レポート

Executive summary

Dynamic market shifts are propelling traditional enterprises in all industries toward digital. The forces are many: Companies feel pressured to find better ways to engage with customers and make the most of data proliferation while being challenged by disruptive innovators. They all are grappling with the same critical decisions about how to build the digital capabilities that will support their future growth.

Bain & Company wanted to track traditional (i.e., non-digital native) enterprises on this journey to understand how well positioned they are to succeed, what companies farthest along on the digital journey are doing to stay ahead of the competition and which best practices companies can apply to their own digital transformation. We partnered with Red Hat to survey 449 US executives and IT leaders across industries.

Among the objectives of our research: to determine the future role of next-generation technology in digital transformation for traditional enterprises, with emphasis on containers, a new technology that enables software to run reliably when moved from one computing environment to another.

A quest for digital maturity

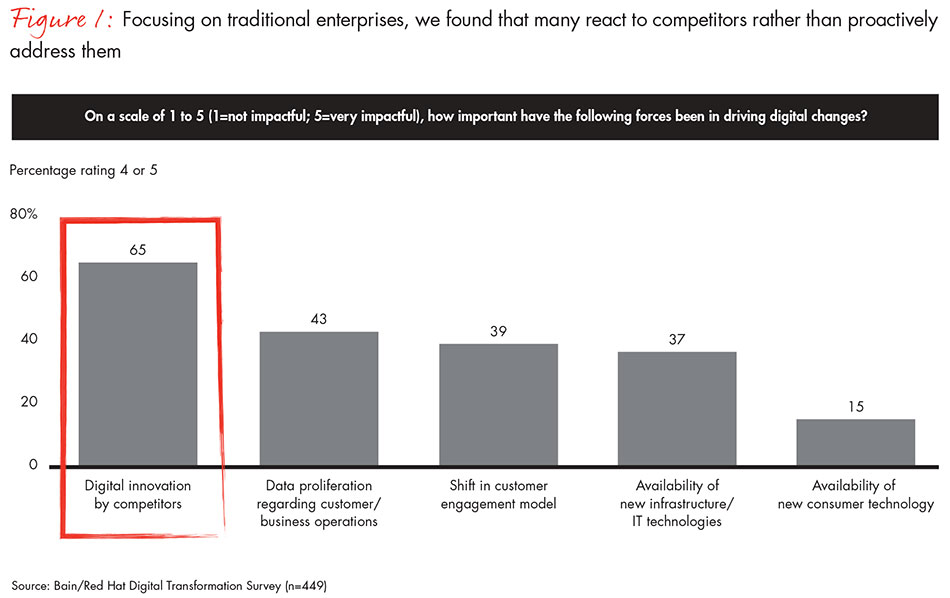

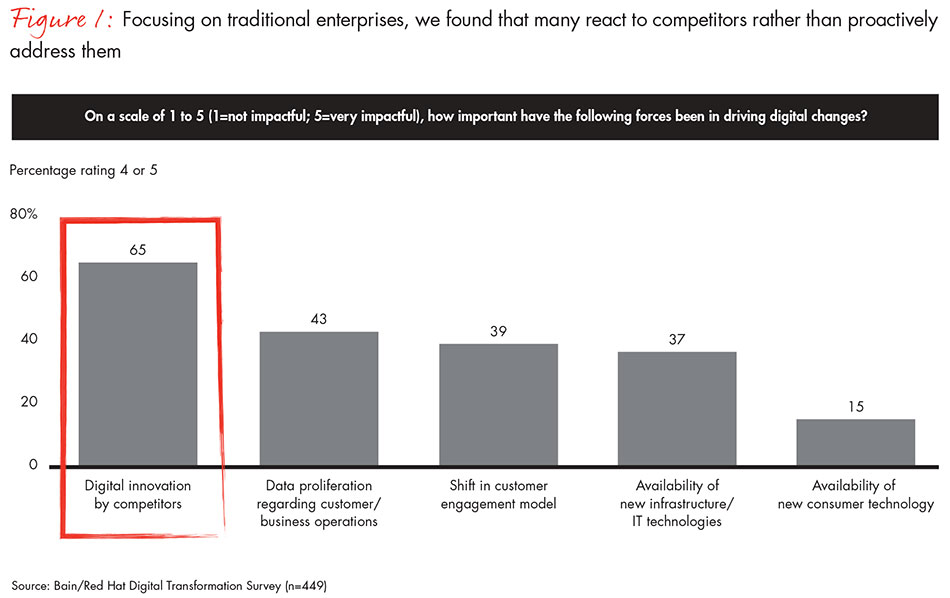

Our research helped us bring digital transformation into sharper focus. Digital disruption is affecting different industries at different rates, but few will avoid its impact. Our research shows that far and away, the biggest disruptive force is digital innovation by competitors, which was cited more frequently than any other factor. This finding reinforces our view that many companies are in a reactive mode and that those that wait to respond to competitors’ moves risk being out-innovated by more proactive companies. Despite the mounting pressures, we found that few traditional enterprises have made substantial progress on the digital journey and even the most digitally mature traditional enterprises are not on the bleeding edge.

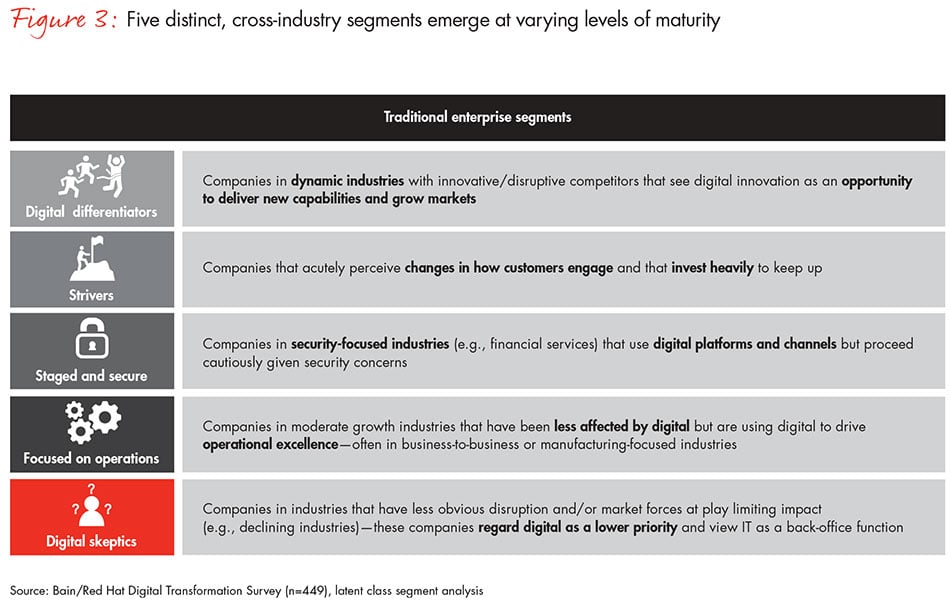

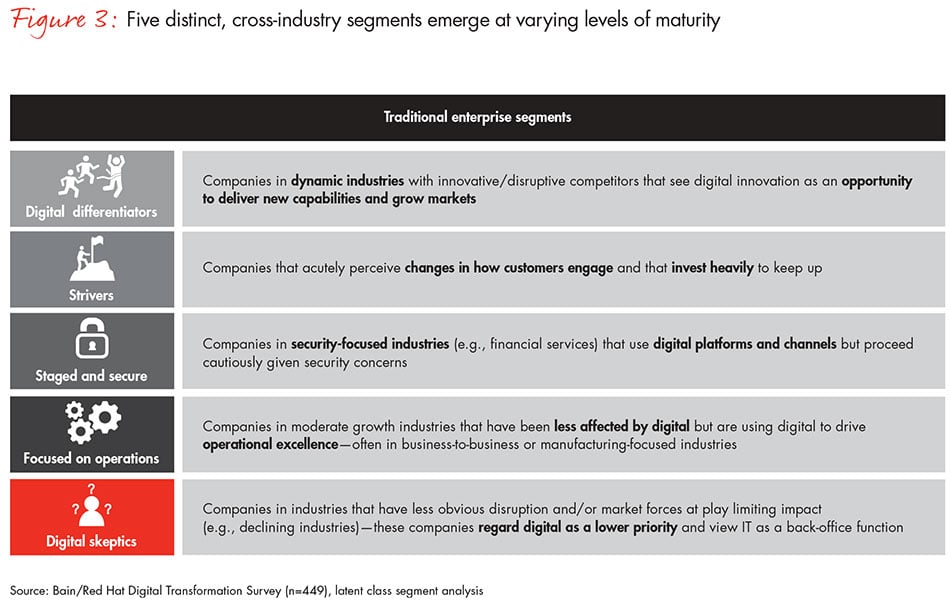

In all, we identified five distinct segments of companies:

- digital differentiators in dynamic industries that need to stay aggressive to compete, deliver new capabilities and grow the market;

- strivers that are investing to keep up with changes in customer engagement;

- staged and secure companies in security-focused industries (such as financial services) that use digital platforms but need to proceed cautiously;

- operations-focused companies in moderate growth industries (often business-to-business or manufacturing-focused) that have been less affected by digital but are using digital for operational excellence; and

- digital skeptics in industries with less obvious disruption that regard digital as a lower priority and view IT primarily as a back-office function.

