Brief

For all the noise about cloud computing, many companies that sell cloud-based products and services still struggle to answer fundamental questions about how they will make money.1 To gain a foothold in the sector, providers have launched offers that appeal to the earliest adopters. Profitable growth has taken a backseat to being first to market and building customer awareness.

But the market is in transition. Companies that have waited on the sidelines are now entering the marketplace. Compared with the earliest adopters, later entrants have a much wider range of business needs, IT priorities and views on cloud computing. That’s shaping the approach of the most effective providers, who are focused now on developing targeted offerings, marketing messages and sales approaches to address the full dimensions of the emerging customer landscape.

The evolution of cloud computing

Cloud computing is, in fact, an old idea whose time has come. It represents the latest chapter in the story of two intersecting trends that have been playing out for some time: the desire of companies to outsource an ever wider range of their capabilities and the efforts of providers to deliver IT as a utility, like electricity.

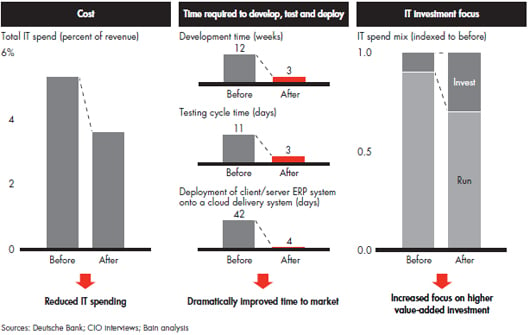

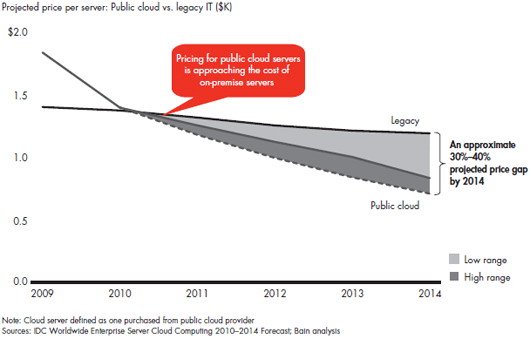

Cloud computing is different, however. Thanks to the cloud, businesses are using and administering their IT infrastructure more efficiently. The economics of cloud computing have also become attractive over a wide range of circumstances. In the next three years, we see a 30 percent to 40 percent price advantage opening up between the costs of deploying a public cloud and an on-premise server.

As providers create real value for customers, some players have at last begun to turn a profit. In response, customers now have confidence that many emerging providers will be around for the long term, and buyers are growing more comfortable placing critical systems in their hands.

The result: We expect business spending on cloud computing to grow fivefold by 2020, expanding from $30 billion to $150 billion, according to some estimates, and accounting for one-fifth of all growth in technology industry profits over this period.

Of course, the field still faces many challenges. Even under the most optimistic growth projections, cloud computing will not displace existing technologies any time soon. Cloud services will represent less than 10 percent of total enterprise technology spending by 2020, for instance.

From security concerns to high-profile outages, substantial barriers to customer adoption remain.

Some paths to the cloud—such as data-intensive workloads, custom legacy applications or private clouds for small businesses—hold little promise. Legacy technologies will continue to occupy a significant place in IT, as the sustained demand for mainframe computing demonstrates.

For these and other reasons, cloud computing represents an important evolution, rather than a revolution, in information technology.

Customers require a targeted approach

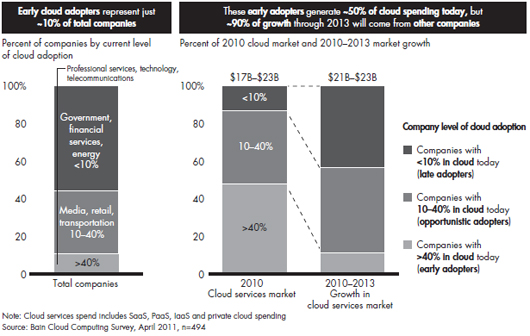

Today’s cloud customers look and act alike. Just 10 percent of companies account for nearly half of the market for cloud offerings. Smaller companies represent the majority of purchasers, and they tend to use public cloud services to launch new applications or businesses. These early adopters are concentrated in industries like professional services, ecommerce, technology and telecommunications.

But the customers that have fueled growth to date will not be the same as those that fuel growth in the future. Over the next three years, nearly 65 percent of the growth in cloud spending will come from companies that make little or no use of the cloud today (see Figure 3). Industries like retail, transportation, industrials and financial services will demand more private and hybrid cloud offerings.

