論説

In an industry that puts great stock in the balance sheet, one might expect that bigger is better. Yet somehow large, global insurers have consistently underperformed their smaller peers, delivering returns on equity (ROE) that are about 200 basis points lower than those of their national and regional peers, and a similar difference is seen between global and national insurers’ total shareholder returns. The gap in ROE stems from higher costs and slower premium growth (see Figure 1). Other than the scale benefits that seem to accrue to investment platforms, this performance raises the question: Are global insurers too big to succeed?

We think otherwise. Bigger insurers can deliver a lower-cost, higher-growth model. To do so, they must address the heart of the problem: complexity.

As companies add more products and geographic markets, they tend to get more complex, and complexity becomes the silent killer of growth. To be sure, this problem pervades most industries, not just insurance. Globally, only one large company in nine have been able to grow their profits and revenues by 5.5% or more over a 10-year period, and earn back their cost of capital, Bain & Company research shows. Complexity also explains why 85% of executives blame internal factors for their shortfall, not external ones beyond their control.

Reining in complexity has become crucial for insurance carriers, as they face a macro environment characterized by low interest rates and subdued economic and demographic growth. The rise of aggregators and an advertising arms race have led to intense price competition in many insurance markets, so with limited leeway to raise prices, insurers must look to productivity gains to raise their ROE.

Insurers must deal with three flavors of complexity: business, process and organizational. Many have started to address business complexity, usually by shedding unprofitable lines. However, until insurers get serious about addressing process and organizational complexity, they will not be able to compete effectively. Complexity of operations makes most global insurers slower, costlier and less responsive to customer demands. They’re burdened by years of adding processes, systems, products and features, and rarely removing outdated ones. Agents and employees find it harder to explain products to customers or to understand how all the products fit together. At many large insurers, basic customer service, such as paying claims and calling back customers who have questions about their coverage, lags service provided in industries that have set a higher bar.

It’s hard to be simple

Why is complexity so difficult to eradicate? We have seen three pitfalls that commonly snare insurers.

A focus on cutting costs, not complexity. Many insurers have been through cost-reduction programs that typically follow a similar pattern. They start by benchmarking each aspect of the organization and identifying high-cost areas. They haggle over targets for cost reduction in each area and then launch headcount-reduction programs to meet those targets, often using crude tools, such as reducing spans and layers, to push through changes. Invariably, though, costs come back, because the nature of work has not really changed. Tackling spans and layers alone does not get to the root causes of complexity.

Failure to tackle issues “in the seams.” If a company reengineers and automates processes to reduce rework and minimize delays, shouldn’t it be able to drastically simplify decisions and reduce costs? That’s fine in theory, but in practice (to paraphrase management consultant Peter Drucker), the strong organizational silos in insurance eat Six Sigma black belts for lunch. Every organizational structure creates boundaries between departments, geographic units or lines of business, and people must collaborate across these seams. The largest global insurers, with their entrenched silos, find it difficult to do this. As a result, single-function efforts aimed at tackling complexity are doomed to fail—P&C underwriting optimization, for instance, can’t succeed without a connection to the claims unit.

Risk aversion encourages complexity to creep back. Complexity results from many small decisions compounding on each other. Each decision—customizing a process within claims, for example, or adding a layer of control to audit underwriting—might have been reasonable from a narrow perspective. But in aggregate, the decisions lead to costly, harmful complexity. Most insurers have a risk-averse “belt and suspenders” culture, which manifests through narrow solutions to single-point problems. Given that culture, complexity is bound to come back. A permanent solution requires a shift in mindset, to emphasize discipline around simplicity.

One large global insurer made several attempts to reshape its cost base, at first focusing on specific functional areas and then tackling spans and layers. But these efforts did not address the underlying complexity. Overly long decision-making processes undermined initiatives to be more responsive to customers—for example, actions following underwriting decisions were drawn out because too many national, regional and global decision makers weighed in. This particular insurer has since made substantial strides in reshaping its cost structure and becoming more customer centered, by focusing on simplicity.

Ultimately, reducing complexity in a large enterprise requires careful planning and orchestration, yet at a fast pace. From our work advising and studying insurance companies, we have discerned three practical guidelines that can help senior leaders balance the short- and long-term concerns, to achieve a successful transformation.

