Snap Chart

Medtech customers will increasingly consider ESG criteria

Some ESG factors are table stakes in the US; others are growing important

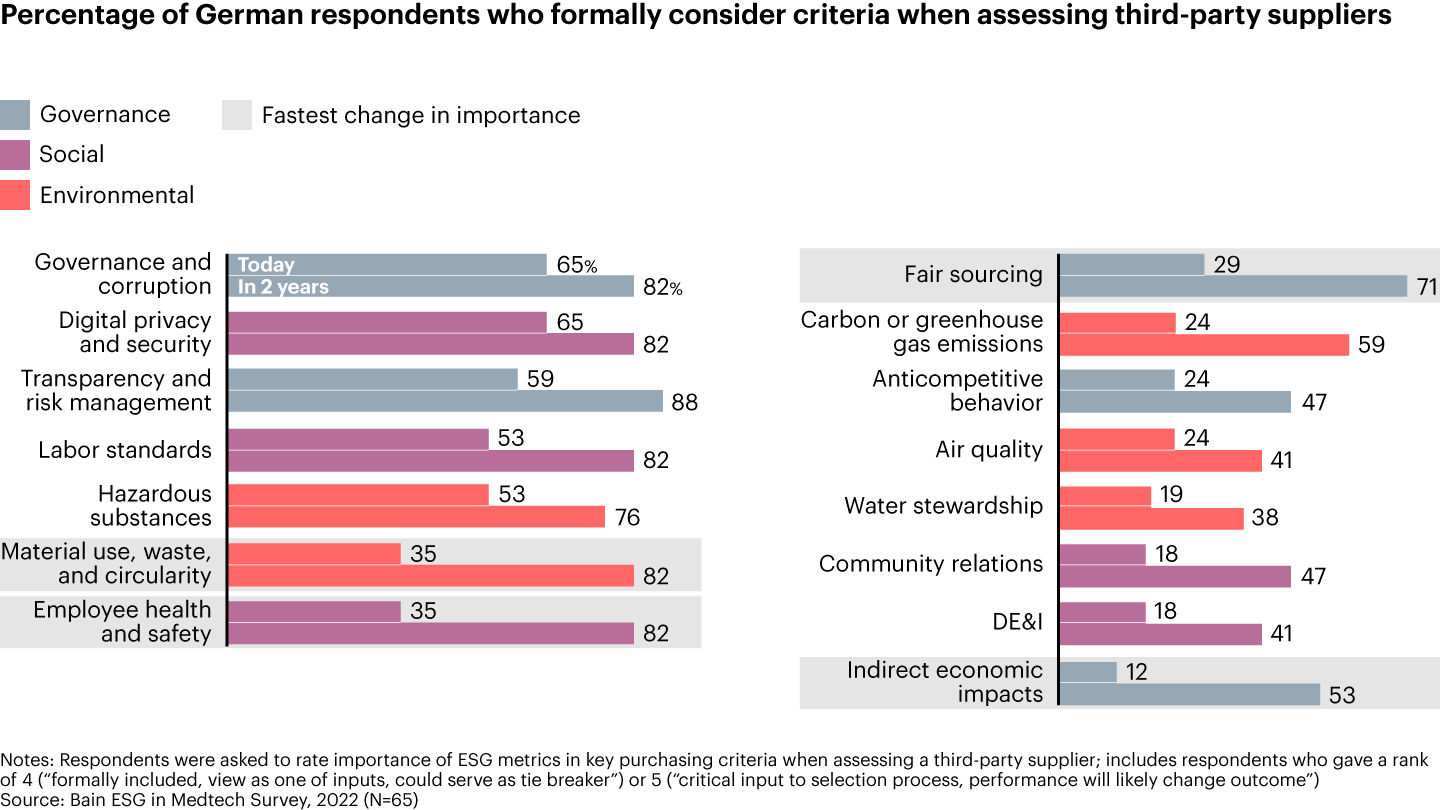

