スナップチャート

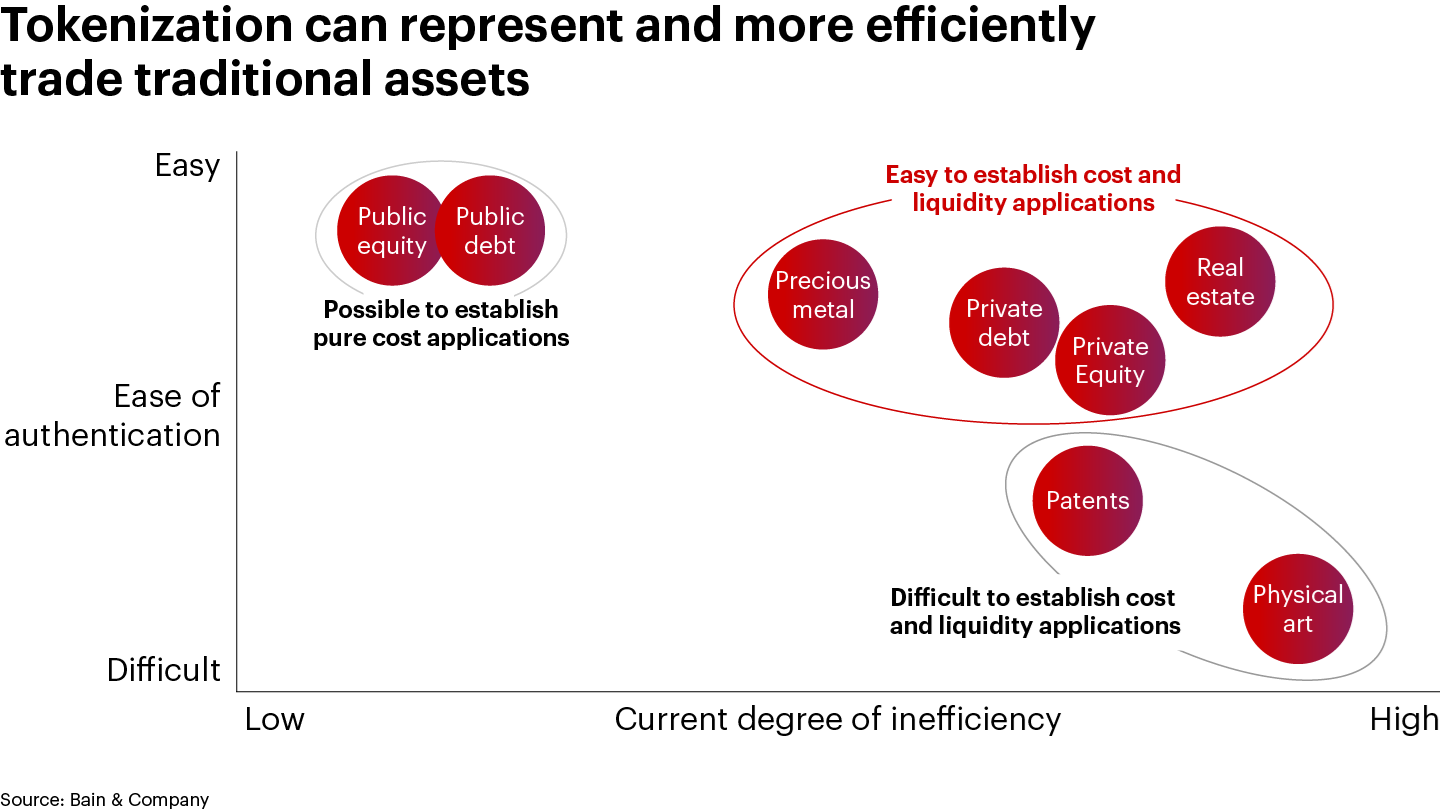

Beyond the crypto trading headlines, real asset tokenization is an important but less known part of web3. A token is a piece of data that represents a piece of information, such as a credit card account number or any digital or physical asset. Private market assets like real estate, private equity, and private debt do not operate with the same type of infrastructure as public security markets. Tokenizing these assets and defining standards for trading can make it easier and more efficient to trade real-world assets or use them as collateral, like public securities are used as collateral today (see Figure 1). For instance, shares of an office building in Miami would move more easily through the financial system with tokenization. Tokenization is emerging in private equity, where KKR plans to use tokenization to enable part of one of its private-equity funds available to individual investors on the public blockchain.

