Forbes.com

Fund-raising is always the last piece to fall in place when the private equity cycle enters an upswing. Judging from the uncertain outlook for the current recovery, 2012 is shaping up as an inauspicious year for eager general partners (GPs) that are looking to line up commitments from limited partners (LPs) for new funding rounds. As we conclude in Bain’s Global Private Equity Report 2012, fund-raising activity, which failed to stage a hoped-for rebound in 2011, remains mired in a cyclical slump.

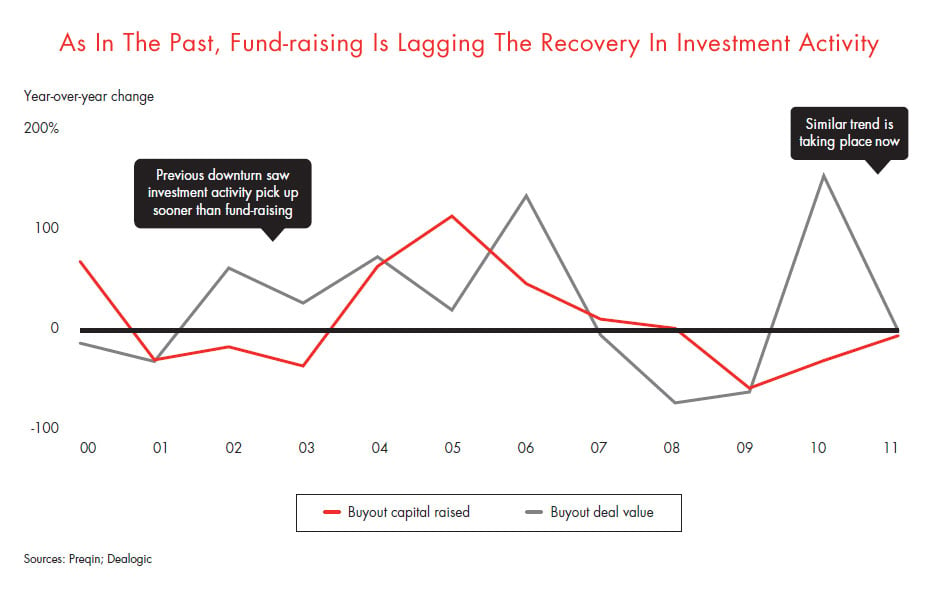

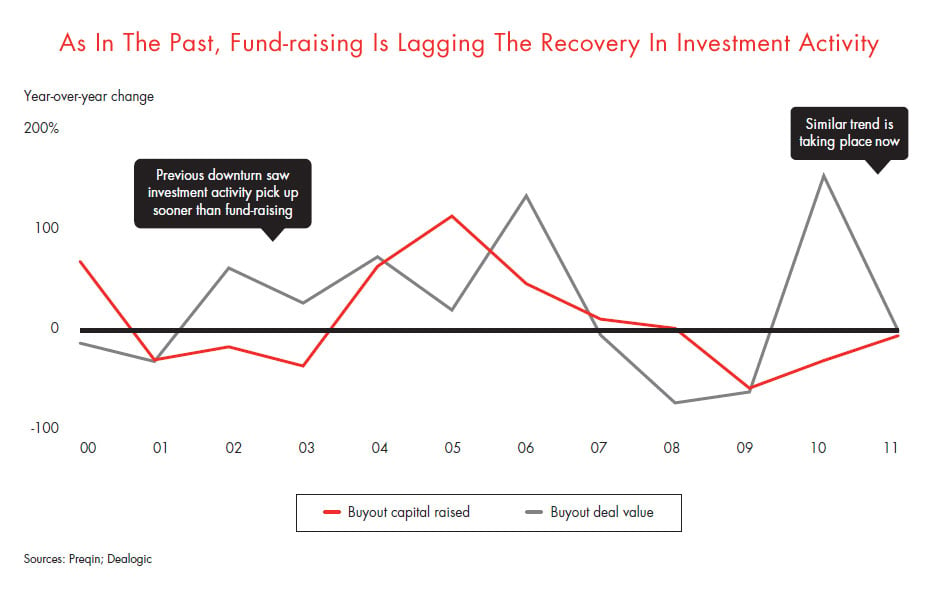

Absent a clear and sustained pickup in investments and exits, GPs will not see a revival this year. Fund-raising tends to lag a revival in investments, as LPs scramble to meet capital calls on prior commitments and have little headroom to take on new ones (see figure). Fund-raising also strongly correlates with exit activity. Particularly in times like today when LP allocations for private equity are tight, many LPs depend on receiving distributions in order to recycle capital into new fund commitments. With all exit channels remaining blocked going into 2012 as we saw in our previous installment they had been since mid-2011, LPs will be cut off from that critical flow of cash.

Sluggish fund-raising conditions in no way suggest a weakening of LPs’ commitment to the asset class—at least not any time soon. For many LPs, their private equity programs remain the top-performers in their portfolios. Yet, most LPs will be hunkering down in the coming year. Their net cash flows will likely be negative as GPs call capital yet return little. Meanwhile, the weak performance of the public equity markets continues to hold down the value of their total assets under management, further tightening the lid on allocations.

GPs that plan to go to the well to fill up new funds in 2012 know they will be facing a wall of LP skepticism. Many LPs are also doubtful about GPs’ ability to invest the dry powder they already are sitting on and find it hard to understand how they would productively put to work even more capital they are now trying to raise. But that has not caused GPs to temper their fund-raising targets.

Such challenging conditions call for resourcefulness on the part of GPs. With pension funds, endowments, foundations, big institutional investors and many other usual LP candidates for fund-raising solicitations tapped out, GPs are turning over rocks in search of new investors, including ultra-high-net-worth individuals and deep-pocketed sovereign wealth funds. But for private equity firms that are forced to retrench, the implications will be severe. Many are counting on using the fees they collect from managing more capital to hire the top talent and build organizational capabilities they will need to strengthen their portfolio management skills. With the private equity industry increasingly reliant on firms’ ability to generate market-beating alpha going forward, second-tier funds will fall farther behind the leaders.

Will this happen in 2012? Perhaps not, but if investment and exit activity remain suppressed over a sustained period of economic weakness, a thinning of the PE-firm ranks cannot be ruled out.

This post was written by Graham Elton, Bill Halloran, Hugh MacArthur and Suvir Varma, leaders of Bain & Company’s Private Equity Group.