfaction through a positive interaction.

Be a champ about resolving issues. Bain’s work has suggested that solving customer service issues is a critical pain point for customers of communications service providers. In this area, providers could benefit by looking at what works so well for Amazon.com. The online retailer’s “call me now” and “call me in five minutes” options—available on the site’s customer service page—are designed to tackle problems quickly, eliminating the need for a customer to wait to talk to a customer service representative and ensuring that representatives are aware of customers’ problems as soon as they get on the phone.

Create pleasant and effective processes for upgrading, cross-selling, renewal and relocation services. A key part of retention is the ability to cross-sell or ensure renewals at critical contract points. To increase satisfaction, SK Telecom wants all customers to have access to the latest handsets, so it offers two ways for customers to get them whenever they want: Rolling subsidies make it easier for customers to afford new handsets before the end of their contract, or customers can spread the cost of a new phone evenly over the bills that remain for that contract. In a different example, another wireless company watched its NPS for relocation customers jump from -40 percent to +10 percent by simply creating a single point of contact for customers in the process of relocating.

Keep me!

Let your high-value customers know they are your high-value customers—and shower them with rewards. All too often, long-term customers become frustrated by deals that apply only to new customers, while they see little reward for their long-term loyalty. In this area, providers could take a lesson from credit card leaders, whose high-value card members are routed to the best representatives upon dialing a call center. Within the industry, wireless provider US Cellular uses tenure as a basis for providing loyalty points redeemable for desirable products and services. The loyalty program is one part of its broad effort to address several customer pain points and treat its high-value customers better than the competition might—a strategy that has helped the company achieve an NPS that’s two times the industry average.

Know how to proactively detect when your customers are disappointed—and know how to change their minds. Leading companies monitor potential triggers of customers at risk of churn— events like bill spikes, complaint calls or payment problems. At one wireless provider, no fewer than 15 percent of its customers experience a potential churn trigger every month. Those at-risk customers are proactively called, and customer service representatives offer customized solutions such as no-fee plan switching or extra loyalty points. In its first six months, the process reduced churn and led to a 15 percent fall in deactivation calls.

When customers opt to cancel, have a plan for bringing them back—at least the ones you want to keep. Companies need to have a system for identifying the root causes of customer churn, assessing the economic benefit of saving the customer and determining which specific offers or services will entice the customer to stay—it may be a less expensive plan or a more flexible plan. One provider monitors its competitors to detect new, enticing offers before—or at the moment when—they hit the market. The company then quickly lays plans to react with equally attractive counteroffers. The provider also has a system in place for customer service agents— often the first to hear about competitive plans— to alert the company to such programs. Of course, there are a few cautions with this approach. First, retention-offer marketing development must be nimble enough to quickly customize and test response offers. Second, the increased generosity of counteroffers creates a buzz that results in numerous clients calling to get in on the deal. To reduce such spillover effects, companies need to provide generous retention offers only to those customers who are at risk of churn, and they need to train customer service agents to identify such individuals. Areas to manage and measure carefully: competitor moves, how much to invest in keeping a customer and the potential for creating a spillover effect.

The ultimate differentiator is the ability of an operator to deliver a full, end-to-end experience that is consistent with its vision and customer promise. For example, TD Bank lives its vision of being “America’s most convenient bank.” The bank is open seven days a week—even holidays— and provides such services as mobile banking and free coin counting. It delights customers with everything from free dog treats to candy for children to umbrella escorts. Employees are delighted, too, with surprise parties and rewards for NPS-leading branches and agents. Based on its efforts, TD Bank claims the highest NPS among its peers in the Northeast US, earning a 19 percent score vs. the industry average of 5 percent for regional banks. Such customer loyalty has led TD Bank to become the leader in domestic deposit growth—and a clear example of how to get customers to love a company.

Getting started

Our work with clients across the communications services industry has enabled us to develop an effective approach to improving the customer experience and boosting customer loyalty.

Create the vision and roadmap. Companies need to determine their point of departure—their current status—and the point of arrival they hope to reach. This begins by asking some fundamental questions about their current experience with customers and what, specifically, they hope to achieve (see sidebar: Knowing your point of departure and point of arrival).

