Brief

Is there a place on Earth with a grocery environment as tumultuous as Western and Southern Europe? Think about the shifting ground. The widespread popularity of everyday value stores continues to fuel price wars in all formats. The unabated demand for convenience is altering impulse shopping. Traditional retailers are striving to crack digital commerce. The hypermarkets that once were so popular are quickly losing steam—the victims of everything from eroding margins in nonfood products to their inherent inconvenience compared with other store formats. All of this is occurring in a region that is uniquely challenging to manage. Western and Southern Europe may be unified, but the same can’t be said of its grocery business: Most retailers are still local, and store format mix differs by market, with the growing formats varying across countries.

Of course, some retailers have continued to thrive in this environment, but the average performance of most retailers has been disappointing. Meanwhile, in Eastern Europe, performance is rising along with rapid sector modernization. The region seems to be shielded from the gloom. However, if retailers there start emulating the behavior of their counterparts in Western and Southern Europe, they could meet the same fate of saturation or deceleration—just much earlier in their growth cycle.

What events have unfolded to get us to this turbulence? Let’s take a look in more detail.

Unstoppable rise of everyday value. Europe has long been familiar with price-oriented models such as hard discounters, and these stores have continually gained share over the past decades—for example, capturing more than 35% market share in Germany. Historically, hard discounters focused on providing private-label goods at unbeatable prices in no-frills retail environments. Some players have evolved this concept toward soft discounting, introducing branded goods, and offering more compelling store layouts and customer experiences. And now, some supermarkets are even bridging the supermarket and discount store formats by offering a simplified yet engaging shopping experience, focusing on value for money rather than the absolute lowest price. Such supermarkets, including Colruyt in Belgium or Mercadona in Spain, have performed extraordinarily well during the past decade. Not only are their commercial appeal and sales growth escalating, but their profits are also rising, in large part due to a deep-rooted culture of continuous cost improvement.

But these winners have also contributed to reduced average prices in the European grocery sector. Many traditional grocers across Europe have tried to catch up and reconnect with shoppers by launching price wars. But given their complex operating models and less stringent cost discipline, they’ve been unable to offset eroding revenue, challenging their own economics and lowering the sector’s total profit pool.

Europe's Shifting Grocery Sector

Innovative strategies can help retailers meet challenges such as shrinking profit margins over the next decade.

Popularity of convenience. Europe’s shifting demographics tell a big story for grocers. Among the major changes: Households are getting smaller, and people are increasingly showing a preference for living in urban areas. From a practical standpoint, that means smaller basket sizes and more frequent trips to the store. Already, convenience stores are growing by 5% annually, a rate that could reach 7% by 2025.