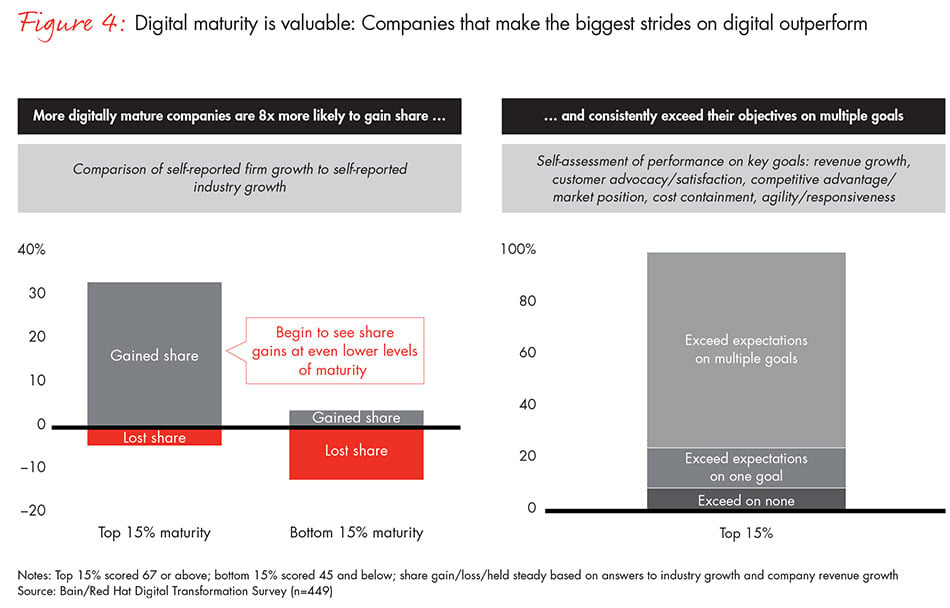

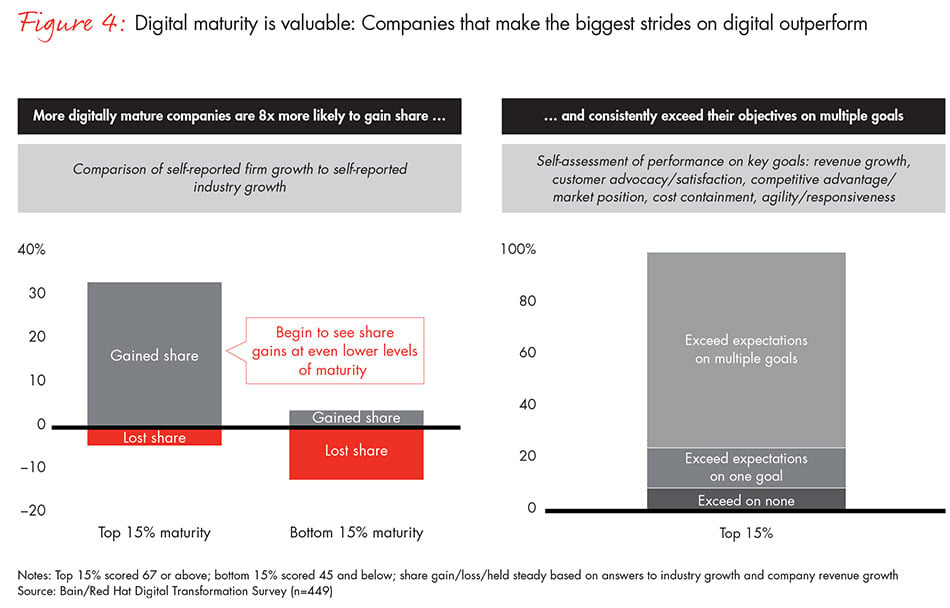

Across this landscape, one finding underscores the true value that is associated with becoming more digitally advanced. Among the surveyed companies, the 15% of companies that are farthest along on the digital maturity curve are 8 times more likely to have gained share than the 15% of companies that are least mature. This finding is based on data across industries, whether business success is driven by operational efficiency or customer/ product innovation. Digital capabilities are enabling leaders to differentiate and drive business outcomes.

The digital maturity journey

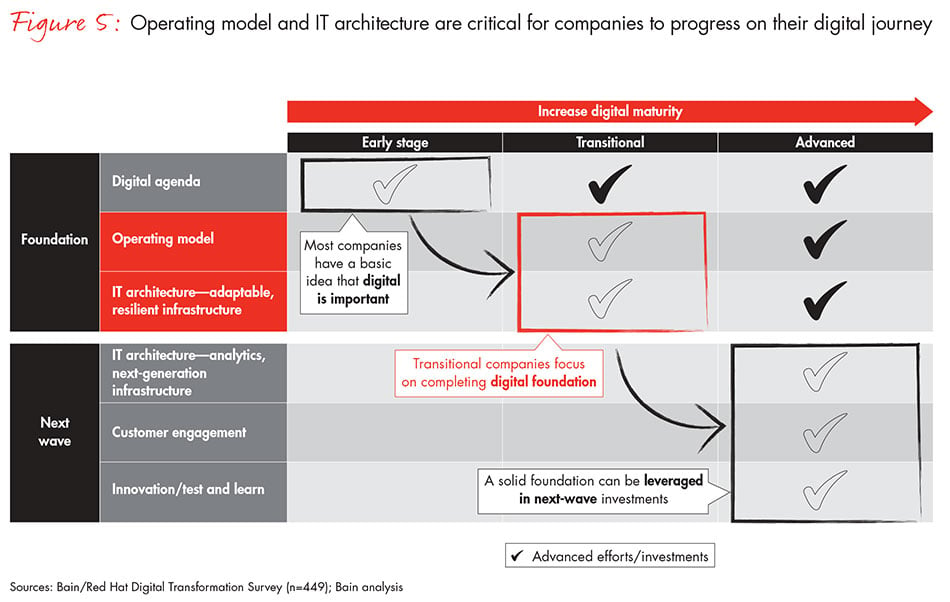

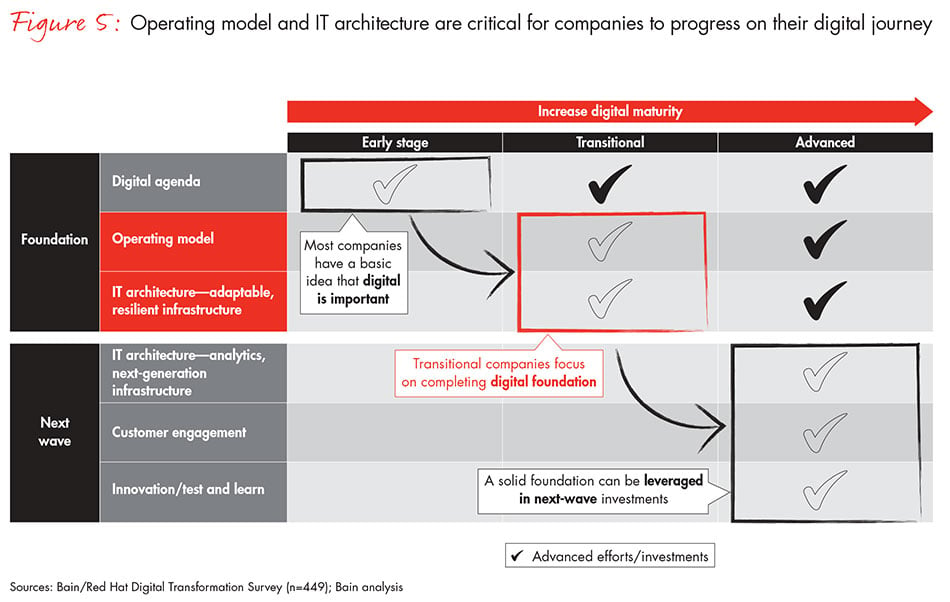

Across segments, companies take a well-defined path toward digital maturity by prioritizing investments in operating model changes to improve decision rights, talent management and collaboration, as well as in the core elements of an IT architecture needed to spur digital capabilities. These investments are the digital foundation that enables more advanced capabilities in customer engagement, analytics and rapid innovation. More digitally mature companies understand that, without having such investments in place, these more advanced initiatives will be limited in their potential impact. Building this foundation is the focus of a comprehensive, cross-functional transformation, and the elements of this transformation are highly interrelated. For instance, before making technology decisions, more digitally mature firms ensure that investments are aligned with the processes, culture and architecture that support digital capabilities.

