論説

The sharp declines in public software values in recent weeks reflect rising concerns over AI’s growing ability to replicate core functionality and, over time, erode installed bases. The spark for last week’s drop was Anthropic’s introduction of Claude Cowork, which exacerbated those concerns. Broad software indices are now down by about 15% over the past few weeks and by about 25% from 12-month highs. To date, installed bases have largely held up, with average gross retention still around 90% or better—but investor confidence has clearly shifted.

These concerns are hitting on top of an already challenging growth environment.

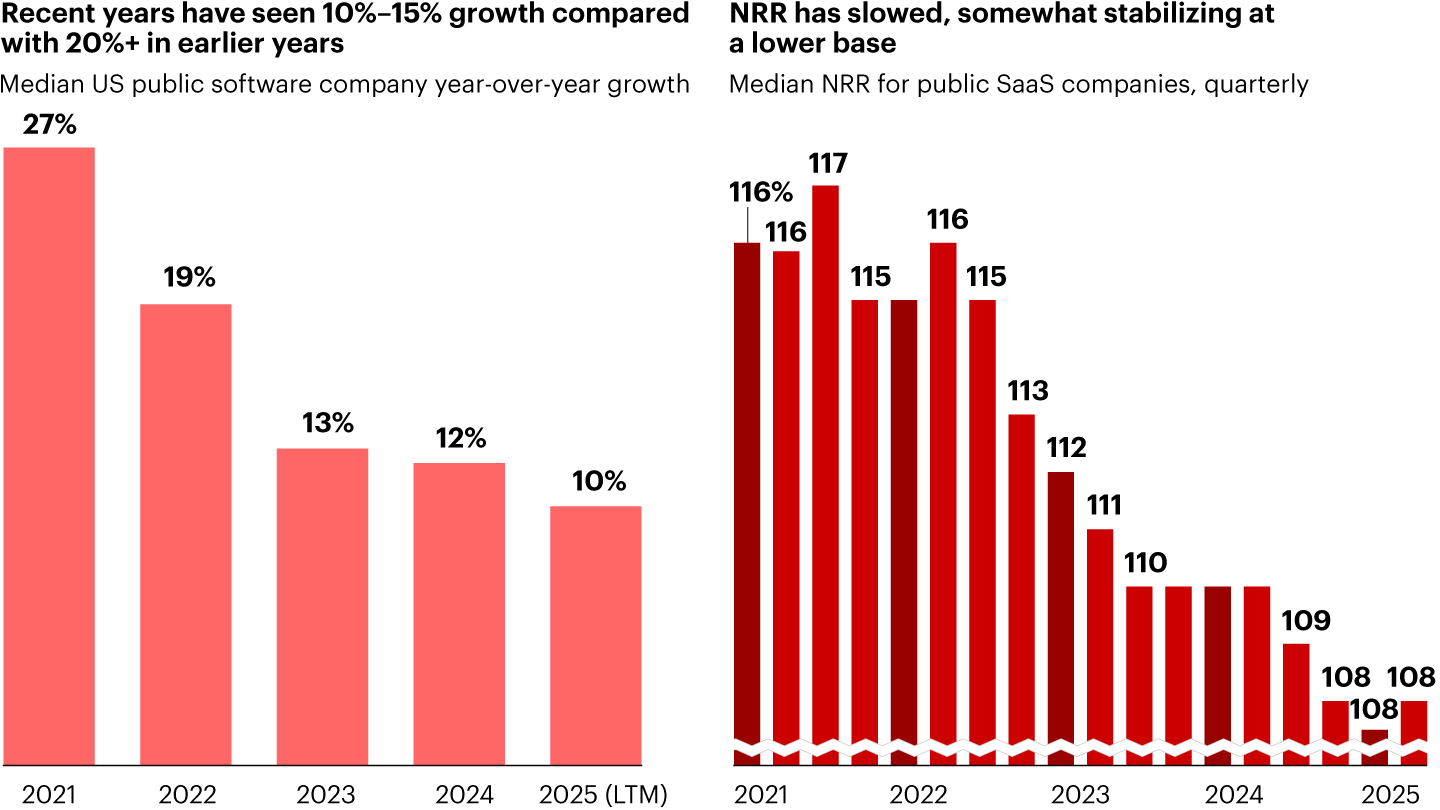

Net revenue retention has stalled as penetration curves flatten for core functionality and seat growth becomes a less meaningful driver (see Figure 1). At the same time, AI has dampened near-term growth for many independent software vendors (ISVs) as buyer attention and budgets shift from incremental software purchases to AI tooling and broader transformation efforts, where the promise of step-change improvements in labor efficiency and effectiveness is greater.