Define the case for change. The challenge here: conduct a dive deep into the customer experience to discover the elements that matter the most. Then use a pragmatic and systematic methodology (and a data-driven approach) to prioritize where and how much to invest—and how much it would be worth. This is not easy. It requires using detailed data from customers to understand their true experiences, priorities and willingness to make tradeoffs based on the value they assign to different products or services. But it can pay off dramatically if done correctly.

Master the basics. Before investing to exceed expectations, make sure you can meet them. Understand the root cause of defection—events or a series of events—and the priority of those reasons for defection. Then redesign the customer experience and define the required operational imperatives.

Create the “wow” effect. Think through where to differentiate across the 10 dimensions listed above. This may mean better segmenting your customer base and tailoring your offering accordingly; it could mean more recognition of high-value customers. Regardless, the goal is to understand what will make a difference to your customers and to have a laser focus on excelling in those areas.

Build supporting processes and platforms. Transforming the customer experience is not a simple process. It will require new platforms, new processes and significant retraining upfront, as well as a longer-term customer feedback mechanism to understand how you are doing, learn evolving customer pain points and continuously improve over time (often best achieved with a robust Net Promoter system). By applying a structured approach to the customer experience, companies like Charles Schwab have improved performance. Charles Schwab administers an NPS survey to a large client base and makes branch managers accountable for their customers’ scores. After identifying dissatisfied clients, managers respond personally to rectify the root cause of the problem. The closed-loop feedback ensures that detractors become satisfied customers. NPS scores have increased 75 points since Charles Schwab started its customer advocacy program and 40 points since it began the closed-loop feedback process.

Transform the organization and culture. No effort will be successful without ensuring that organizational interfaces and decision roles are consistent with the new processes and without making certain that the people behind the effort are both well trained and enthusiastic. While it is one of the toughest pieces to implement, ensuring that the organization is structured and able to behave differently is a critical step to success.

Only by understanding your customers and what they want, and creating offerings that not only meet but also exceed their expectations where it matters most, can communications service providers turn the big corner. It’s difficult. But providers that can get their customers to love them and become vocal promoters—as opposed to watching their customers wait for the first excuse to abandon them—will outpace their competitors over time.

Domenico Azzarello is a Bain & Company partner in Paris. Mark Kovac is a partner in Dallas.

Net Promoter® and NPS® are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

Knowing your point of departure and point of arrival

Building a vision and roadmap for change begins by answering a series of questions designed to help your company understand where it now stands (its point of departure) and where it hopes to be (its point of arrival).

- What is the current experience for our customers? How are we performing against our peers across critical dimensions of winning, delighting and keeping customers. Based on the answers, the next questions to answer are: where do we need to be in five years in order to be leading the industry in customer experience?

- What is our NPS? Why are our promoters promoters? Why are our detractors detractors? Then, what specific factors do we need to change to increase our promoters and convert detractors?

- Do we have the right internal capabilities, organizational structure and culture to deliver exceptional customer experience? Then, what would our new organization look like in five years?

- Do we have the right systems, metrics and benchmarks? Then, how will we adjust our ways of working and align the organization accordingly?

NPS 101—Building a Net Promoter system with closed-loop feedback

NPS allows employees to immediately see whether a customer touch-point was a success or a failure—and why. After customers give their numerical answer to the “How likely would you be to recommend?” question, they are then asked to describe why they would be likely or unlikely to recommend the company based on that interaction. Their answers help employees quickly identify issues that create detractors and the actions required to address them.

As they analyze customer feedback, companies should pay particular attention to the “moments of truth”—interactions that hold the greatest potential to delight or alienate customers.

Frontline employees are best positioned to pinpoint such pivotal customer experiences and come up with effective ways of improving them. A small customer-focus team, reporting directly to the board, can design, build and test a feedback system for make-or-break experiences and then roll it out to customer-facing employees.

Here’s how such a system could work: After every transaction, an independent polling firm immediately contacts the customer and conducts a brief survey. It emails the results to the employee who provided the service and publishes aggregated results on the local intranet. Frontline employees then follow up by calling a sample of customers who have agreed to be contacted. After listening to the customers’ problems, they correct them or escalate them to someone who can.

Frontline employees have responsibility for improving their work unit’s feedback scores and meet frequently to devise service improvements, both large and small.