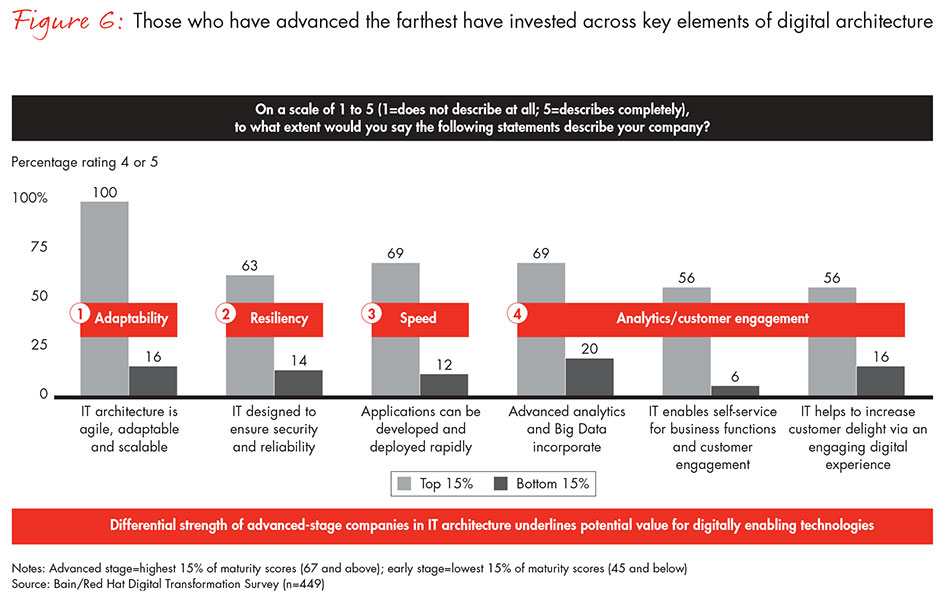

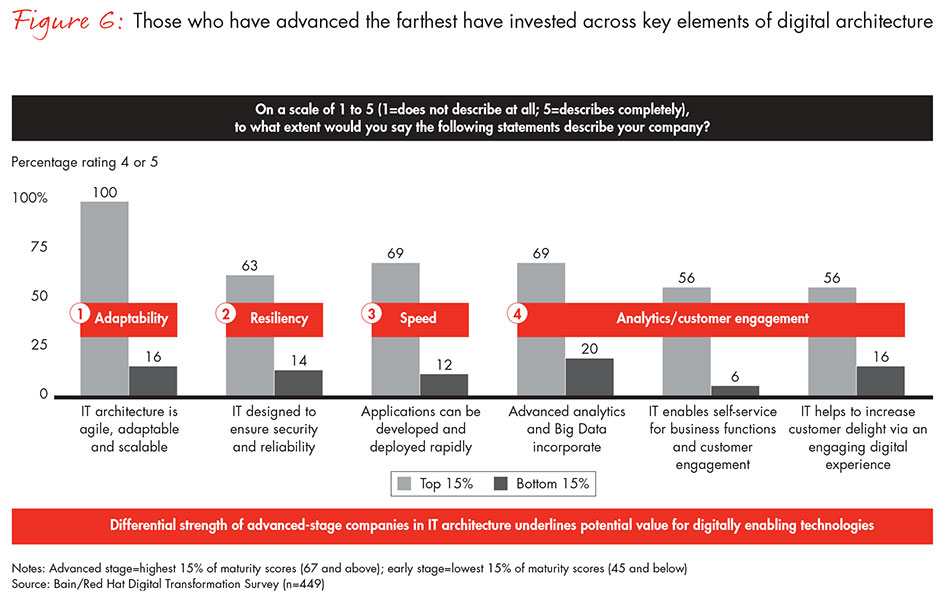

Specifically in terms of IT architecture, firms invest in technology that delivers adaptability, resilience, speed and the ability to use analytics for better-informed decisions that improve the customer experience and operations. These involve significant investment, with next-generation architecture being a particularly consistent focus. As expected, our research determined that, among the most digitally advanced traditional enterprises, all report that they consider their architectures to be agile, adaptable and scalable, vs. only 16% of those that are least advanced.

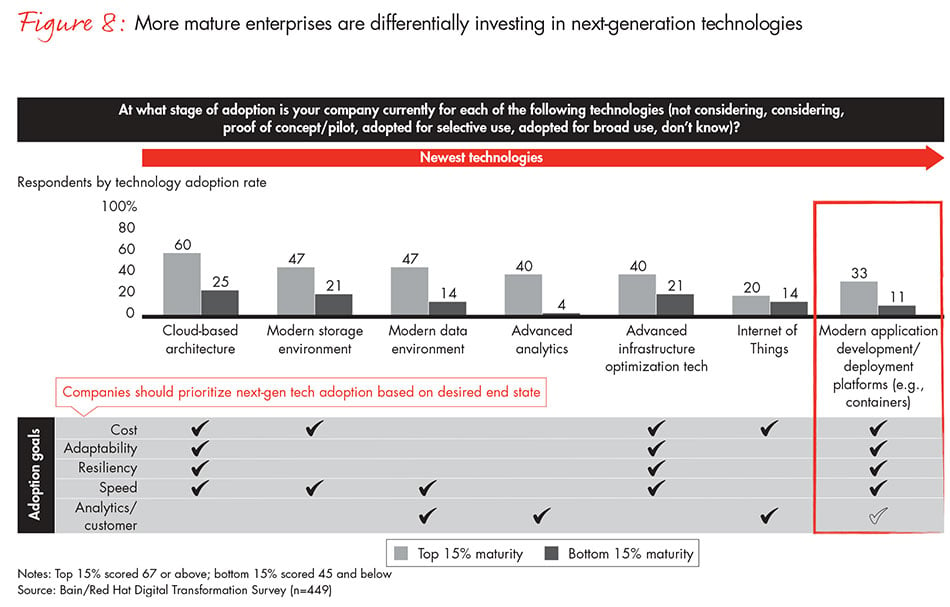

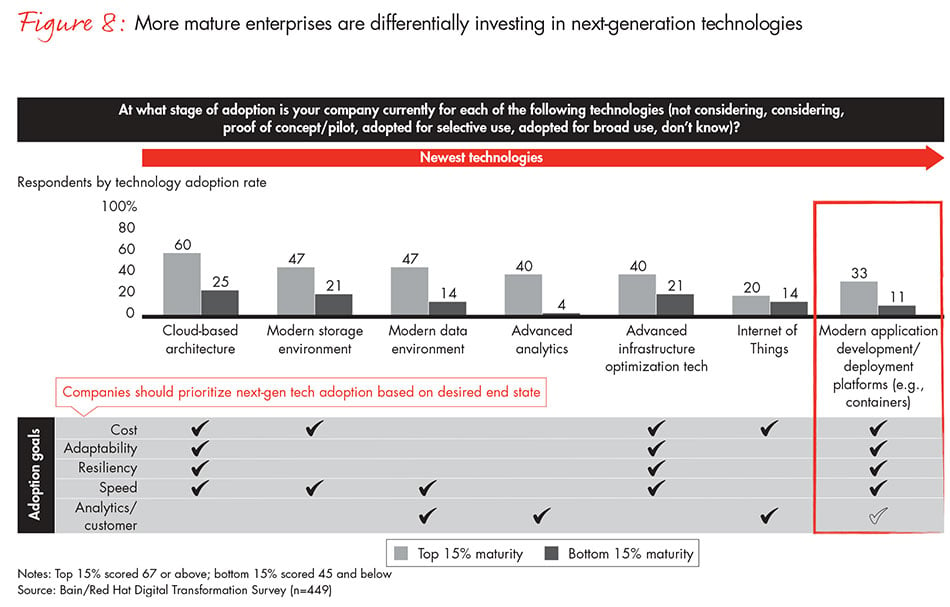

More digitally mature companies also tackle the challenges of architecture modernization head-on, seeking to capitalize on infrastructure and invest in differentiators. They recognize that existing infrastructure and applications do not need to be a drag on digital efforts; optimizing and modernizing existing technology should be part of the overall journey. When comparing more and less digitally mature companies, our survey showed that investment varies dramatically in cloud-based architecture, data access and advanced analytics (machine learning, Big Data), infrastructure optimization technologies, and modern application development and deployment platforms such as containers. In the newest of these technologies, modern application development, companies that are most digitally mature are three times more likely to invest than the least mature companies. This emerging investment trend led us to conduct a deeper dive into containers to understand the future role they may play in modernization.

The Path to Digital Maturity

The most digitally mature companies are eight times more likely to gain market share than the least digitally mature. Here’s how containers can help facilitate a digital transformation.

Can containers make a difference?