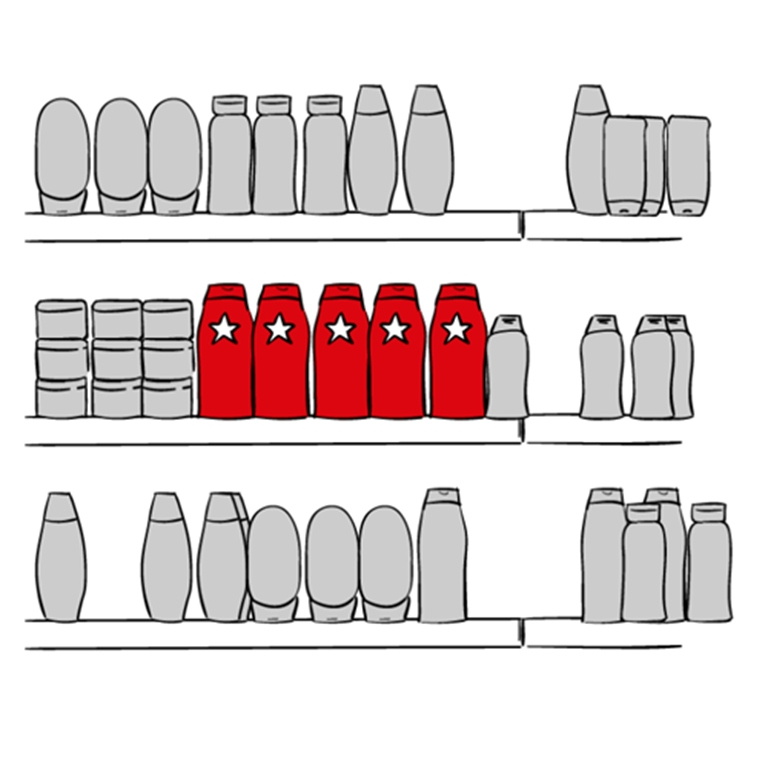

Acceleration of digital commerce. Propelled by the growing penetration of mobile phones and tablets and by consumers’ insatiable appetite for convenience and value, the online channel continues to gain momentum. Online share is already high in consumer electronics, apparel and other nonfood categories commonly sold in hypermarkets, causing a lot of sales and profit turbulence for this format. But online shares have now also reached 5% in some grocery markets (including the UK and France) for some of the most profitable packaged goods categories for manufacturers and retailers—for example, cosmetics, diapers, pet care and baby food. Five percent may seem low in absolute value, but it actually is high enough to affect the economics of these categories in stores.

And online share almost certainly will accelerate, fueled by a proliferation of digital offerings aimed at serving latent shopper demand. Everyone seems to be in this game: traditional grocers, online pure players or unexpected disrupters such as the Belgian Post or Uber, which try their luck in grocery despite the persistently challenging economics.

Many traditional grocers now find themselves in a variant of the prisoner’s dilemma: Should they participate in the online market at the risk of strongly diluting their margins? (Online solutions developed by grocers are proving largely unprofitable. While the basket size and gross margins for online and stores may appear similar, stores typically don’t charge for the additional services associated with picking, packing and, in some cases, delivering the orders, which results in incremental, non-offset costs, hence much lower profits.) Or, should they choose not to participate at all, and still risk seeing their margins erode as some of their shoppers shift part of their baskets from in-store to digital shopping options, leaving them with lower revenue and a fixed cost base that is tough to adjust?

Challenges to the big-box model. All of these developments created a problem for the big-box stores that have dominated Europe’s grocery landscape for years. Often called hypermarkets or supercenters, these stores, typically covering a surface area of more than 5,000 square meters (or more than 50,000 square feet), offer both a comprehensive range of food and a wide choice of nonfood items at low prices due to scale purchasing.

These stores have lost ground to more accessible shopping options, such as discount and convenience stores and e-commerce, as well as to specialized and online competition for nonfood products. The shift to smaller households, aging populations and growing urbanization has reduced the attractiveness of a concept that requires consumers to drive relatively long distances to stock up for a week. Consequently, hypermarkets’ share of the grocery pie in Western and Southern Europe has dropped from 27% for both regions in 2008 to 26% for Western Europe and 22% for Southern Europe in 2014, according to retail analyst firm Planet Retail. But their locations have continued to grow in number in many countries, now reaching a point of saturation, and they experience steadily declining productivity. The economics of big-box stores are severely challenged, particularly by negative profits in many nonfood categories, which impairs their ability to reinvest in growth (see Figure 1).

Two views of the future

Will these trends continue or even accelerate in the future, significantly affecting Europe’s grocers in the years ahead? Our research and executive interviews helped us formulate a viewpoint that confirms these trends and highlights the fact that they are mutually reinforcing. For example, as the discount format accelerates, it supports the deceleration of the big-box format. Similarly, the acceleration of e-commerce hurts the performance of both big-box and discount stores. To assess the impact of these trends, we modeled two different scenarios across Western and Southern Europe.

In the first scenario (our base case), we assumed that the overall grocery market as well as the convenience and value channels would continue growing at their current rates, the growth of supermarkets and hypermarkets would slow down slightly, and the penetration of online grocery pure plays would slightly accelerate compared with today’s rate—essentially, more of the same trends.

In the second scenario (an accelerated situation), we assumed that the overall market would continue growing at the current rate but convenience and value would grow 2 percentage points faster, the penetration of online pure plays would accelerate faster than in the base case, and the growth of supermarkets and hypermarkets would decelerate strongly compared with their historical rate.

Either way, Europe’s grocery landscape could be significantly reshaped by 2025 (see Figure 2). In our base case, the market share of traditional supermarkets and hypermarkets would erode to 59%, down from 70% today. In our accelerated case, their market share would shrink to 48% while online pure plays and convenience and value stores will grow to represent the majority of sales.

