Report

Auf einen Blick

- Technologie, Kapital im Überfluss und zunehmende staatliche Interventionen haben 2018 zu einem Jahr der Disruption gemacht.

- Dies erfolgt in einem Moment, in dem die meisten Unternehmen ohnehin schon damit kämpfen, die hohen Wachstumserwartungen der Investoren zu erfüllen.

- M&A ist in diesem Umfeld ein veritables Mittel, um die hohen Erwartungen des Marktes zu erfüllen.

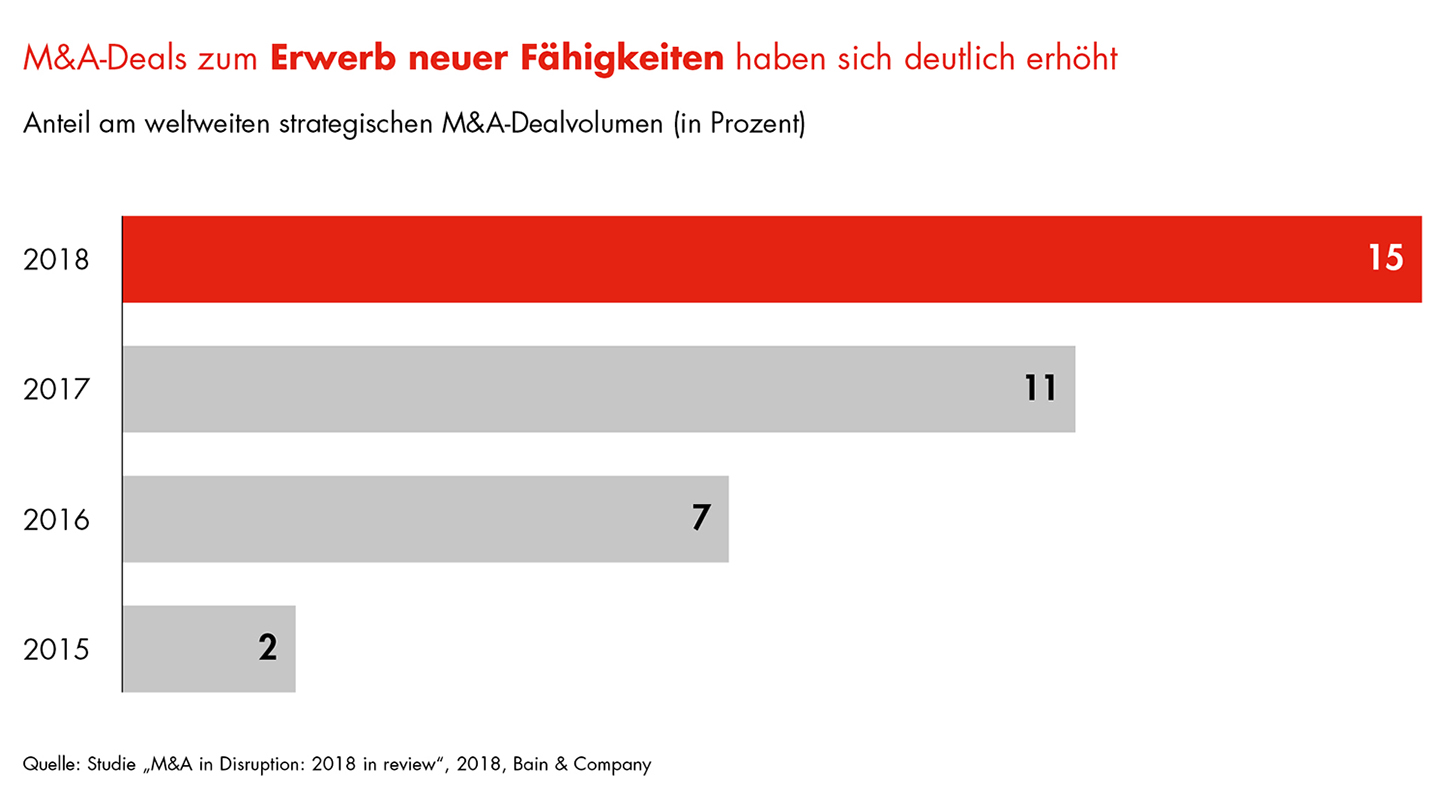

- Dabei rücken 2018 insbesondere Scope-Deals, die auf die Erweiterung z. B. technologischer Fähigkeiten zielen, in den Fokus.

- Volumen strategischer M&A-Deals ist 2018 auf 3,4 Billionen US-Dollar gestiegen.

-

Letter to readers (click to expand)

Dear friends,

This is Bain & Company’s inaugural M&A annual report. And yes, we know, the world doesn’t need another retelling of how great the past 12 months were for deal makers.