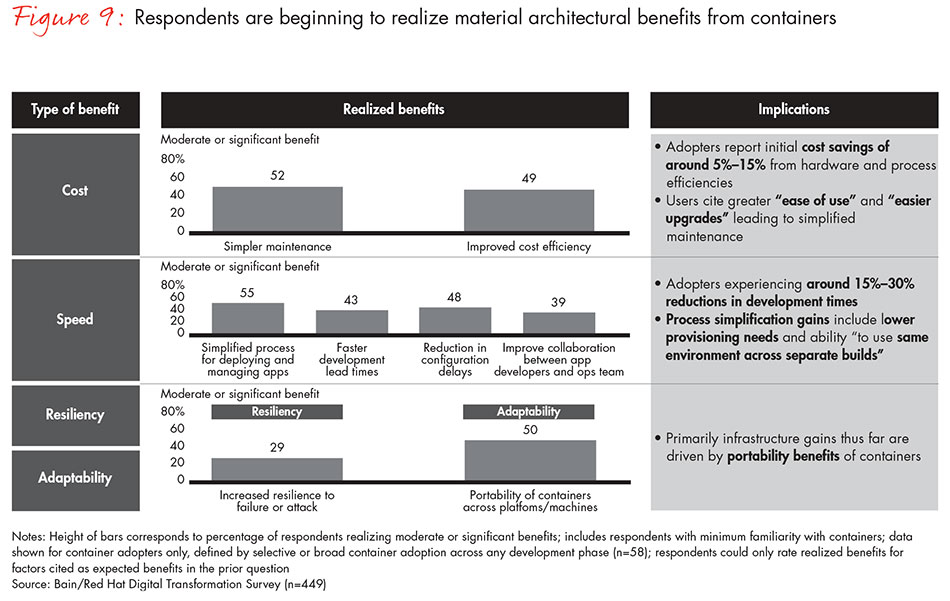

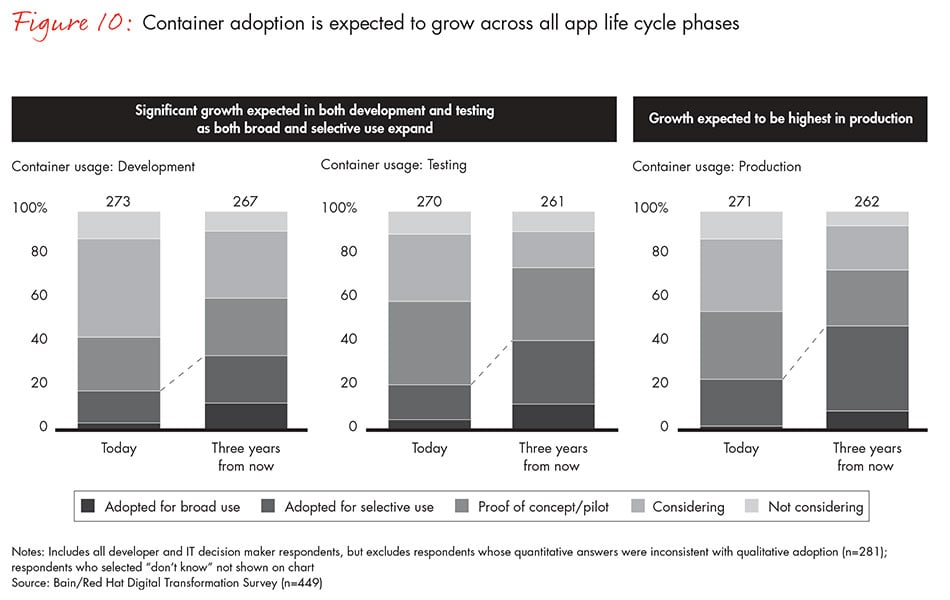

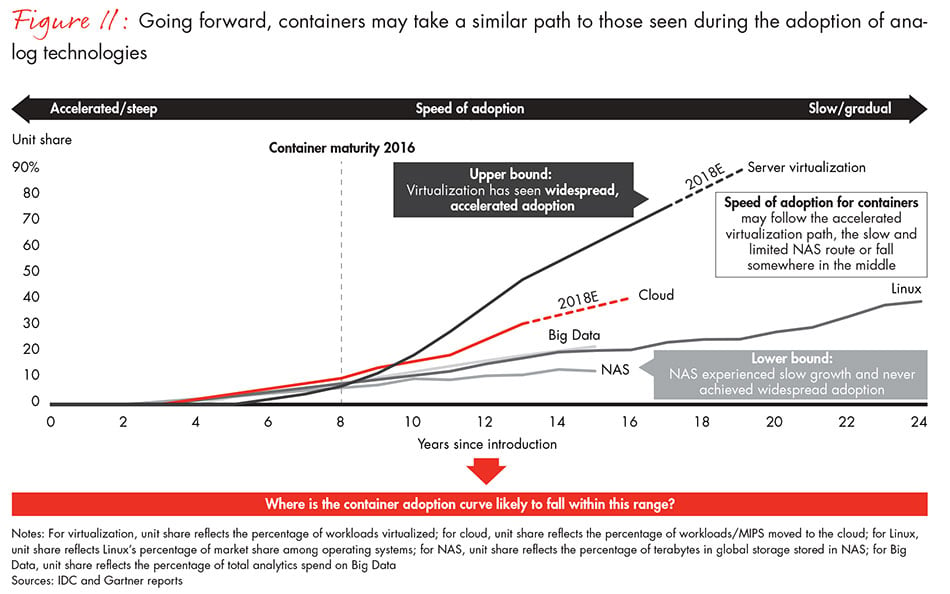

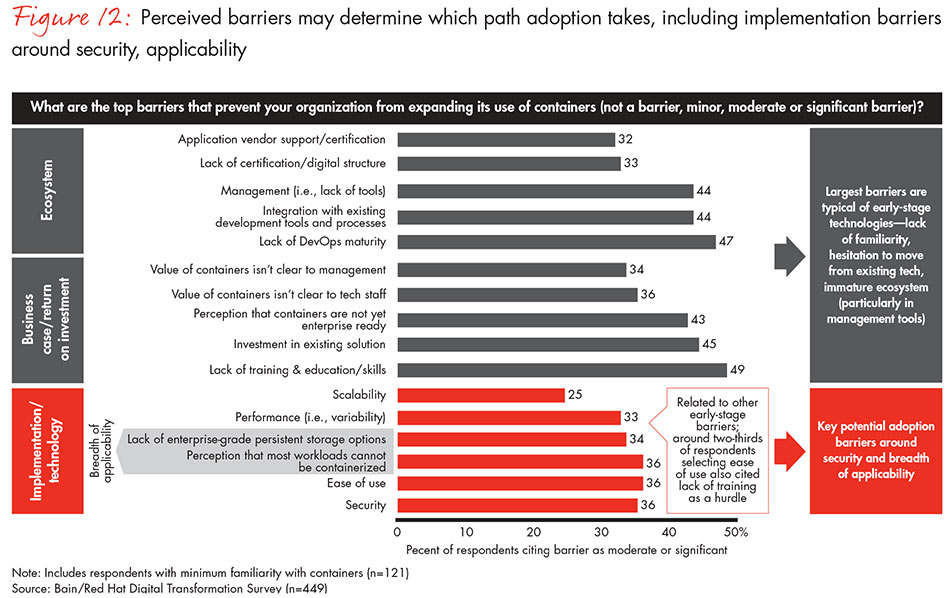

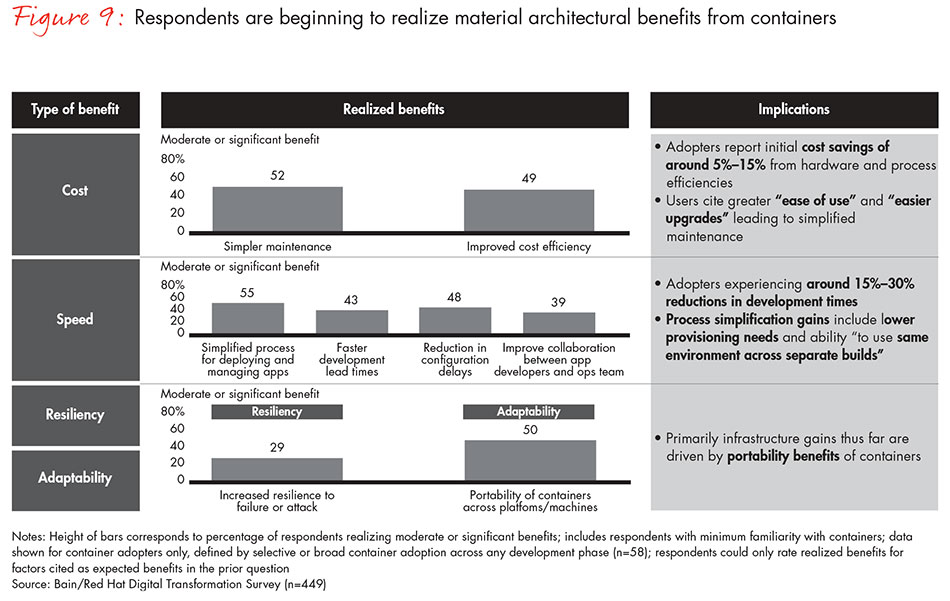

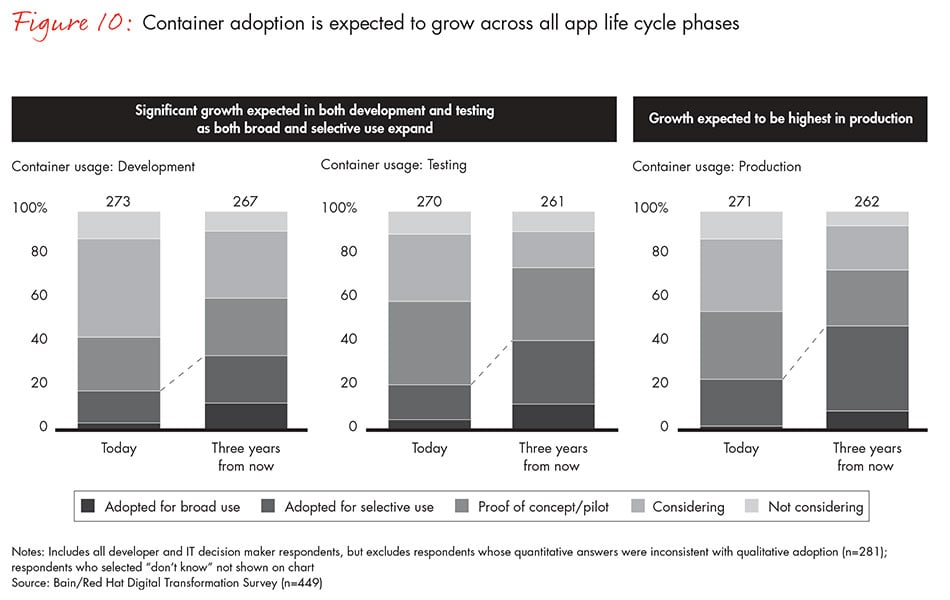

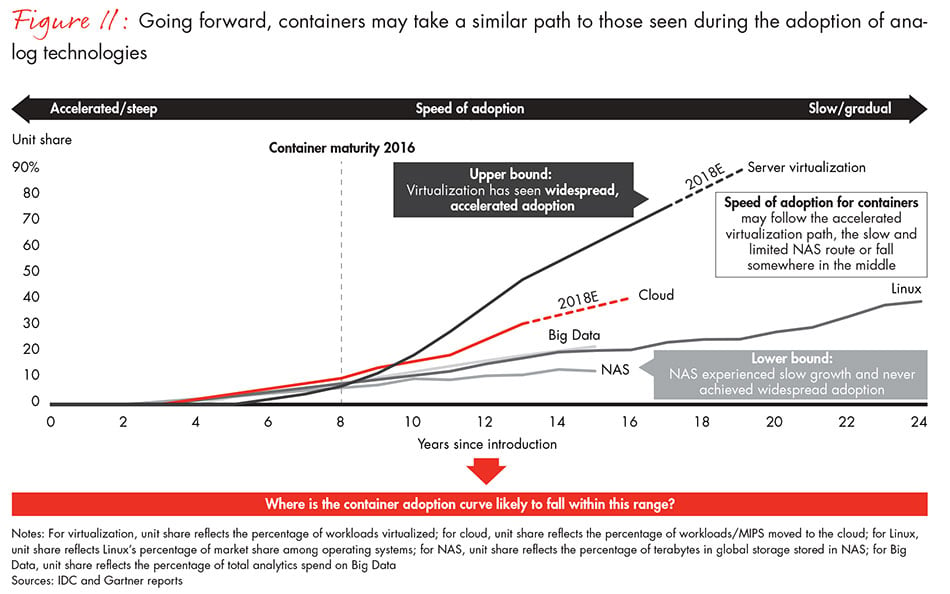

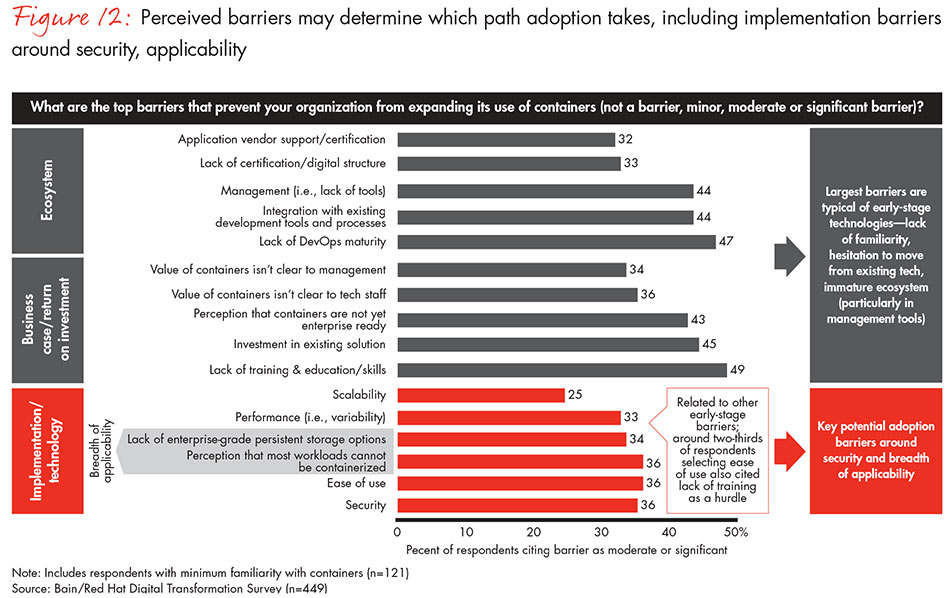

One of the objectives of our research was to determine the likely path of container adoption, as containers directly or indirectly enable several key attributes of digital transformation. Indeed, our survey found that respondents are beginning to benefit from faster innovation as well as improved development and deployment cycles. For example, adopters frequently report 15% to 30% reductions in development time. Adopters also report initial cost savings of 5% to 15% due to greater hardware and process efficiencies. Containers’ greater portability also improves the flexibility and scalability of IT architectures, with some adopters mentioning containers as a step toward migration to more cloud-focused architectures. Given these benefits, container adoption is expected to grow across all phases of the application life cycle (development, testing and production), with the growth being most dramatic in production. Some perceived hurdles to adoption include security issues, the impression that most workloads cannot be containerized (i.e., applicability) and worries about the lack of enterprise-grade persistent storage options. Given these concerns, we wanted to understand if containers could replicate the rapid adoption of analog technologies such as server virtualization once the perceived obstacles are lessened. Our research suggests that there are reasons to be optimistic about the future of containers.