注 2025 revenue data as of February 2, 2026; last twelve months (LTM) revenue used for 2025 if Q4 reporting was unreleased; data for each indicated year includes firms with software (primary) as industry classification and more than $50M in LTM revenue in that year; bar values for Q2 2021 and Q1 2025 are rounded up to nearest whole number; bar heights represent actual values; Median NRR N=85

Sources: S&P Capital IQ; AlphaSense (N=90)The result is a market that feels frozen. The growth outlook for many ISVs is uncertain, and leadership may change hands. AI poses a structural threat to seat-based models in some use cases and may directly compete with existing products in others. Some vendors are already reporting slower growth in seat count as customer companies become more efficient. Meanwhile, new AI-native players are often funded by capital markets rather than dependent on operating cash flow.

Disruption is mandatory; obsolescence is not

Importantly, not all software companies face the same risks or timeframe. Some players are no doubt being unfairly discounted. Exposure varies by category-level factors (e.g., tolerance for error, task structure, data ownership) as well as company-specific fundamentals (e.g., current net and gross revenue retention, competitive positioning).

Customers say they would prefer to buy AI-enabled solutions from their incumbent vendors. They trust them. They know they are secure. They believe they will be around for the long term. But most incumbents have yet to deliver compelling offerings or prove they can win this new spending. Even where they can, it’s not clear what level of investment is needed to compete effectively. In many cases, the vendors themselves have not sorted out how they would get paid for those solutions. Cracking this challenge will position some as the leaders of the next cycle.

All of this may come as a shock to investors, since software has historically been such a favored asset class. It has been sticky, less cyclical, and cash generative, with high gross margins. Those characteristics do not disappear overnight. But growth is increasingly shifting toward AI features, functionality, and agents, and that requires new investment. Not every software company will be able to make that transition.