As the market for cloud computing evolves, the emerging leaders will find ways to serve a more diverse range of customer needs. Those that fail to adapt risk hitting a wall—either developing generic offers that more focused players surpass or appealing too narrowly to only the earliest adopters.

The five types of cloud customers

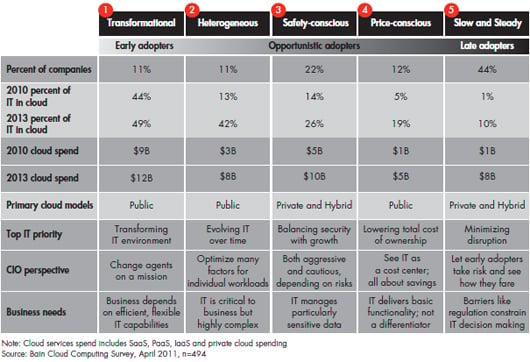

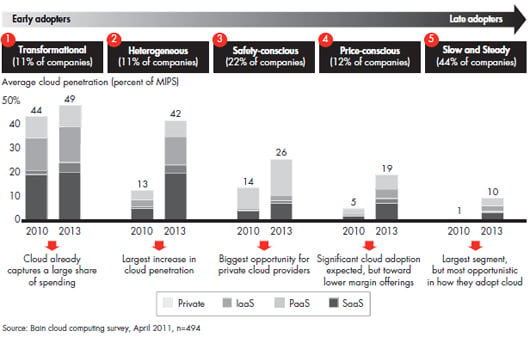

To help providers navigate their way through this market transition, Bain surveyed nearly 500 North American CIOs and IT decision makers and spoke with more than 25 cloud providers. Through this research, we identified five clusters of companies with common approaches to cloud computing.

The key to sustainable and profitable growth over the coming years will be to develop focused offerings that are better tailored to these five types of customers. To bring to life their diverse priorities, here are profiles of CIOs in each segment.

Transformational

These early adopters already use cloud computing heavily, with on average more than 40 percent of their IT environments relying on one or more cloud models.

The experience of a midmarket professional services company illustrates how one CIO in this segment approaches the market. When he was hired three years ago, his mission was to transform IT into an enabler rather than an impediment to growth. After taking over, he found that the previous on-premise systems were not flexible enough to respond to new product launches, price changes or regional expansions. “There must have been thousands of spreadsheets floating around to track everything until IT could catch up,” he says.

After a major overhaul, roughly 90 percent of the company’s IT environment now resides in the cloud with a combination of software-as-aservice (SaaS) and platform-as-a-service (PaaS) providers. The offerings make adding and changing products, pricing, employees or offices faster and easier. And the individual business units can create their own applications directly without going through a prolonged request process. Although the move has not substantially reduced IT costs, it has allowed the business to grow faster than it would have otherwise.

Heterogeneous

These companies typically have an exceptionally diverse mix of legacy systems and newer technologies like virtualization and cloud computing. While they have on average just 13 percent of their environment in the cloud today, that share is poised to rapidly expand to more than 40 percent by 2013.

As an example of an IT leader in this segment, consider the seasoned CIO of a $30 billion industrial company. He has been in the position for 10 years, and before that time he worked for 30 years in a business unit. He knows how to balance the demands for speed and responsiveness with the challenges of managing a complex environment created over many decades and acquisitions.

The CIO has already moved 15 percent of IT onto the cloud, using SaaS vendors for customer relationship management (CRM) and human resources systems. Over the next three years, he plans to place up to 30 percent of the IT environment on the cloud, adding workloads like email and office productivity software. But many other workloads do not yet make sense, including real-time manufacturing control systems that are sensitive to any delay in data and transaction processing systems handling millions of deals a day that must never fail.

Safety-conscious

These companies are particularly concerned with the security and reliability of their IT environments. They understand the value proposition that cloud computing offers, but are willing to compromise to ensure that their environment is safe and secure. Private cloud and hybrid public-private cloud models have the most appeal.

A $40 billion media company in this segment hired its CIO six years ago from another firm in the industry. He stepped into an organization that had been slow to respond to business unit demands and consistently ran over budget on critical projects. He turned to an outsourcing partner to get the situation under control, but continued to have a large problem with “shadow” projects happening outside the central IT organization.