Jed Fallis, a partner with Bain's Financial Services practice, describes common pitfalls that snare large insurers and shares three steps they can take to reduce complexity and drive long-term profitable growth.

1. Change the nature of the work

Executives who decide to tackle organizational complexity sometimes start by drawing boxes on a page, in an effort to build a simpler organizational structure. In our experience, it’s more effective to start by redesigning the work itself, which entails being structurally agnostic about the nature of the work.

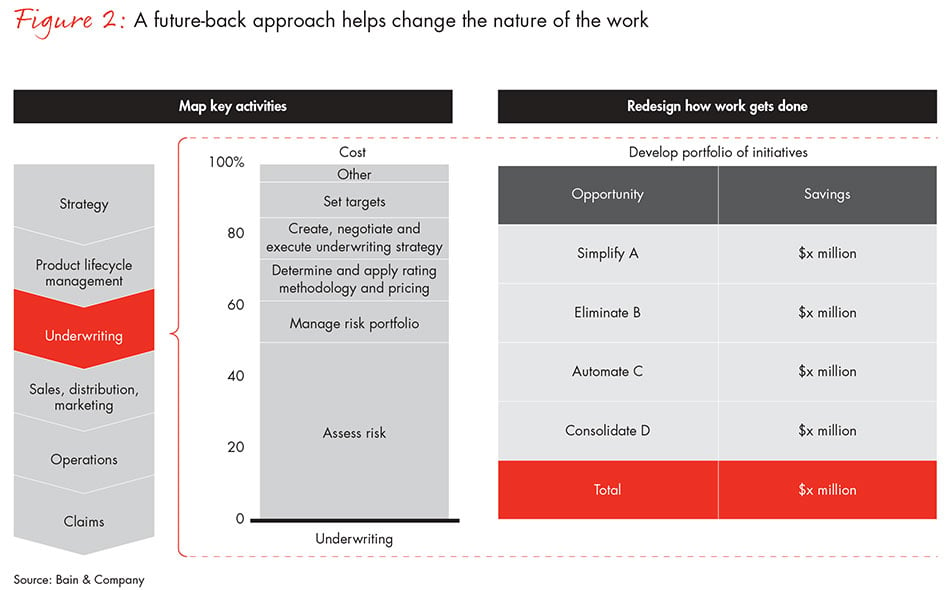

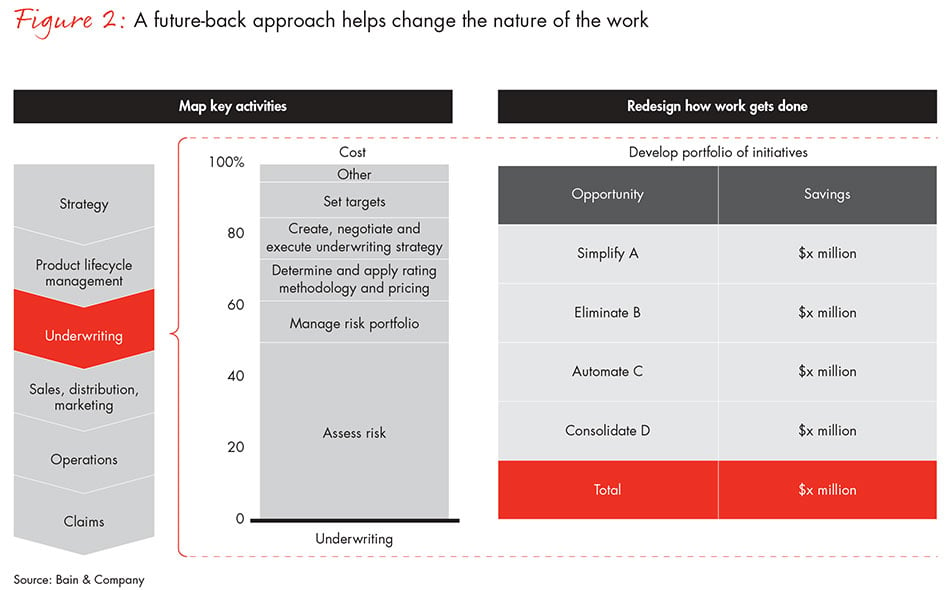

The key to this exercise is to take a future-back approach. Rather than mapping the minutiae of current processes and attempting to refine them, start with the core elements of the value chain, project the future state of the market and the company’s desired position, and design how work should get done. This forces management to make breakthroughs in decision making and work processes.

