Brief

Tim Beckman, the chief operating officer of International Energy, buried his head in his hands.1 He was frustrated beyond belief.

A few months before, he had finally decided to scrap his company’s T662 turbine, a product that just wasn’t selling. The decision hadn’t been easy. In fact, he had originally overruled his subordinates’ recommendation to kill the T662 and had kept it on the market. After a while, though, he had to admit that the product was a bust and should be terminated.

But the T662 wouldn’t die. First the factory in California had somehow managed to ignore Beckman’s decision. It continued to crank out the turbines, and it continued to sign big supply contracts. Then the company’s leasing unit had pointed out that IE itself owned most of the T662s already produced, and a cancellation would persuade most customers not to renew their leases.

Beckman shook his head. The terms of the decision kept changing. What were the real facts? What were the alternatives? How did things reach this pass anyway? And above all, what should he do?

Like the company we’re calling International Energy, too many organizations fail to make and execute their critical decisions well. Some just dither. Others come to a decision but revisit it repeatedly. Still others make poor choices or never translate their decisions into action. For decisions with a great deal of value at stake, the cost of these failings can be extraordinarily high.

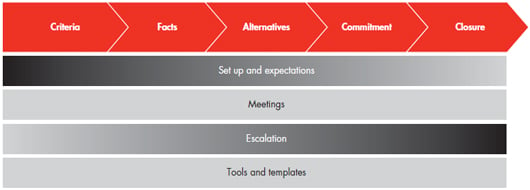

The source of the trouble often lies in the way companies try to make critical decisions. Here’s a more-or-less typical scenario. A day before the key meeting, attendees get copies of a 165-page PowerPoint presentation. The presentation outlines the principal recommendation, the logic behind it and the supporting data. Nobody reads it, of course, because they assume someone will walk them through it the next day. In the meeting itself, everyone sees and hears the presentation, but reactions differ. Some people believe the team hasn’t looked at the right data in forming its recommendation. Others question the criteria underlying it. Still others wonder whether there’s a better alternative. One executive doesn’t believe the company can implement the recommendation. Finally, everyone agrees to delay the decision until the following month, after the group’s next meeting. The scenario would be funny if it weren’t so painful: we have seen many organizations struggle with just such dysfunctional processes. But companies that are most effective at decisions don’t get bogged down in this way. They follow a carefully structured approach to decisions, one that ensures agreement on criteria, facts, alternatives, commitment and closure. And they put in a place a few simple enablers that help the process work smoothly. The results are fast, high-quality decision making and execution.

A structured decision approach

Creating a structured approach means establishing assumptions and procedures for “the way we make decisions around here.” It means making explicit what is often implicit or missing. There are five critical elements.

Criteria. You can’t come to a decision unless you know the criteria for making it. Is the goal of this decision to increase market share or to increase quarterly earnings? Is it to increase employee engagement or customer loyalty? Are we trying to minimize capital expenses this year, or operating expenses?

In our experience, many companies fail to clarify the criteria for a decision, and the decision makers wind up fl ying blind. A major UK retailer, for instance, launched an experimental program of always matching competitors’ prices in some locations. But when the test results came in, executives were stymied. They had never determined whether the goal of the test was to increase store profits, increase market share, build customer loyalty or something else entirely. They thus had no criteria for determining whether the test was a success or a failure. As a result, they couldn’t decide whether to terminate the program or to roll it out nationally.

Facts. Twenty years ago, gathering data required a lot of time and effort. Now the problem is usually the opposite: everybody has too much data, and it’s not hard to get still more. That can lead to seemingly innocuous requests in making critical decisions, such as “Maybe we should get more facts.” Sometimes the request is reasonable; more often it’s simply a way of delaying a decision.

The goal, after all, is not to have “all” the facts, but the precise facts that are required to understand the current situation, develop alternatives and make good choices. Tim Beckman, of International Energy, took a long time even to decide to kill the T662—it had been his baby, and he kept requesting more market data in hopes that the next batch would look more favorable. But successive waves of data all pointed to the same conclusion: the model just wasn’t selling. In short, additional facts weren’t bringing different alternatives to the surface, nor were they meaningfully improving the evaluation of those alternatives. The choice was clear: terminate the T662.

Alternatives. A few years ago, we asked executives in a survey whether they routinely considered alternatives when making major strategic decisions. A whopping 82 percent said no. They probably did what most companies do, which is to consider a new course of action against staying with the present one. Of course, sometimes executives see choices that are alternatives in name only. It is said that whenever Henry Kissinger, the former US secretary of state, asked his foreign policy team for alternatives, the team would always present three. The first invariably resulted in unconditional surrender to the Soviet Union. The second led to thermonuclear war. The third was always the one the team wanted to pursue.

If you don’t get good alternatives, it’s hard to make good choices. At IE, the choices seemed to be to discontinue the T662 or not. But had the decision been framed early on as “What should we do to generate the most profit for the business?” there might have been other viable alternatives.

The product might have been scaled back, redesigned, or built and marketed through a joint venture. We don’t know, of course, because the company never explored alternative courses of action.

To instill discipline around alternatives, we recommend to our clients that, when presented with a recommendation of any sort, they ask, “What alternatives did you consider and reject and why?” This simple question reinforces the need to examine more than one option and nearly always improves the quality of decision making.

