Forbes.com

With developed economies stuck in the doldrums, private equity’s fascination with the fast-growing emerging markets continues to intensify. Captivated by robust emerging market GDP growth, increasingly sophisticated companies and managers, and their seeming exemption from the debt market woes that beset Europe and North America, limited partners (LPs) continue to pour money into funds that target emerging market opportunities. Eventually, hopeful investors believe, those vast sums of capital will surely find abundant productive investment outlets in these underpenetrated economies.

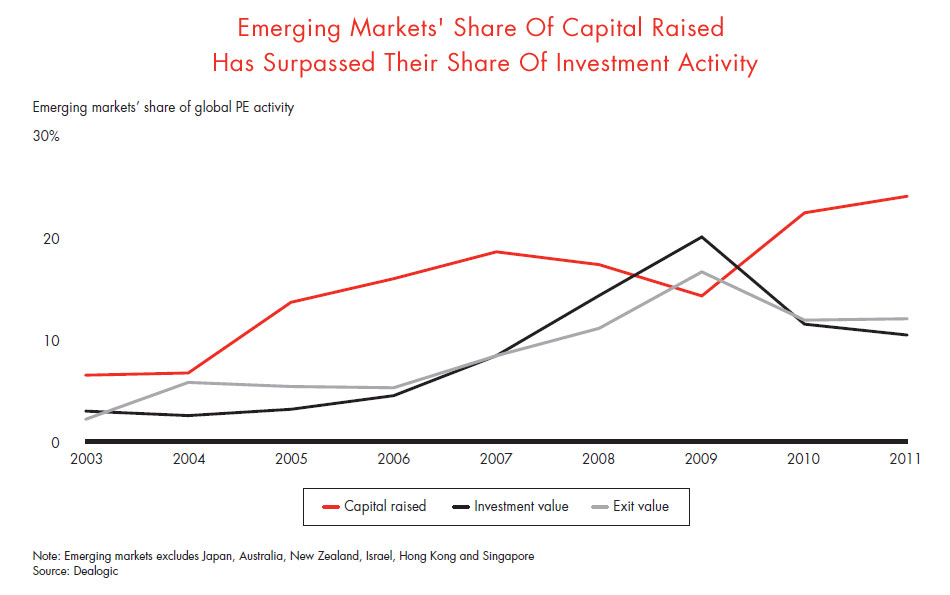

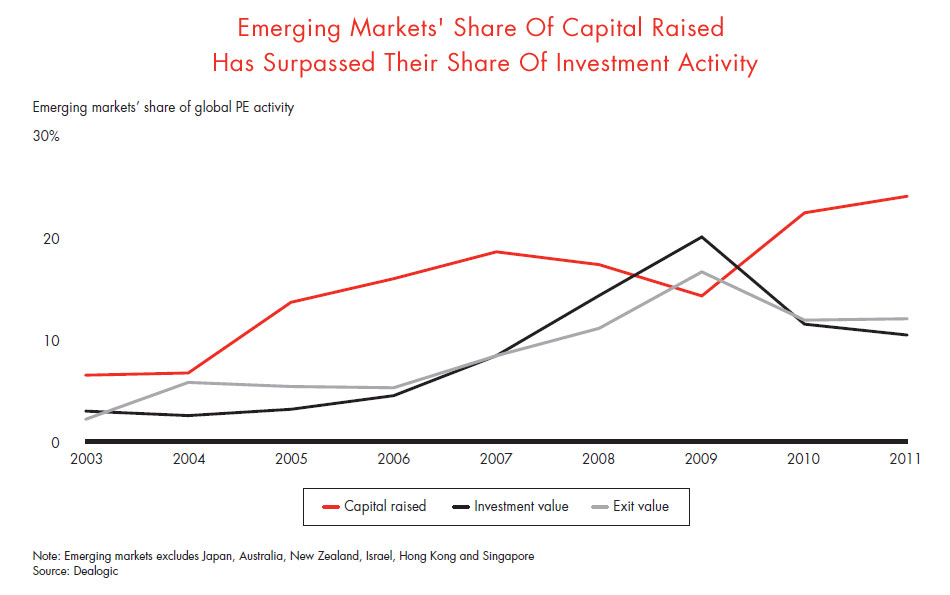

To date, however, that long-anticipated potential has failed to materialize to the extent investors had hoped. As we described in our Global Private Equity Report 2012, emerging market fund-raising has garnered an increasing share of global PE capital raised over the past decade, but PE deal value and exits have not kept pace. Both remain stuck at only slightly more than 10% of global activity (compared with nearly 25% for PE capital raised), despite the much faster pace of relative and absolute emerging market GDP growth (see figure). As a result, dry powder continues to pile up at a faster rate in the emerging markets—growing at a 32% annual rate compounded since 2005 compared with 8% and 7% in Western Europe and North America.

What will cause PE investment in emerging markets to take off? Supporting the idea that PE could grow substantially is the sheer growth and increasing size of their economies. Accounting for just over one-third of total global GDP of $70 trillion in 2011, according to the International Monetary Fund (IMF), the major emerging economies’ share is forecast to expand to nearly one-half of the $100 trillion global economy by 2020. By then, the IMF projects, China and India alone will account for about one-half of the $32 trillion GDP of the major developing countries.

With the emerging economies still on the lower slopes of all of that anticipated growth, the theory holds, they will surely soak up all of the private equity dry powder currently earmarked for investment, and much more, as their GDP expands. But Bain analysis found that an economy’s size is not a reliable indicator of its capacity to absorb PE capital. A far more important determinant of an economy’s attractiveness to PE investors and capacity to absorb PE capital is its number of scale companies. For example, South Africa, with a GDP of $400 billion, enjoys a PE penetration (measured as PE deal value since 2007 divided by total GDP in 2011) of 0.3%. By contrast, PE penetration in Russia, with a GDP nearly four times larger than South Africa’s, has been negligible. Yet, holding other factors constant, both countries have roughly the same capacity to absorb PE investment. Despite Russia’s far-larger GDP, South Africa has almost as many companies with annual revenues that exceed $250 million (see figure).

The number of scale companies an economy boasts is itself evidence of the presence of a host of other critical factors that increase a market’s ability to absorb private equity capital. Some of these, such as the depth and liquidity of the country’s capital markets, its legal system and protection of investor rights and the availability of debt financing, reflect underlying economic and policy foundations. Other variables, including corporate governance and transparency, the depth of management talent, a creative entrepreneurial culture and investors’ ability to influence companies’ direction, reflect a nation’s commercial maturation. Taken together, these qualities are the signposts of a market—or region’s—receptivity for PE investment.

This post was written by Graham Elton, Bill Halloran, Hugh MacArthur and Suvir Varma, leaders of Bain & Company’s Private Equity Group.