As a fallout from the shift toward smaller store concepts, we estimate that the average size of grocery stores in square meters could decrease by about 10% in our base case. In the accelerated case, in which we assume that hypermarkets will also have to reduce their network capacity by 30% to address declining traffic and plummeting sales, the average store could shrink by 30% to 35%, resulting in a sizable reduction of store concepts and available shelf space.

The combined effect of channel trends will take a toll on retail margins, which are likely to fall over the next decade by 20% in our base case and by up to 40% in our accelerated case. Whether the base case or the accelerated case plays out, the future will be less than encouraging for European retailers, with the changing business conditions rewriting their rules for survival.

For years, many grocers’ main growth engine was to focus aggressively on building their networks, often beyond their domestic borders. But as store density started to reach saturation levels, they were challenged to change their growth model toward a stronger focus on improving like-for-like sales.

Many, nevertheless, continued to develop their networks, making stores increasingly unproductive. And too many grocers started constantly changing their concepts in an attempt to turn around their performance, confusing customers in the process.

Sales slumped. To face the growing gap in profitability, their emphasis then shifted to optimizing procurement. Rather than focusing on the changing consumer, grocers transformed even more into “buying” businesses, often joining forces to gain extra scale (hence Europe’s flurry of buying partnerships and alliances). That is helping them get some margin relief, but it hasn’t helped deliver profitable growth.

Marc-André Kamel, who leads Bain’s Retail practice in Europe, the Middle East and Africa, talks about the five obligations that European grocers must fulfill to emerge as winners in today’s turbulent environment.

How to manage for today and the future? We drew on our recent research in Europe’s grocery business and work with clients in all major European markets to determine the critical steps for winning amid the changes.

We believe grocers can find ways to become profitable “selling” businesses again by following five fundamental rules:

- Achieve local leadership in every possible catchment area.

- Deliver a distinctive concept and an appealing store experience.

- Make operational excellence a day-to-day goal and an integral part of their DNA, as opposed to a one-off, painful effort every three to five years.

- Figure out how to transform for an omnichannel retail world while improving the economics of both offline and online operations.

- Anticipate the inevitability of consolidation, looking for strategies that will eventually make them a winner, not a victim.

Let’s look at these rules one by one.

Lead locally

There is a perennial rule in retail, which is that local leadership is the biggest source of economic benefits for retailers. Many grocers have spent the past years trying to build their national market share and make the most of it through increased purchasing power.

But while the benefits of national scale are undisputable, we’ve found, with every grocery client we have worked with, that leadership economics are even more grounded in local leadership. Local leaders draw on their intimate knowledge of catchment areas to provide localized offerings that better suit local shopper needs. As the leading grocer in an area, they have greater customer visibility and appeal—and often more pricing power. They can also access the best locations and build more efficient logistical operations to serve a denser local store network. Local leadership fosters a virtuous circle in which increased customer advocacy results in more profitable stores that enable investments to create more value.

The trouble is, many grocers in Europe have purposely built out their networks to put distance between stores in an effort to avoid cannibalization. Again, winning in grocery actually requires building stores not too far from each other to gain higher visibility and local leadership. That means rethinking their approach to network deployment and being thoughtful about incremental expansion. Instead of trying to boost growth rates by focusing on areas where they have the least presence or allocating resources equally across all stores, the better approach is to concentrate investments on openings, renovations and refurbishments in the areas where they have the highest potential to achieve local leadership—that is, where they already have a strong presence.

Grocers need to think broadly about how to achieve this, also considering acquisitions or asset swaps to reinforce positions where it matters most. Another option for players who have been primarily operating large stores: Given the levels of store saturation we are seeing in Europe and the eroding economics of hypermarkets, it may make sense to investigate smaller or adjacent formats for future network development.

Reinvent a distinctive proposition and appealing store experience

In such a competitive environment and with shrinking margins, grocers need a way to strongly differentiate themselves from the rest of the pack, giving shoppers a reason to choose them over rival stores, including online food stores. Unsurprisingly, that starts by learning what shoppers want and to anchor the proposition in those dimensions that they particularly value. A host of Bain surveys of more than 35,000 consumers across Europe, the US, China and Australia found that beyond a reasonable price, shoppers value high-quality and abundant fresh food, a convenient in-store experience (such as one-stop shopping and efficient checkout) and helpful floor service. The best grocers in Europe and elsewhere are using this list as a guide for keeping their value proposition and store experience constantly aligned with shopper expectations.