As part of a broader redesign of its operating model, one global insurer reviewed how pricing and underwriting decisions were made in individual countries. Applying a structurally agnostic lens to this question helped reveal the need for global oversight and control, as well as local (or national) authority. It became clear that the insurer did not need a regional layer in between. The company virtually eliminated the regional layer, saving cost and materially improving responsiveness to customers.

A future-back approach could also highlight opportunities to make operational improvements. At another global insurer, executives envisioned how the underwriting operation would need to look in the future (see Figure 2). That led the firm to completely change how it prepared underwriting quotes. For example, rather than having senior underwriters oversee the entire process, junior staff could draw up the initial quotes and leave more complicated quotes for senior staff to review.

2. Realign the operating model

Once the core nature of the work has been defined, the next step is to overlay the appropriate operating model. Returning to the seams between departments, geographic units and lines of business, it’s important to define these seams in a way that reflects how the company creates value, promotes better decision making and balances operating-unit accountability with economies of scale. Realignment thus involves the way people interact across these seams. A decision made by the underwriting group has implications for the claims group and the agents. Similarly, a new approach by the audit group has implications for underwriting. Where two parts of the business don’t align, complexity abounds—and costs rise and customers suffer.

The global insurer mentioned earlier found that different parts of its business needed substantial realignment. Senior management changed the structure of accountability for the core business units. Parts of operations that had previously been run as a separate vertical were brought under direct control of the unit, while the remaining operations shifted to a shared services group, in order to realize benefits of scale. To pull this off, the company clarified the relationship and accountability between business units and the shared services group. That ensured clear ownership of the businesses without fragmenting operations. The company sorted out a similar balance in other parts of the business.

These and other changes to the operating model helped the insurer reduce costs by more than hundreds of millions annually while improving the overall experience for both customers and employees. Fewer layers led to better, faster decisions with less effort. And reducing the number of matrix reporting relationships allowed employees to spend more time on high-priority customer segments and initiatives.

Many other global insurers, including AIG, Zurich and others, have publicly recognized the importance of redesigning the operating model—and not just adjusting the global reporting matrix—for cost reduction and performance improvement. But they are taking different routes on redesign.

AIG, for example, has been overhauling its operating model to decentralize decision making, provide more accountability to business leaders and move to a more variable cost structure. The company is now realizing improvements in operating expenses and ROE.

Zurich recently announced a reorganization that highlighted the importance of the regional management structure to improve customer relationships and reduce costs. CEO Mario Greco noted that the previous “fragmented structure” added to costs and made interactions with customers more complex; sometimes units within the company found themselves competing against one another.

3. Sustain the change to keep complexity from creeping back

Ultimately, a realigned operating model with simplified operations should put a company in a better position to sustain a lean stance over the long term. Of course, sustaining change is not easy. These shifts in organizational structure by major insurers underscore that complexity is an insidious enemy moving from products and geographies to customer segments, in an attempt to creep back into new seams. At a minimum, senior-level controls can be put in place, like elevating all new spending requests to the CFO. A permanent solution, though, involves building a culture obsessed with simplicity.

To change behaviors accordingly, companies must introduce a mix of incentives and reinforcement. Leaders at all levels need to become aware of how their decisions can compound or add hidden complexity to the organization.

Finally, what keeps a company on track to embrace simplicity is executives’ behaviors. Employees will be more motivated to resist adding bad costs and complexity when they see the senior team doing the same. With the entire organization focused on the simplest route to delighting customers, insurers raise the odds of accelerating profitable growth.

Jed Fallis and Thomas Olsen are partners with Bain & Company’s Financial Services practice and are based in Toronto and Singapore, respectively. Ron Kermisch is a Boston-based partner with Bain’s Organization practice.