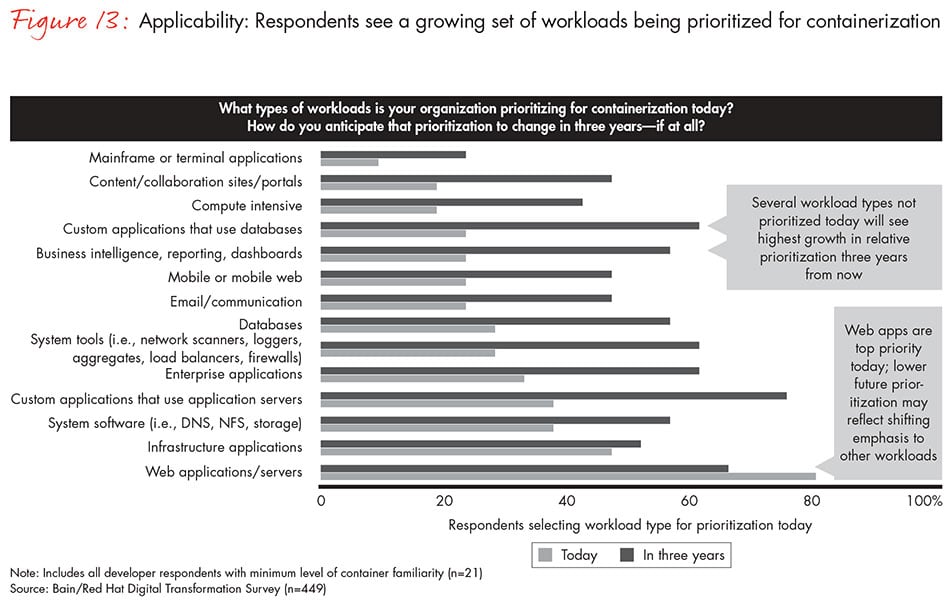

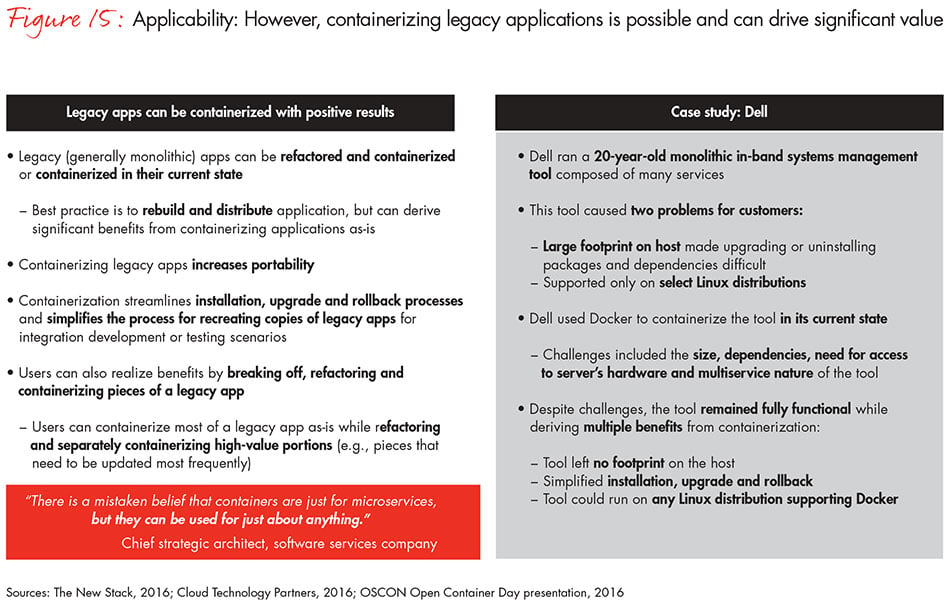

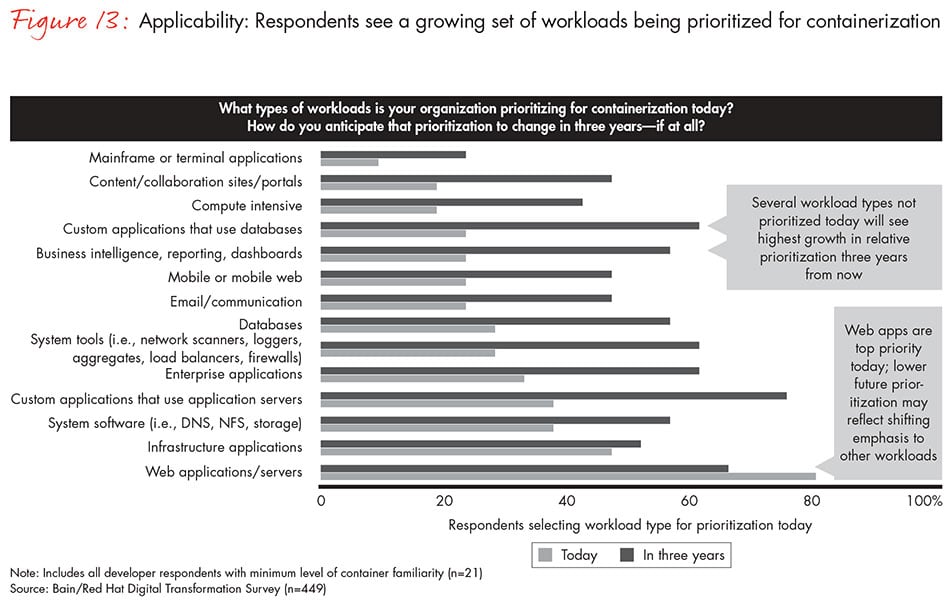

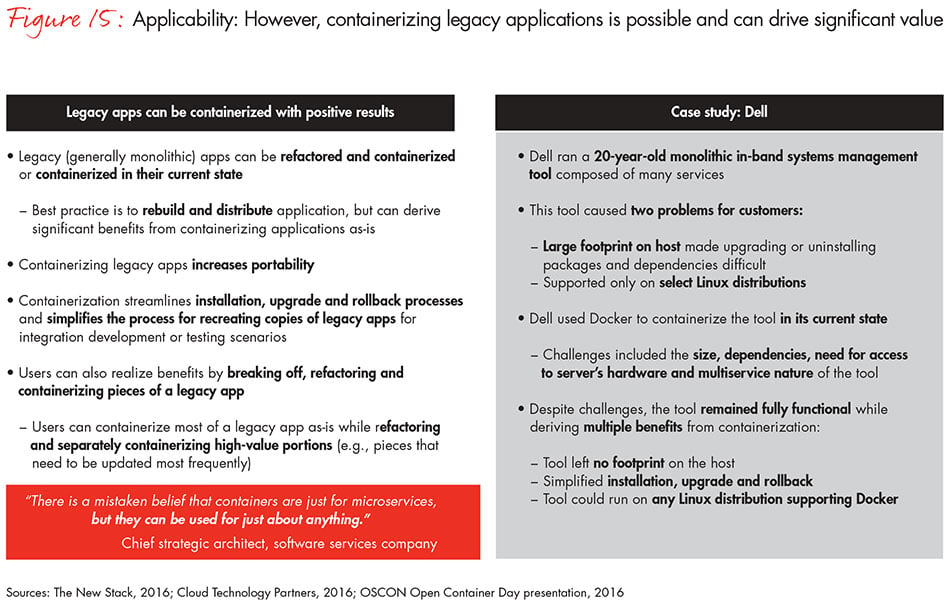

Many companies evaluating containers ask a fundamental question: Are they as broadly applicable as server virtualization to a spectrum of workloads? While overcoming the applicability barrier will be key to containers’ future path, survey respondents do report a growing set of workloads being prioritized for containerization. We are seeing progress on initially more difficult-to-containerize stateful applications, and companies are showing high interest in moving beyond web applications to containerize more traditional applications (e.g., databases, business intelligence/analytics, custom apps) over the next three years. In addition, while today early container adopters are prioritizing net new applications engineered in ways that are easy to containerize (e.g., microservices), we are increasingly seeing examples of companies containerizing older, monolithic applications, further expanding containers’ applicability. As with other applications, containerizing these legacy apps has potential to improve adaptability and cost efficiency by increasing portability, decreasing complexity and streamlining the installation, upgrade and rollback process. Among the companies benefiting from the new technology, Dell has publicly stated that it used the industry-leading Docker container format to containerize a 20-year-old monolithic in-band systems management tool that remained fully functional while leaving no footprint on the host. Containerization simplified installation, upgrade and rollback, and could run on any Linux distribution supporting the Docker format.

As containers grow in value, we are seeing industry momentum increase around them. Battle lines are being drawn in container orchestration and management between lead innovator Docker, which continues to drive the container format standard, and solutions from incumbent software vendors as well as leading cloud vendors (e.g., Google’s Kubernetes), and many respondents are indicating that they are implementing multiple solutions or even developing their own.