Fresh food has long been a major area of focus, but in an increasingly digitalized retail landscape, it is regaining importance as the one category that will entice shoppers to come to stores instead of buying online. For a variety of reasons, we see that renewed emphasis on fresh food everywhere (see the Bain Brief, “Why Grocers Are Battling Big Over Fresh Food”).

In the main food aisle (packaged food and beverages), grocers should emphasize the uniquely distinctive sensory experience that a physical store can bring compared to discount concepts or online purchasing. For instance, they can offer tasting sessions and cooking animations—often paid for by suppliers—that help boost the sales of packaged food, which typically is much more profitable than fresh food and nonfood items. With their abundant space, hypermarkets could have an advantage on this front.

Big-box retailers who play in both food and nonfood have to address the critical issue of category profitability. First, they can rely on category management techniques that, based on the importance to shoppers and to the retailer, will help clarify the role that each category should play. This will lead to defining a simple set of guidelines spanning offer, range, price, promotion and cost model, with investments and actions adapted for different categories based on the distinctive opportunities. In some extreme cases, grocers might see the need to exit categories where competition with specialty and online retailers has become too intense and emphasize categories where they can still make money and maintain a competitive advantage.

It also could mean trying out new operational models to reshape the economics of certain categories, looking for ways to build growth, cut costs and improve margins—as opposed to serving as funding sources for diminishing profits. For instance, they can choose to outsource selling surface in categories such as consumer electronics to category specialists who can more efficiently operate a shop-in-shop. Alternatively, they could convert space to virtual shopping showrooms where customers can shop offline to online (consult electronic screens to purchase goods that will be delivered to their home). That eliminates the need for grocers to carry the inventory. Some grocers might also choose to repurpose space for services that will bring traffic to the store and enhance the shopping experience such as coffee shops and restaurants or click-and-collect services.

Ruthlessly focus on operational excellence

Even the most innovative approach to differentiation won’t succeed if a grocer fails to rigorously pursue operational excellence as a matter of course. It’s a fact of life that retail prices always go down over time, and a lack of ongoing cost improvement inevitably leads to painful restructuring—the kind experienced by many European grocers who’ve been forced to close stores or cut jobs in the recent past.

The big challenge is to reengineer operations to make money again—or, for stores that are structurally unprofitable, to minimize losses. That starts by clearly analyzing a store’s operating model, processes and cost structure, and then diving in to find ways of not only controlling costs but also boosting growth in the process.

Naturally, with the cost of goods sold representing 80% of operating costs for typical grocers, this is a big concern. But too often grocers try to improve these procurement costs by taking the wrong steps with their suppliers, particularly the branded suppliers. They may try broadly squeezing them for better deals, which won’t do anything to unlock growth. Or, in an attempt to twist a supplier’s arm, they may delist an important product—a move that can backfire when shoppers can’t find products they want and flee to competing stores.

The right way to negotiate with branded suppliers is to take a tiered approach, segmenting them based on each category’s strategic importance and a grocer’s actual bargaining power. For instance, some suppliers are strategic, playing in must-win categories with hero SKUs. If you don’t have them, you lose. Grocers are best served by joining forces with those suppliers to develop a category plan that grows the pie for everyone. That requires shifting from a confrontational "buying" mindset to a collaborative "selling" mindset, working with suppliers to come up with more compelling shopper propositions.

Private labels can be a critical weapon for traditional grocers in the defense against value grocers. When it comes to buying private labels, Spain’s Mercadona has moved away from the classic arm’s-length supplier relationship model by establishing solid, long-standing supplier relationships—in some cases, coinvesting in their operations to generate cost savings that can be reinvested in lower prices, fostering a virtuous cycle for both.