Commitment. Very little is as frustrating as post-meeting conversations of this sort: “Wait—what did we just decide to do?” or perhaps, “Well, we may have decided X, but personally I’m just going to wait and see.” The opposite of this murkiness is commitment, an agreement on what the group decided and unanimous support for the decision. Decision logs—record books of every decision a group takes—can help reinforce commitment. So can explicit “rules” regarding decisions: Intel, for example, expects everyone to “agree and commit, or disagree and commit, but commit.” Dow Chemical takes commitment one step further. The company embeds decisions regarding business-unit strategy in contracts that detail the specific strategic decisions that have been made, the resources required to implement the strategy effectively, and the individuals who are accountable for delivering on the decisions.

Closure. We like to tell audiences the fable about three frogs on a log. One frog decides to jump off; how many are left on the log? Some people say two, the obvious choice; others say none, figuring the first frog rocked the log and knocked the others off. But the answer is three, because deciding to do something isn’t the same as doing it. This homely lesson applies to every major decision: if you don’t communicate the decision, establish responsibility and timelines for implementation and set up a feedback loop to monitor performance, nothing will happen. That was Tim Beckman’s problem with his California turbine factory.

Paying attention to closure is essential because the people trying to implement a decision can run into so many different obstacles. Companies may need to reallocate resources and adjust budgets. They may need to redefine individual responsibilities. Quick feedback is critical, so that executives can determine whether the decision is working out as planned. In 2004, for instance, Wal-Mart decided not to offer steep discounts during the holiday selling season. On the Friday after Thanksgiving—the season’s traditional opening day—competitors noticed Wal-Mart’s strategy and began trumpeting their own holiday discounts, sensing an opportunity to draw customers away from the retail giant. But Wal-Mart was closely monitoring results, and its executives soon realized their new approach wasn’t working. They quickly reversed the decision—and within days, every store in the Wal-Mart system had returned to the company’s traditional practice of holiday discounting. Wal-Mart’s same-store sales for the month rose 3 percent, not far behind Target’s 5 percent, thanks to the leadership’s ability to respond quickly to feedback and the organization’s ability to swiftly execute the new decision.

Decide & Deliver

Learn more about the five steps that leading organizations use to make great decisions quickly and execute them effectively.

Decision enablers

This overview of a structured decision approach should help you eliminate any dysfunctional practices and establish more fruitful ones. But many companies have found that they also need enablers—practical methods for oiling the decision-making machinery. Our research and experience have helped us identify four such enablers, each one remarkably powerful in its effects.

Set decisions up for success. Too many companies just dive into a major decision. They never take the time to plan, prepare and set it up for success. It helps to take a few moments before every such decision to ask questions such as these:

- What decision are we actually trying to make?

- What are the criteria for the decision?

- What is the information required, and what is the burden of proof?

- Who will play what role?

- What is the timeline, both for the decision and for execution?

Best-practice companies make a point of determining in advance who will recommend alternative courses of action and who will ultimately make the choice. Both of these parties can get together in advance to answer the basic initiation questions.

Don’t try to do too much in one meeting. We wrote extensively about meetings in a previous article, so we won’t go into detail here. But we do want to note two common errors relating to decision-focused meetings. One is this: companies often try to cover operating performance reviews and strategic decisions in the same session. It never works. The two tasks require different mindsets: operating reviews necessarily focus on holding people’s noses to the grindstone, while strategy discussions depend on raising people’s eyes to the horizon. Once meeting attendees focus on either one of these topics, the other will get short shrift.

A second error: trying to discuss facts, alternatives and the decision all in the same meeting. The pharmaceutical company Roche, under Franz Humer, made a point of doing the precise opposite. One session decided whether the attendees had all the facts they needed and were considering the right set of options. A second session then chose among the available options (based on predetermined and agreed-upon criteria) and formalized the commitment through plans for execution. Though it sounds like a lot of trouble, separating the two kinds of meetings makes for a faster process because it eliminates much rework.

Establish clear guidelines for escalation. Every organization must sometimes escalate its decisions to a higher level—for instance, when lower-level managers disagree. Unless there are specific guidelines for when escalation is appropriate, however, too many decisions may wind up on the desks of busy senior executives, who don’t have time to give them the attention they deserve. A typical set of guidelines might specify (a) when escalation is appropriate, (b) how often escalation is likely to happen and (c) what the appropriate path is. You may find it helpful to track the number of times major decisions are kicked upstairs and to brainstorm ways to manage the number down. Intel’s Embedded and Communications Group (ECG), for example, found that too many decisions were being escalated. ECG general manager Doug Davis explicitly “set the expectation that we were not going to allow maverick escalations,” while also spelling out the process to follow if someone really believed a given approach was “doomed to fail.”

Use common tools and templates. Many high-performing companies use standard tools and templates to structure decisions, rather than reinventing the wheel each time. For long-term strategic decisions, for example, planning templates can assure rigorous comparisons of opportunities across disparate parts of the business. For everyday decisions such as pricing, templates can assure that companies gather a standard set of facts and apply standard analytic approaches. Using such templates facilitates data gathering and frees up people’s mental energy to focus on assessing the information and making the right decisions.

Good decision processes are as essential to an organization as good production processes. Companies can create structured approaches and enablers, help their employees learn the necessary skills and behaviors and reinforce those behaviors through everyday reminders such as signs in meeting rooms. The result will be quicker, better decisions followed by effective execution—and no more decision swamps of the kind that trapped Tim Beckman and International Energy.

Michael C. Mankins leads Bain’s Organization practice in the Americas and is a key member of Bain’s Strategy practice. He is a partner in the firm’s San Francisco office.

Jenny Davis-Peccoud is senior director of Bain’s Global Organization practice and senior director of the Bain Cares Global Social Impact Program. She is based in London.

1 This is a true story, but we have changed names and other identifying details.