We have been studying the whys and hows of M&A success for a very long time. We have learned a lot working side by side with our clients and decided to peek beneath the headlines to interpret and synthesize the most important takeaways from 2018. The goal of our annual report is to make all of us just a bit better at the craft of M&A.

The year 2018 set a near record for M&A, driven by momentum in the first half even as the last quarter slowed down. You don’t have to look much further than the “A’s” to see a number of big names in the middle of the action, including AT&T, Alibaba, Amazon and AXA. We’ll spare you the full list through the “Z’s.” In this report, we look at the forces that are driving the M&A market and what you can do as an executive to ensure that the deals you make are successful.

It was a year of disruption. That very word gained prominence in the popular lexicon in 2018, and M&A was in many respects a key enabler.

Fun fact: 2018 was the first time that scope deals outnumbered scale deals. As best we can tell, this has never happened before. This is profound. In 2018, most deals were not predicated on the basis of scale—that is, for cost synergies and the many unspoken benefits of industry consolidation. Rather, most deals were done to expand scope, either through new markets or new capabilities. This is either a sign of hubris or a huge change in executive mindset about the source and value of future growth. We think it is the latter.

These scope deals are harder to get right. They are more expensive, demanding a deal premium that’s a third higher than scale deals, on average. They have unique requirements to get them right. They require different diligence. Scope acquisitions often require different operating models to allow people to work together. Scope deals present cultural challenges. That’s why traditional advice has been to “stick to your knitting” with scale deals.

Except, scope deals can lead to growth (both top line and bottom line), and they can give companies access to capabilities that would take too long and cost too much to develop internally. Scope deals can preempt competitors. Today, most industries face significant disruptive challenges, both digital and otherwise. In this context, scope deals can accelerate and transform a company’s growth trajectory, and that is why companies are doing them.

We will have a lot to say about how to do scope deals successfully.

We will also look at the changes in the landscape for scale deals—if done thoughtfully, they remain another antidote for disruption.

As we survey what companies around the world are dealing with in the rough and tumble M&A arena, we observe four other trends.

- Financial sponsors are evolving their role in M&A within the corporate world.

- M&A-related investor activism continues to accelerate and affect companies globally.

- Governments are becoming involved in M&A from a very different vantage point—national security.

- Cross-regional M&A has lost momentum since the heights of 2016.

Our report has lots of good facts and figures, but much of the insight comes from the case studies we present. We thank the dozens of executives who worked with us to bring these lessons to life.

As we head into 2019, we expect many of these trends to persist. But we also expect that at some point, there will be a downturn in deal activity as the current global cycle peaks. Inevitably, investing through the downside of the cycle will provide some of the greatest opportunities. This has always been the case. As Warren Buffett says, “Be greedy when others are scared, and be scared when others are greedy.”

Thank you for reading, and we look forward to your feedback.

Sincerely,

The Bain Global M&A team

2018 wird als das Jahr in Erinnerung bleiben, in dem der Begriff Disruption im globalen Wirtschaftsleben fast schon zum geflügelten Wort wurde. Führungskräfte beschäftigen sich intensiv mit dem Zusammenspiel von E-Commerce, Datenanalyse, mobilen Anwendungen, Internet der Dinge und anderen digitalen Entwicklungen. Sie treibt die Frage um, inwieweit das Geschäftsmodell ihres Unternehmens veraltet ist und wie es weiterentwickelt werden kann. Gleichzeitig sind sie mit politischen Unwägbarkeiten konfrontiert. Disruption ist zur neuen Normalität geworden, für die sich die Unternehmen rüsten müssen.

Doch unabhängig von Disruption stieg das Volumen strategischer M&A-Deals 2018 auf 3,4 Billionen US-Dollar. Prominente Beispiele sind die Übernahme des US-Saatgutanbieters Monsanto durch den Chemiekonzern Bayer oder die Fusion des Industriegasehersetellers Linde mit dem US-Wettbewerber Praxair.

Erstmals gab es auch mehr umsatzgetriebene Scope- als Scale-Deals, mit denen vor allem Skaleneffekte und damit Kostenvorteile erzielt werden sollen. Tatsächlich dienen mittlerweile rund 15 Prozent der größeren strategischen Übernahmen dem Erwerb neuer Fähigkeiten, 2015 waren es lediglich 2 Prozent (Abbildung).

In der Studie „M&A in Disruption: 2018 in Review“ beleuchtet Bain die Hintergründe und Treiber für den gegenwärtigen Boom im M&A-Geschäft.

Bain Partner Peter Horsley discusses why acquirers should focus on three crucial areas—diligence, operating model and integration—to improve performance and gain a competitive edge.

Bain Partner Les Baird discusses why acquirers need new capabilities to succeed as the number of scope deals surpasses scale deals.

Bain Advisory Partner David Harding discusses how in the changing world of M&A, companies with repeatable models are best positioned to succeed.