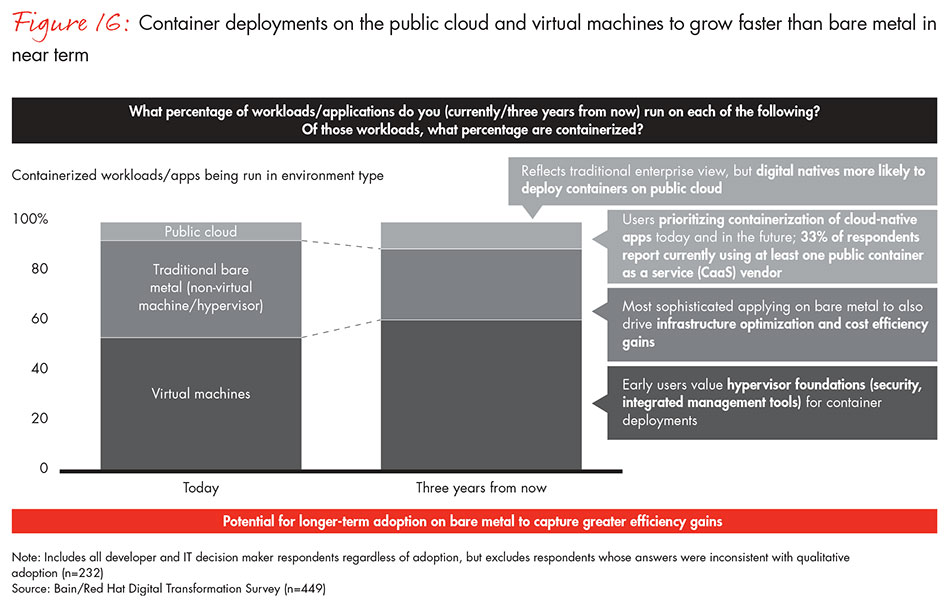

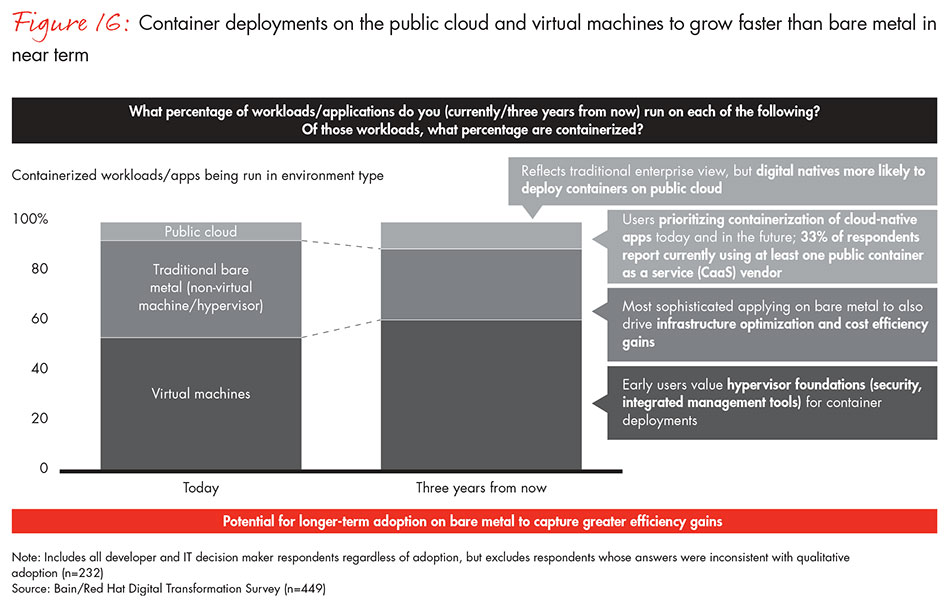

Yet, despite the potential for broader ecosystem impacts, we do see containers continuing to coexist with virtual machines (VMs) in the near future, as respondents indicated that over the next three years they will increasingly deploy containers on VMs as opposed to bare metal. Despite the limitations on cost efficiencies from containers when implemented on VMs, companies continue to value VMs’ security, familiarity and integrated solution suites.

Whether or not they replicate VMs’ rapid ascent, as container usage continues to evolve and containers become more applicable, we do see them becoming an increasingly attractive option for companies across many industries, particularly as they struggle to meet the intensifying digital imperative.

1. The need to embrace a digital future

- When focusing on traditional enterprise, our survey found that the biggest disruptive force was competitor innovation, indicating that many companies are taking a reactive rather than proactive approach to digital. Beyond this, companies are also responding to the greater availability and potential value in new data for their customers and operations.

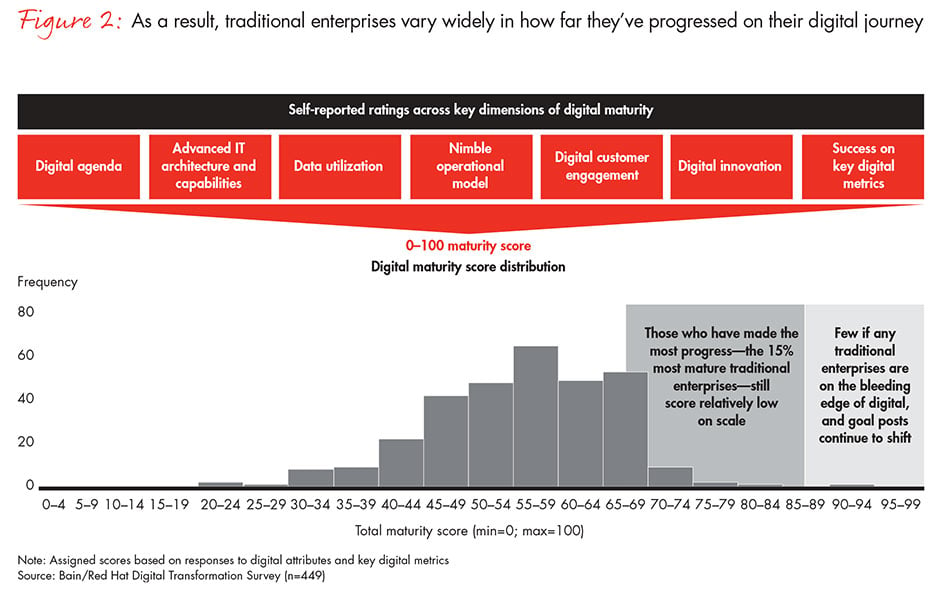

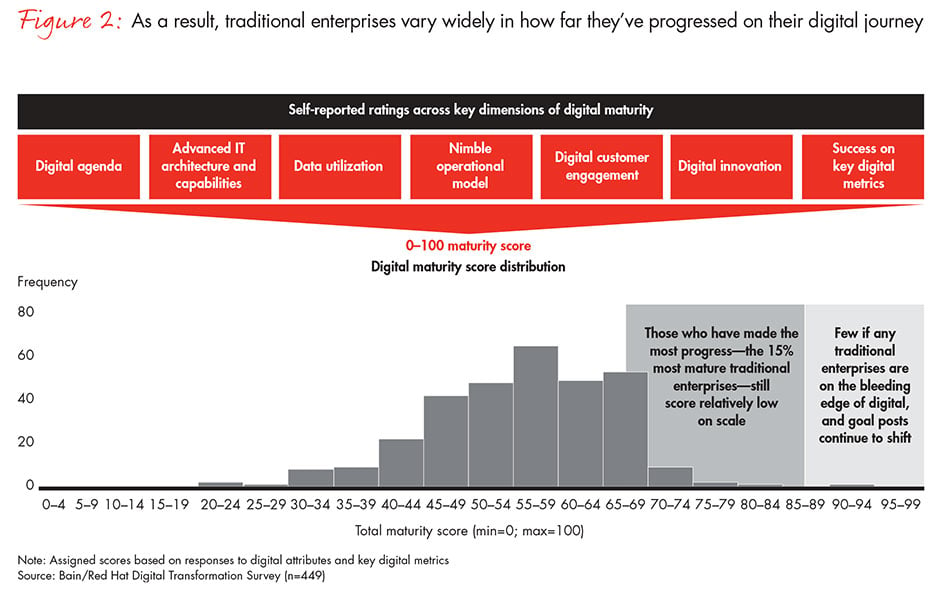

- We assessed the digital maturity of traditional enterprises across key attributes and business metrics such as the use of digital to improve engagement for data analytics and rapid innovation. We also considered the agility, adaptability and scalability of their IT architecture. On these measures, traditional enterprises vary widely in how far they’ve progressed on their digital journey. However, even those that have made the most progress—the 15% of most mature traditional enterprises—still score relatively low compared with what we would expect for digital innovators.

- Five distinct, cross-industry segments emerge at varying levels of maturity: digital differentiators, strivers, staged and secure companies, operations-focused companies and digital skeptics.

- Companies that have made the most strides in digital outperform their rivals. The 15% of companies that are farthest along on the digital maturity curve are 8 times more likely to have increased market share and consistently exceed multiple goals than the 15% of companies that are least mature.

2. Finding the right path to digital maturity

- Companies take a well-defined path to digital maturity by investing in operating model changes to improve decision rights, talent management and collaboration as well as the IT architecture needed to spur digital capabilities. This gives them a solid foundation to invest in the next wave.

- Digitally mature traditional enterprises are making gains in adaptability, resilience, speed and analytics/customer engagement. For example, on a 1 (does not describe at all) to 5 (describes completely) scale, 69% of leaders rated themselves a 4 or 5 when it comes to investing in capabilities to rapidly develop and deploy applications while only 12% of the less mature traditional enterprises rated themselves a 4 or 5.