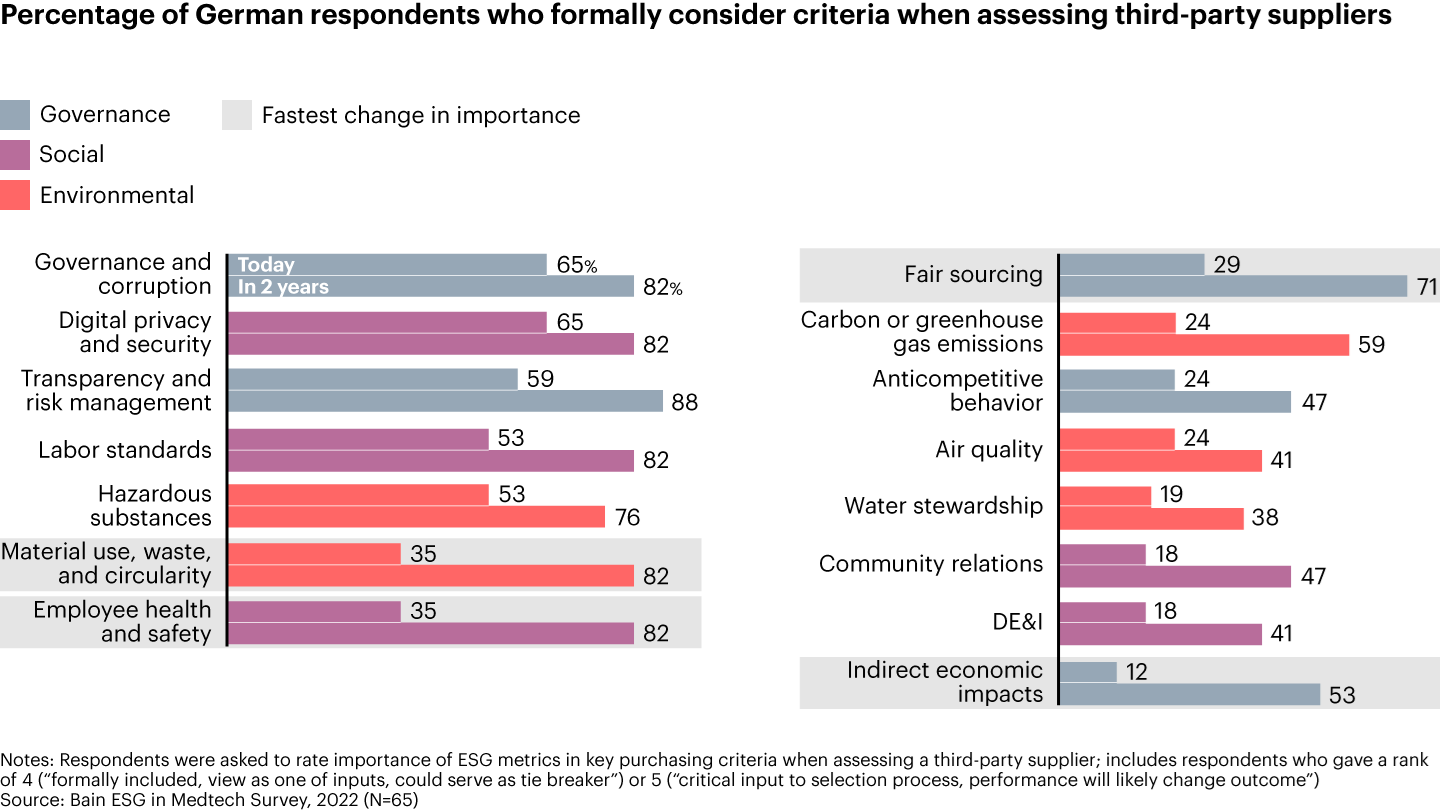

For German customers, some factors are quickly gaining importance

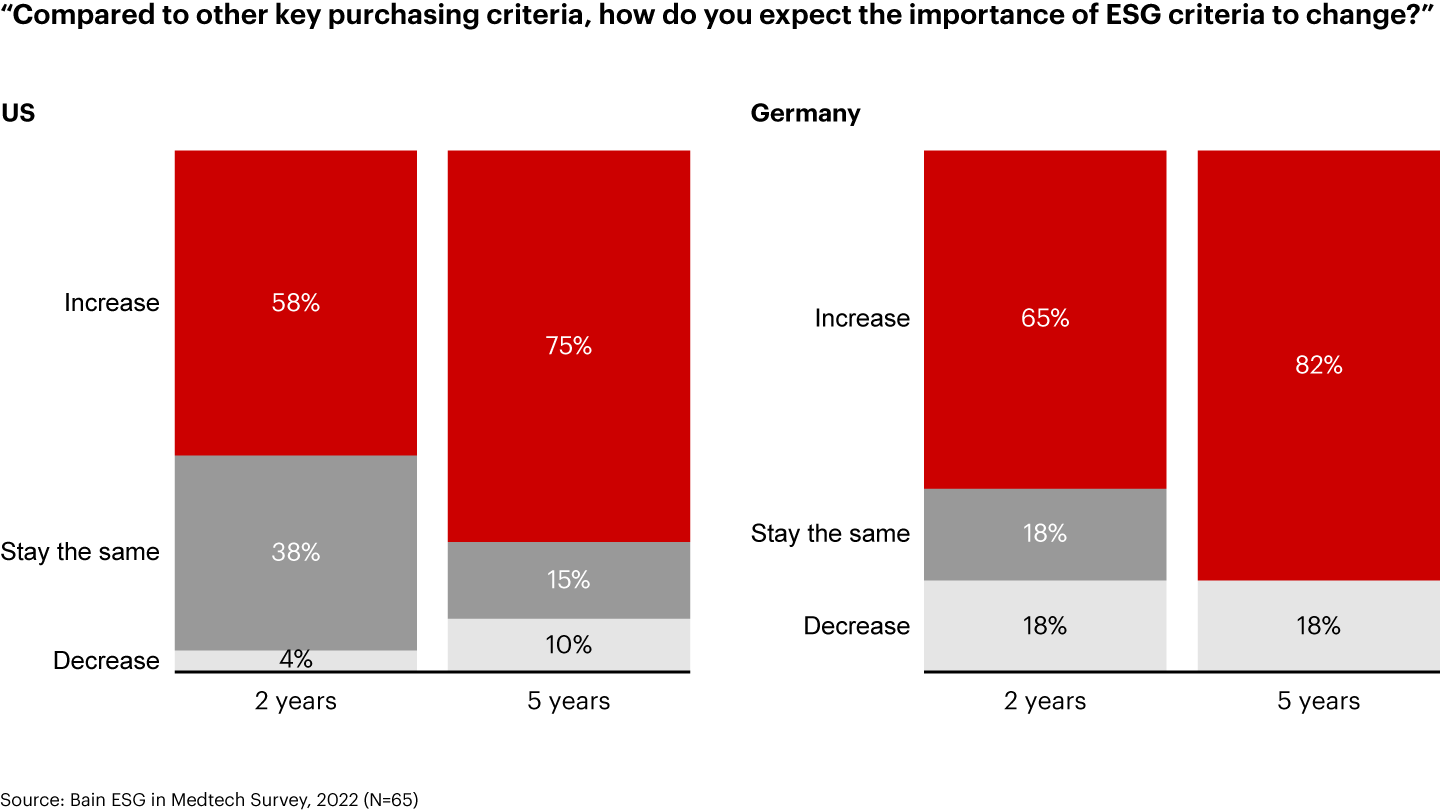

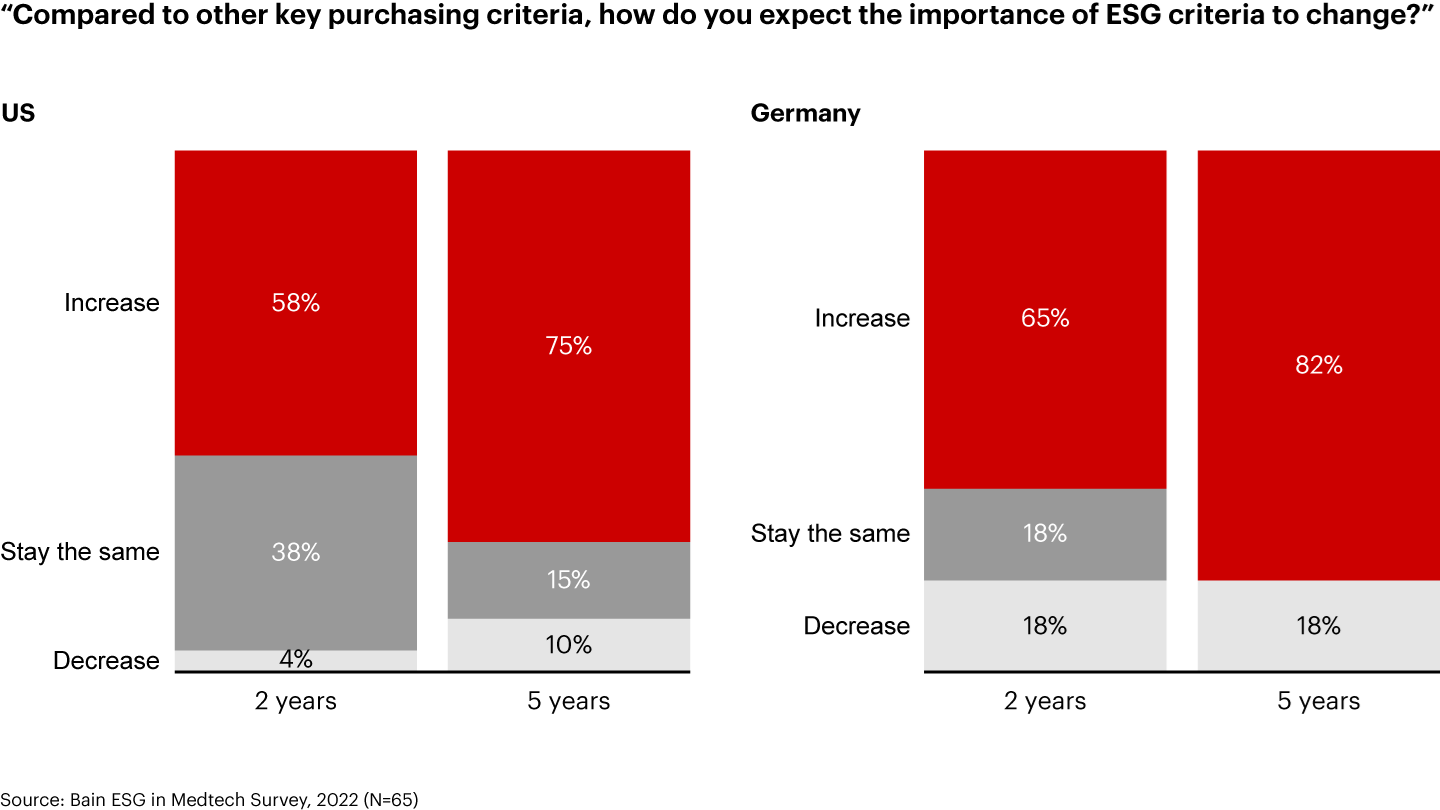

ESG is changing the rules of business—even in medtech. The industry has historically lagged others, such as industrials and tech, in environmental and social efforts. But a shift is coming. According to a recent Bain survey of procurement decision makers at healthcare providers, 75% of US respondents and 82% of German respondents expect the importance of ESG in purchasing criteria to increase in the next five years (see Figure 1).