Beyond procurement, labor represents the next biggest portion of store costs, and here, too, we have seen many retailers take the wrong steps as they tried to compensate for sales erosion. The drop in performance sets a doom loop in motion: Reduced foot traffic combines with price pressure to compress the top line. This results in lower sales per square meter and deteriorated economics, leaving stores to deal with a decrease in labor productivity and difficulty adjusting their fixed costs. In response, most grocers cut variable costs, starting with store personnel. That only causes poorer service, unreplenished shelves, stock-outs and other challenges that worsen the store experience. This inevitably pushes more shoppers toward the competition, further intensifying the losing cycle.

The best companies are discovering moves that not only keep expenses in line but also boost productivity. Here, too, Mercadona sets the standard for motivating employees, with stable work schedules, higher salaries, more training and opportunities for advancement. Fully 95% of the grocer’s employees qualify to receive bonuses if the company meets targets. If it doesn’t, nobody receives a bonus. Mercadona’s efforts have kept turnover at a low rate of 3%–4% while workforce productivity has risen by 3% annually over the past five years. Instead of cutting into its labor muscle, the grocer is continually building muscle.

Finally, Mercadona and other leading grocers strive to standardize their store concepts as much as possible. It’s not a matter of ensuring that every store is exactly alike but of making sure that stores are similar enough that winning concepts can easily be transferred and are easy to effectively and efficiently operate.

Lead a successful omnichannel transformation

Even with a comparatively high rate of penetration, digital grocery sales in Europe remain largely unprofitable. For the near-term future, as grocers strive to combine their online and physical offerings and operations, success means setting up a business that is not losing too much money.

Unfortunately, that’s a difficult order to fill. Grocers in France, for instance, have invested in bespoke click-and-collect networks (“drives”) aimed at generating online sales, only to realize that they can’t make money on these operations, given the average low sales per unit, the added labor costs and other expenses. Despite their popularity with shoppers, they’ve failed to deliver the desired omnichannel synergies for the grocers, who are helplessly watching them cannibalize sales at brick-and-mortar stores and shrink their investment capacity.

Grocers have specific omnichannel imperatives. They need to rationalize these click-and-collect networks and improve operating efficiency. They need to do a better job of matching pricing with the cost to serve. Also, success will require grocers to make the most of their scale across channels as they substantially differentiate their online offers—in anything from availability to substitution to fulfillment options. Grocers can spur growth by pursuing the most profitable customer segments, shopping missions and fulfillment routes. Meanwhile, they must do a better job of deterring new pure-play market entrants.

Omnichannel winners also will invest to differentiate by introducing technology solutions that improve the in-store experience. For example, many grocers now offer scan-as-you-shop devices that allow shoppers to easily pay for and bag items as they shop, avoiding the need for waiting in a checkout line.

Proactively consolidate

Finally, with overcapacity taking its toll on European groceries, it’s time for a serious look at consolidation, which is bound to happen in any industry with growing overcapacity and a declining profit pool. Consolidation has not yet really taken hold in grocery retailing. In part, that’s due to the real estate situation: Many grocers own their stores, and consolidation would mean that some would have to be closed or repurposed. There’s also resistance from the operational side, as operational managers would need to endure the pain of closing and repurposing stores.

Instead, many European grocers have looked for midway solutions: The so-called virtual consolidation of retailer alliances or partnerships has helped many grocers negotiate deals with branded suppliers due to larger combined scale. They provide temporary margin relief, but prices and store productivity continue to decline and like-for-like sales growth remains challenged. There will come a point when buying alliances won’t suffice. For many, the bigger and longer-term results will be achieved by taking control of the inevitable physical consolidation and thoughtfully pursuing various forms of M&A—including mergers, asset swaps, and acquisitions aimed at achieving local leadership, improving margins (through better pricing and better buying) and building the new capabilities needed to win.

The shifts rocking Europe’s grocery industry will only intensify in the years ahead. As they do, grocers can rely on five rules—local leadership, a distinctive proposition, operational excellence, an omnichannel transformation and consolidation—to survive in Europe’s grocery battleground.

Marc-André Kamel is a Bain & Company partner based in Paris and the head of Bain’s Retail practice in the Europe, Middle East and Africa region. Jonathon Ringer is a partner based in London and a leading member of Bain’s Retail practice. Joëlle de Montgolfier is senior practice area director for Bain’s Retail and Consumer Products practices in the Europe, Middle East and Africa region, based in Paris.