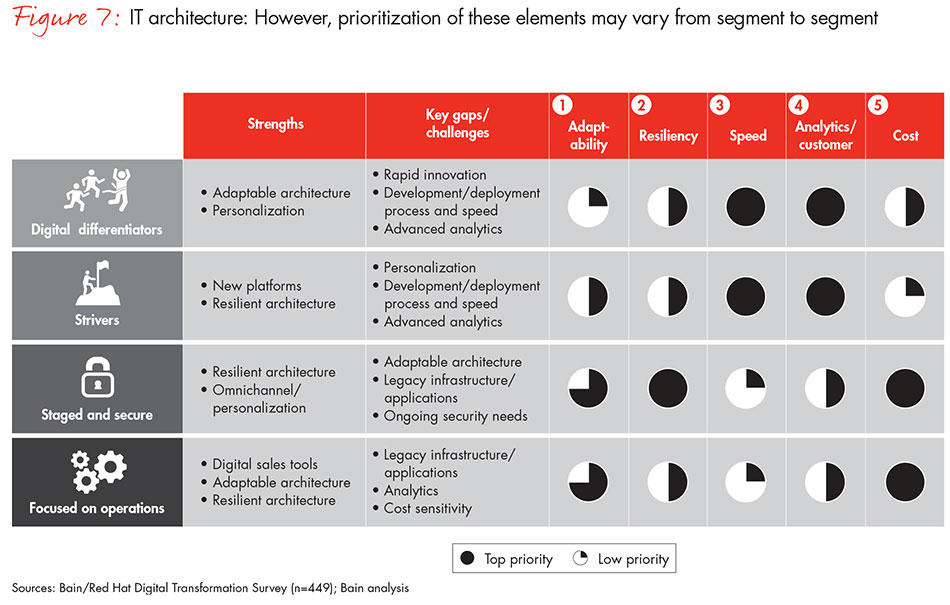

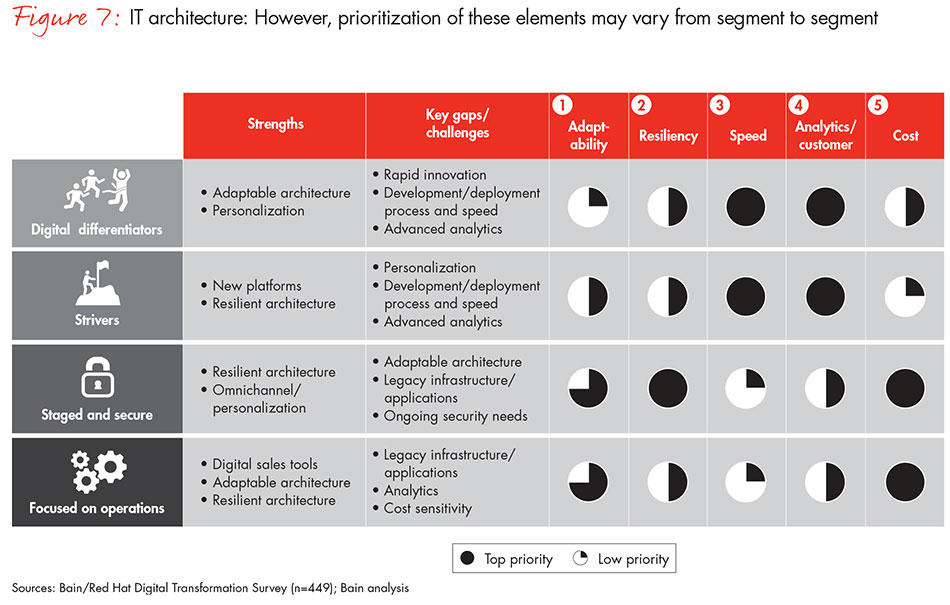

- Prioritization of these elements, however, may vary from segment to segment. Speed is likely to be a priority for digital differentiators and strivers while cost may be a key objective for staged and secure and operations-focused companies.

- As companies move along the digital maturity curve, they invest more in next-generation technologies because more demands are placed on the infrastructure to be adaptable, scalable and agile.

- The survey found that respondents are beginning to realize material architectural benefits from containers. Process simplification gains include lower provisioning needs and the ability to use the same environment across separate builds.

3. The evolution of container technology

- Container adoption is expected to grow across all app life cycle phases, especially the production phase.

- Going forward, containers may take a similar adoption path to that seen by analog technologies such as virtualization.

- Perceived barriers may determine which path adoption takes. Some of those include implementation barriers regarding security and applicability as well as concerns typical of early-stage technologies such as training and familiarity, stickiness of existing technology investments and an immature ecosystem.

- With regard to concerns about applicability, we see container adopters prioritizing a growing set of workloads. Today, web apps are a top priority for some of the companies we studied, but future emphasis may shift to other workloads, even those traditionally considered more difficult to containerize.

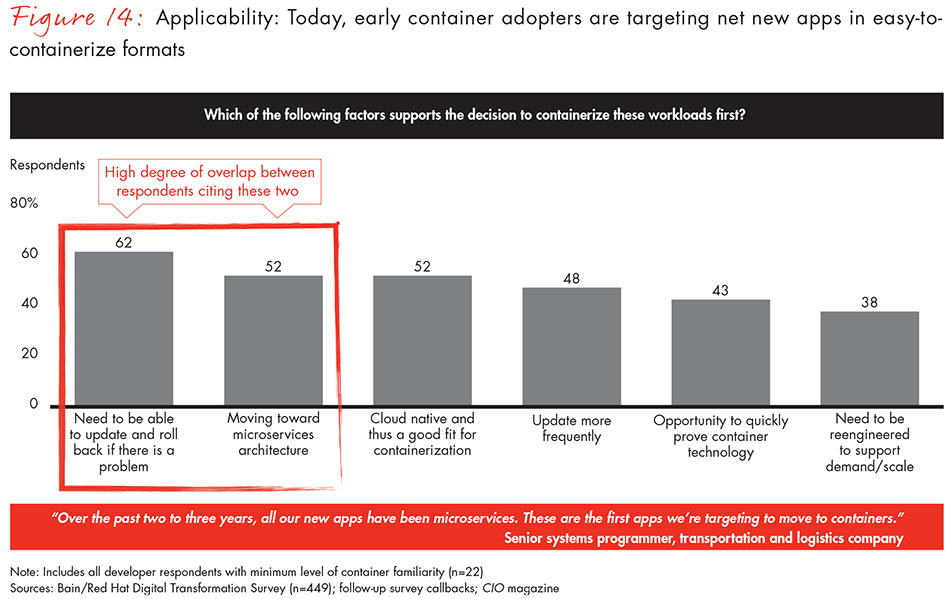

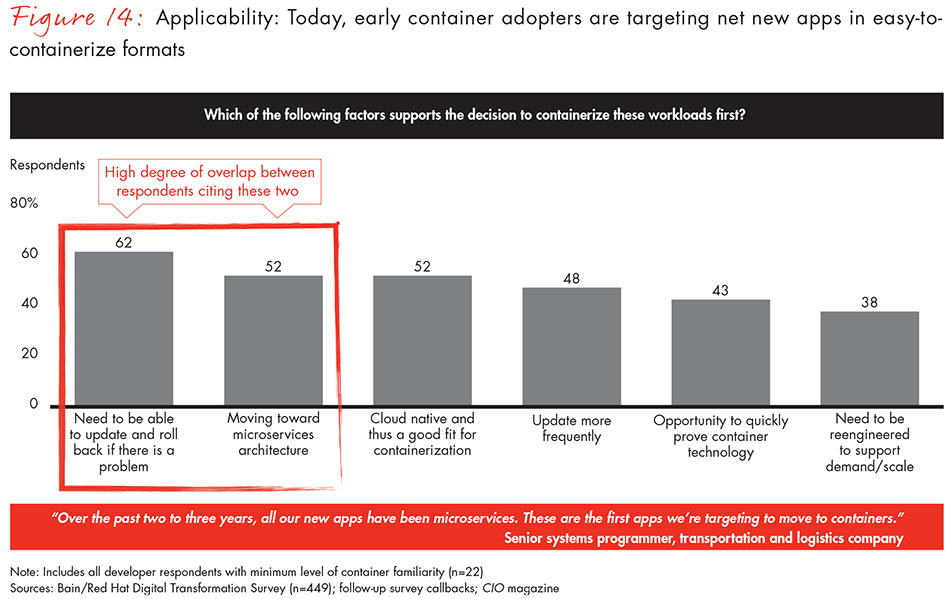

- A further example of expanding container applicability can be found in companies looking beyond net new applications when thinking about containers. Today, early container adopters are most often targeting apps (typically, net new apps) constructed in ways that fit well with containers. For example, the modular nature of applications engineered for microservices suits them well for containerization and maximizes container benefits for rapid updates and rollback. Among respondents, half of container adopters indicate that they are prioritizing workloads in which they are moving toward a microservices architecture.

- Yet, companies are finding that containers are not just for workloads that have already been designed for microservices. Increasingly, they are using containers for legacy apps as well. For example, Dell successfully used Docker to containerize a 20-year-old systems management tool.

- Container deployments on the public cloud and virtual machines will grow faster than bare metal deployments despite enhanced efficiency in private environments.

Jeff Taylor is a Bain & Company partner based in Boston. Paul Renno is a partner based in San Francisco and Jesse Klein is a manager in Boston. All are members of Bain’s Technology practice.

Red Hat is the world’s leading provider of open source software solutions, using a community-powered approach to provide reliable and high-performing cloud, Linux, middleware, storage and virtualization technologies. Red Hat also offers award-winning support, training and consulting services. As a connective hub in a global network of enterprises, partners and open source communities, Red Hat helps create relevant, innovative technologies that liberate resources for growth and prepare customers for the future of IT. Learn more at http://www.redhat.com.