Press release

- Rapid and robust transition of banks’ loan portfolios to green assets will unlock value

- Banks must invest in high-calibre tracking for their financed emissions immediately to be able to make accurate strategic decisions

- Banks must develop long-term strategic plans that allow them to adapt quickly and decisively as the carbon transition unrolls

BOSTON—June 7th, 2022—The world's banks are accelerating on the carbon transition, but they face three major strategic challenges to reaching net zero emissions by 2050, according to new research from Bain & Company. As financed emissions—those associated with an organisation’s lending or investment activity—represent at least 95% of a bank’s overall carbon footprint, it is essential to prioritize granular measurement of these emissions along with a long-range strategy to capture value from the carbon transition.

Bain & Company’s new study reveals that many banks have the opportunity to build a more accurate baseline of emissions in their lending and other financed portfolios as there is a risk of over- or under-estimating financed emissions by up to double when using loan data that is not granular enough. This critical but complex task of measuring financed emissions makes it challenging to understand where and when value will emerge in the carbon transition and which strategy is best for a bank to capitalise on it.

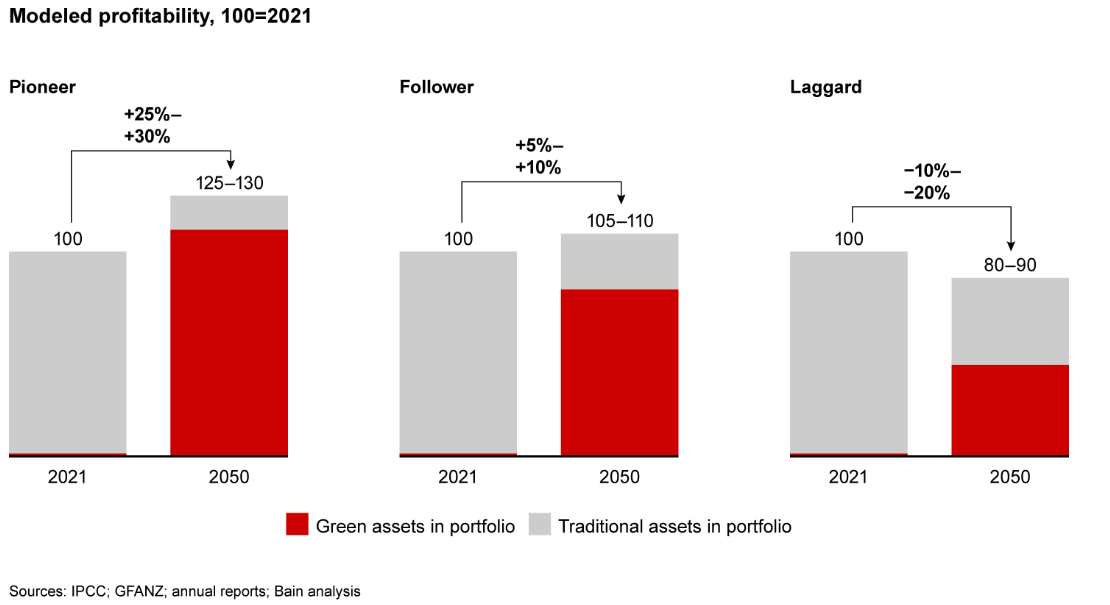

Bain & Company’s experts predict that banks that tackle these challenges head on—which Bain calls “pioneer banks”— will see profits grow by between 25% and 30%. In sharp contrast, banks that either delay or adopt a passive approach tied simply to following regulatory requirements will see profits eroded by between 10% and 20%.

Pioneer banks will ensure they invest in high-calibre emissions tracking to help their clients transition and make smarter strategic decisions, actively steering their portfolios based on both financial indicators and carbon footprints. By moving quickly, pioneer banks will shift a much larger percentage of their portfolios to green assets—up to 85% by 2050. In turn, their cost of funding and risk will be far lower than those of slower-moving competitors, who will be increasingly penalised by markets and investors for higher exposure to traditional industries and projects.

“Banks have a pivotal role to play in limiting global warming to 1.5 degrees Celsius, and industry-wide initiatives, such as the Glasgow Financial Alliance for Net Zero, are critical,” said Camille Goossens, Bain & Company’s global lead for sustainability and responsibility in financial services. “We see positive momentum on both commitments by 2050 and 2030 as well as on disclosures that are increasingly transparent and precise. However, this critical topic requires banks to invest in reliable granular data and to increasingly adopt longer-term adaptable strategic thinking. Each bank will also need to decide on the posture it wants to take in order to unlock value, asking themselves ‘Are you willing to be a pioneer?’”

Media contacts:

For questions or to request an interview, please contact Gary Duncan at gary.duncan@bain.com or Katie Ware at katie.ware@bain.com.

Notes to editors:

Methodology

Bain & Company examined the top 15 banks by assets in Europe, Asia-Pacific and North America using data from PCAF, PACTA, S&P Global Market Intelligence and banks' annual reports to determine where banks stand in terms of disclosures and target setting. Bain & Company measured both a bank's financed emissions disclosure and the percentage of portfolio value it covered in this study. In addition, it measured whether the bank discloses its 2030 targets, as well as how many sectors it is measuring to assess if it is declaring absolute emissions.

Bain & Company also conducted a study to determine whether data granularity has a significant impact on measurement reliability. This study calculated the carbon footprint for four representative loan portfolios: electric power, metallurgy, automotive and home mortgage, using three methodologies in accordance with the PCAF standard. The Partnership for Carbon Accounting Financials (PCAF) establishes a data quality score that considers the granularity and specificity of emissions data. The score ranges from 1 to 5, with 1 representing highly certain data and 5 representing highly uncertain (nonspecific and general) data.

Bain & Company modelled a theoretical bank with a representative portfolio (e.g. international activities, balanced industries exposure and product mix). Based on volume and probability factors, the model simulated how a bank’s profits would change between now and 2050, excluding inflation or market growth and following three different strategies:

- Pioneer. The bank displays an early, strong commitment to climate transition.

- Follower: The bank undertakes climate transition, but not quickly or aggressively.

- Laggard: The bank delays and adopts a passive approach, tied to regulatory requirements.

ベイン・アンド・カンパニーについて

ベイン・アンド・カンパニーは、未来を切り開き、変革を起こそうとしている世界のビジネス・リーダーを支援しているコンサルティングファームです。1973年の創設以来、クライアントの成功をベインの成功指標とし、世界40か国65都市にネットワークを展開しています。クライアントが厳しい競争環境の中でも成長し続け、クライアントと共通の目標に向かって「結果」を出せるように支援しています。私たちは持続可能で優れた結果をより早く提供するために、様々な業界や経営テーマにおける知識を統合し、外部の厳選されたデジタル企業等とも提携しながらクライアントごとにカスタマイズしたコンサルティング活動を行っています。また、教育、人種問題、社会正義、経済発展、環境などの世界が抱える緊急課題に取り組んでいる非営利団体に対し、プロボノコンサルティングサービスを提供することで社会に貢献しています。

商号 : ベイン・アンド・カンパニー・ジャパン・インコーポレイテッド

所在地 : 東京都港区赤坂9-7-1 ミッドタウン・タワー37階

URL : https://www.bain.co.jp