Recently, the CIO launched a popular private cloud, which now makes up roughly 10 percent of the total IT environment and should expand to about 20 percent as adoption continues. The CIO explains his motivation for choosing a private cloud this way: “If we don’t do it, the business units just solve the problem themselves. I need to give them self-service ability without sacrifi cing security.” In the future, the company may become open to public SaaS and PaaS offerings, but right now the CIO has too many concerns about reliability and security to use a public cloud just to save money.

Price-conscious

These bottom-line focused companies purchase cloud technologies and services primarily for the cost savings.

At one $5 billion transportation company in this segment, the CIO has spent 20 years in IT and has lived through waves of cost reduction. In a slow-growing industry, his eye is always on the bottom line. He has encountered his share of dramatic new technologies, but if they don’t save him money, he won’t buy. “I’m tired of the hype about cloud,” he says. “These solutions are often expensive and disruptive to implement and just not worth the hassle.”

That said, cloud computing has in fact saved him money. About 10 percent of his company’s IT environment resides on the cloud, using a variety of SaaS providers for CRM, payroll and call-center workloads, and he expects that to rise to about 25 percent by 2014 as prices come down. A legacy mainframe system that processes transactions will not be retired in the foreseeable future, but other workloads are possibilities if the price is right. He has looked at email, office, business intelligence and enterprise resource planning (ERP) workloads, but could not save the 15 percent minimum he believes is required to make a move worthwhile.

Slow and Steady

These companies, for a range of reasons, do not yet appear ready to adopt cloud computing in a meaningful way, although they express interest in exploring offerings if a provider can slowly and steadily take them down the migration path. Slow and Steady companies are the largest segment of customers.

In the case of a $50 billion financial services company, the CIO has occupied his position for more than a decade, and he has worked in IT at the company for virtually his entire career. He manages a large mainframe environment and eight highly virtualized data centers, but he does not use a public cloud today nor does he have plans to create a private cloud. The value he sees in some cloud offerings does not warrant the loss of control, security risks and regulatory issues he expects to face.

The CIO can envision some workloads with highly varied usage patterns someday moving to an infrastructure-as-a-service (IaaS) offering. The cloud might prove useful for other situations, but providers have not yet articulated a compelling vision to him.

What it all means

Transformational customers have generated nearly half of cloud computing revenues to this point, although the other customer segments will spur the vast majority of future growth.

Each customer segment will move to the cloud in different ways. While Transformational customers have the highest adoption rates today, Heterogeneous customers will nearly match them within three years. Safety-conscious customers will adopt more slowly, but at twice the size, this segment will cause a significant increase in spending growth. For Price-conscious customers, adoption will nearly quadruple as prices come down, and this segment will focus more on less expensive public cloud offerings than other later adopters. Finally, Slow and Steady customers, who have barely begun to experiment with the cloud, will see meaningful adoption over the next three years. Given its size, the segment represents a sizable opportunity.

Preferences for private, public and hybrid cloud offerings vary substantially across the segments. As their names imply, Safety-conscious and Slow and Steady customers express significantly greater demand for more secure private and hybrid offerings. Transformational, Heterogeneous and Price-conscious customers show three times the likelihood to adopt the public cloud, on the other hand. Successful public cloud providers will either place less emphasis on the Safety-conscious and Slow and Steady segments or develop new offers that address their unique needs.

Demand for cloud offerings also depends on the workloads they address. Transformational and Heterogeneous customers will soon begin to look at moving more complex workloads to the cloud, such as ERP, supply chain management and business intelligence. Price-conscious customers will be among the earliest to consider the massive spending on licenses for office productivity applications and see an opportunity to adopt much less expensive cloud-based offerings.

Providers who understand how their offerings appeal to different segments will have the best chance of sustaining profitable growth. They will either focus on where demand is naturally greatest or make the necessary changes to adequately address a more diverse set of customers.

Key questions to ask

This new way of looking at cloud computing customers is only helpful to providers if it is practical and easy to use. We have identified four major factors, with a few simple questions for each, that can help providers and their salesforces efficiently and effectively assess a company’s readiness for cloud computing:

• Business context , which includes aspects like a company’s growth rate, speed-to-market requirements and regulatory constraints.

• CIO philosophy , which includes the IT leader’s outlook on technology investments and past experiences with outsourcing.

• Workload characteristics , which include issues like the difficulty of moving workloads to the cloud and the level of customization of existing platforms.

• Economics , which include the degree to which cost savings are a priority.

Business context

Is the company experiencing revenue growth greater than 10 percent year over year?