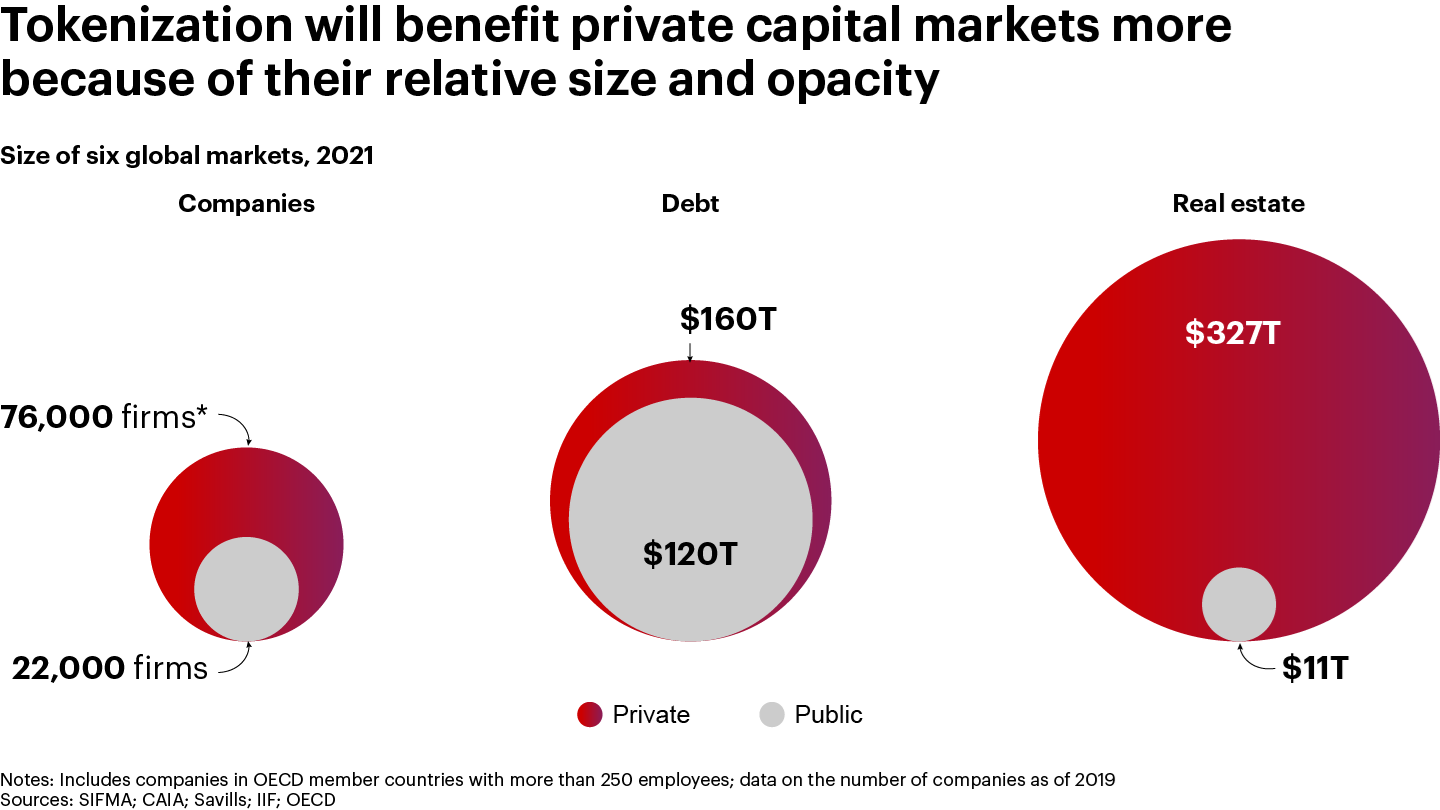

These private markets are far larger than public markets (see Figure 2). The web3 evolution could take a decade or more, but any firm working in capital markets, asset or wealth management should be excited about the chance to improve its view of and access to private assets.

For Digital Assets, Private Markets Offer the Greatest Opportunities

Four emerging business models hold promise by tapping the benefits of distributed ledger technology.