We publish our annual M&A report to help business leaders get better at M&A and divestitures.

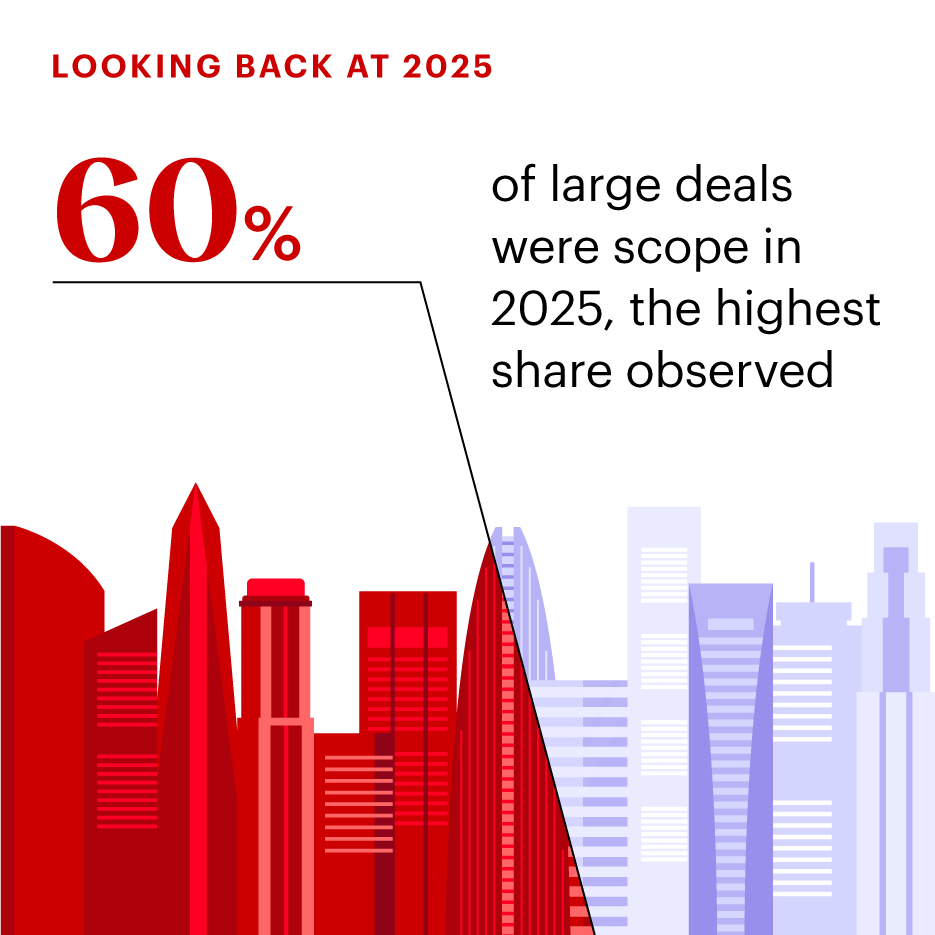

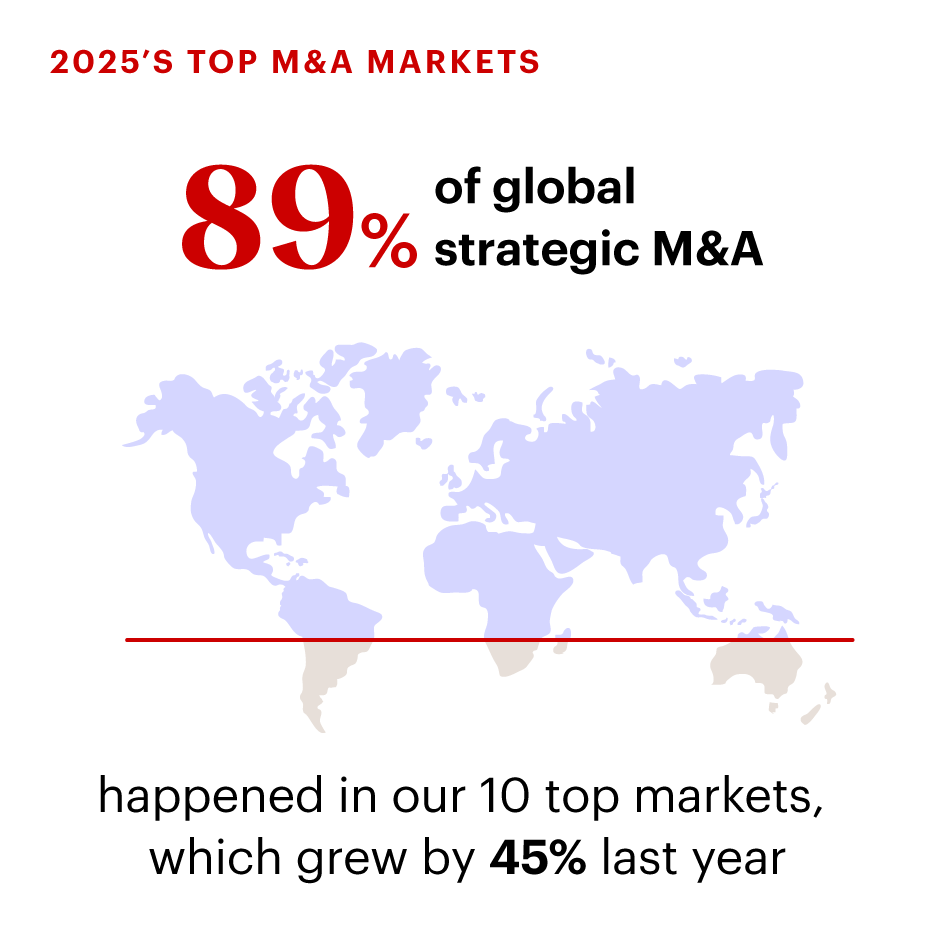

In 2025, deal value rose dramatically to deliver the second-highest year on record in a broad-based rebound that spanned all industries. Behind this resurgence is the urgent need for companies to reinvent themselves to get out ahead of the big forces of technology disruption, a post-globalization economy, and shifting profit pools.