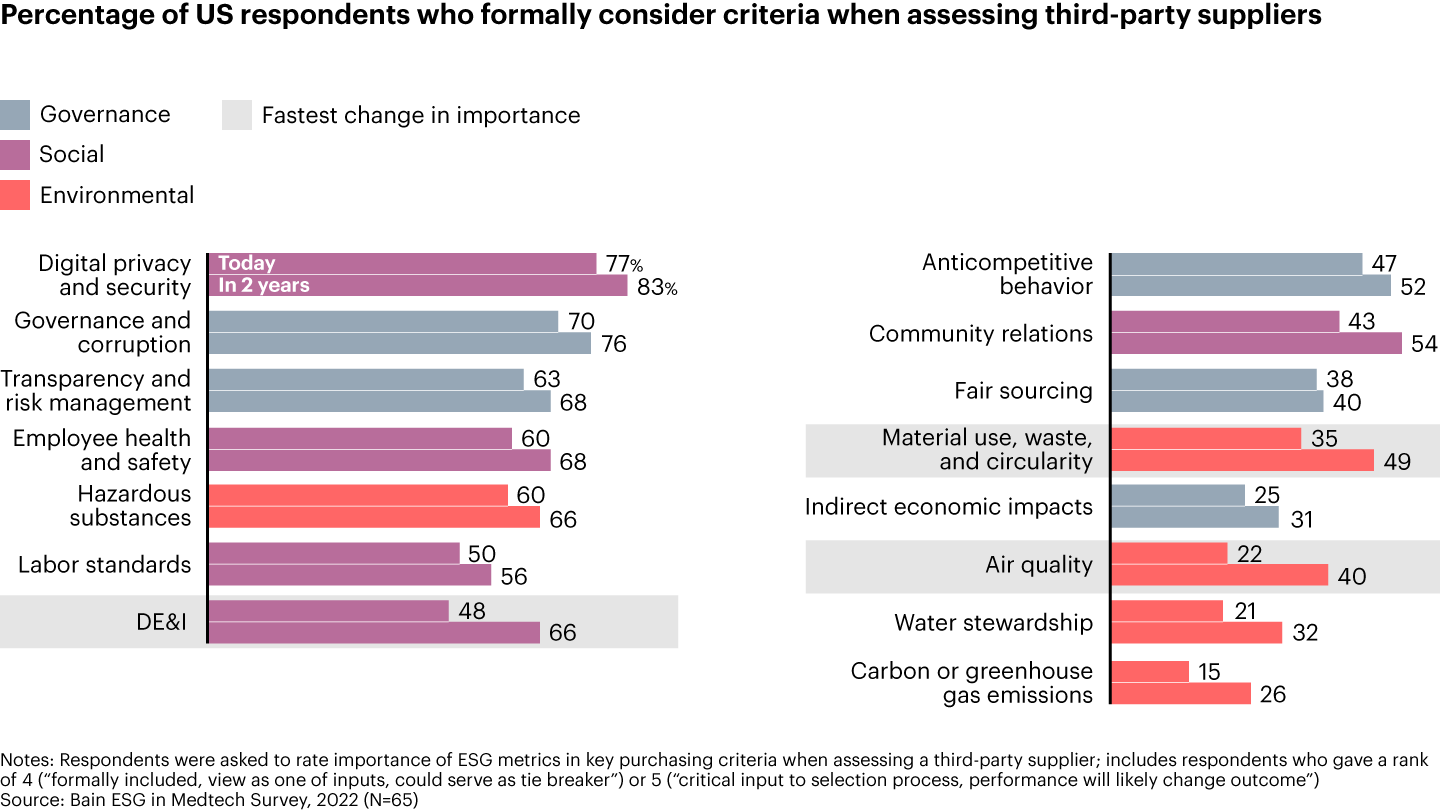

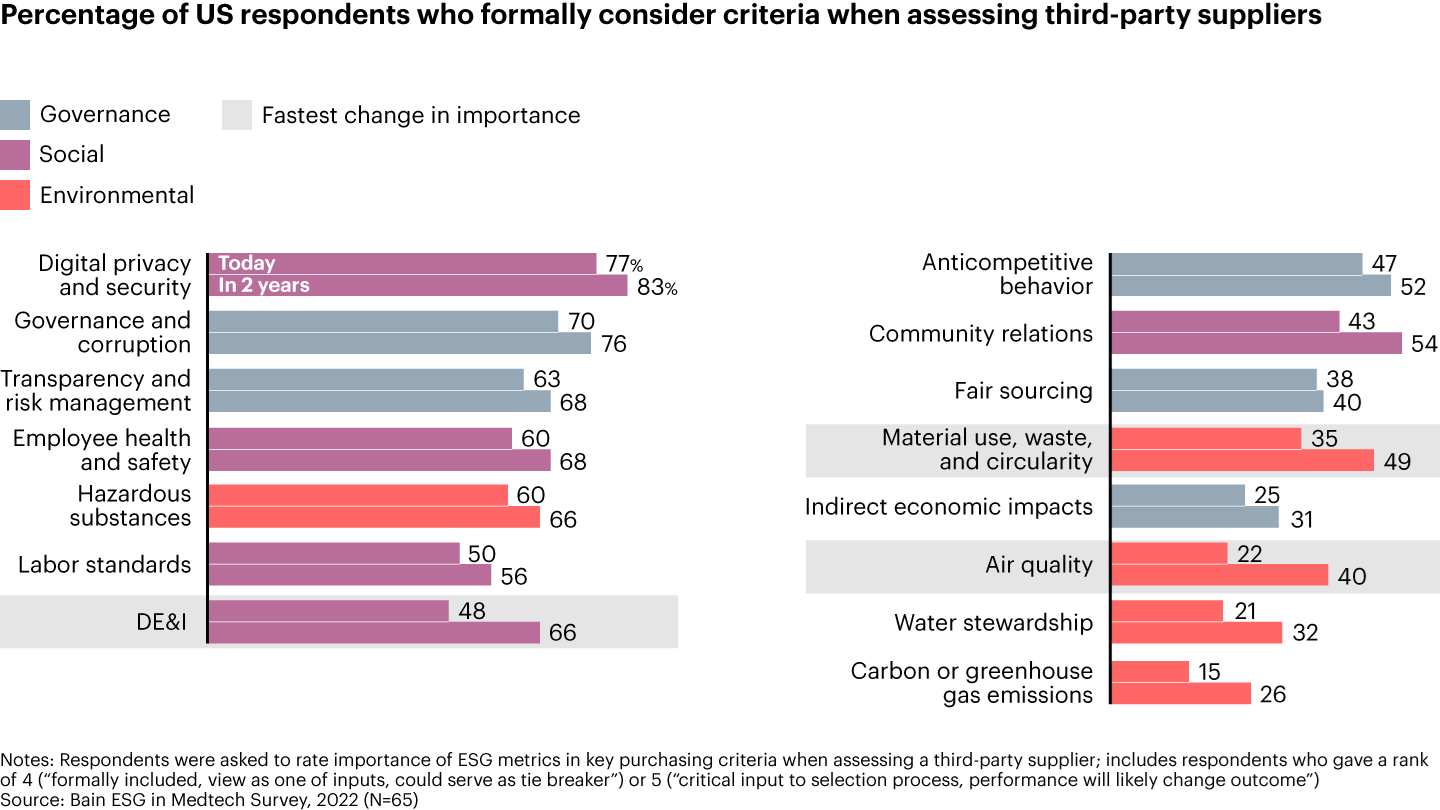

Several social and governance factors—such as corruption and transparency, data security, employee safety, and labor standards—are already table stakes. More than half of medical equipment buyers formally consider performance in these areas when assessing a third-party supplier. But other topics are poised to rapidly move up the priority list in the next two years. In the US, an increasing number of medtech customers expect to formally include diversity, equity, and inclusion (DE&I); material use, waste, and circularity; and air quality in their purchasing criteria (see Figure 2). The pace of change will be much faster in Europe: The number of German providers that consider suppliers’ material use, waste, and circularity; fair sourcing; and carbon and other greenhouse gas emissions is set to skyrocket by 2025 (see Figure 3).

US healthcare providers are already more inclined to focus on social targets, whereas German customers are more likely to focus on environmental ones. Regardless of region, ESG initiatives that provide tangible value—such as implementing circularity practices, boosting energy efficiency, and reducing packaging—have the strongest potential to resonate with customers.

Medtech companies still have plenty of space to define their ESG goals and differentiate themselves from the pack: Bain research shows that customers are just as likely to perceive a medtech company to be an ESG leader as an ESG laggard. As the importance of ESG grows, the next generation of leading companies will take a value creation approach, going beyond a compliance agenda to build competitive advantage. This will involve deliberate choices around where to meet requirements to limit risk exposure and keep up with the market vs. where to invest to deliver well above industry standards. Through these selected areas of ESG differentiation, medtech companies can win over procurement leaders and capture market share.