Readiness to adopt cloud computing: Companies with aggressive growth plans, shifting priorities and rapid speed-to-market requirements use more cloud services than companies growing at a slower pace. We found that companies growing faster than 10 percent per year use 145 percent more cloud services than slower-growing companies. Cloud computing helps expanding companies more rapidly develop and scale new capabilities and in the process exploit the significant benefits the cloud has to offer.

Implications for providers: Public cloud offerings that scale automatically and can be rolled out with minimal lead time will be most attractive to highgrowth companies. These include SaaS offerings for CRM, email and HR functions, which often need to scale with the business.

CIO philosophy

Has the company’s CIO been in the position less than three years?

Readiness to adopt cloud computing: CIOs who have moved into the position within the past 12 months use 141 percent more cloud services than leaders with greater than six years on the job. Relatively new IT leaders embrace change more than those who have been in place for some time, and they typically take the position with a specific mandate to achieve major change.

Implications for providers: New CIOs will be most interested in replacing core legacy systems with cloud products and services that can create a stepchange in performance. SaaS offerings in areas like ERP and supply chain management, as well as custom products built in a PaaS environment, will find the most appeal with new CIOs.

Does the CIO have a significant non-IT background?

Readiness to adopt cloud computing: CIOs with diverse business experience use 82 percent more cloud services than those who have spent their professional careers predominantly in IT. These CIOs know what it feels like to be a consumer of corporate IT, and they more often prioritize speed of execution over the elegance of an offering.

Implications for providers: Effective providers explain how a public or private cloud can dramatically reduce the time required to deploy new workloads and change existing ones. Basic IaaS offerings will fit well with CIOs who want to rapidly roll out new offerings without creating a shadow IT problem.

Workload characteristics

Is the company targeting a workload for which IT administration represents more than 10 percent of the total cost of ownership (TCO)?

Readiness to adopt cloud computing: Workloads that cost a lot to maintain show the highest rates of cloud adoption. By moving infrastructure, middleware and software to the cloud, the burden of administration shifts to the provider as well. When administration accounts for more than 10 percent of the TCO for a workload, a cloud provider will likely administer it much more cost effectively and pass on some of the savings.

Implications for providers: Workloads that tend to consume the most IT administration as a share of total cost include custom web applications, websites, email, and development and test (dev/ test) applications, all of which have some of the highest rates of cloud adoption today. Effective providers understand the burden of administration on customers and speak to the ways that cloud offerings can alleviate it.

Economics

Is the company targeting a new workload or one in need of an upgrade, or is the workload operating at a steady state?

Readiness to adopt cloud computing: Moving new workloads or those at an upgrade point generates a 20 percent TCO advantage on average relative to workloads that do not require new infrastructure or licenses.

Implications for providers: Convincing a CIO to replace a system that was recently deployed and has not been fully depreciated usually proves to be an unwinnable battle. Leaders plan technology road maps and life cycles far in advance. Leading cloud computing providers know the best transition points and expend the most effort when they face the greatest opportunity.

Can a move to the cloud reduce TCO more than 20 percent?

Readiness to adopt cloud computing: While price conscious companies make up only 12 percent of customers, they have a high likelihood of purchasing if they can reach this 20 percent TCO savings hurdle.

Implications for providers: Effective providers know how to calculate the fully loaded TCO for customers—no mean feat considering the wide range of costs involved, from infrastructure and connectivity to professional services and administration. They understand where the economics are most attractive, identify customers for whom those uses are most relevant and then lead with a message about the savings potential. The most attractive economics lie in workloads like email, CRM, websites, team collaboration, dev/test and office suites. Successful providers of these workloads will specifically target Price-conscious customers with value-oriented messages.

Conclusion

Over the coming years, customers will move toward the cloud in a multitude of ways. The one-size-fits-all approach that has brought providers this far will prove unsustainable.

Companies that fail to adapt will not survive the coming industry shakeout. In contrast, the next generation of cloud computing winners will focus their product development pipelines, marketing strategies and sales approaches on the segments that they are best equipped to address. In the process, they will widen their lead against the competition.

Michael Heric is a partner with Bain & Company in New York. Ron Kermisch is a Bain partner in Boston. Stephen Bertrand is a partner in Bain’s London office.

1For the purposes of this discussion, we define cloud computing as an IT delivery model in which pooled computing resources that scale dynamically provide services on demand. Specifically, cloud computing includes public cloud services (including software as a service, platform as a service and infrastructure as a service), virtual public clouds from third-party providers and software tools that enable company-owned private clouds.