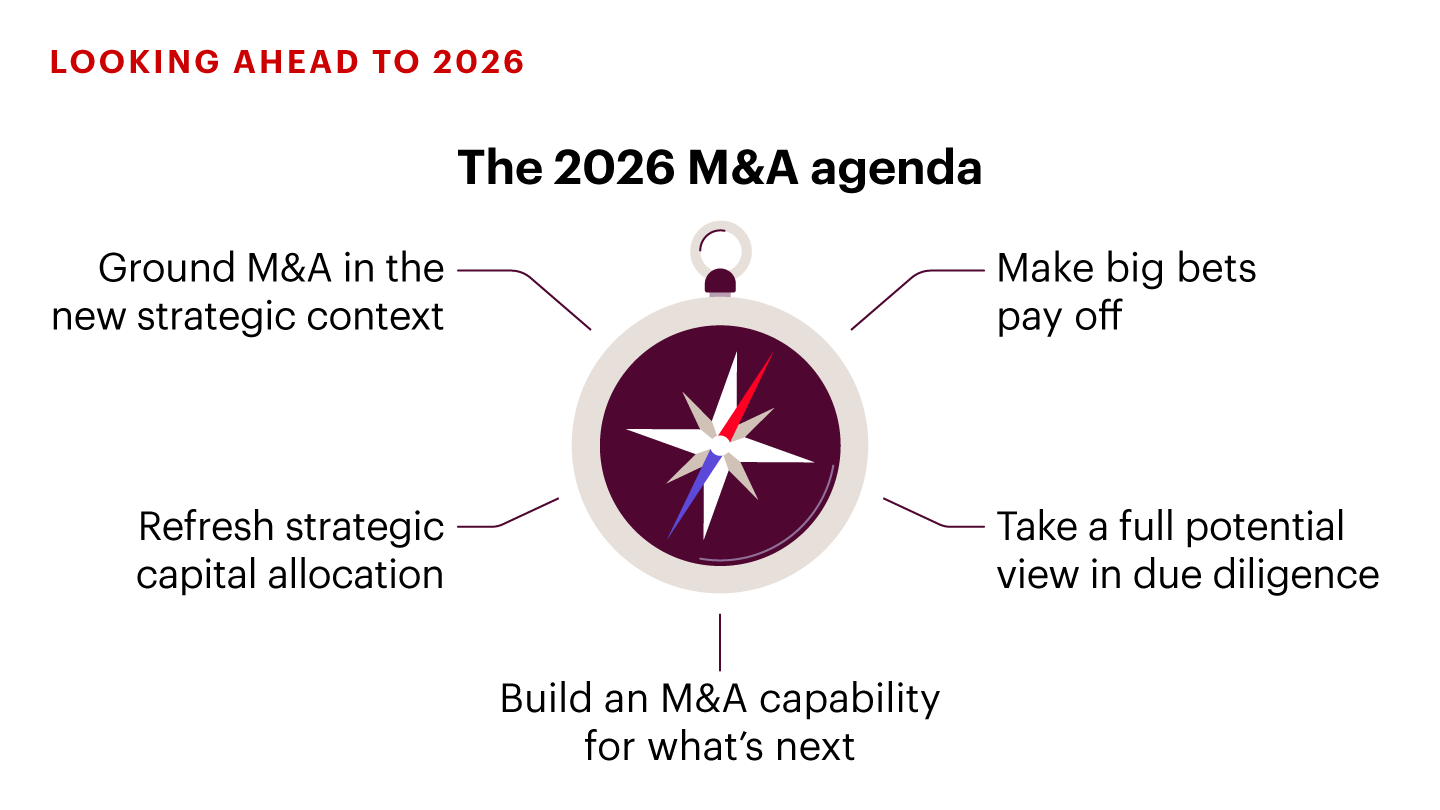

But whether companies are turning to M&A to gain capabilities that give them a competitive edge in the AI revolution, create the agility required to succeed in post-globalization’s fragmented markets, or pursue new sources of growth in rapidly changing industries, they now can draw on new tools and approaches to hasten value creation.

Read on to learn how various industries are adapting to today’s M&A market, deal trends by market, and how more companies are deploying AI to improve their M&A capabilities.

We publish our annual M&A report to help business leaders get better at M&A and divestitures.

In 2025, deal value rose dramatically to deliver the second-highest year on record in a broad-based rebound that spanned all industries. Behind this resurgence is the urgent need for companies to reinvent themselves to get out ahead of the big forces of technology disruption, a post-globalization economy, and shifting profit pools.

But whether companies are turning to M&A to gain capabilities that give them a competitive edge in the AI revolution, create the agility required to succeed in post-globalization’s fragmented markets, or pursue new sources of growth in rapidly changing industries, they now can draw on new tools and approaches to hasten value creation.

Read on to learn how various industries are adapting to today’s M&A market, deal trends by market, and how more companies are deploying AI to improve their M&A capabilities.