Where AI creates opportunity

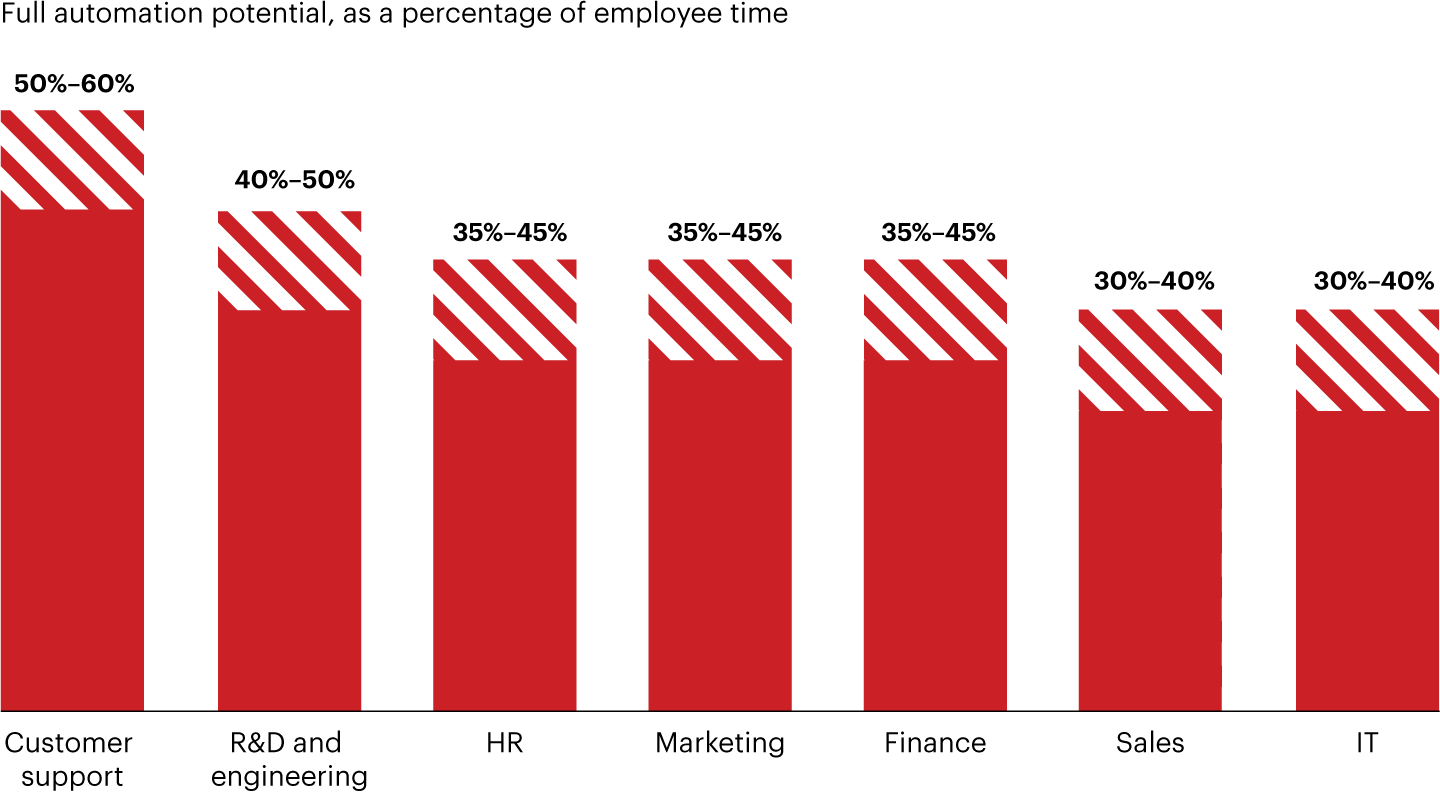

Finding the upside in all this requires software leaders to be clear on a few dimensions. First, how large is the agentic opportunity in a given workflow? High-volume, highly digitized, lower-stakes activities, such as handling customer support tickets, writing code, and answering inbound inquiries, sit at the top end of that spectrum (see Figure 2). There’s a real opportunity for market expansion, but also a real risk of seat compression and budget deferral if incumbents don’t participate.

注 Excludes hyperscalers (e.g., Google), foundation models (OpenAI, Anthropic), and vertical-specific AI-native start-ups (e.g., Hippocratic AI)

Sources: US Census data; US Bureau of Labor Statistics; Bain analysis; literature searchSecond, how exposed is the underlying software to erosion by AI? This depends on a range of factors, including barriers to switching, mission criticality, data access, and how closed the system is. For most enterprise systems of record, those moats remain strong.

Even so, pressure on the per-seat license model is a rising consideration. Right now, copilots and coworkers can automate marginal usage. Instead of 500 seats, a customer might buy 450 and let an agent do the rest. Clearly, that doesn’t sink the business case for the system, but it does change the economics.

At the same time, AI increases costs. Cloud already introduced meaningful new costs into software models. AI compute will accelerate that. The amount varies widely by use case, and pricing discipline matters. But the underlying economics of the software layer don’t simply vanish.

Clarifying the path to durable growth

All of this leads to a very urgent strategic imperative. Software CEOs and boards need to be clear-eyed about where they sit, what bets they are making, and how fast they are moving

That starts with staying close to customers and understanding what problems they are desperate to solve, what parts of their labor stack they need to make more efficient, and where agents can truly deliver value. It requires making hard change initiatives to bring in the talent and processes needed to build that engine while keeping the base business healthy.

Some moves are “no regrets.” In the past, a great product in a growing market could compensate for weakly managed operations because customer adoption kept rising anyway. That’s no longer true. Software companies now need to run their core business extremely well, with better cost control, strong execution, and high productivity, just to stay competitive.

The good news is that software businesses still have a right to win. Core software outside of AI should continue to outpace the general economy. Total addressable market will expand, but the question is who will capture it.

This is a moment when the baby can get thrown out with the bathwater in the public and private markets. That creates risk, but it also creates opportunity. The next generation of leaders will be the companies that clarify their AI strategy, communicate it clearly, and start building—fast.